[ad_1]

DAVOS, Switzerland — Ripple explored markets outside the U.S. for its initial public offering, CEO Brad Garlinghouse told CNBC, blaming a “hostile” regulator.

However, the firm has put any plans for an IPO on hold for now, Garlinghouse said.

Garlinghouse told CNBC in 2022 that Ripple, the company behind the cryptocurrency XRP, will explore a public listing after its lawsuit with the U.S. Securities and Exchange Commission ends. The lawsuit, which began in 2020, is still ongoing.

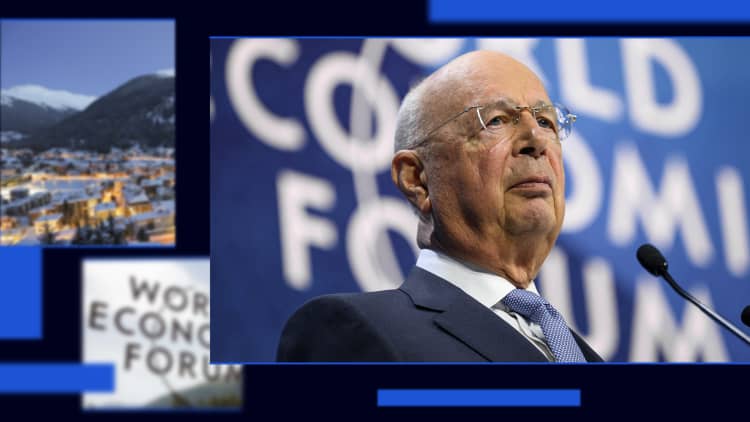

However, speaking to CNBC at the World Economic Forum in Davos, Switzerland, Garlinghouse said Ripple has “looked at other jurisdictions that have clear rules of the road,” to go public.

The Ripple CEO said his company has not gone public in the U.S. yet because of the SEC’s actions.

“In the United States, trying to go public with a very hostile regulator that’s approved your S-1, that doesn’t sound like a lot of fun to me,” Garlinghouse said.

“Coinbase obviously had their S-1 approved. And now the SEC is suing them for doing things that was outlined in their S-1.”

An S-1 is a document that is filed with the SEC ahead of an IPO in the U.S. and lays out information such as a company’s financial performance and the key risks of investing in the firm.

Coinbase is listed in the U.S. The SEC sued Coinbase last year alleging that the company was acting as an unregistered broker and exchange.

‘Political liability’

Garlinghouse has been critical over the past few years to the SEC’s approach to regulating the crypto industry.

On Tuesday, he called the SEC Chair Gary Gensler a “political liability.” He said he thinks there will be a new chair of the SEC and then his company could consider a U.S. listing.

The SEC did not immediately respond to a CNBC request for comment.

The Ripple CEO said he is keeping the IPO “option open” and will evaluate it “as time continues.”

“And we’ll evaluate again, as we have new regulators sitting at the United States SEC,” he said.

Garlinghouse made clear, however, that going public is now “not an immediate term priority” for Ripple.

Reuters reported this month that Ripple bought back shares from its shareholders. Garlinghouse confirmed this and said the company to date has bought back $1 billion of its stock.

“You know, shareholder liquidity is important to me. We have investors that first invested in Ripple in 2012. So they’ve been in this deal for eleven-and-a-half years. And so we want to provide that liquidity, which is one of the reasons why we’ve done these tender offers,” Garlinghouse said.

The buyback came after a buoyant year for cryptocurrencies. Bitcoin rallied more than 150% last year. That has injected confidence back into some crypto firms.

Circle, the company behind the stablecoin USDC, filed for an initial public offering in the U.S. this month.

[ad_2]