[ad_1]

More than half of the world’s largest public companies have committed to an emissions reduction target and many plan to buy carbon credits to “offset” their ongoing emissions. The voluntary carbon markets (VCMs) trade in these credits, which equate to one tonne of CO₂ reduced or removed from the atmosphere. The credits are generated by an array of climate mitigation projects dotted across the planet that offer the potential to channel vast swathes of private capital into climate action. The most prolific project type is forest carbon offsets.

‘Reducing Emissions from Deforestation and Forest Degradation’ (REDD+), boasts a quarter of all carbon credits to date. REDD+ pays landowners for activities that preserve forests (and their carbon sequestration), typically in Global South countries. Forests are home to a large share of the world’s biodiversity, 40% of its plant-based carbon (more than 180 billion tonnes) and many of its indigenous communities. Yet despite more than £3bn in aid for and 20 billion carbon credits from REDD+ over the past two decades, deforestation continues at an alarming rate: roughly one football field of forest is lost every second.

The integrity of REDD+ forest carbon offsets is increasingly under fire. The latest blow comes from a new study of the market by Berkeley’s Goldman School of Public Policy, which has revealed serious shortcomings: it finds vastly exaggerated carbon savings and failed safeguards for forest communities. The researchers call for a re-evaluation of the role that avoided deforestation carbon credits play in corporate carbon neutrality claims, climate change mitigation strategies and funding for forest protection.

“I don’t think the market is fixable – I am having the same conversations about quality that I was 20 years ago,” says lead author Barbara Haya, director of the Berkeley Carbon Trading Project, a research and outreach programme dedicated to studying the effectiveness of carbon trading and offsetting. “An entirely different approach is needed to reduce deforestation and cut emissions.” But what?

Widespread over-crediting

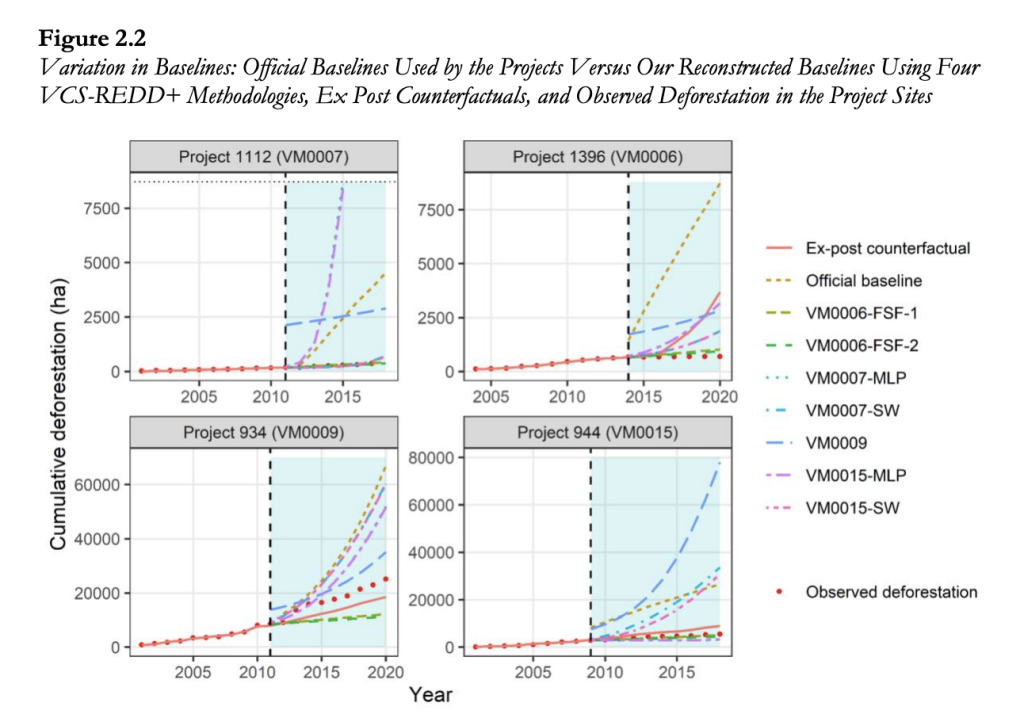

The Berkeley team’s research reviewed the four most widely used REDD+ carbon crediting methodologies: Verra’s VM0006 (Terra Global Capital, 2017), VM0007 (Avoided Deforestation Partners, 2020), VM0009 (Wildlife Works & ecoPartners, 2014) and VM0015 (Pedroni, 2012) on the basis of five quality factors: baselines, leakage, forest carbon accounting, durability and safeguards.

The primary takeaway was a widespread practice of significant over-crediting by REDD+ forest carbon offset methodologies across all the factors. The researchers found that flawed baselines alone likely resulted in over-crediting of 92% (projects are issued 13 times more credits than their actual emissions reductions). In addition, forest carbon accounting methods used by project developers typically resulted in estimates 23–30% higher than the Berkeley team’s calculations. The researchers also found that average deductions for natural risk (pests, forest fires, for example) were 2% when they should have been greater than 28%, which translates into additional over-crediting of more than 36% from that factor alone, they say. Leakage deductions were much lower than those from the academic literature. In sum, since over-crediting compounds across factors, only a very small fraction of forest carbon offset credits likely represent real emissions reductions from REDD+ projects, the Berkeley researchers conclude.

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free

sample

Thank you!

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

One of the main problems is the REDD+ forest carbon offset market’s perverse incentive structure, finds the study. By primarily valuing carbon, emissions reductions are prioritised over all else. Safeguards such as community consultations are presented as a backstop to avoid harm but are limited in their effectiveness. The complex, unequal and often contentious contexts of REDD+ interventions create the perfect conditions for generating poor-quality credits and exploiting vulnerable populations.

“All participants in the carbon market benefit from more credits,” says Haya. “Significant uncertainty and complexity in carbon calculations creates an opening for many decisions, all leaning towards excess credits, that compound into overwhelming levels of over-crediting.”

Offsets, argue Haya and her colleagues, do not reduce the concentration of greenhouse gases in the atmosphere but move where the emissions occur. As companies lay claim to the carbon sequestration services proffered by distant landscapes, the governments, landholders or communities that receive offset payments cede their own emissions rights – their ability to use the territories designated as carbon sinks for their own subsistence and development. According to Oxfam, the land area required for the offsetting plans of just the top four oil companies that have made net-zero pledges would be the size of the UK by 2030 and twice that by 2050. Rather than relying on offsets, the world should focus on the underlying causes of deforestation and work to reverse the policies that promote them, state the researchers.

The alternatives to forest carbon offsets

There exist many programmes aimed at reducing deforestation that do not rely on a market-based system, typically run by impact funds, foundations, NGOs and conservation charities. “Sometimes it is presented as if it is all or nothing: either it is carbon credits or it is no conservation – but there is a lot in-between,” says Jonathan Crook, a policy analyst at the non-profit Carbon Market Watch. “Offsetting needs to go.”

One alternative to relying on carbon markets would be to curb the demand-side drivers of deforestation. Demand for food, fibres, ores and fuels drives deforestation, but legislation can mandate sustainable trade, such as the EU’s regulation on deforestation-free products. Companies may also be incentivised to phase out their supply chain inputs from high-conservation-value areas through sustainability reporting laws.

Another approach would be to support forest plans designed by indigenous and local communities. These communities have proven to be the most effective forest protectors but often lack the resources to make an impact. Contributions from indigenous peoples networks can help recognise the human and land rights of these communities while also supporting sustainable development.

Organisations, funds, programmes and projects could invest in climate mitigation, without counting any corresponding benefits as offsets. Criteria and procedures for such contributions have been proposed by civil society organisations, and are under discussion at the UNFCCC over how carbon markets can help achieve the Paris Agreement goals.

“There has been movement towards the idea of a ‘contribution claim’ where companies could retire carbon credits but without using them to compensate for their emissions,” says Crooks.

Debt relief can also play a role. Some governments condone forest-destroying activities because exports from them earn foreign-exchange income. After the Covid pandemic and energy crisis, Global South debts are once again spiralling. Loans from the IMF and multilaterals have added to the debt burden, with requirements that borrowers take steps to increase exports. Writing off some of these debts could relieve some pressure driving tropical deforestation.

Most importantly, the global community must take actions that focus on reducing fossil fuel emissions at source. That would help relieve the biophysical stresses that forests face from climate change itself. Companies could invest funds they would have spent on carbon credits into directly reducing their own emissions.

“Ideally, offsets should be used as a last resource only after organisations have taken every possible action to reduce their emissions,” says Thales A.P. West, an environmental scientist at Vrije Universiteit Amsterdam and a fellow at the University of Cambridge. “Rather than wasting money on potentially junk offsets, it is better to invest in avoiding, reducing and insetting [when companies invest in carbon reduction projects within their own supply chain] emissions – in that order. The current REDD+ system is not fit for purpose.”

Baby, bathwater

However, not everyone agrees. For many, these are just the teething issues of any maturing financial market. The idea of jettisoning the whole system and starting again with a new approach smacks of throwing the baby out with the bathwater.

“We can’t get rid of these risks to environmental and social integrity, but we can manage them and make sure they are far outweighed by the benefits,” says Frances Seymour, distinguished senior fellow at environmental research NGO the World Resources Institute. “The answer to the 2007 mortgage crisis wasn’t to ban mortgages, it was to regulate them better.” She adds that The Integrity Council for the Voluntary Carbon Market, formed in September 2021, is already addressing a lot of these governance and oversight issues.

The issues are not specific to REDD+ forest carbon offsets either but are relevant to all project types including emerging carbon removal technologies such as direct air capture (DACCS), bioenergy carbon capture and storage, and biochar. “REDD+ has just become the poster child for this because it was where the market started,” says Caitlin Smith, manager of the Carbon Markets Initiative at the clean energy think tank RMI. For example, a recent investigation in India found that carbon credits linked to clean cookstove offsets produced millions of fake emissions cuts.

Instead of binning REDD+ offsets, a shift towards “jurisdictional-based crediting” would go a long way towards addressing many of the problems, say both Smith and Seymour. To date, REDD+ credits on the VCMs have been issued by individual projects, focused on a defined area of forest. A baseline level of deforestation is established for that area, informed by historic trends and activity in one or more nearby, similar reference areas. The number of credits issued by the project depends on how much deforestation has reduced relative to this baseline.

In jurisdictional-based crediting, all the forest in a national or regional jurisdiction must be considered when setting a baseline and monitoring deforestation in a REDD+ project. With the advent of remote-sensing and artificial intelligence in recent years, this can realistically be done to a high level of accuracy. “We now have remote sensing technologies such as satellite imagery and Lidar that can detect deforestation down to the removal of individual trees, so we can better estimate the carbon fluxes that are associated with that deforestation,” adds Seymour.

The big advantages of jurisdictional approaches to REDD+ are: a reduced risk of inflated baselines and overcrediting; improved leakage monitoring; economies of scale; and, finally, because jurisdictional approaches are overseen by governments, an incentive to use politics, policy and regulation to tackle forest emissions.

One of the key requirements for an improved offsets market is also transparency. To this end, RMI has teamed up with blockchain company Ripple to launch Centigrade, an open data platform focused on delivering valuable data to all carbon offsets players – sellers, buyers and service providers including digital measurement providers, verifiers, auditors, certifiers and ratings agencies. Suppliers can use the platform to introduce their product to the world, exchanges and buyers can use it for price discovery, searches and due diligence, and service providers can use it to evaluate, track, analyse and rate credits and their movements.

“The aim is for it to play a role like the Bloomberg Terminal does in traditional financial markets,” says Smith. “Our theory is that the market needs more transparent information, where all stakeholders have the information they need to differentiate based on the quality attributes they are looking for. So that means the people who want to buy $3 junk credits can do so, as can people who want to buy the $900 DACCS credits. There needs to be a way to differentiate the quality based on the data that is in the credit.”

At the end of the day, perhaps the most compelling argument for sticking with forest-based carbon offsets is also the most reductive: we are in a climate crisis and time is of the essence. All Intergovernmental Panel on Climate Change pathways state the world needs to not only halt but reverse deforestation by 2030. The Energy Transitions Commission predicts that will cost $130bn a year by 2030; currently, financing to protect forests stands at a mere $2bn–$3bn a year. For Seymour, the idea that public financing for that purpose is going to increase 100-fold in just seven years is at best fanciful.

“When we started building this [REDD+] machine 15 years ago, it was the last best hope for raising the large-scale finance required to solve this [deforestation] problem; to decommission it now would be madness,” she says. “The planet is on fire. We simply don’t have time to build a new machine. We should be improving the current one as well as coming up with new approaches – we are going to need all the help we can get.”

[ad_2]