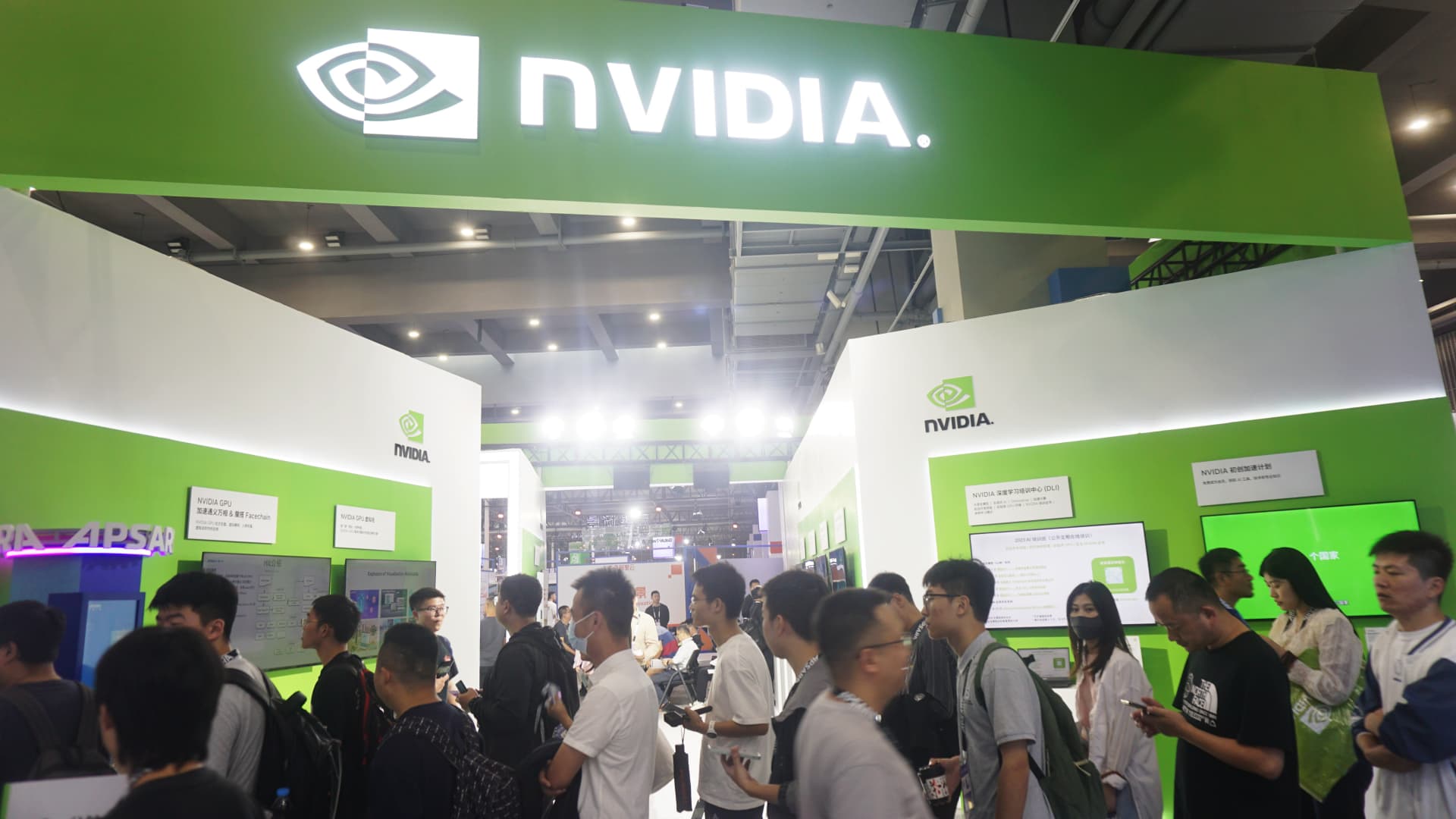

Nvidia earnings will be in focus in the Thanksgiving-shortened week ahead, as investors consider the sustainability of the November rally heading into year-end. The chip giant, which reports Tuesday, is anticipated to show solid third-quarter results. Nvidia is expected to have earned $3.37 per share on revenue of $16.19 billion, according to consensus estimates from FactSet. The revenue figure alone would be above its $16 billion guidance for the quarter, and also higher than the $5.9 billion registered a year earlier, highlighting just how crucial the company’s graphics processing units (GPUs) have become to the growth of artificial intelligence. But after the stock’s more than 200% advance this year, investors will focus on the Nvidia’s guidance and forward-looking commentary to determine whether the chipmaker’s overvalued, or if the bullish case around the main AI beneficiary remains intact. “I think the path of least resistance is still up,” said Timothy Arcuri, managing director at UBS who covers the stock. “And I think it’s going to be a solid set of results.” NVDA YTD mountain Nvidia YTD The chip giant’s results will come amid a broad rally for equities this month. In November, the Dow Jones Industrial Average gained more than 5%. The S & P 500 has climbed more than 7%, and the tech-heavy Nasdaq Composite has advanced more than 9%. Is Nvidia expensive? Part of what’s driving concern around Nvidia is its valuation, especially when it’s compared with the broader market. Nvidia, which became a $1 trillion company this year, has a trailing 12-month price-to-earnings ratio at an eye-watering 118. That stands in marked contrast to the S & P 500, which trades at a multiple of 22. Another worry for investors is demand for Nvidia chips after the fresh U.S. restrictions on exports to China — and after Microsoft this week unveiled its own custom AI chips to compete with Nvidia. Even so, investors remain bullish on the stock, which remains a consensus buy on the Street. As for concerns around the stock, Piper Sandler analyst Harsh Kumar noted Nvidia should be able to design around China bans, which would have a “minimal impact to future guidance.” He also said the launch of other AI services that are coming online will only “put more pressure on the demand for GPUs and could ultimately extend the longevity of the AI upcycle.” Some market participants, meanwhile, see any disappointment out of Nvidia’s results that hurts the stock price will only be bought up by investors eager to get into the trade. “Even if they disappoint somehow — without, you know, without a major disappointment — the buyers could come in soon after,” said Quincy Krosby, chief global strategist at LPL Financial. “It is an essential, essential component of the AI story.” Hopes for a dovish Fed Wall Street is also heading into next week after absorbing some positive news. In addition to falling Treasury yields, the latest inflation data appeared to confirm the Federal Reserve is done with rate hikes. October’s consumer price index and producer price index both came in cooler than expected. The S & P 500 and Dow on Friday were headed for their longest weekly winning streak since July, as investors started deliberating when the central bank could begin to unwind its tightening campaign, adding to bullish sentiment. .SPX 1M mountain S & P 500 “I actually think it’s pretty likely we could see record highs before the end of the year,” Bill Baruch, founder at Blue Line Futures, told CNBC’s ” Halftime Report ” on Friday. “This is one of the most healthy consolidations over the last couple of days.” In fact, the timing and likelihood of rate cuts in 2024 are moving up. According to the CME FedWatch Tool , there’s a near 40% chance rates will be down by 0.5 percentage point in July. That’s up from a roughly 30% probability just last week. But some market participants voiced concerns that the market is overstretching itself, and may be too early in pricing in a dovish pivot from the Fed. Some expect that Treasury yields will continue to compete with equities, and attract more investors by year end. “There is a natural imbalance that is going to happen at year-end. Bonds have taken it in the chin, and equities have done fairly well with pretty much the recent peak. So you need to basically sell your equities and get back into Treasurys just by the nature of the cycle,” said Giuseppe Sette, co-founder and president at investment platform Toggle AI, who expects the market will end the year close to where it traded this week. “This pressure — maybe connected with some profit taking — might keep equities capped from here,” added Sette, the former co-CIO of global macro at Lombard Odier. Investors will get more insight into the Fed’s potential moves Tuesday, when the minutes from its Oct. 31-Nov. 1 meeting are released. Thanksgiving trading In recent years, at least, trading around the Thanksgiving holiday has been choppy, according to the Stock Trader’s Almanac. Since 1988, the Dow has posted gains during the Wednesday-through-Friday stretch 18 out of 34 times. “The best strategy appears to be coming into the weekend long and exiting into strength before the holiday,” editor Jeff Hirsch wrote in the Almanac. Markets will be closed Thursday for the Thanksgiving holiday, and close early Friday. Week ahead calendar All times ET. Monday, Nov. 20 10 a.m. Leading indicators (October) Tuesday, Nov. 21 8:30 a.m. Chicago Fed national activity index (October) 10 a.m. Existing home sales (October) 2 p.m. FOMC Minutes Earnings: Nvidia , HP Inc. , Autodesk , Best Buy , Analog Devices , Lowe’s Companies Wednesday, Nov. 22 8:30 a.m. Durable orders preliminary (October) 8:30 a.m. Initial jobless claims (week ended Nov. 18) 10 a.m. Michigan sentiment final (November) Earnings: Deere Thursday, Nov. 23 Thanksgiving Day — U.S. markets are closed Friday, Nov. 24 9:45 a.m. S & P Global PMI composite preliminary (November) 9:45 a.m. S & P Global PMI manufacturing preliminary (November) 9:45 a.m. S & P Global PMI services preliminary (November) — CNBC’s Michael Bloom contributed to this report.