A Volvo C40 Recharge electric SUV is on display during the Volvo “A New Era of Volvo Cars” press conference at The Shilla Seoul on March 14, 2023 in Seoul, South Korea.

Han Myung-gu | Wireimage | Getty Images

Volvo Cars shares surged more than 24% Thursday after the Swedish automaker announced that it will stop funding subsidiary Polestar Automotive.

Volvo earlier in the day reported a 10% year-on-year increase in fourth-quarter net sales to 148.1 billion Swedish krona ($14.16 billion), bringing its full-year 2023 total to 552.8 billion krona. Adjusted operating income jumped to 18.38 million krona from 12.17 million for the same period in 2022.

The group announced that it may hand stewardship of ailing luxury car brand Polestar over to majority Volvo shareholder Geely Holding.

In its full-year report, Volvo said Polestar is “entering the next exciting phase of its journey with a strengthened business plan and cost actions, but that the parent company’s focus is on developing Volvo Cars and concentrating its resources accordingly.

“We are therefore evaluating a potential adjustment to Volvo Cars’ shareholding in Polestar, including a distribution of shares to Volvo Cars’ shareholders. This may result in Geely Sweden Holdings becoming a significant new shareholder,” the company added.

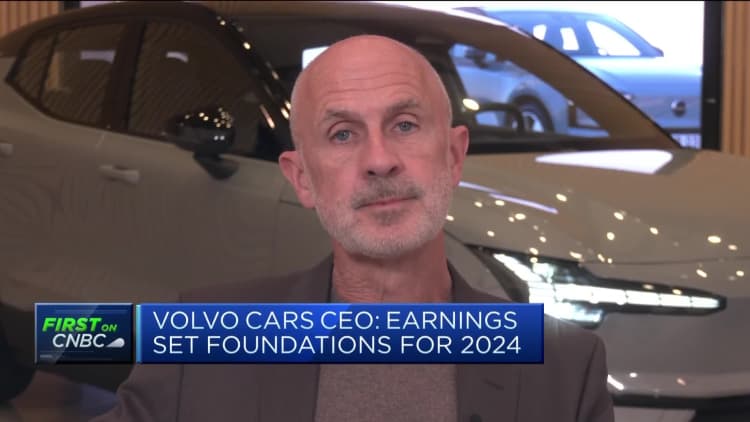

Volvo Cars CEO Jim Rowan told CNBC’s Silvia Amaro on Thursday that this was a “natural evolution” in the relationship between the two carmakers.

“Obviously, we spun out Polestar as a separate company a long time ago, and since then we’ve been incubating and working with Polestar for a number of years,” Rowan said.

“Now, Polestar … they’ve have got a very exciting future ahead of them, they’ve moved from being a one-car company to a three-car company, they’ve got two brand new cars coming out very shortly, in fact in the first half of this year, and that’s going to take them to a new growth trajectory.”

Volvo Cars holds around a 44% stake in Polestar, having acquired the company in 2015, but the compatriot luxury electric vehicle brand has struggled since going public in June 2022, and analysts were wary that it had become a drag on Volvo’s resources.

Rowan said this felt like the right time for Volvo Cars to begin reducing its shareholding of Polestar and for the company to “look for funding outside of Volvo.”

“That allows us and Volvo as well to fully focus on our growth journey, especially some of the technology investments that we need to make in the next two-three years.”