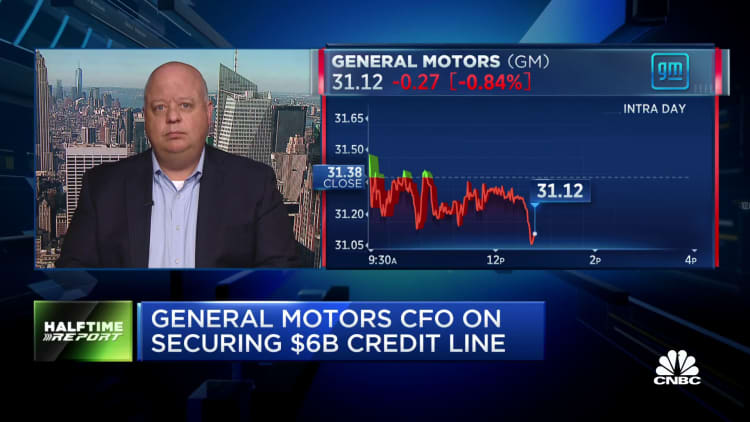

DETROIT – General Motors secured a new $6 billion line of credit as the automaker braces for additional strikes by the United Auto Workers union.

“The facility that we announced today is a $6 billion line of credit that I think is prudent in light of some of the messages that we’ve seen from some of the UAW leadership that they intend to drag this on for months,” CFO Paul Jacobson told CNBC’s Phil LeBeau in an interview on “Halftime Report.”

The targeted strikes already cost the automaker $200 million during the third quarter, GM said Wednesday.

A GM spokesman said the $200 million strike cost is due to lost production on wholesale volume, largely due to the UAW’s initial Sept. 15 strike at GM’s midsize truck and full-size van plant in Wentzville, Missouri. The strike has since expanded to GM’s parts and distribution facilities nationwide and, as of last Friday, a crossover plant in mid-Michigan.

As a result of the strike in Missouri, GM also idled its Fairfax Assembly Plant in Kansas, where it builds the Cadillac XT4 SUV and the Chevrolet Malibu sedan, and laid off nearly 2,000 workers.

Both GM CEO Mary Barra as well as Ford Motor CEO Jim Farley have publicly criticized UAW President Shawn Fain and the union’s strike strategy, claiming Fain is not actually interested in reaching deals for 146,000 workers with GM, Ford and Chrysler parent Stellantis.

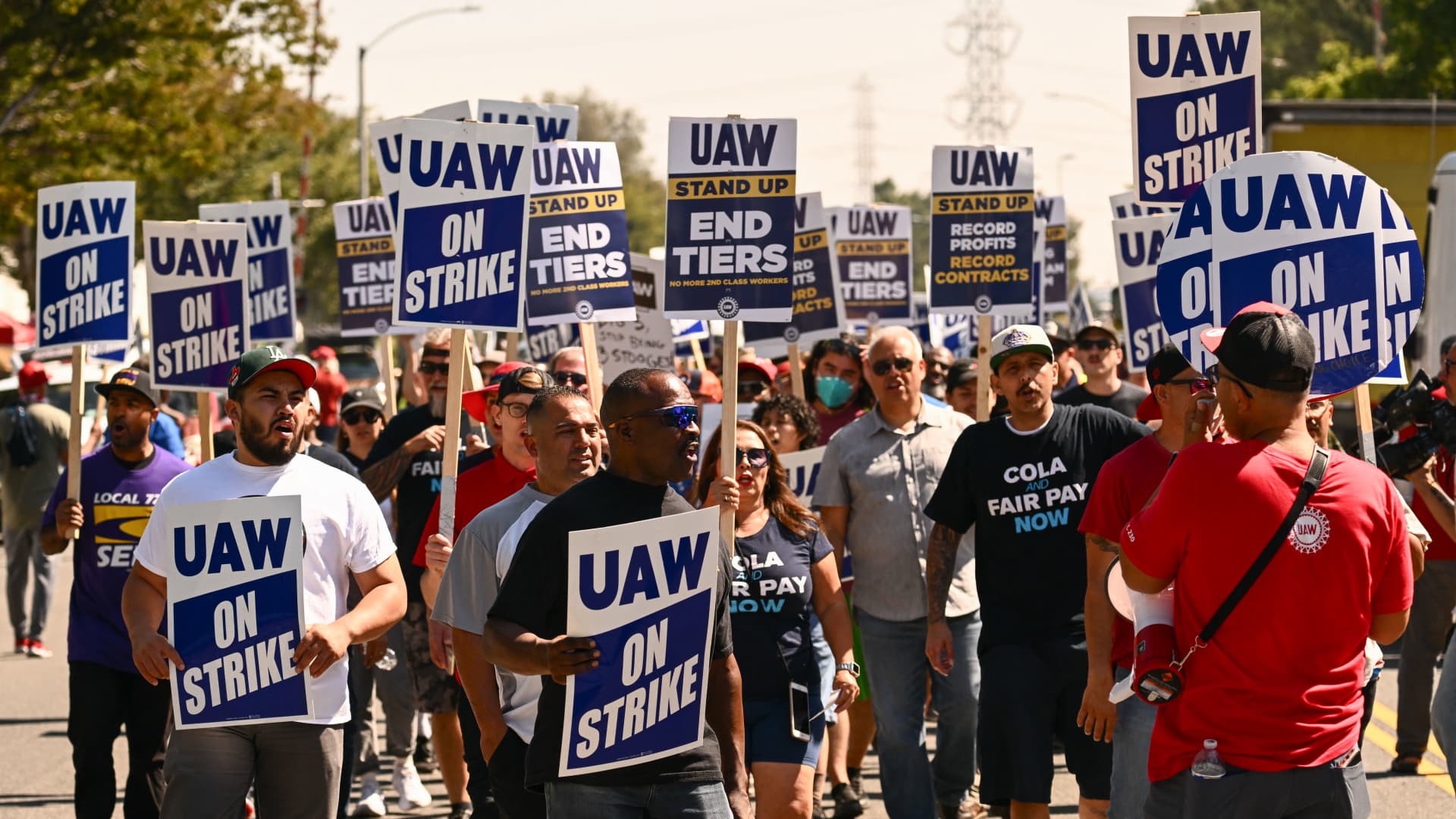

Members of the United Auto Workers (UAW) Local 230 and their supporters walk the picket line in front of the Chrysler Corporate Parts Division in Ontario, California, on September 26, 2023, to show solidarity for the “Big Three” autoworkers currently on strike.

Patrick T. Fallon | AFP | Getty Images

“It’s clear that there is no real intent to get to an agreement,” Barra said in an emailed statement Friday night. “It is clear Shawn Fain wants to make history for himself, but it can’t be to the detriment of our represented team members and the industry.”

Fain has consistently said the union is available to negotiate 24/7 and has in turn accused the automakers of slow-walking negotiations.

GM’s newly announced line of credit will require the automaker to maintain at least $4 billion in global liquidity and $2 billion in U.S. liquidity. The terms of the credit agreement also restrict GM from mergers or sales of assets and limits on other, new debt. As of June 30, GM’s total automotive liquidity was $38.9 billion.

The credit line comes more than a month after Ford obtained a $4 billion line of credit to help it manage through “uncertainties” in the market.