To find the best Airbnb property, investors use an Airbnb rental calculator to help them determine a short term rental property’s profitability.

Investing in short term rentals is one of the most lucrative forms of investment. Since home-sharing platforms became famous around 2009, many short term rental owners have earned a lot of money renting out extra spaces in their homes. Nowadays, many investors venture into the Airbnb rental market because of its gainful returns.

While the short term rental market is one of the most adversely affected industries during the pandemic, it has substantially recovered when lockdowns were lifted in mid-2021. In fact, Airbnb owners have seen so much improvement in bookings and returns. In 2023, the short term rental market across the US is expected to remain as strong as ever.

If you’re planning to invest in Airbnb to take advantage of the potential strong demand, be sure to find the best investment property that will generate maximum profits. It’s no secret that successful real estate investors use numerous tools to help them become successful. One of these tools is the Airbnb rental calculator, which is necessary to help you find the right property.

Mashvisor offers the best investment tools that will help investors find the most profitable investment property, including investment property calculators. If you’re planning to buy a property to rent out on Airbnb, you should definitely use an Airbnb rental calculator. This tool will help you determine whether or not a property is optimal for an Airbnb investment.

How Much Can You Make on Airbnb?

Airbnb offers one of the most generous returns — this is the reason why many real estate investors want to try investing in one. However, how much you can earn from an Airbnb property will greatly depend on several factors. Before buying any investment property for Airbnb, make sure to understand these factors to help you choose your investment wisely.

Factors That Affect Your Airbnb Income

Before you decide to buy a particular investment property to rent out as a short term rental, you have to consider the following variables:

- Location: The profitability of an Airbnb business greatly depends on where it is located. Some areas are not as good for Airbnb investing as others. That is why you should be careful in choosing your location. Remember that where you invest can either make or break your investment.

- Occupancy: You should aim for a property guests would want to stay in, so that it will have a high occupancy rate. A property with a high occupancy rate means it generates more income and cash flow. On the other hand, if the property is seldom occupied, you will likely have more negative cash flows in a year, which is not good for the business.

- Property Type: The demand from guests will also depend on the type of property that you own. For instance, if your property is a small condominium unit, you can only host solo travelers or couples. If you own a single-family home, you may be able to host an entire family or group of friends. This can affect how much you can charge for the stay.

- Seasonality: Airbnb is a seasonal business. During peak season, you can charge a high rental rate for your property. On the other hand, you need to lower your price during the low season. The seasonality of the location will affect your overall rental income.

In the next section, we will discuss the traditional way of calculating your potential Airbnb income.

How to Estimate Your Potential Airbnb Income in 3 Steps

While there is no hard and fast rule in finding out how much you can make from an Airbnb property, you’ll have a general idea of your potential income by studying the rental comps in the area. You need to look at the average gross revenues in your preferred location. In addition, you need to analyze similar properties in the local neighborhood where you plan to invest.

Here are three simple steps on how to do this method:

Step 1: Research the Market Gross Average Revenues

The first step is to research the gross average revenues in the market of your choice. To do this, you need to determine the Airbnb properties in the local area where you plan to invest in Airbnb. You can manually interview the owners to see how much they earn from their short term rental properties. Keep in mind that this step is the most difficult part of the process.

Step 2: Get the Sum of the Airbnb Income

Once you find out how much Airbnb hosts make in the area, you need to calculate their total income. To do this, you simply need to add the average income of each host in the area to get the total amount. Make sure also to count how many Airbnb properties are there in the area.

Step 3: Calculate the Average Airbnb Income

The next step is to divide the total Airbnb income by the total number of listings in the area. The result will be the average Airbnb income in the local short term rental market where you are interested in investing. This will give you a quick overview of how much the average Airbnb income hosts are making in the area.

Keep in mind, however, that studying the market average and analyzing similar Airbnb properties in your area will not give you an actual figure of how much you can earn. If you want to know the Airbnb estimate of the investment property that you’re eyeing, it’s best to use a reliable Airbnb rental calculator.

In the following section, we will discuss how this online real estate tool will compute the Airbnb income of an investment property.

What Is an Airbnb Rental Calculator?

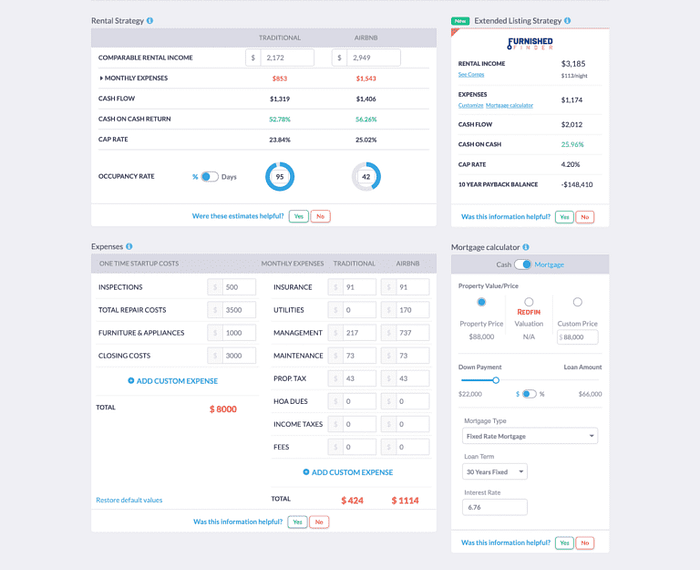

An Airbnb rental calculator is an online real estate tool that can help you determine the potential income of a particular short term rental property. The Airbnb rental calculator uses several metrics to determine the profitability of an investment. Such metrics include the cash on cash return, cap rate, cash flow, Airbnb daily rate, Airbnb occupancy rate, and monthly income.

This investment property calculator allows property investors to analyze how profitable a certain property is for investment purposes. There are many websites that offer this investment tool, and you can find an online Airbnb rental calculator on almost any real estate platform. However, it’s worth noting that not all Airbnb calculators provide reliable and accurate results.

To find the best Airbnb calculator, you need to ensure that the provider is a reliable source of real estate data and offers a thorough Airbnb analysis to help investors make a decision. Fortunately, this real estate tool is easily available with Mashvisor. Mashvisor provides the best and most reliable Airbnb rental calculator that can help you find a profitable income property.

What Makes Mashvisor’s Investment Calculator the Best Option?

What’s different about Mashvisor’s rental property calculator is that it projects readily calculated returns for both long term rental AND Airbnb investment properties across the US housing market. It uses traditional and predictive data to ensure accurate results. Mashvisor’s investment calculator can also work as both an Airbnb rental calculator and long term rental calculator.

Mashvisor’s Airbnb Rental Calculator

Mashvisor’s calculator provides the data that you need, so you don’t have to do your own research. However, another great thing about this tool is that it is interactive. This means you can customize certain figures, like the expenses associated with the property. These include the purchase price, expected rental income, and other recurring monthly expenses.

Moreover, you can also include your preferred financing method — whether you plan to buy the property using a loan or through cash entirely. If you plan to take out a loan for the purchase, you can input the type of mortgage, amount of down payment, loan term, and interest rate. This will provide a more accurate computation based on your personal plans.

The investment property calculator then does automatic calculations and provides an estimation of the return on investment and profits expected from this property. As an Airbnb host, this will help you make an informed decision. Using the computed figure, you can decide if renting out on Airbnb will help you achieve your goal of making money in real estate.

Start out your 7-day free trial with Mashvisor now.

What Types of Data Does an Airbnb Rental Calculator Provide?

A reliable Airbnb rental calculator does not only provide the monthly income that you can earn from a particular short term rental property. As mentioned earlier, there are numerous factors that can affect an investment property’s profitability. As an investor, it’s crucial to study each of these factors if you want to make an informed decision that will help you succeed.

Let’s take a further look at the important numbers and projections property investors get from Mashvisor’s real estate investment calculator. These Airbnb data and figures can help investors make smart investment decisions.

1. Cash Flow

Cash flow is simply the difference between the monthly rental income and monthly expenses. Property investors always aim to invest in positive cash flow properties as these are the best and most profitable investments in the market. A positive cash flow means that you will have more cash left from your income after you deduct all your expenses.

Mashvisor’s Airbnb profit calculator allows you to plug in all expenses for your income property and subtracts them from the projected Airbnb rental income. So with this real estate investment tool, you can calculate cash flow before you even buy the property. This will help you ensure that you don’t end up with a losing investment.

2. Airbnb Cap Rate

The capitalization rate (also known as cap rate) is a key return on investment metric that the Airbnb rental calculator provides both on the property level and neighborhood level. The cap rate shows you what kind of return on investment you will receive by comparing the annual income to the property’s purchase price.

With this knowledge, property investors can find properties and locations with high Airbnb cap rates to ensure the success of their short term investment properties. Keep in mind that the cap rate does not take into account the method of financing used to purchase the property. It only takes into consideration the purchase price or market value of the investment property.

3. Airbnb Cash on Cash Return

The cash on cash return is another important real estate metric in calculating the potential profit of an investment property. It shows the property’s return on investment in terms of how much money the income property makes compared to how much money you invested in it. Keep in mind that it only considers the amount of cash that you invested initially.

The cash on cash return calculator takes into account the method of financing that you use. If you purchase the property through a mortgage, it will only consider the amount of your down payment and other costs that you paid for in cash. While you may be able to do cash on cash return calculations for a particular property, it’s difficult to do so on the neighborhood level.

With an investment tool like the Airbnb rental calculator, however, it’s possible to find the cash on cash return for an entire location. This way, property investors can ensure not only investing in the right Airbnb rental, but also in the right location where Airbnb is the optimal rental strategy.

4. Airbnb Occupancy Rate

The success of short term investment properties mainly depends on the occupancy rate. This refers to the number of days the income property is occupied versus the number of days it is listed for rent. Airbnb hosts typically can’t make good rental income without a high occupancy rate. This is why it’s important to check a property’s occupancy rate before buying one.

The occupancy rate is important because it basically means that there is a strong demand for short term rentals in your chosen real estate market. The Airbnb rental calculator shows you the Airbnb occupancy rate of different locations instead of having to gather such data manually. It lets you easily find the best places to invest in Airbnb rentals with high occupancy rates.

What You Can Do With an Airbnb Rental Calculator

As a real estate investor planning to invest in short term rentals, using an Airbnb rental calculator can help you find the right investment property that will provide the most profits. There are several factors that can affect your investment, and you’ll need the help of this real estate investment tool to ensure that you’re making the right decision based on these essential factors.

A short term rental calculator can help you do the following:

1. Find the Right Location

As you should already know, the optimal strategy to rent out a house (long term vs. short term) depends on which one has a higher demand in the real estate market. With the knowledge of the above-mentioned numbers, Airbnb hosts can ensure that their location or market of choice does, in fact, make a good place for investing in short term rentals.

Finding the right location is crucial to becoming a successful real estate investor. Investing in the right location is a great way to make money in real estate. However, if you choose the wrong real estate market to invest in, you could end up losing your investment. With the help of an Airbnb rental calculator, it’s easier to identify the right markets for short term rentals.

2. Access Real Estate Comps

One way to decide if you’re investing in the right place is through real estate comps. These are properties similar to yours that were sold recently in the same area. Property investors try to find at least three rental comps to have a basis of comparison when determining the profitability of a rental market.

Rather than doing this manually, Mashvisor’s Airbnb rental calculator lets you see other Airbnb rentals in your area with their numbers. This allows you to easily use them as comps, saving you time that you would otherwise spend on analyzing each individual property and comparing it with the others.

3. Analyze the Investment Property

After determining that renting out for the short term is the optimal strategy in your location, you’d want to ensure that your chosen property is the best one out there. With the data and analytics provided by the Airbnb rental calculator on both the neighborhood level AND property level, Airbnb hosts can easily perform an investment property analysis.

This analysis will further prove which is the optimal rental strategy for your chosen property. This can help ensure that you’ll make the most out of your investment.

To get access to our real estate investment tools, sign up for a 7-day free trial of Mashvisor today.

Use an Airbnb Rental Calculator for Your Next Investment

We have established that investing in short term rentals can provide generous returns if you know which Airbnb rental market to invest in. Whether you’re renting out a house on Airbnb or planning to buy an investment property to rent on the short term rental site, the Airbnb rental calculator is the ultimate investment tool.

Mashvisor’s Airbnb rental calculator will provide you with the necessary information that you need so you can make the right investment decisions. You can trust that the real estate data we provide are accurate and reliable. What’s more, you can customize the figures so that you’ll get more personalized results based on your individual investment plans.

Are you ready to invest in Airbnb rentals? Schedule a demo with Mashvisor to have hands-on experience on how our real estate tools work.