[ad_1]

A construction in a multifamily and single family residential housing complex is shown in the Rancho Penasquitos neighborhood, in San Diego, California, September 19, 2023.

Mike Blake | Reuters

In theory, getting inflation closer to the Federal Reserve’s 2% target doesn’t sound terribly difficult.

The main culprits are related to services and shelter costs, with many of the other components showing noticeable signs of easing. So targeting just two areas of the economy doesn’t seem like a gargantuan task compared to, say, the summer of 2022, when basically everything was going up.

In practice, though, it could be harder than it looks.

Prices in those two pivotal components have proven to be stickier than some other things like food and gas or even used and new cars, all of which tend to be cyclical as they rise and fall with the ebbs and flows of the broader economy.

Instead, getting better control of rents, medical care services and the like could take … well, you might not want to know.

“You need a recession,” said Steven Blitz, chief U.S. economist at GlobalData TS Lombard. “You’re not going to magically get down to 2%.”

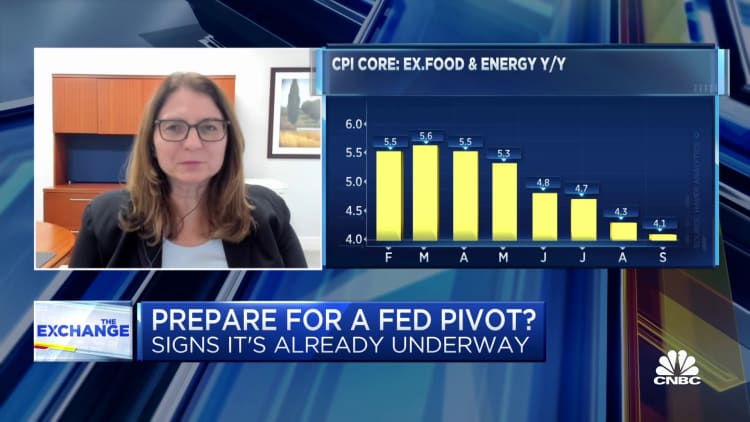

Annual inflation as measured by the consumer price index fell to 3.7% in September, or 4.1% if you kick out volatile food and energy costs, the latter of which has been rising steadily of late. While both numbers are still well ahead of the Fed’s goal, they represent progress from the days when headline inflation was running north of 9%.

The CPI components, though, told of uneven progress, helped along by an easing in items such as used vehicle prices and medical care services but hampered by sharp increases in shelter (7.2%) and services (5.7% excluding energy services).

Drilling down further, rent of shelter also rose 7.2%, rent of primary residence was up 7.4%, and owners’ equivalent rent, pivotal figures in the CPI computation that indicates what homeowners think they could get for their properties on the rental market, increased 7.1%, including a 0.6% gain in September.

Without progress on those fronts, there’s little chance of the Fed achieving its goal anytime soon.

Uncertainty ahead

“The forces that are driving the disinflation among the various bits and micro pieces of the index eventually give way to the broader macro force, which is rising, which is above-trend growth and low unemployment,” Blitz said. “Eventually that will prevail until a recession comes in, and and that’s it, there’s nothing really much more to say than that.”

On the bright side, Blitz is among the consensus that sees any recession being fairly shallow and short. Even more so, many Wall Street economists, Goldman Sachs among them, are coming around to the view that the much-anticipated recession may not even happen.

In the interim, though, is uncertainty.

“Sticky-price” inflation, a measure of things such as rents, various services and insurance costs, ran at a 5.1% pace in September, down a full percentage point from May, according to the Cleveland Fed. Flexible CPI, including food, energy, vehicle costs and apparel, ran at just a 1% rate. Both represent progress, but still not a goal achieved.

Markets are puzzling over what the Fed’s next step will be: Do policymakers slap on another rate hike for good measure before the end of the year, or do they simply stick to the relatively new higher-for-longer script as they watch the inflation dynamics unfold?

“Inflation that is stuck at 3.7%, coupled with the strong September employment report, could be enough to prompt the Fed to indeed go for one more rate hike this year,” said Lisa Sturtevant, chief economist for Bright MLS, a Maryland-based real estate services firm. “Housing is the key driver of the elevated inflation numbers.”

Higher interest rates have made their biggest impact on the housing market in terms of sales and financing costs. Yet prices are still elevated, with concern that the high rates will deter construction of new apartments and keep supply constrained.

Those factors “will only lead to higher rental prices and worsening affordability conditions in the long run,” wrote Christopher Bruen, senior director of research at the National Multifamily Housing Council. “Rising rates threaten the strength of the broader job market and economy, which has not yet fully digested the rate hikes already enacted.”

Longer-run concerns

The notion that rate increases totaling 5.25 percentage points have yet to wind their way through the economy is one factor that could keep the Fed on hold.

That, however, goes back to the idea that the economy still needs to cool before the Fed can complete the final mile of its race to bring down inflation to target.

One positive in the central bank’s favor is that pandemic-related factors largely have washed out of the economy, but other factors linger.

“Pandemic-era effects have a natural gravitational pull and we’ve seen that take place over the course of the year,” said Marta Norton, chief investment officer for the Americas at Morningstar Wealth. “However, bringing inflation the remainder of the distance to the 2% target requires economic cooling, no easy feat, given fiscal easing, the strength of the consumer, and the general financial health in the corporate sector.”

Fed officials expect the economy to slow this year, though they have backed off an earlier expectation for a mild recession.

Policymakers have been banking on the notion that when existing rental leases expire, they will be renegotiated at lower prices, bringing down shelter inflation. However, the rising shelter and owners equivalent rent numbers show that could be a long log even though so-called asking rent inflation is easing, said Stephen Juneau, U.S. economist at Bank of America.

“Therefore, we must wait for more data to see if this is just a blip or if there is something more fundamental driving the increase such as higher rent increases in larger cities offsetting softer increases in smaller cities,” Juneau said in a note to clients Thursday. He added that the CPI report “is a reminder that we do not have good historic examples to lean on” for long-term patterns in rent inflation.

[ad_2]