Becoming a successful real estate investor is not only about being able to find the best investment property with the highest return but also about being able to do so quickly and efficiently before someone else does. Competition in real estate investing is tough, especially in the short term rentals industry which is emerging as a more profitable strategy than traditional rentals. This means that investors in Airbnb rental properties need to arm themselves with all the top real estate investing tools out there to beat the competition, and the Airbnb calculator is one of those must-have tools.

What Is an Airbnb Calculator?

An Airbnb calculator is a type of investment property calculator that has been specifically developed to help first-time real estate investors — as well as more experienced ones — search for and find top-performing vacation homes. Also known as Airbnb profit calculator, this is an advanced real estate technology tool that performs real estate market analysis in addition to investment property analysis over hundreds of thousands of MLS listings, foreclosed homes, off-market properties, and even properties that you input on your own to estimate the profitability potential of each one of them. In this way, it eliminates the need for investors to engage in a complicated, time-consuming comparative market analysis (CMA), search for Airbnb rental data, and calculations of return on investment. An Airbnb calculator has the power to turn 3 months of research (that’s how long it takes on average a beginner real estate investor to find his/her first rental property) into 15 minutes, allowing you to buy the most profitable investment properties before anyone else.

What Does an Airbnb Rental Property Calculator Do for Real Estate Investors?

The best feature of the Airbnb rental calculator is that it can do A LOT of things for a real estate investor. The ultimate result will be buying Airbnb property with a high return on investment quickly and with confidence. Here is a breakdown of the specific aspects of real estate investing that this Airbnb analytics tool can handle:

Find the Best Places to Invest in Real Estate on Short Term Basis

Every real estate expert knows that location, location, location are the three most important factors for the success of a real estate investment. However, researching and learning about the best markets to invest in an Airbnb rental property can take months of your time, and by the time you are done with your analysis, the situation might have already changed. This is not the way to do business in the 21st century.

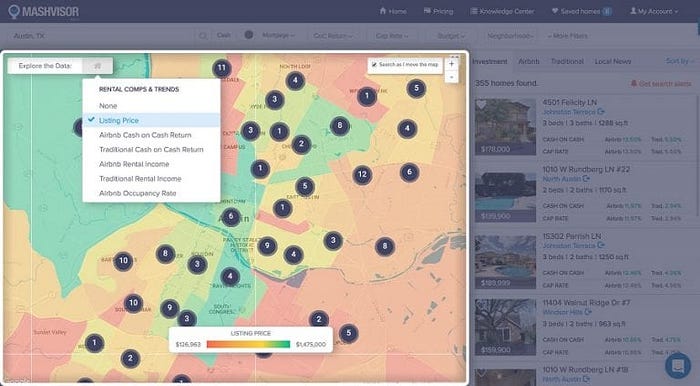

An Airbnb calculator spares investors the need to conduct neighborhood analysis manually by showing them the best neighborhoods to buy a short term rental in any city in the US housing market. If investors want to really target their property search and start from the top neighborhoods right away, they can use a heatmap to identify the neighborhoods of their real estate market of choice which are ideal for finding income properties to rent out on Airbnb or other similar platforms.

Mashvisor’s Heatmap

Perform Real Estate Market Analysis

Finding the best neighborhood for Airbnb rentals is not enough for a profitable real estate investment. Paying the right price is equally important as the purchase price is one of the two most important factors into any rate of return calculation in real estate, the other one being the rental income.

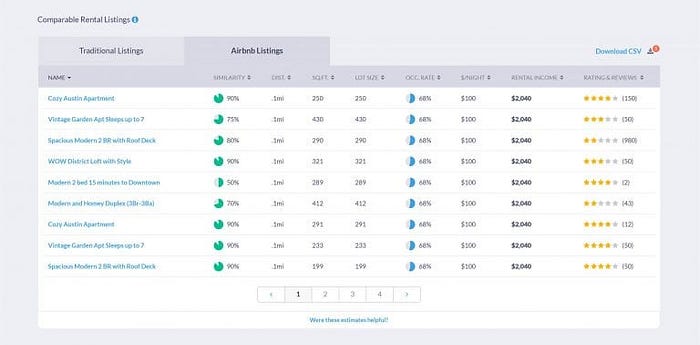

Conducting comparative market analysis can take months when done by a new investor with little experience. Alternatively, it can be done in a matter of minutes or even seconds by an Airbnb investment calculator. This tool will show you how much real estate comps are currently listed for to assure that you don’t pay more than the fair market value.

Airbnb Comps at Mashvisor

Real Estate Expert Tip: If you are interested in buying an investment property under market value, look for foreclosures and off market properties.

Conduct Property Search

With the advancement of big data and machine learning algorithms, real estate investors no longer have to read through newspaper ads, drive around to find “For Sale” signs, or connect with a real estate agent right away to get access to MLS listings. The property search process has been automated and optimized by the Airbnb profitability calculator. The tool will show you all the homes for sale in the housing market that you are interested in which meet your investment criteria such a budget, property type (single family home, condo, townhouse, or multi family home), number of bedrooms, optimal rental strategy (in this case Airbnb), rental income, and return on investment.

Do Airbnb Investment Property Analysis

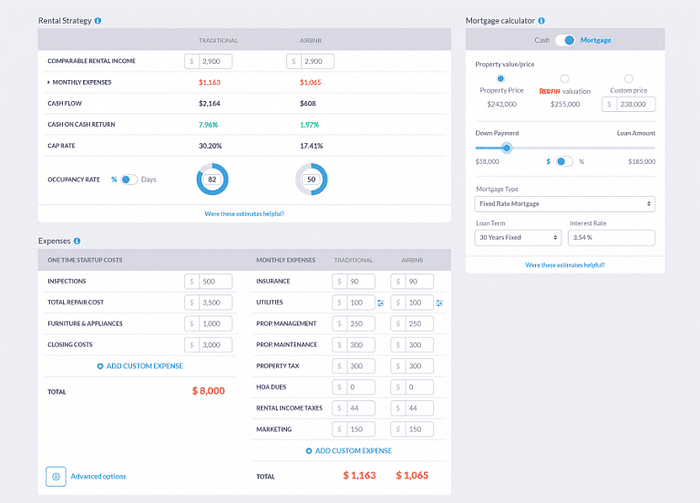

The next thing which the Airbnb calculator will do for a real estate investor is to conduct Airbnb investment analysis. With a few clicks of a button, you can access a comprehensive report with all the most important numbers and indicators which an Airbnb host needs to optimize his/her investment. These include things such as property price, costs, rental income, and various metrics of return on investment in real estate. All these figures are based on reliable rental comps and Airbnb data to assure the highest degree of accuracy and confidence. What’s even better is that if you have a strong reason to believe that your Airbnb investment property will perform differently (because of your own experience as an Airbnb host or because of what your friend investing in the same neighborhood told you), you can customize any of the readily available metrics, and the Airbnb calculator will redo all the affected calculations in a couple of seconds.

Mashvisor’s Airbnb Calculator

To learn more about how Mashvisor can help you find profitable investment properties, schedule a demo.

What Kind of Airbnb Data Can You Expect from the Investment Property Calculator?

Now that you have a general idea of all the wonderful things which an Airbnb calculator can do for you as a new real estate investor, let’s have a more detailed look at the precise figures and metrics which this tool will generate for you:

Property Listing Price

First, an Airbnb investment calculator will show you how much the properties you are interested in are listed for. While the listing price is not always the final sale price, it is a good indicator of how much you can expect to pay for your Airbnb rental property.

Real Estate Expert Tip: To negotiate the best purchase price for your Airbnb investment property, hire one of the top performing real estate agents in your housing market.

As we mentioned before, the property price together with the other costs and the rental income you generate will determine how much money can you make on Airbnb.

Startup Costs and Monthly Expenses

To enable you to calculate the return on investment on any Airbnb rental property, the Airbnb calculator will also provide you with all the one-time startup costs and recurring expenses that you can expect to pay. All these numbers are based on the prevailing rates in the local real estate market.

The one-time, startup costs include:

- Inspection

- Closing costs

- Repair

- Furniture

The ongoing, monthly expenses cover:

- Property tax

- Insurance

- Property management

- Cleaning fees

- Property maintenance

- Utilities

- HOA fees (in case you invest in a condo)

- Rental income tax

Of course, the Airbnb profit calculator has the option to manually add the Airbnb fees and taxes which your state, county, and city authorities impose.

Airbnb Rental Income

Now we get to the really exciting stuff. While spending money is a must in property investments, investors do this in order to make money in real estate. An Airbnb rental calculator will estimate Airbnb income for you as well. For this reason, the tool is sometimes called an Airbnb price calculator as it will figure out the predominant Airbnb nightly rate in your real estate market and neighborhood to predict a highly reliable estimate of the Airbnb rental income which you will be able to make from your property.

Airbnb Occupancy Rate

To forecast the Airbnb rental income, an investment property calculator will need two variables: the short term rental nightly rate and the Airbnb occupancy rate. Then the rental income is just the result of multiplying these two numbers. A good Airbnb calculator will, thus, also provide real estate investors with the Airbnb occupancy rate for their rental property. This number will be derived from actual, reliable Airbnb occupancy rate data on the entire neighborhood and not just a few neighboring properties.

Cash Flow

Calculating the cash flow once you have the Airbnb rental income and the recurrent costs associated with owning and renting out an Airbnb property is relatively easy. However, if you want to forget about spreadsheets in your rental property analysis, the Airbnb investment calculator will allow you to do that. You will be provided with the expected cash flow from any property you are interested in.

Real Estate Expert Tip: Always go for positive cash flow properties from day one! Don’t buy a breaking even or negative cash flow property hoping that your luck will change. That’s not how you make money from real estate.

Cash on Cash Return

Last but not least, this real estate investing tool will calculate for you exactly how much you can expect to make from your rental property. The two main metrics of return on investment in real estate comprise of the cap rate and the cash on cash return, with the main difference between the two being that the former does not take property financing into consideration, while the latter does.

Even when you have all the numbers that you need, calculating the Airbnb cap rate and the Airbnb cash on cash return can be time-consuming. But an Airbnb profit calculator will give you these figures right away. Having the estimated return on investment is the most important factor for choosing an investment property to buy, together with the listing price, of course.

Real Estate Expert Tip: Remember that most real estate professionals agree that good cap rate for rental properties is 8% and above.

What Will This Real Estate Investing Tool Not Tell an Investor?

None of the available real estate investment tools out there is perfect, and the Airbnb calculator is not an exception. There is one very important aspect of investing in Airbnb rentals which this tool does not help with, and this is knowing if Airbnb is legal or illegal in your real estate market.

More and more cities in the US housing market and worldwide impose major restrictions on vacation rentals, many of them making non-owner occupied Airbnb rentals illegal. These locations include some of the top tourist destinations in the US such as Los Angeles, New York, Santa Monica, Las Vegas, and San Francisco.

Real Estate Expert Tip: To stay up-to-date on the Airbnb laws and regulations in all US real estate markets, read our real estate blog and sign up for regular email updates.

Where Can You Find the Best Airbnb Calculator?

RIGHT HERE! Mashvisor, a real estate data analytics platform applying machine learning algorithms to big data, has the ultimate Airbnb calculator. Our investment property calculator has all the features explained above to help beginner real estate investors find the best Airbnb rental property to invest in.

After the introduction of AI and predictive analytics, the real estate investment business has been changed forever. No smart, successful investor will go around for months looking for properties for sale or sit down for weeks to calculate the return on investment a rental property will generate. All this is in history. In 2020 real estate investors will use the best Airbnb calculator to find the top-performing Airbnb investment properties in any US housing market.

To start your 7-day free trial with Mashvisor and subscribe to our services, click here.