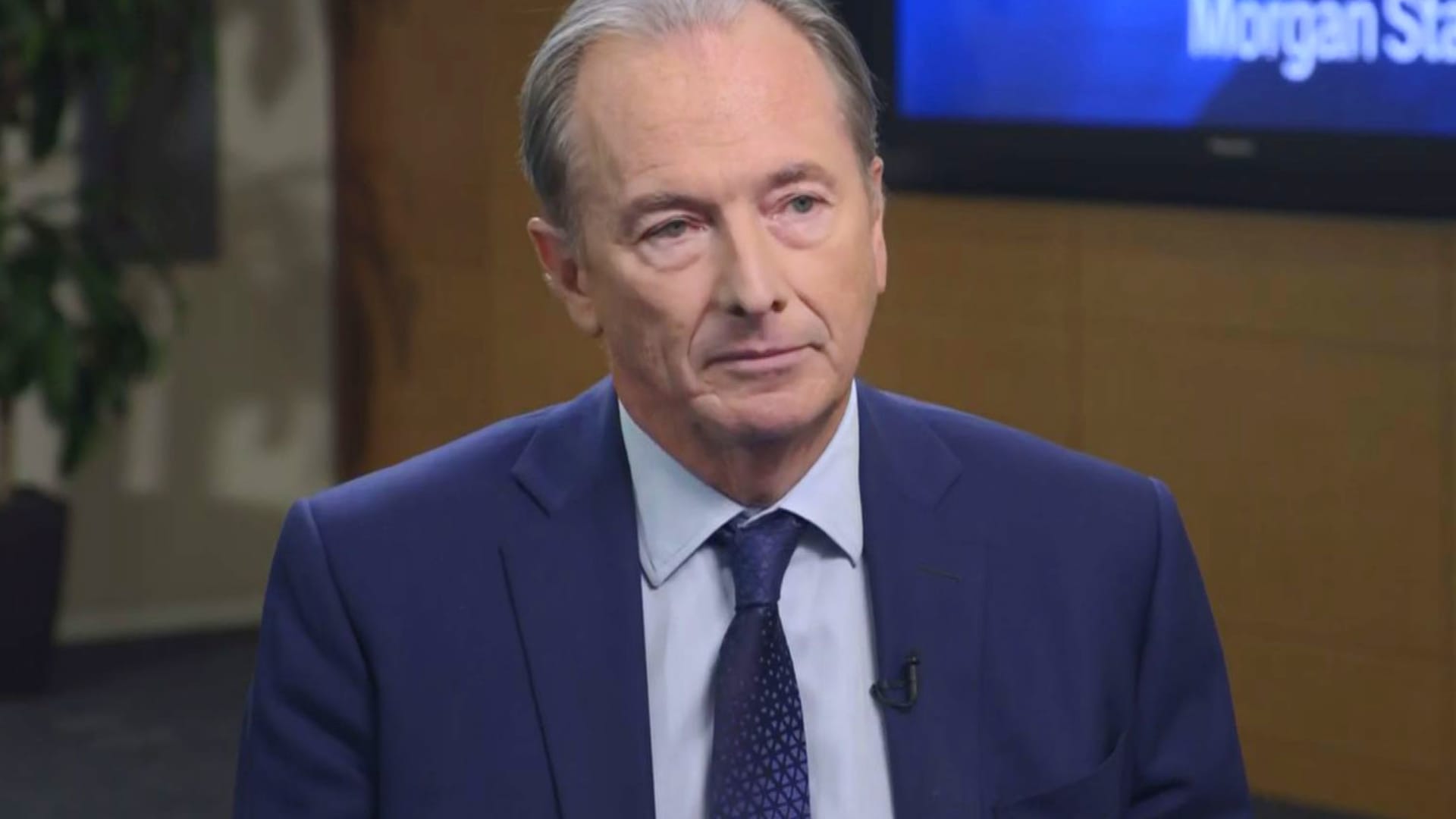

James Gorman, Morgan Stanley CEO, July 18, 2023.

CNBC

Morgan Stanley said Wednesday that Ted Pick will succeed James Gorman as CEO at the start of 2024.

Pick, a Morgan Stanley veteran who rose through the ranks to lead the bank’s Wall Street operations, will also join the New York-based bank’s board, according to the release.

Gorman will stay on as executive chairman.

The announcement ends the top succession race on Wall Street. Morgan Stanley announced in May that Gorman intended to step down within a year and that it would select his successor from one of the bank’s three main division heads.

Pick, who was co-president of Morgan Stanley for the last two years, led the bank’s institutional securities group, which includes investment banking and trading activities.

Among insiders, Pick has long been considered frontrunner for the CEO job because of the complexity and risks involved with leading one of Wall Street’s top firms. Pick, who graduated from Middlebury College and has a Harvard MBA, joined Morgan Stanley in 1990.

He earned his reputation by whipping several businesses into shape during an uncertain time for Morgan Stanley. The bank nearly capsized during the 2008 global financial crisis and needed a $9 billion injection from Mitsubishi bank.

In the aftermath of that tumultuous period, Pick led Morgan Stanley’s equities division to become the global leader by revenue, in part with technology investments for quant investors and an emphasis on becoming a top prime broker to hedge funds.

Then, he was assigned to lead the bank’s ailing fixed income business, where he is credited with another turnaround. That performance led to his most recent role, as head of all Wall Street activity.

This is breaking news. Please check back for updates.