When it comes to condo investing in 2023, there are advantages and disadvantages that should be weighed against each other.

Investing in a condo by turning it into a rental property may seem like an alluring opportunity, but it’s imperative to recognize that it comes with both benefits and pain points that demand careful consideration.

This guide provides a comprehensive overview of everything you need to know about whether condos are a good investment, including tips on how best to approach such an endeavor successfully. We will also answer some frequently asked questions, so you’ll have the information necessary at hand when making their decision.

Short Summary

- Condo ownership offers potential investors unique benefits and drawbacks, such as lower purchase prices, attractive amenities, and rental restrictions.

- Researching local markets, working with an experienced real estate agent, and understanding HOA rules are essential for making a wise investment in a condo.

- Analyzing factors like location, market conditions, and financing options can help determine if a condo is the right fit for your financial goals.

Understanding Condos: The Basics

Investing in condos can be beneficial for some people. But there are also downsides to consider. Assessing if condos are a good investment for you personally depends on various factors such as:

- Your financial objectives

- The local market situation

- Your personal preferences

When comparing condo ownership with single family homes, the former usually offers lower purchase prices accompanied by attractive amenities. However, it also comes with high monthly fees and rental restrictions that come along with being part of a larger complex or condominium community.

Knowing this information beforehand will help you understand all aspects involved so they can make an informed decision about whether it is ultimately right for them or not.

Condo Ownership

Condo ownership is a desirable investment for those wishing to make passive income from renting properties without having to worry about the outside upkeep.

The condo owners possess their unit’s airspace and collectively own common areas. This makes them holders of both private and shared property rights, with each owner responsible for maintaining their space while exterior maintenance goes through the condo association.

An alternate form of owning condos can be found within fractional ownership, which allows multiple people to own a part of one single property. Any rental earnings from this property will be divided by each condo owner.

Condo Community

When investing in a condo community, homeowners association (HOA) or condo fees are necessary to keep shared areas such as pathways and swimming pools maintained. As a result of this exterior maintenance that the HOA manages and the HOA fees fund, residents can enjoy living in a well-kept area without bearing the burden themselves.

However, you need to be aware of any potential issues before you buy an investment property in the community, such as:

- Noisy neighbors

- Plumbing issues

- Odor issues

- Pest infestations

- Structural or maintenance issues

You’ll need to root out these challenges so you can confidently enter into a great investment.

Analyzing Condo Investments

Before engaging in condo investment, it is essential to evaluate whether this is the ideal choice for you. You must consider areas such as location, market conditions, and financing options when investing in a condominium unit. Assess both the pros and cons of buying a condo depending on its purpose: if it will be used as your primary home, holiday residence, or rental property.

Below, we are going to study factors like location and market dynamics together with funding possibilities. Learning these should help you make an informed decision about opting for condos as investment properties given your financial objectives.

Location and Market Conditions

When investing in a property, the area and current housing conditions should be thoroughly looked into. It’s important to look at how attractive the location is likely to remain as well as its potential rate of appreciation.

By taking an informed approach when picking your condo investment option, you may see higher returns, improved occupancy levels, quicker turnover rates, and augmented cash flow from renters or buyers alike.

Assessing recent comparable sales for condos within that same building or complex can help you determine whether it’s worth purchasing. By gauging the rental property’s fair market value correctly, you will minimize your risk of overpaying. A wise evaluation combined with desirable local prospects will substantially boost any real estate investor’s chances of success.

Financing Options

When it comes to financing a condo, there may be more stringent requirements than when acquiring a single family home. For instance, lenders might necessitate that the community should have at least some already-occupied units before they pre-approve your application. They could also ask for sound financial stability, higher down payment rates, or supplemental documents about the condominium complex.

If you’re looking into rental property loans to finance your condo investment, you must research your options thoroughly and work with an experienced lender.

Advantages of Condo Investing

Investing in a condo has several benefits. Firstly, compared to a single family home, a purchase price can often be much lower when buying condos, making them attractive investments. Secondly, they’re well equipped with amenities that draw renters and require minimal maintenance from the owners’ end.

Herein we’ll explore each benefit associated with purchasing condominiums.

Lower Purchase Price

For many investors, condos are a very appealing investment option due to their lower purchase price. The affordability provided by investing in condos allows investors to profit more from rent than they would if purchasing single family homes, creating larger cash flow opportunities. This makes them especially attractive for those just looking to acquire their first real estate investment and seasoned pros alike!

Attractive Amenities

Most condos have amenities available for residents’ use and are funded by HOA fees. These could include grilling areas, gyms, pools, or other communal spaces designed with potential renters’ needs and desires in mind. Attractive features such as these may result in higher occupancy rates while also increasing your property’s overall value.

Understanding how well-equipped their home would be plays an essential role in attracting prospective tenants. Being able to offer them quality facilities can prove invaluable towards successful condominium investing!

Minimal Maintenance Responsibilities

Investing in condos has a significant appeal due to the minimal upkeep involved. Their exterior maintenance is taken care of by the homeowners association, which can be beneficial for those looking to generate passive income through rental properties. All investors have to do is pay the condo association fees.

Being able to avoid time-consuming and costly property maintenance tasks allows condo owners to direct their attention toward servicing tenants and controlling cash flow. They don’t have to take on more responsibilities with regard to managing multiple units that come along with investing in the real estate market.

As such, low maintenance benefits are intrinsic when considering the purchase of a condominium as an investment vehicle over traditional ownership options like single family homes or townhomes.

Disadvantages of Condo Investing

Investing in condos have potential drawbacks that you must also consider. High monthly fees and restrictions on renting from condo associations can limit the returns an investor receives, as well as slow down appreciation compared to single family homes. To provide a more comprehensive look at this topic, we will explore these disadvantages in detail below.

By looking over all of its components, you should understand that when evaluating condos for investment purposes, you’ll find a higher-than-average cost. This is due mainly to your monthly payments plus any regulations imposed by associated organizations which may reduce return rates or slow long-term growth.

High Monthly Fees

When it comes to investing in a condo community, one potential drawback is the regular condo association fees that must be paid in order to maintain shared spaces and common property. These charges may vary from a couple of hundred dollars per month up to $300 or even more, depending on the size of the community.

Though these payments help preserve your condos’ market value, they can also reduce your monthly rental earnings and affect overall cash flow too. It’s therefore important for investors to look at all expenses associated with any particular condo development when assessing their return investment opportunities. This will help you maximize profits while minimizing risks along the way.

Rental Restrictions

Investing in a condo requires a careful review of the association’s bylaws and an understanding of its rental restrictions. Condo associations could limit renters, as well as certain exterior features such as paint color, decks, and parking, all of which may lead to fines or legal action if not followed properly.

If you’re investing in a condominium to turn it into a short-term rental, you need to make sure this is permissible under the HOA’s regulations. Take into account any other restrictions that the condo association enforced when considering this type of investment opportunity.

Slower Appreciation Potential

When selecting between a single family home and a condo investment, keep in mind that condos generally experience slower appreciation rates due to factors like small demand or association regulations.

But the conditions of the condo community, as well as market trends, can influence its market value growth. Taking time for research before settling on your choice is wise so you can make sure your decision makes sense from both short-term and long-term perspectives.

Tips for Successful Condo Investing

For a successful investment in condominiums, it’s vital to do your homework and adhere to some key principles. Learning the local market conditions, consulting an experienced realtor, and finding out the condo association rules will help heighten the odds of your success.

Here are some useful tips on how you can make wise investments when dealing with condos that could maximize their potential benefit.

Research the Local Market

When investing in condos, it’s important to have a comprehensive understanding of the local market. This involves evaluating regional economic conditions, demographic shifts, and real estate trends so you can pinpoint possible investment chances and risks.

In analyzing condo markets specifically, make sure to look at average prices for units as well as rental values plus services provided with them. This data enables investors to locate areas showing good fundamentals that are likely poised for growth potential down the line, leading potentially toward more lucrative investments over time.

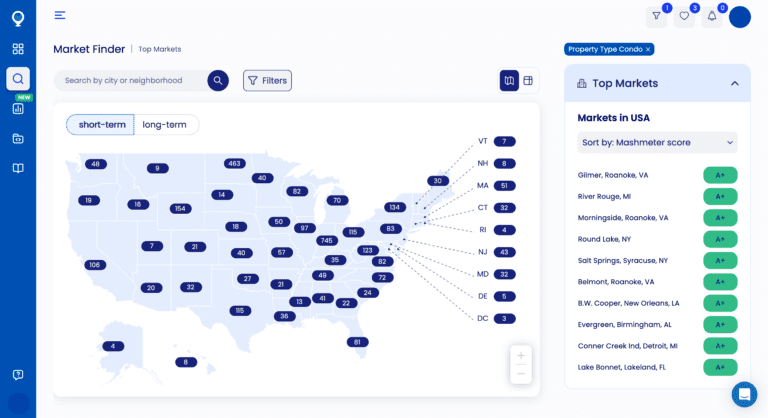

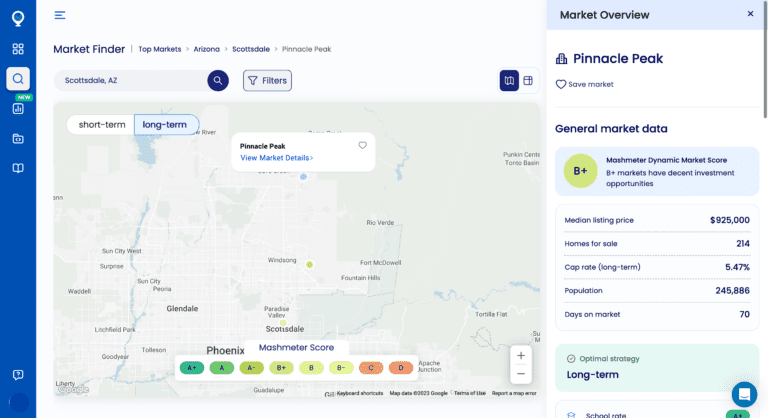

Mashvisor’s Market Finder is the perfect tool for researching the local market to find a good condo investment.

If you need help finding top-performing markets, Mashvisor’s Market Finder can help you identify areas where you can gain the highest monthly profit from your rental property. Its proprietary neighborhood evaluation system, called the Mashmeter Score, shows which neighborhoods are worth investing in. Here’s how to use this tool:

How to Research the Local Market Using Mashvisor’s Market Finder

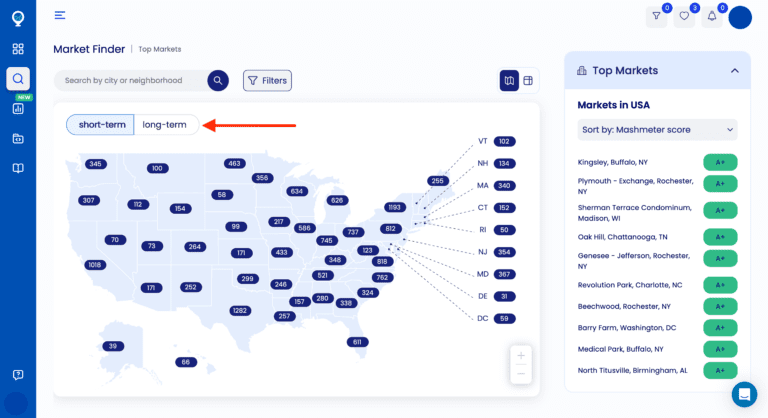

- On the Market Finder page, select your preferred rental strategy: short term or long term.

Select between “short term” and “long term” so you can configure the analysis based on your preferred rental strategy.

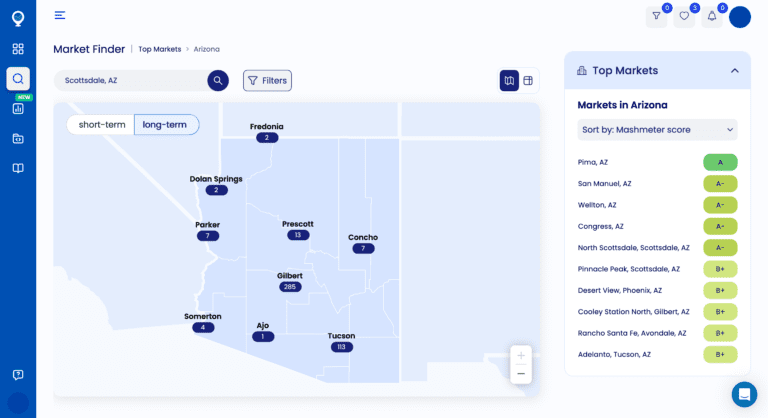

- Select the state that you wish to look into. You should be able to see labels of several locations on the map as well as numbers in blue bubbles below them. These numbers correspond to the number of neighborhoods that you can analyze in that city. The Top Markets on the sidebar should also be showing the top neighborhoods in that state based on your chosen criteria (Mashmeter score, rental revenue, or cap rate).

Aside from the map zooming into the state you choose, the Top Markets list on the side bar will only show the areas in that particular state as well.

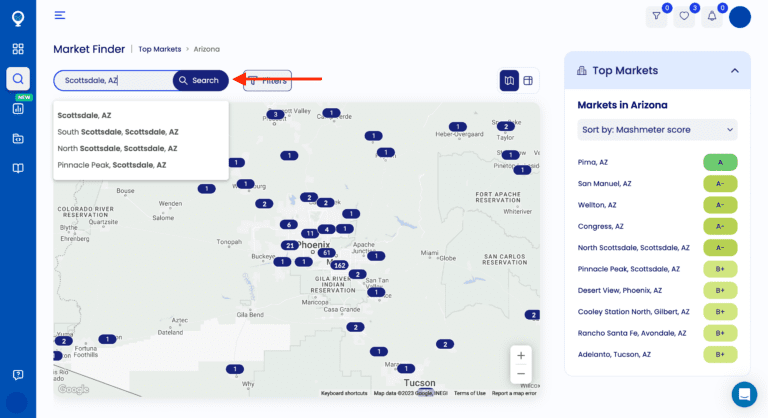

- Click on the number of the corresponding area that interests you. You might have to select more numbers if the map is still covering a large area. Alternatively, you could also type in the city or neighborhood of your choice in the search bar above the map.

If you know what city or neighborhood you wish to look into, just type it in the search bar so that the map can zoom into that area.

- You’ll know you’ve zoomed furthest into the map once you see circles in shades of red or green. These colors indicate the Mashmeter score of that area. Clicking on a circle will open that neighborhood’s details on the sidebar. You can use the information there to help you determine whether the area is worth investing in.

Clicking one of the circles on the map will display our real-time analysis for the selected neighborhood.

Work With a Real Estate Agent

When investing in a condo unit, the help of a competent realtor can be invaluable. An experienced professional will assist you throughout the entire process. From finding ideal listings to keeping up with market fluctuations and negotiating advantageous terms for your purchase. Plus, they’ll make sure that you’re paying an appropriate rate for any condos on offer.

It is prudent to partner with someone who knows their way around the local condo market if one wishes to get ahead when embarking upon this type of investment journey.

Understand HOA Rules and Regulations

For a successful experience when investing in condos, it is important to be familiar with the HOA rules and regulations. Any violations may lead to various repercussions, including fines, higher insurance fees, or even legal action against you, so it’s best to fully understand them all.

To make sure there are no issues due to a lack of knowledge about these policies, carefully review what applies and contact the association should any questions arise. Following their guidelines can help avoid potential conflicts as well as financial losses for your condo investment venture.

Summary: Are Condos a Good Investment?

If you are considering a condo investment in 2023, proper research is essential for reaping the rewards of this venture. It can be beneficial to collaborate with an experienced realtor and become aware of all HOA regulations that come along with owning such a property.

Understanding the advantages and disadvantages involved will help guide you on your path toward generating passive income through rental properties. All in all, if done correctly, investing in condos now could prove highly lucrative.

Frequently Asked Questions

Do condos hold their value?

Compared to single family homes, condos tend to appreciate at a slower rate, even the ones in desirable areas. Nevertheless, they still typically retain their value over time.

Is it financially smart to buy a condo?

Purchasing a condo can be both beneficial and profitable. This is because it enables you to possess equity in the property, as well as gain rental income that can serve as an expenditure for your business.

What are the disadvantages of a condo?

When deciding on whether to purchase a condo, it’s important to consider the trade-offs that come with investing in this type of property. Condo fees are required for the upkeep of shared areas and tenants can expect limited privacy due to sharing walls with neighbors.

Weighing all potential advantages and disadvantages before buying a condominium is essential. One should make sure they have considered every factor before making such an investment.

Why are condos great investments?

Investing in a condo is an excellent option for long-term stability and growth. With each mortgage payment, you will be increasing your equity while also having low maintenance costs associated with owning a condo. There’s a potential that the value of the property may increase over time, which makes it an attractive investment choice.

You’ll benefit from all these advantages when you purchase your own condominium unit. You’ll build up equity, avoid large repair bills thanks to minimal upkeep requirements, and even be able to witness its appreciation in value if conditions are favorable!

What are the main advantages of investing in a condo?

For those looking to invest, condos have the benefit of having lower purchase prices than single family homes. They also offer desirable amenities such as swimming pools, fitness centers, and communal areas that can provide recreational activities. Owning a condo means fewer maintenance responsibilities compared to other properties, which makes it an appealing option for potential investors.