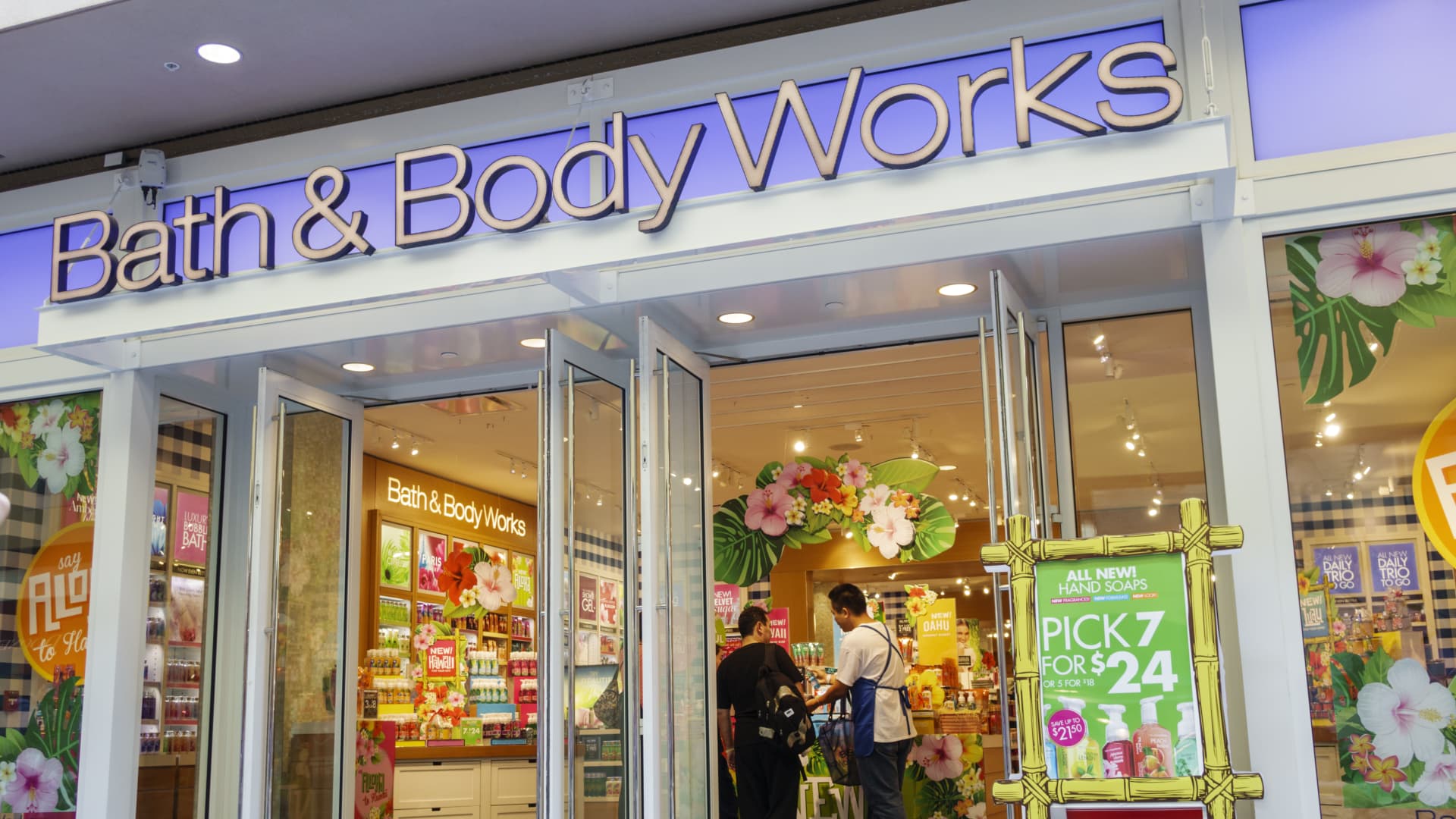

Bank of America is out with its latest short-term stock picks as the third trading quarter of the year gets underway. The S & P 500 is now up about 16% this year and equity analysts at the firm are still expecting a summer rally that could hurt investors who have been positioning for bad news. “Over the last quarter, the BofA Macro view has evolved,” strategist Anthony Cassamassino wrote in a note Monday. “Our U.S. equity strategist, Savita Subramanian recently declared the bear market is over. While Michael Hartnett maintains his overall bearish view, he thinks the pain trade is higher in the near-term. Our U.S. Economist, Michael Gapen, pushed out his recession call and sees a more moderate downturn starting next year. Even the technicals suggest SPX 4900-5000, according to Stephen Suttmeier.” Bank of America gathered its 10 best ideas for the new quarter, all of them buy-rated, Cassamassino said. Here are five of them: The note refers to candle and personal products retailer Bath & Body Works as a “consistent grower at an inexpensive valuation.” This year it’s gained market share in all three of its categories (fragrance, body, soaps) while competitors have seen declines. The bank also sees multiple growth drivers this year and improvements in merchandise margins as cost inflation and freight expenses normalize. In technology, Bank of America names software company Datadog . It says demand for Datadog’s developer security operations platform is “healthy” and the company stands to benefit from AI-driven cloud workloads. Potato products maker Lamb Weston is another stock on the list. Bank of America points out that restaurant demand, which makes up about 85% of the company’s sales, was resilient from March through May even as price increases across foodservice and retail channels took effect in May. The banks’ analysts expect Lamb Weston to beat and raise earnings expectations when it reports financial results on July 25. For Disney , which has risen 4% in 2023 and is lagging the S & P 500, Bank of America highlights continued robust demand at its theme parks and increasing focus on content quality and spending. Its $135 price target on the stock is more than 50% above its closing price Friday. Wells Fargo offers “among the most attractive risk/reward in the large-cap banks given self-help potential (capital return, efficiency), a resilient deposit franchise and credit defensibility,” according to the note. The positive outcome of last week’s regulatory stress tests in combination with excess capital positioning also “should allow the bank to return capital (buybacks, hiked dividend by 17%) while being better positioned to absorb changing regulatory capital requirements (Fed proposal expected mid-July).”