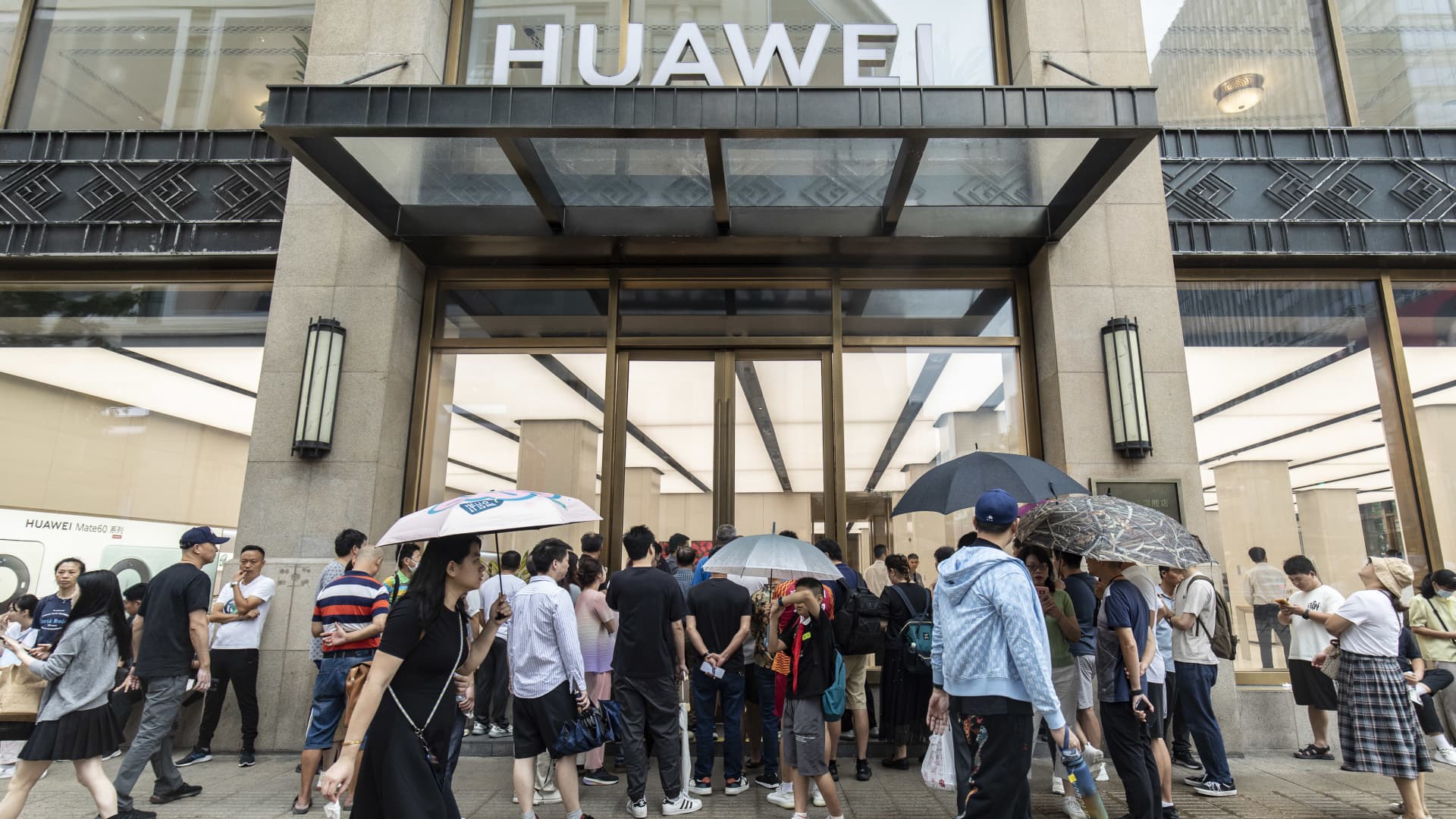

Chinese smartphone companies like Huawei are rebounding in their home market, giving a boost to domestic suppliers — and increasing the pressure on Apple . It’s a reflection of a geopolitically-driven shift in the tech industry. A clear takeaway from last week’s meeting of the U.S. and Chinese presidents is that American restrictions on sales of high-end tech to China will not be going away. While the summit could reduce the risk that tensions escalate in the near term, Morgan Stanley analysts said that “‘competitive confrontation’ will likely remain for now.” That “does not mean a complete decoupling, but instead continued tech competition and derisking away from China,” the analysts said in a note Thursday. Chinese President Xi Jinping called on the U.S. to lift its sanctions and provide a non-discriminatory environment for Chinese companies, according to a readout. But the U.S. said President Joe Biden emphasized the need to prevent advanced U.S. tech from undermining national security. In fact, Raymond James analysts said in a note Thursday their conversations with Washington, D.C., contacts supports expectations for more tech export controls. The Biden administration has also taken pains to emphasize the majority of trade with China is not affected by the restrictions, and that it does not target consumer-related applications. Huawei suppliers outperforming But investors are already moving. In a year in which negative sentiment has sent the MSCI China index down by nearly 11% in U.S. dollar terms, a Wind Information index of Huawei corporate partners and suppliers is up 36%. That is more than double the 15.5% increase so far this year for a Wind index of Apple suppliers. Telecommunications giant Huawei was a relatively early target of U.S. sanctions, halving its revenue from consumer products such as smartphones. The restrictions, imposed in 2019, included licensed access to the latest versions of Google’s Android operating system. Huawei has instead built out its own operating system. Reviews also indicated the company’s new Mate 60 Pro smartphone offers download speeds associated with 5G — thanks to an advanced chip, made by Chinese semiconductor giant SMIC. Huawei smartphone sales surged by 83% in October from a year ago, Counterpoint Research said in a note Tuesday. Honor, a Huawei spin-off, saw sales climb by 10%, while Xiaomi smartphone sales rose by 33%, the report said. The report did not break out Apple sales, only saying a broad category of “others” saw October smartphone sales drop by 12% from a year ago. Shenzhen-listed Lihexing sells smartphone testing equipment to Huawei and expects the company to ship at least 70 million phones next year, Nomura analysts said in a report Tuesday, citing a meeting with Lihexing management earlier in the week. The stock is up by more than 80% so far this year. In the most optimistic scenario, Lihexing expects Huawei could ship 90 million smartphones in 2024, the Nomura report said. “For the mid-/long-term, management expects additional revenue streams from EVs and charging stations, thanks to its long-lasting relationship with Huawei,” the analysts said, noting Lihexing does not plan to increase market penetration in Xiaomi and other Android brand phones “due to low profitability and intensified competition.” For context, Shanghai-based CINNO Research expects a 2% decline in Apple iPhone sales in China this year to 45.5 million units. Huawei sells a range of mass market phones in addition to premium models. On the electric vehicle front, Huawei has focused on providing in-car tech while partnering with manufacturers to make the vehicle. Shanghai-listed Sokon manufacturers the hybrid and pure battery-powered cars for Huawei under the Aito brand, officially launched in late 2021. In the last week, Huawei claimed it had already delivered 120,000 units of the Aito M5 alone. Shares of Sokon have climbed by more than 100% so far this year. Nomura analysts also said they met with Guangdong Topstar Technology, which became a supplier of Huawei, Xiaomi and others this year in the industrial robot space. The Shenzhen-listed stock is up by about 10% so far this year. Nomura does not yet have ratings on the Lihexing or Topstar. But Chinese investment banking giant CICC has an outperform rating on both Sokon and Topstar. Shenzhen-listed BYD shares and Shanghai-listed Foxconn Industrial Internet shares are in both Wind’s Huawei and Apple indexes. — CNBC’s Michael Bloom contributed to this report.