The tremendous rally for S&P 500 (SPY) this week has more people believing the bull market is at hand. 43 year investment veteran Steve Reitmeister weighs in with his updated market outlook at trading plan. (Spoiler alert: the future for stock prices may not be as bright as advertised). Get the full story below.

Stocks burst through stiff resistance at 4,200 for the S&P 500 (SPY) on Thursday. Then Friday put an exclamation point on the move by closing all the way up at 4,282.

Can we finally call this the new bull market?

And what does that mean for stocks in the days ahead?

These timely topics will be the focus of today’s commentary as well as our trading strategy going forward.

Market Commentary

There are already many people claiming this is the new bull market. And it might be true in time. However, right now stocks fail the official definition which is a 20% gain from the closing low.

So back on October 12, 2022 the S&P 500 closed at its lowest level of 3,577.03. Now add 20% to that equates to stocks needing to close above 4,292.44 to technically be called a new bull market.

(Yes, the market did hit an intraday low of 3,491 in October. But the official measure of bull and bear markets is based on closing prices like shared above).

So as of Friday’s close we are just 10 points away from an official crowning of a new bull market. That event would likely would spark a serious FOMO rally as more bears would throw in the towel, but first a word of caution…

DON’T BELIEVE THE HYPE!

Please remember that this rally was all about the announcement of a debt ceiling deal. Yet as shared in my recent article, that outcome was never in doubt because allowing a default is a nuclear option that neither party can afford.

When the irrational exuberance clears out next week investors will be right back to the same bull/bear debate as to whether we could be heading into a future recession. The most recent economic data was a mixed bag in that regard starting with ISM Manufacturing coming in well under expectations at 46.9. Plus, the forward-looking New Orders component plummeted to 42.6 point to weaker results ahead.

Yes, below 50 = contraction. And yes, we have been under 50 since November without a recession forming. But with it directionally getting worse, it is certainly not a positive for those calling for a bull market.

But Reity, how about the strong employment report Friday morning…certainly that is cause for some bullish cheer, right?

Wrong.

In general, the market should feel good about signs of economic strength like 339K jobs added which was a whopping 80% better than expected. However, it’s not a positive thing when the Fed is still very much pressing on the brakes of the economy to tamp down inflation.

One of the most resilient (aka sticky) forms of inflation is wage inflation. That is still too high because the labor market too strong. Thus, if you are a Fed official relying upon the recent data to make your next rate decision…then today’s far too strong employment report will only stiffen their hawkish resolve.

Today’s news still has the odds of a 6/14 rate hike at only 30%. Meaning investors are expecting a pause which the Fed has signaled is most likely. BUT the odds of a rate increase again in July just spiked to 70% which says that investors realize the Fed is not done with their hawkish regime (and that is NOT bullish).

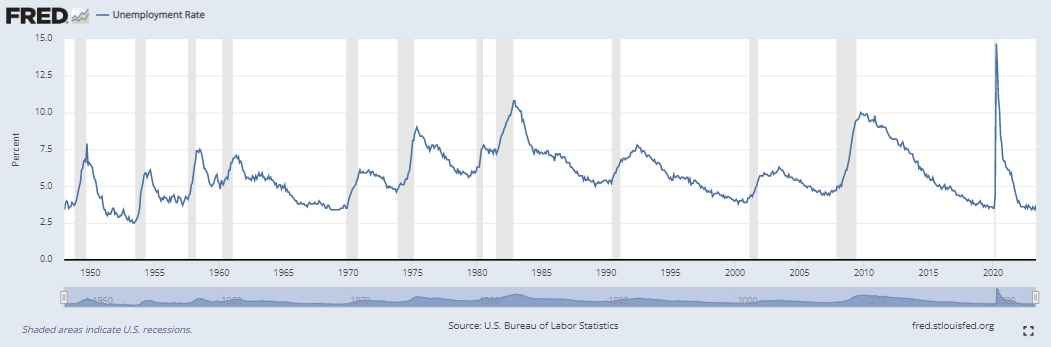

Now consider this chart of the unemployment rate just before the start of each recession:

It is abundantly clear that the unemployment rate is a lagging indicator of recessions as it is looking its effervescent best just before the next recession begins.

But indeed, we do need to see job adds actually roll negative, and unemployment rate spike to confirm that a recession is at hand. Given all the previous false signals of a recession forming…this is what will be necessary to convince investors to sell stocks in earnest once again.

Reity, is it possible that you are wrong and that this is actually the start of the new bull market?

Yes. That is possible which is why my 2 newsletter portfolios are basically 50% long at this time. What you might call balanced and ready to shift more bullish or bearish when more concrete evidence avails itself.

The key at this time is to remember the painful lessons from the 2007 to 2009 bear market (aka Great Recession). Stocks technically rang in a new bull market given a 20% rally from the November 2008 lows into early January 2009. Next thing you know stocks fall another 28% to a final and painful low in March 2009.

These false breakouts are far too common in the modern era given the undue influence played by computer based traders. Their favorite game is pushing stocks past key levels of resistance and support to draw in the suckers…then they reverse course locking in ample profits at the expense of others.

I will get more bullish when the odds of recession truly diminish. As already shared, that is not the case leaving my balanced approach in place.

At this stage I suspect stocks will play around in a range of 4,200 to 4,300 into the 6/14 Fed announcement where they likely to remind folks ONCE AGAIN that there is more work to do. And rates will stay higher for longer. And still don’t plan to lower rates til 2024. And that inflation is too sticky. And that their base case is that a recession will form before they are done with their efforts to get inflation down to 2% target.

Investors seem to have a monthly case of amnesia between Fed announcements. Then sell off as they are somehow surprised by what Powell says time and again at the press conferences. So, I think getting more aggressively long stocks before that mid June announcement seems quite unwise.

What To Do Next?

Discover my balanced portfolio approach for uncertain times. The same approach that has beaten the S&P 500 by a wide margin in recent months.

This strategy was constructed based upon over 40 years of investing experience to appreciate the unique nature of the current market environment.

Right now, it is neither bullish or bearish. Rather it is confused and uncertain.

Yet, given the facts in hand, we are most likely going to see the bear market coming out of hibernation mauling stocks lower once again.

Gladly we can enact strategies to not just survive that downturn…but even thrive. That’s because with 40 years of investing experience this is not my first time to the bear market rodeo.

If you are curious in learning more, and want to see the hand selected trades in my portfolio, then please click the link below to start getting on the right side of the action:

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares rose $0.08 (+0.02%) in after-hours trading Friday. Year-to-date, SPY has gained 12.32%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post NOW is it a Bull Market? appeared first on StockNews.com