Investor Steve Eisman of “The Big Short” fame is questioning the level of bullishness on Wall Street — even with the market’s tepid start to the year.

From enthusiasm surrounding the “Magnificent Seven” technology stocks to expectations for multiple interest rate cuts this year, Eisman believes there’s little tolerance for things going wrong.

“Long term, I’m still very bullish. But near term I just worry that everybody is coming into the year feeling too good,” the Neuberger Berman senior portfolio manager told CNBC’s “Fast Money” on Tuesday.

On the year’s first day of trading, the tech-heavy Nasdaq fell 1.6% percent, the S&P 500 fell 0.6%, and the Dow eked out a gain. The major indexes are coming off a historically strong year: The Nasdaq rallied 43%, while the S&P 500 soared 24%. The 30-stock Dow was up nearly 14% in 2023.

“The market climbed a wall of worry the whole year. So, now here we are a year later, and everybody including me has a pretty benign view of the economy,” Eisman said. “It’s just that everybody is coming into the year so bullish that if there are any disappointments, you know, what’s going to hold the market up?”

Eisman notes that fewer rate hikes than expected in 2024 could emerge as a negative short-term catalyst. The Federal Reserve has penciled in three rate cuts this year, while fed funds futures pricing suggests even more trimming. Eisman thinks these expectations are too aggressive.

“The Fed is still petrified of making the mistake that [former Fed Chief Paul] Volcker made in the early ’80s where he stopped raising rates, and inflation got out of control again,” said Eisman. “If I’m the Fed and I’m looking at the Volcker lesson, I say to myself ‘What’s my rush? Inflation has come in.'”

Yet, Eisman suggests it’s still a wait-and-see situation.

“If you had to lay your life on the line, I’d say one [cut] unless there’s a recession. If there’s no recession, I don’t see any reason why the Fed needs to be aggressive at cutting rates,” he said. “If I’m in [Fed chief Jerome] Powell’s seat, I pat myself on the back and say ‘job well done.'”

‘Housing stocks are justified’

Eisman, who’s known for predicting the 2007-2008 housing market collapse and profiting from it, appears to be warming up to homebuilding stocks.

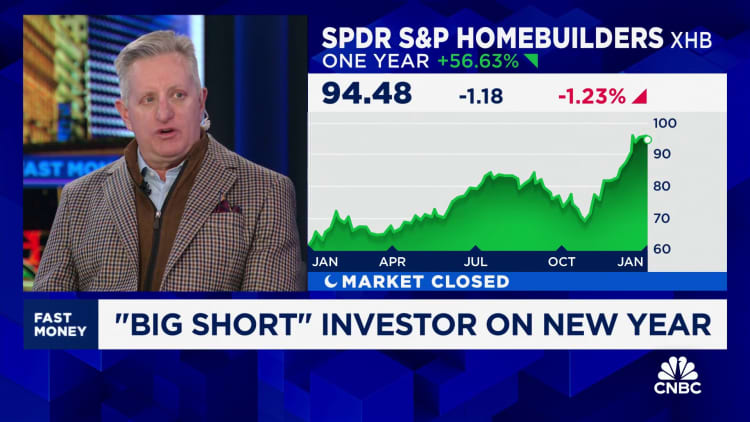

The investor said on “Fast Money” in October it was a group he was avoiding. The SPDR S&P Homebuilders ETF, which tracks the group, is up 25% since that interview and 57% over the past 52 weeks.

“The housing stocks are justified in the sense that the homebuilders have great balance sheets. They’re able to buy down rates to their customers, so that the customers can afford to buy new homes,” he said. “There’s a shortage of new homes.”

However, Eisman skips housing among his top 2024 top plays. He particularly likes areas of technology and infrastructure.