Why let capital gains tax gobble up your real estate profits when there’s a savvy strategy at your disposal? Imagine being able to leverage your investment returns by deferring tax liabilities, augmenting your investment capital, and diversifying your real estate portfolio. This isn’t a fantasy; it’s the reality of a well-executed 1031 exchange.

Key Takeaways

- A 1031 exchange is a transaction in which one investment property is exchanged for another without incurring capital gains tax or triggering tax liabilities.

- Benefits include deferring taxation on depreciation recaptured and estate planning strategies.

- Careful consideration must be taken when selecting properties, meeting deadlines, and providing adequate documentation to avoid common pitfalls.

Understanding the 1031 Exchange: The Basics

A 1031 exchange, referenced from its section in the Internal Revenue Code, is a method employed in real estate investing to defer capital gains tax. Envision selling a commercial building. You could avoid immediate capital gains tax on the sale proceeds by reinvesting them into a substitute property with equal or greater value, efficiently postponing the tax. Seems like a clear win, right?

However, the procedure is not as straightforward as merely buying and selling. The exchange process must be guided by a qualified intermediary, and the replacement property must be identified within a specific timeline. Furthermore, you cannot receive any sale proceeds directly; they should be held by the qualified intermediary until the purchase of the replacement property. Consider it similar to a relay race, where the baton, in this case, the exchange funds, must be passed directly from one participant (property) to another without letting it fall.

What Is a 1031 Exchange?

A 1031 exchange is fundamentally a transaction where one investment property is interchanged with another replacement property. Most swaps are taxable as sales, but if you come within 1031, you’ll either have to pay no tax or limited tax due at the time of the exchange. You can modify the form of your investment without incurring a capital gain or cashing out. This is known as an “in-kind exchange”. Your investment can grow without paying taxes on it. This is a great advantage of tax-deferred growth. There’s no limit on how many times you can do a 1031.

You can transfer the gain from one real estate investment property to another. This process can be repeated again and again. You may have a profit in each swap transaction; however, you won’t be taxed until you exchange it for cash many years down the road. Selling for cash is the only way to trigger tax liabilities on these profits. Then you’ll hopefully pay only one tax, and that at a long-term capital gains rate.

Benefits of a 1031 Exchange

A 1031 exchange is like a force multiplier for your real estate investment strategies. You get to defer your capital gains tax, augment your investment capital, and diversify your portfolio. Imagine you’re a chess player, and you have the power to upgrade your pawn (investment capital) to a queen (like-kind property) without any immediate penalty (capital gains tax). Sounds like a dream strategy, right?

The efficacy of a 1031 exchange empowers real estate investors to diversify their real estate holdings strategically, potentially enhancing their overall return on investment.

Eligibility Criteria for a Successful 1031 Exchange

While a 1031 exchange is an effective instrument, it comes with its unique set of regulations. Not all properties and transactions are eligible. Picture a member’s only club, where access is granted to only those who meet the specific criteria. In a 1031 exchange, the properties must be like-kind and used for investment or business purposes. Think of it this way: you can’t trade your pet cat for a lion, even if they’re both felines. Similarly, you can’t exchange your primary residence (personal use property) for a rental property (business use).

Also, the IRS imposes certain exclusions and limitations. Picture a room with a low ceiling. You can move freely, but if you try to jump too high, you’ll hit the ceiling. The IRS exclusions and limitations act as that figurative ceiling, ensuring that the exchange is conducted within the set parameters. You must adhere to these stipulations to successfully defer your capital gains tax.

Like-Kind Properties

Replacing like-kind properties is a must for a 1031 exchange.

‘Like-kind’ is a wide-ranging concept in the realm of 1031 exchanges. It pertains to the nature or character of the property, not its grade or quality. For instance, you can exchange:

- An apartment building in the city for vacant land in the countryside

- A commercial property for a residential property

- A single-family rental property for a multifamily investment property to rent out

They’re all considered ‘like-kind’ because they are all real estate. However, bear in mind that the replacement property must be of equal or greater value to fully benefit from the tax deferral.

Investment or Business Purposes

The property involved in a 1031 exchange must be held for investment or business purposes. This means that your primary residence or vacation home doesn’t qualify. It’s like trying to use Monopoly money in a poker game; it’s just not the right currency. The ‘investment or business purpose’ is the currency of a 1031 exchange.

Both the relinquished property you’re selling and the one you’re buying must be held for rental, business, or investment properties, including income-producing investment properties.

Exclusions and Limitations

In a 1031 exchange, not everything goes. Personal and intangible property, such as:

- Machinery

- Equipment

- Artwork

- Intellectual property

are off the table. Think of it like a food diet; some items are simply off-limits.

Moreover, the IRS has set specific timelines to follow: you have 45 days to identify a potential replacement property and 180 days to close on the new investment property. It’s a race against the clock, and failing to meet these deadlines could turn your sweet tax deferment into a sour tax bill.

Navigating the 1031 Exchange Process

Navigating the process of a 1031 exchange can seem like sailing in unfamiliar waters. It’s not just about selling one property and buying another. The process involves working with a qualified intermediary, who holds the proceeds from the sale of your relinquished property and facilitates the completion of the exchange. It’s like having a seasoned captain guiding your ship through the rough seas of tax codes and regulations.

Also, timing is of the essence. The IRS is stringent about the deadlines for identifying and acquiring replacement properties. Imagine playing a game of hot potato: if you don’t pass the potato (identify and acquire the replacement property) within the set time limit, you’ll get burnt (incur tax liabilities).

Working with a Qualified Intermediary

In a 1031 exchange, a qualified intermediary plays a crucial role. They’re like a relay race runner, holding the baton (proceeds from your property sale) until it’s time to pass it on (purchase the replacement property). They ensure that you don’t directly receive the sale proceeds, which could disqualify your exchange and trigger immediate tax liabilities.

It’s also worth noting that you can’t act as your own intermediary. You need someone who’s neutral, has no prior relationship with you, and hasn’t acted as your agent within the last two years.

Meeting Deadlines: The 45-Day Rule and the 180-Day Rule

Complying with strict deadlines is an obligatory part of a 1031 exchange. The two critical timeframes are the 45-Day Rule and the 180-Day Rule. The former requires you to identify potential replacement properties in no more than 45 days of selling your relinquished property. You must close on the new property within 180 days of the sale. This mandate is not to be taken lightly.

Picture it as a ticking time bomb; if you don’t defuse it (complete the exchange) in time, it’ll explode (resulting in tax liabilities).

But how do you find a replacement property in such a short time? Mashvisor can help.

Finding a Replacement Investment Property with Mashvisor

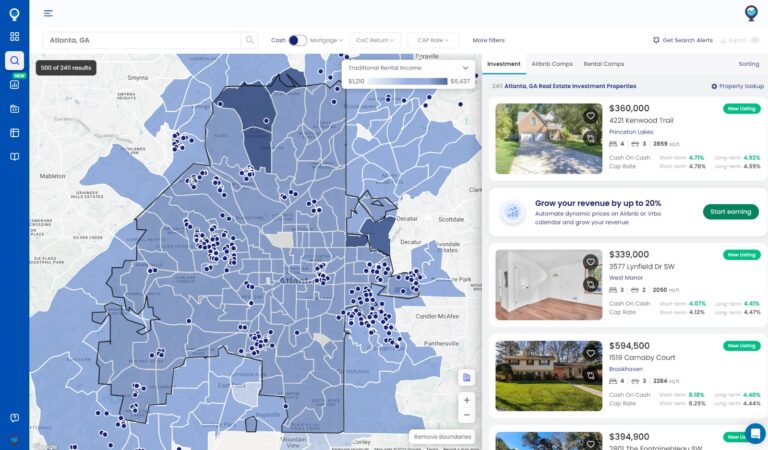

You can use the Mashvisor real estate investment platform to find properties for 1031 exchange.

Mashvisor is a real estate investment platform that hosts all the tools that real estate investors need to find profitable investment properties.

- Market Finder: You can use the Mashvisor Market Finder to identify the best cities for buying a rental property that meets your specific requirements, like type, budget, and expected ROI.

- Heat map: The Mashvisor real estate heat map can help you find areas within your selected real estate market that offer affordable property prices, strong rental income, and high return on investment.

- Property Finder: The Mashvisor Property Finder can find available properties for sale that correspond to your exact criteria and expectations such as location, type, rental strategy, and budget.

- Rental property calculator: With the Mashvisor rental property calculator, you can conduct detailed investment property analysis to choose the best property for sale and determine the optimal strategy for your needs in a 1031 exchange.In this way, you can locate the best replacement property in 45 days or even less.To start a 7-day free trial of Mashvisor to find money-making investment properties in no time, click here.

Types of 1031 Exchanges: Choosing the Right One for You

Just as an artist uses various brushes to create an ideal masterpiece, a real estate investor has different types of 1031 exchanges to cater to their distinct investment situations. The three main types are delayed, reverse, and build-to-suit exchanges. Choosing the right one is like picking the perfect outfit; it depends on the occasion (your investment needs) and the weather (market conditions).

A delayed exchange, the most common type, allows you to sell your property before acquiring a new one. It’s like selling your old car before buying a new one.

A reverse 1031 exchange flips this process, letting you buy the replacement property before you sell the old one. Picture a seesaw; while a delayed exchange starts with a sale and ends with a purchase, a reverse exchange starts with a purchase and ends with a sale.

Lastly, a build-to-suit exchange gives you the freedom to use your sale proceeds to renovate or construct improvements on the replacement property. It’s like buying a fixer-upper and using the sale proceeds from your old house to fund the renovations.

Delayed Exchange

In a delayed exchange, you sell your property before buying a new one. It’s like a relay race where you pass the baton (old property) to the next runner (new property). The sale proceeds are held by a qualified intermediary until you’re ready to acquire the replacement property. But remember, you’re on the clock. You have 45 days to find suitable replacement properties. You have 180 days to complete the purchase of the new property.

It’s a race against time, but with proper planning, you can cross the finish line with flying colors.

Reverse Exchange

A reverse exchange is like a mirror image of a delayed exchange. Instead of selling your property before buying a new one, you purchase the replacement property first. It’s like buying a new car before selling your old one. The new property is held by an Exchange Accommodation Titleholder until you sell your old property. However, like a delayed exchange, you’re still on the clock. You have 180 days to sell your old property, starting from the day you acquire the replacement property.

It may seem backwards, but in certain investment scenarios, it could be the perfect strategy.

Build-to-Suit Exchange

Build-to-suit exchange is one of the types of 1031 exchange.

Imagine you could buy a property and use the sale proceeds from your old property to renovate or construct improvements on the new one. That’s what a build-to-suit exchange allows you to do. It’s like buying a blank canvas and using your sale proceeds to create your masterpiece.

But remember, the clock is still ticking. The improvements must be completed within 180 days of selling your old property. It’s a race against time, but with proper planning and execution, you can turn your investment into a work of art.

Tax Implications and Strategies in a 1031 Exchange

Navigating the tax implications of a 1031 exchange can seem like deciphering a complex puzzle. But once you understand how the pieces fit together, you can use this knowledge to your advantage. Two important tax concepts to grasp are depreciation recapture and estate planning strategies.

Depreciation recapture is like a boomerang; it’s the part of the capital gain attributable to the depreciation deductions taken on the property that’s being exchanged. It comes back to you as taxable income when you sell the property. However, a 1031 exchange can defer this tax liability.

Estate planning, on the other hand, allows you to defer your tax liabilities until your death, at which point your heirs inherit the property at its current market value. It’s like passing on a golden goose to your heirs, minus the golden eggs (tax liabilities).

Depreciation Recapture

Depreciation recapture can feel like a rude awakening. You sell your property, expecting to defer your capital gains tax through a 1031 exchange, only to realize that you owe tax on the depreciation deductions you took while you owned the property. It’s like enjoying a delicious meal, only to be handed the bill at the end.

However, by rolling over the cost basis from your old property to your new one, a 1031 exchange can defer these taxes.

Estate Planning and 1031 Exchanges

Inheritances and capital gains taxes often go hand in hand, but a 1031 exchange can soften the blow. If you hold your property until your death, your heirs inherit the property at its stepped-up market value. The capital gains tax is erased, and your heirs won’t have to pay tax on the appreciation that occurred during your lifetime.

It’s like bequeathing a valuable antique to your heirs, minus the dust (tax liabilities).

Common Pitfalls and How to Avoid Them

Just as every rose comes with thorns, every 1031 exchange comes with its pitfalls. However, if you plan and execute carefully, you can avoid these thorns and enjoy the bloom (tax benefits). Three common pitfalls involve selecting non-qualifying properties, failing to meet deadlines, and maintaining inadequate documentation.

Choosing a non-qualifying property for your 1031 exchange is akin to using an incorrect key; it won’t unlock the door to tax deferral. Make sure you select like-kind properties used for investment or business purposes. It’s like picking the right key for the right lock.

Missing the 45-day or 180-day deadlines is akin to missing a flight; you forfeit your opportunity to defer your taxes. Keep track of these deadlines and plan your exchange accordingly to avoid having to pay taxes immediately.

Lastly, maintaining insufficient documentation is akin to embarking on a road trip without a map; you might lose your way and end up in an undesirable place, like tax liabilities. Keep accurate records and file the necessary forms with the IRS to report your exchange.

Selecting Non-Qualifying Properties

Selecting a non-qualifying property for your 1031 exchange is a misstep that can cost you dearly. It’s like buying a ticket for a Broadway show, only to realize you’ve bought it for the wrong date. Make sure the properties involved in your exchange are like-kind and used for investment or business purposes.

Remember, your primary residence or personal property like your car or boat doesn’t qualify. It’s all about picking the right players for your 1031 exchange team.

Failing to Meet Deadlines

Just as Cinderella had to leave the ball by midnight, you have to adhere to strict deadlines in a 1031 exchange. You have up to 45 days to identify potential replacement properties from the sale of your old property. You must close on the new property within 180 days. If you fail to adhere to these timelines, your 1031 exchange could turn into a pumpkin (taxable sale).

So, keep an eye on the clock, and don’t let the time slip away.

Keeping Inadequate Documentation

Maintaining accurate documentation is like keeping a detailed travel journal; it helps you remember where you’ve been and where you’re going. In a 1031 exchange, you need to provide evidence of ownership for your relinquished property and comprehensive documentation to meet legal requirements. You also need to file the IRS Form 8824 to report your exchange, detailing the properties involved, the timeline, who was involved, and all the money involved.

It’s like telling a story, and every detail counts.

Summary

Whether you’re a seasoned real estate investor or just getting started in the property industry, understanding the power of a 1031 exchange can open doors to tax deferral, capital growth, and portfolio diversification. But remember, it’s more than just buying and selling real estate. It’s about understanding the rules, working with a qualified intermediary, meeting deadlines, selecting qualifying properties, and maintaining proper documentation. Through careful planning and execution, you can leverage a 1031 exchange to enhance your real estate investment strategy and keep your capital gains tax at bay.

To get the help you need in finding lucrative investment properties for sale in less than 45 days, sign up for a 7-day free trial of Mashvisor.

1031 Exchange FAQs

What Is a 1031 Exchange?

A 1031 exchange is a tax deferral strategy that enables real estate investors to swap like-kind properties without incurring immediate capital gains tax liabilities.

What Properties Qualify for a 1031 Exchange?

To qualify for a 1031 exchange, the involved properties must be of like-kind and used for investment or business purposes, not including your primary residence or personal property.

Who Cannot Do a 1031 Exchange?

Businesses, real investment property, and certain real estate fractional ownership structures are the only types of properties eligible for 1031 exchanges; personal property like primary residences, second homes, or vacation homes do not qualify, so their owners cannot engage in this activity.

What Are the Disadvantages of a 1031 Exchange?

1031 exchanges offer a variety of tax benefits, but they do come with certain drawbacks that should be taken into consideration. These include lack of liquidity, complicated paperwork, and often expensive costs associated with them.

What Is a Qualified Intermediary, and Why Do I Need One?

A qualified intermediary is a neutral third party required for a 1031 exchange, who holds the proceeds from the sale of your property and facilitates the completion of the exchange to prevent you from directly receiving the sale proceeds, which would disqualify the exchange and trigger tax liabilities.