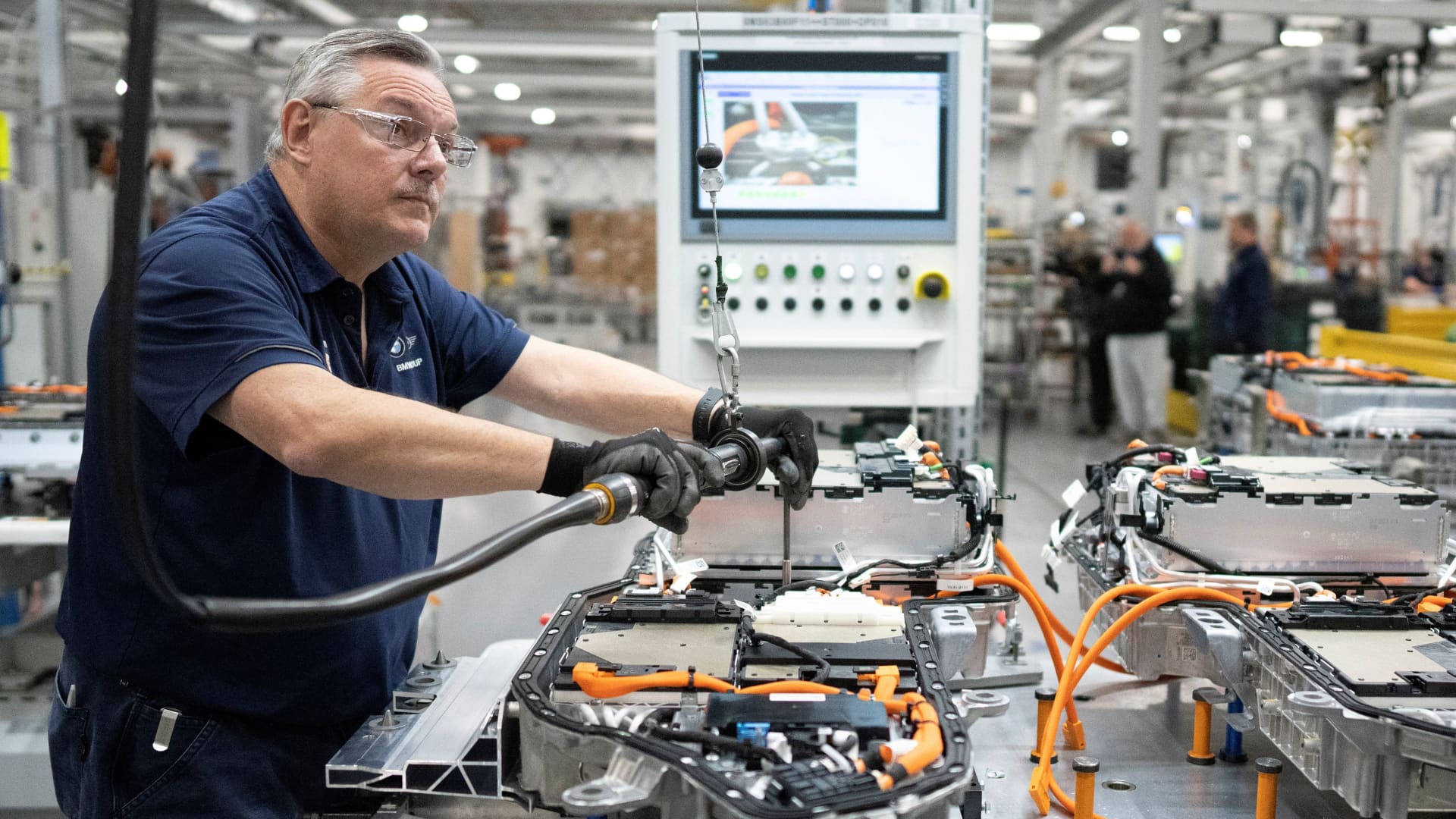

Several signals from China this week suggest that European companies with close ties to the world’s second-largest economy may face difficulties in the coming months. China’s central bank, in a surprise move, cut interest rates on Tuesday as it attempts to buoy a stuttering economy. Wall Street bank JPMorgan also raised its expectations for higher default rates in the broader emerging markets, primarily due to rising contagion fears in China’s depressed property sector. The investment bank’s risk assessment underscores fears that a slowdown in the world’s second-largest economy will have a far broader ripple effect. For instance, companies in the European Union relied on China as its third-largest export market during 2022, with goods and services worth 230 billion euros ($250 billion) being sold into the country, according to data from Eurostat. CNBC Pro’s analysis of sales data found that companies in the mining and autos sector, luxury goods, and semiconductor and high-tech manufacturing are the most exposed to China. The table below shows the top 20 companies in the Stoxx Europe 600 index, with the most significant revenue share directly dependent on China. Mining London-listed mining giants Rio Tinto and Anglo American had some of the biggest revenue exposure to China as a percentage of their total sales. Shares of both companies have sold off 15% and 35% this year, respectively, amid negative sentiment toward the basic resources sector. As one of the largest iron-ore miners, Rio’s fortunes are deeply nested with industrial demand for steel, whose fate now lies in the hands of China’s government, according to UBS analysts. “Politburo pivot has boosted sentiment but policy needs to follow to properly gauge commodity demand/price impacts,” the Swiss bank’s analyst told clients on July 26 as they downgraded the stock. Elsewhere, RBC analysts told clients that they “expect iron ore prices to weaken in 2023 driven by tepid China steel demand estimates.” Automakers Porsche , BMW , and Volvo Cars are among the European automakers to make a big chunk of their money in China. At 41 billion euros in annual sales, BMW also had the biggest exposure of any non-oil European company to China in the Stoxx Europe 600 index. However, secular problems facing the auto sector, such as a backlog of orders due to supply chain issues in 2022 and growth in EV sales, have meant demand for cars has stayed buoyant. Shares of BMW have rallied by 30% so far this year. However, according to Sitel analysts, the stock is at risk of reversing its trend. “BMW has the highest China exposure among European OEMs [original equipment manufacturers] — we prefer a higher US exposure (which Mercedes has). Pricing deteriorated (from high levels) in Q2 vs Q1. We expect a further deterioration in H2. BMW has a lower cash conversion rate than Mercedes,” said Stifel’s Europe analysts led by Daniel Schwarz in a note to clients on Aug. 7. Methodology: Revenue data by geography was available only for 422 out of the 600 companies on the Stoxx Europe 600 index. FactSet data relies primarily on geographical sales data disclosures from companies directly. When this is not available, FactSet applies a proprietary algorithm to estimate the percentage revenue exposure.