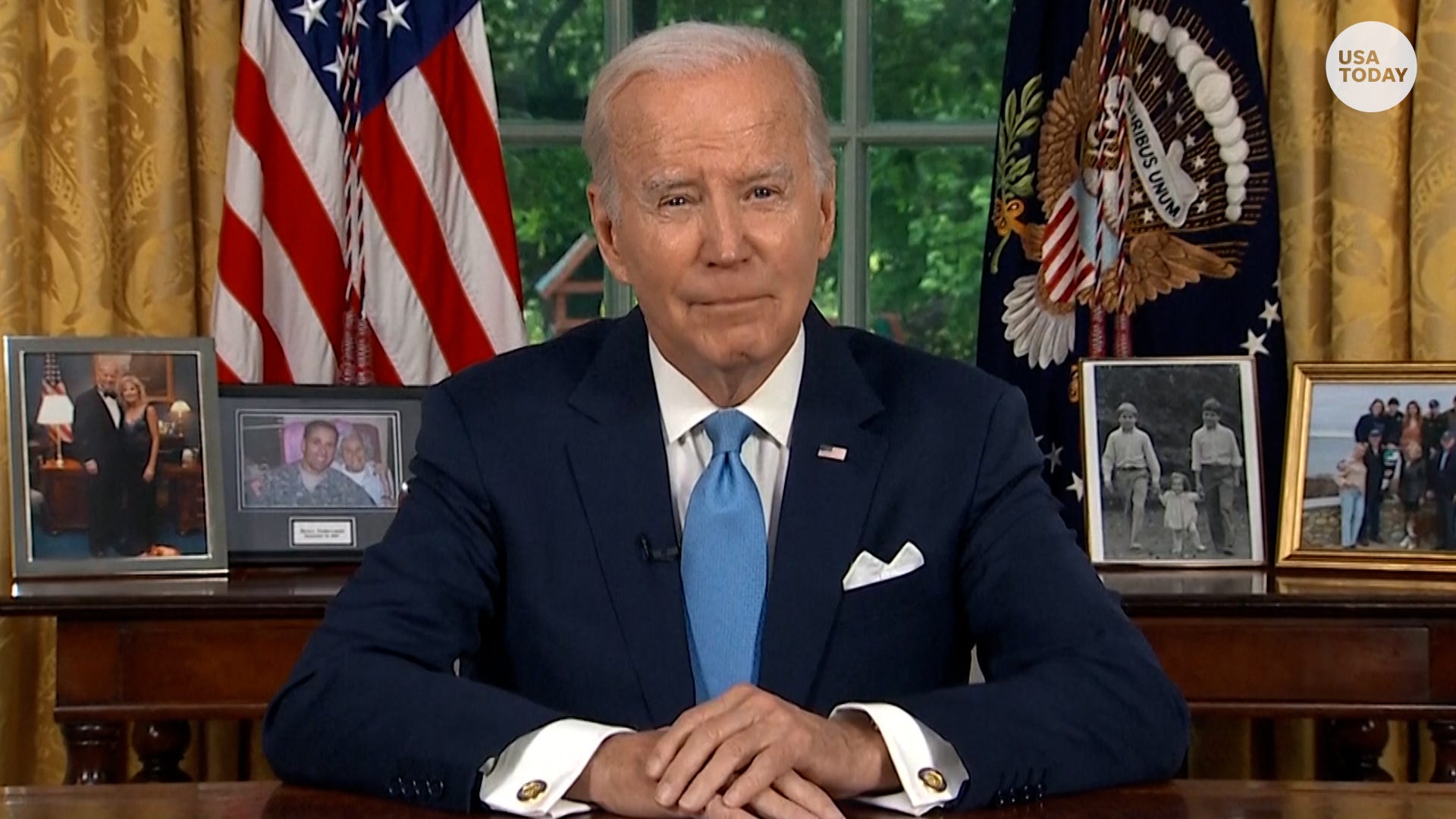

Biden touts debt ceiling deal, tells nation ‘crisis averted’

President Joe Biden addressed the nation after the Congress passed the debt ceiling deal, and said “we averted an economic crisis.”

Anastasiia Riddle, Associated Press

Citing “repeated debt limit political standoffs” and mounting U.S. red ink, Fitch Ratings said Tuesday that it has downgraded the nation’s credit rating one notch to AA+ from AAA.

“The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management,” Fitch said in a news release.

In early June, Congress passed legislation to raise the nation’s debt ceiling while cutting spending over the next two years after a prolonged standoff between the White House and Republicans. Failure to lift the nation’s borrowing authority threatened to cause it to default on its debt and spark a deep recession.

The previous U.S. rating — AAA — was the highest possible, but the new one is still well within investment grade.

Why was the U.S. credit rating downgraded?

But Fitch said “there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding” the last-minute agreement to suspend the debt limit until June 2025.

Fitch also pointed to steady increases in the nation’s debt over the past decade that it attributed to economic shocks, tax cuts, new spending initiatives and the government’s lack of “a medium term fiscal framework.”

The rating agency said there has been just “limited progress” in tackling the challenges of rising Social Security and Medicare costs, which threaten to bankrupt the two programs by 2035.

Fitch said it expects the nation’s deficit to rise from 3.7% of gross domestic product in 2022 to 6.3% this year and 6.9% in 2025. The recent bipartisan deal to raise the debt limit will save just $1.5 trillion by 2033, which Fitch called “only a modest improvement.

How could this impact consumers?

A lower credit rating can raise interest rates on Treasury bonds, which in turn can push up rates on everything from mortgages to corporate bonds.

Has the US credit rating been downgraded before?

During a similar debt ceiling showdown in 2011, Standard & Poor’s downgraded the nation’s credit rating.

S&P 500 futures

U.S. stock futures and global equities fell after the Fitch downgrade. In Wednesday trading before the U.S. market opened, Dow futures fell 0.34% while S&P 500 futures slipped 0.52%. Overseas, Japan’s benchmark Nikkei 225 dove 2.3% in regular trading while China’s Shanghai Composite lost 0.9%. In Europe and Britain, France’s CAC 40 fell 1.3% in early trading; Germany’s DAX dipped 1.4%; and the U.K.’s FTSE 100 dropped 1.8%.

Contributing: The Associated Press