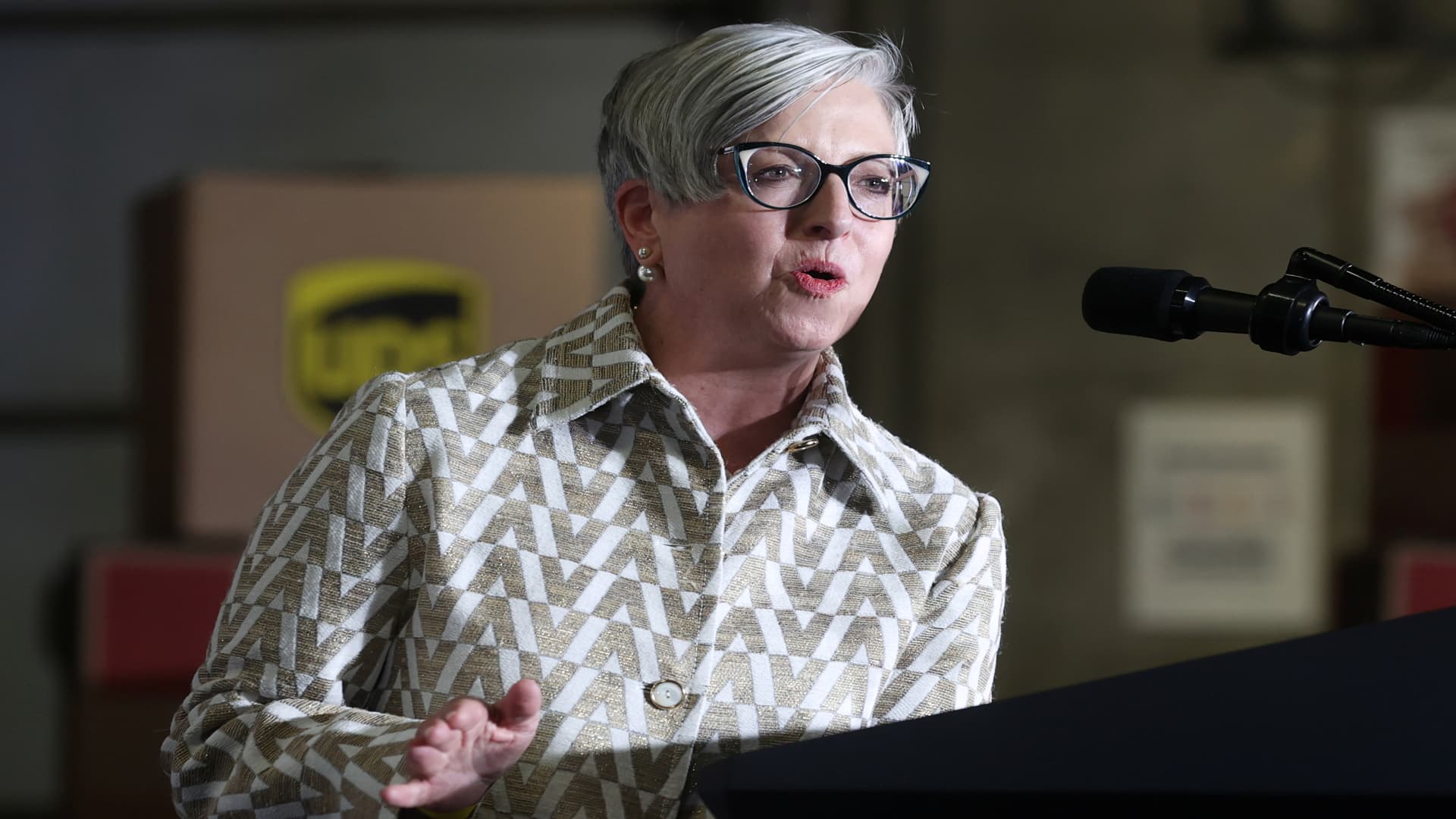

UPS CEO Carol Tome introduces U.S. President Donald Trump for an event at a UPS facility at Hartsfield-Jackson Atlanta International Airport in Atlanta, Georgia, U.S., July 15, 2020.

Jonathan Ernst | Reuters

UPS CEO Carol Tome said the costs incurred by the company for the new Teamsters contract are less than the “$30 billion in new money” touted by the union, as the company aims to sell investors on the agreement.

“It’s not a $30 billion deal,” Tome told CNBC’s Frank Holland in an exclusive interview on Monday. But Tome declined to reveal the internal projection as the company released its first presentation to investors outlining the labor expenses after the bell Monday.

UPS said 46% of the compensation in the deal would be in the first year. Tome called the agreement cost-effective and fair.

“It’s a barbell structure where it’s heavier in the beginning of the contract.” Tome said. “We’ll go in the middle of the contract and it steps back down. This 46% of the cost increase happens in the first year, so imagine what the last four years of the contract are!”

The increases “are really good for us and a 3.3% compounded annual growth rate,” she added. “That’s a deal we’ll take every day, but it wasn’t just about the money. We’ve got work/life balance for people, while retaining the ability to deliver on the weekend, which is really important for our customers.”

Averting a crisis

The labor contract reached in July prevented a potentially widespread and disruptive work stoppage. A Teamsters strike would have been the “costliest in a century,” creating a $7 billion hit to the U.S. economy in the first 10 days, according to a widely reported estimate from Anderson Economic Group.

It also was another milestone in a summer marked by pushes for massive new contracts — and even strikes — in industries ranging from airlines and automaking to television and film. At UPS, full-time drivers will earn up to $170,000 in pay and benefits in the last year of the contract, while part-time workers will see their starting pay rise from $16.20 to $21 an hour.

Official negotiations between UPS and the Teamsters began in April, as union leaders urged members to mobilize and create a “show of force it needs to take on the company.” In June, Teamsters members authorized a UPS strike during the negotiations. Weeks later, both sides accused the other of walking away from the contract talks.

In late July, UPS and the Teamsters announced they had reached a tentative contract agreement. The union ratified the UPS contract on Aug. 25 with record turnout of 58% of members voting and a record 86% approving the deal.

A ‘win-win-win’

After the tentative deal for the Teamsters contract was reached, Tome called it a “win-win-win” for the union, customers and the company.

However, UPS shares have fallen more than 14% since the July 25 announcement. Tome also estimated that UPS lost more than 1 million packages per day in volume in the weeks leading up to the eventual deal.

“We can grow now that we have certainty,” Tome said. “Because we know what our labor costs are over the next five years, we can put together plans to mitigate that cost, plans to drive productivity inside of our business through automation, which, oh by the way, we retained the ability to do so.”

Tome said the win for customers, as the holiday-shipping peak approaches, is the most important part of the deal. U.S. holiday e-commerce sales are expected to increase by 1% year over year to $273 billion, according to a recent forecast from Salesforce.

UPS shifts to modernization strategy

Tome said the Teamsters negotiation was another test of her leadership, rivaling the challenge of becoming CEO of UPS in June 2020 at the height of the Covid-19 pandemic and the beginning of an unprecedented surge in e-commerce.

“We actually started thinking about this contract negotiation the day I onboarded. Where the industry was going, what we needed to survive. We started thinking about this as a strategic imperative,” Tome said.

With the Teamsters contract done, Tome said she is focused on her “Better and Bolder” strategy, the next phase of her initial “Better not Bigger” philosophy which focused on modernizing and maximizing profits at the more than 115-year-old shipping and logistics giant. The “better” part seeks higher margin volume as well as increasing worker and facility productivity, while the “bolder” initiative involves using automation, artificial intelligence and other innovation to capture more business.

“In terms of generative AI, where we can really use this technology is to improve the customer experience,” Tome said. “We have over 12,000 people in our customer care centers around the world, each of them trying to interact with a customer who may have an issue. Think about how it will be when we have a ‘bot’ involved learning from that experience and sharing that learned experience around the world. Not only will it drive productivity but it will give better customer experience.”