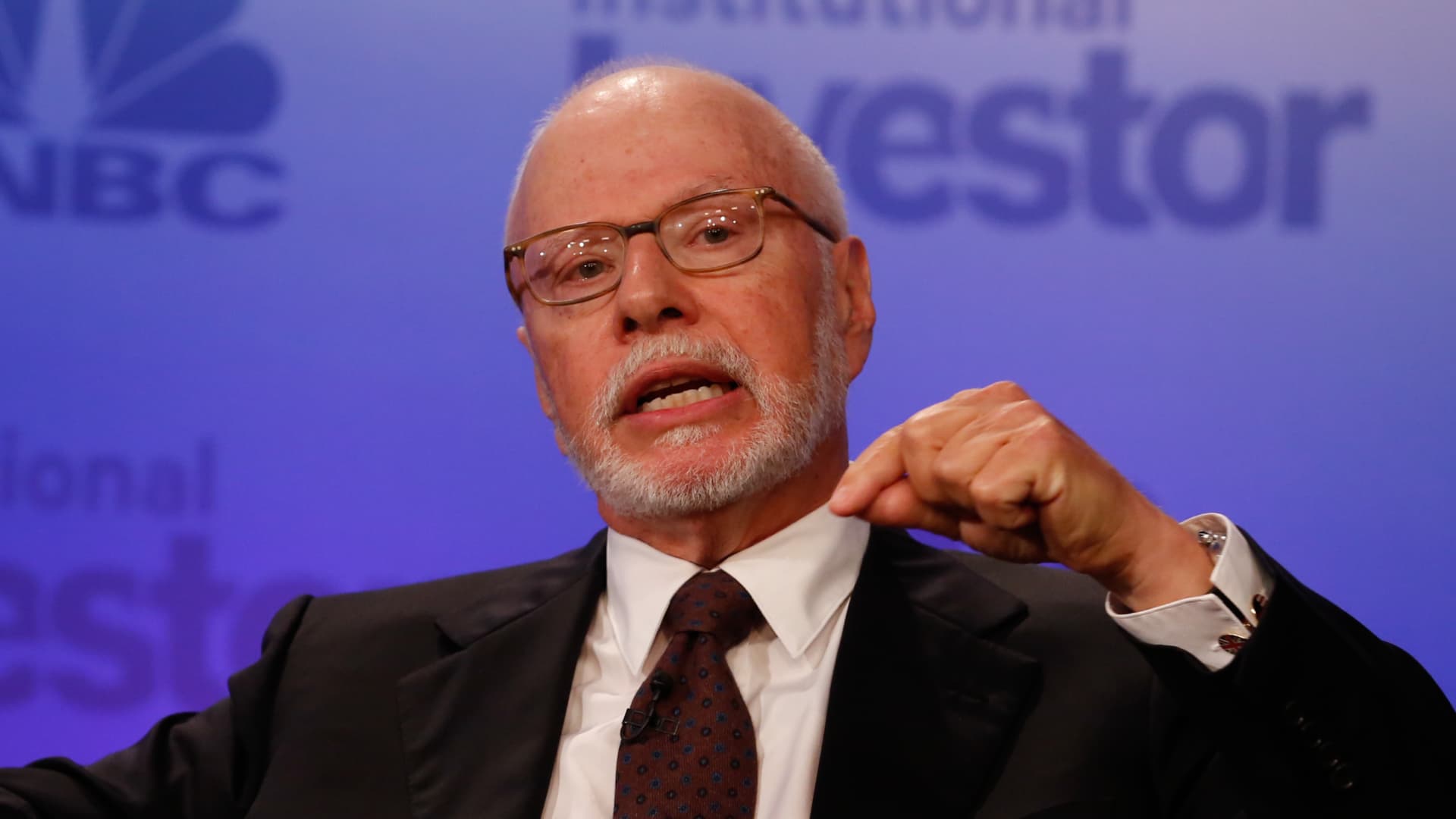

Paul Singer, founder of Elliott Management, speaking at Delivering Alpha in New York on Sept. 13, 2016.

David A. Grogan | CNBC

Crown Castle announced Thursday that CEO Jay Brown is retiring, the same day activist fund Elliott Management sent a letter calling for a new chief executive as part of a campaign for “enhanced governance and fiber-strategy improvements” at the cell tower company.

Brown will be replaced by Anthony Melone, a Crown Castle board member, on an interim basis, the company said in a release. The board is conducting a search for a permanent successor.

Elliott launched its campaign in late November, pushing for “comprehensive leadership change” to address “long-term underperformance.” Shares of Crown Castle, a real estate investment trust, are down 13% this year, while the iShares Global REIT ETF is up almost 1%.

Elliott previously targeted Crown Castle in 2020, but said in a release detailing the latest campaign that the company “disregarded” the firm’s input and pursued a “value-destructive strategy.”

In addition to a shakeup in the C-suite, Elliott is also seeking to implement bylaw changes and a review of Crown Castle’s fiber business, up to and including a sale.

Crown Castle describes itself as one of the largest communications infrastructure providers in the country. The company controls more than 40,000 cell towers and rooftop installations. Its stock is down more than 40% from its 2021 high.

Elliott controls a $2 billion stake in Crown Castle. The activist fund founded by Paul Singer has pursued prior campaigns at companies including Twitter and Salesforce. This year, Elliott built a $1 billion stake in Phillips 66, and is seeking up to two board seats at the crude refining company.

A spokesperson for Elliott didn’t immediately return CNBC’s request for comment.