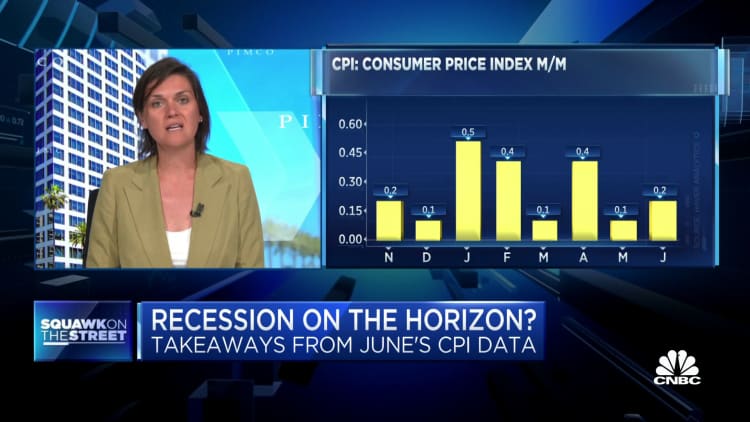

Last week’s consumer inflation numbers fell to their lowest annual rate in two years. A similar encouraging decline was seen in the producer price index, increasing bets that the Federal Reserve can achieve a soft landing for the U.S. economy, an outcome that has rarely happened during previous rate hiking cycles.

Experts are torn about what the progress on inflation means for the July 25-26 meeting of the Fed’s Federal Open Market Committee, which will make its next call on interest rates, as well as the probability of recession.

Reducing inflation remains top of mind for the Fed, and the rate hikes that it refers to as a “blunt tool” remain its primary tool for cooling prices throughout the economy. The market is fully expecting another interest rate hike from the Fed in July, after it skipped a rate hike in June. Current bets are close to unanimous, with 96% of traders saying the Fed will raise rates by another 25 basis points, to a range of 5.25% to 5.50%, according to the CME Fed tracker.

For the Fed, ideal inflation is in the target range of 2%. Fed Chair Jerome Powell has been clear since inflation began falling that he makes a distinction between a disinflation trend that has begun and the Fed being able to declare its fight against inflation over. The 3% CPI print from last week is the closest that the Fed has come to its long-term target in years, and outside the Fed some market pundits are not being shy about declaring victory.

‘Mission accomplished?’

The Fed has “achieved their mission,” said Ed Yardeni, president of Yardeni Research, on CNBC’s “Halftime Report” Wednesday morning,

“They don’t want to use the expression ‘mission accomplished’ because that’s a jinx, but I think to a large extent they have achieved their mission, which was to get the Fed funds rate up to a restrictive level and keep it there,” Yardeni said.

The stock market has been in rally mode, with the Dow Jones Industrial Average closing out a five-day winning streak on Friday, and both the Dow and S&P 500 Index trading above their 200-day averages and roughly 6% from retaking all-time highs.

“This [data] is the stuff of a soft landing, this is what the Fed’s been looking for, this is what the market wants to see,” said Paul McCulley, a Georgetown professor and former managing director at bond investing giant Pimco, during an interview of CNBC’s “Squawk on the Street” last week.

A soft landing and another rate hike for ‘credibility’

But McCulley, while in the soft landing camp, said that doesn’t lead to the conclusion it will ease up on rates when it next meets July 25-26.

“It doesn’t change what’s going to happen in two weeks,” he said. “The Fed is going to tighten another 25 [basis points], they kind of have to in order to put substance to the notion that they skipped last time, they didn’t pause, and they still have one more in the dot plot for the end of the year,” he said.

The Fed maintaining its credibility by hiking rates again was a point made last week by several experts, including stock market strategest Tom Lee, Fundstrat managing partner and head of research.

The latest inflation numbers and odds-against soft landing make the Fed’s short-term course more difficult, but Lee said the central bank will likely hike rates again “for credibility’s sake,” Lee said on “Closing Bell Overtime.“

That’s an important point in reading the Fed, experts said, because when the Fed decided to not raise rates in June it was seen as a “skip” rather than a pause that could be extended.

There remain contrarians, or at least those in the market willing to argue the case that after the latest economic data, the Fed may be done.

“I don’t think that a hike in July is absolutely guaranteed,” said Liz Young, SoFi head of investment strategy, on CNBC’s “Halftime Report” last week. “I think there’s a decent probability that they might be done or that they might prolong the pause even further because there has been good progress, and it’s okay to be positive about that progress.”

Former Federal Reserve vice chairman Roger Ferguson, who has been consistent in his view that inflation will remain sticky and the Fed will not move quickly to declare victory even if it means a recession for the economy, emphasized after the latest inflation data that it is still too early to make a win call. But he is more encouraged about the economy avoiding recession, which recent economic history said would not be possible.

Wait until September

“I think there is an increasing possibility of that soft landing, which is a very positive thing,” Ferguson said on CNBC’s “Squawk Box” last week. “Fortunately we still see forward momentum in many sectors. However, I think it’s really too early to declare that as a done deal, because as the Fed itself has said, much of the work that they’ve done has not yet shown up in market.”

September, Ferguson says, is when the markets should take a closer look at the effects of the previous hikes and see how they have affected the economy. Today, there is still a risk that the cooling inflation is less directly related to the Fed’s hikes than some are concluding.

The message from top corporate executives in the consumer sector has been to expect some level of high inflation for some time to come. PepsiCo chief financial officer Hugh Johnston said last week after its latest earnings it doesn’t expect the basket of commodities it tracks to come back down to a historical average. It’s making less margin off higher prices passed through to consumers today — more margin, he said, is coming from operational efficiencies including automation — but he expects those prices to remain high tied to an elevated underlying rate of inflation, even if it is declining.

Why a recession is still in the picture

CNBC surveying of CFOs indicates the majority still expect a recession, while they’ve become more positive on the outlook for stocks and a less aggressive Fed. Several CFOs said on a recent private call among members of the CNBC CFO Council that they’ve sent the message directly to their regional Fed presidents that it is time to stop raising rates because the economy is slowing in ways that they can see — from trade volumes in the supply chain to manufacturing activity, consumer spending and credit deterioration, if not delinquencies — but that may only become obvious to the Fed too late.

This CFO view that can be summed up in economist Milton Friedman’s description of “long and variable lags” from monetary policy was echoed by Pimco managing director Tiffany Wilding, who thinks a recession is probable.

“We think growth will decelerate in the second part of this year. You have headwinds to consumption from the restart of student loan payments,” she said last week on CNBC’s “Squawk on the Street.“

“Under the surface, credit growth is slowing and slowing quite dramatically. And the economy ultimately needs credit to run on and so that will be a major headwind at a time when monetary policy is very tight,” Wilding said.

As the economy weakens, unemployment will rise. “And usually, historically, that rise in unemployment has been characterized by negative quarters of real GDP growth,” she said. “In other words, we have never seen in the history of getting a rise in unemployment without those negative quarters, so we do think you probably will see a recession,” she added.

Many CFOs remain of the view that even in the current tight labor market conditions, and defiant job growth given the broader economic risks, eventually, when unemployment rises, it will rise by more than the Fed is targeting.

But even in her worst-case scenario, Wilding expects a “moderate” recession. And she does expect the July rate hike to be the Fed’s last in this cycle.

San Francisco Fed President Mary Daly expressed her commitment to lowering inflation even further on “Squawk on the Street” last week.

“It’s really too early to say that we can declare victory on inflation. This month of data is very positive, I hope it’s part of a downward trend in inflation, but I am in a wait-and-see mode on that because I remain resolute to bring inflation down to 2%.”