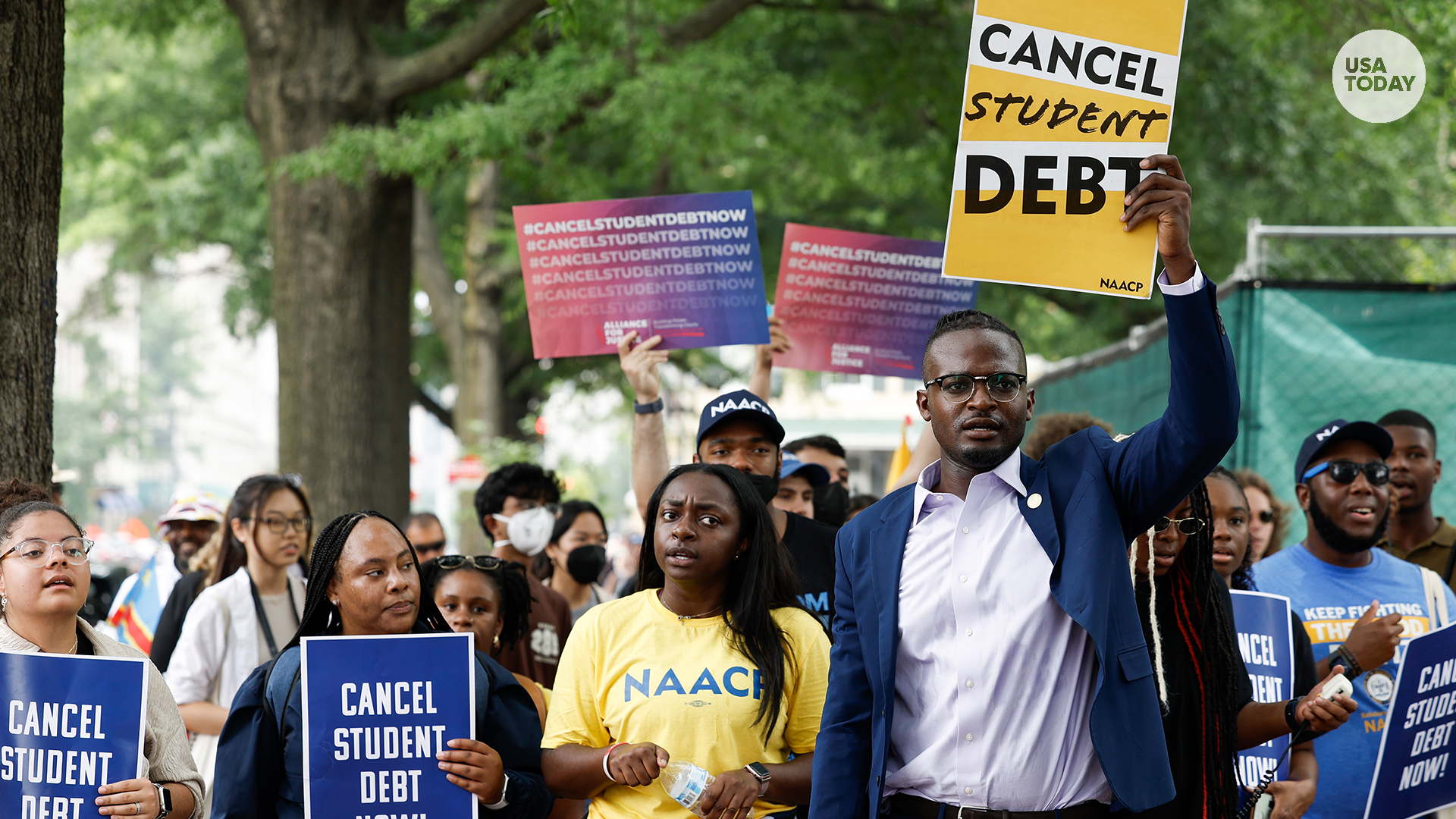

SCOTUS student debt relief decision blocks Biden’s forgiveness program

The Supreme Court blocked a key route for having all or some of America’s $1 trillion in student loan debt erased.

Megan Smith, USA TODAY

The Supreme Court’s decision Friday to strike down President Joe Biden’s student loan forgiveness plan will likely weaken the U.S. economy just at it teeters near the brink of recession, economists say.

Under Biden’s blueprint, about 26 million Americans would have had more than $400 billion in student debt wiped out. Some borrowers would have seen up to $20,000 of their obligations erased.

That would have softened the blow of renewed student loan payments. As part of the deal to lift the federal debt ceiling, the White House and Republicans in Congress agreed to bar further extensions of a moratorium on student debt payments that began in March 2020 in the early days of the pandemic.

Loan payments are set to resume in October.

How does student loan forgiveness affect the economy?

The $73 billion a year that borrowers have been saving on the payments have been funneled to outlays on groceries, travel, clothing and other expenses, juicing the economy. The resumption of the loan payments will shave about a quarter percentage point off of economic growth over the next 12 months, leaving the economy expanding at a 1.6% annual rate this year and 1.4% in 2024, says Mark Zandi, chief economist of Moody’s Analytics.

Biden’s loan forgiveness would have restored about half of that quarter-point dip in growth, meaning the restarting of student loan repayments would have reduced growth by just 0.11%, Zandi says.

“It would have modestly helped support the economy at a vulnerable time,” he says.

Is there a recession coming in 2023?

Zandi believes the Federal Reserve’s sharp interest rate hikes to fight inflation will slow the economy this year but won’t nudge it into recession, and the court ruling doesn’t change his view. Many other economists, however, believe the U.S. will slip into a downturn, so the Supreme Court’s ruling could modestly worsen any slump or possibly turn a stalled economy into an outright recession.

Even without the ruling, some forecasters estimate the economy could shed as many as a few million jobs during a downturn.

Consumer spending, which makes up 70% of economic activity, has been remarkably resilient through the Fed’s rate increases as strong pay increases and pandemic-related savings have offset sharply higher inflation and borrowing costs. But consumption is starting to flag; a report Friday showed that household outlays grew just 0.1% in May.

Who is most affected by student loan forgiveness?

And Biden’s loan forgiveness was set to disproportionately benefit borrowers who are young, have lower credit scores and live in lower- and middle-income neighborhoods, according to a study by the Federal Reserve Bank of New York.

Happy driving Gas prices more than $1 cheaper per gallon await most travelers over July Fourth holiday

“We also find that Black and Hispanic borrowers disproportionately benefit from the proposal,” the NY Fed paper said. “Rising credit card and auoto delinquencies for borrowers with paused payments foreshadow future credit difficulties for borrowers if federal loan payments resume without relief.”

Serious loan delinquencies “could rise by about 67% over time if student loan repayments resume in full, with risks of knock-on effects” to other household debt, Bank of America wrote in a note to clients.