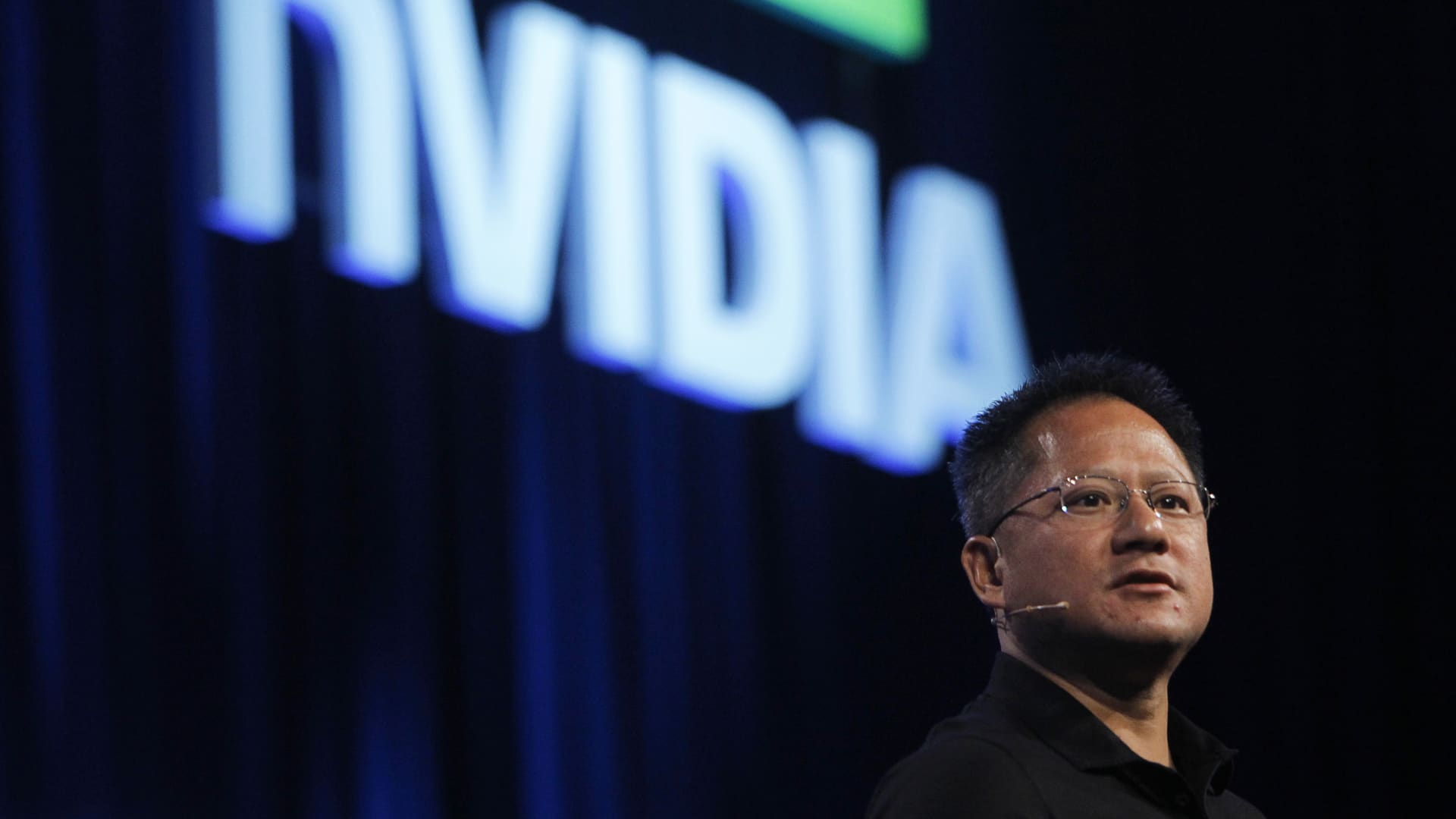

Here are Tuesday’s biggest calls on Wall Street: Barclays reiterates Tesla as overweight Barclays said the stock is well positioned for more gains. “The dominant narrative ahead for Tesla is one of growth, with expectations for significant volume growth and share gains in the years ahead.” Evercore ISI reiterates Nvidia as outperform Evercore said it’s standing by its top-pick status on Nvidia shares. “CEO Jensen Huang offered his first live keynote in ~4 years Sunday evening at Computex. At no surprise, the CEO reiterated how we are at a tipping point of a new computing era, led by accelerated computing and generative AI.” Jefferies upgrades Ford to buy from hold Jefferies said the auto stock looks attractive. “Last week’s Investor event in Dearborn raised our confidence that Ford finally has the plan & the team in place to close a deficit of execution that has dogged shares for years.” Read more about this call here. Roth MKM upgrades Constellation Brands to buy from hold Roth MKM said it sees the company accelerating market share gains. “As weather warms, we expect the share gains for Modelo Especial and Corona to accelerate. For April, much of the Bud Light share losses went to other Premium Light products, but substitution should shift seasonally into STZ’s favor.” Roth MKM upgrades Boston Beer to buy from hold Roth said Boston Beer is a summer beneficiary. “After 1Q, we had two concerns: 1) Truly hadn’t stabilized, offsetting Twisted Tea success and 2) gross margins weren’t improving, despite more in-house production. Now, we believe Seltzer and Truly will benefit in the summer from Bud Light share losses and gross margin lift from production shift will be realized in 2Q.” Read more about this call here . JPMorgan adds Wayfair to the focus list JPMorgan added the stock to its focus list after coming away from recent management meetings feeling more bullish. “Objectively, the only question that we see as a valid pushback against our Wayfair bull case is whether the deteriorating macro backdrop will overwhelm the self-help that is leading to market share gains and structurally improved profitability.” Bank of America upgrades ChargePoint to buy from neutral Bank of America said the electric vehicle charging company is “best in class.” “We upgrade shares of ChargePoint to Buy after reassessing line of sight to cash inflection. ChargePoint is the leading provider of networked EV chargers in the U.S. with ~70% market share.” Read more about this call here. Citi resumes Johnson & Johnson as buy Citi resumed coverage of the stock with a buy and said its turnaround is near complete and that it has a robust pipeline. “After a period of restriction, we are resuming coverage of JNJ with a Buy rating and $185 TP based on 16-17x 2024E EPS ($176-$187).” Mizuho reiterates PayPal as buy Mizuho said investors should buy the dip in shares of PayPal. ” PYPL shares have underperformed the NASDAQ by ~25 percentage points since it reported 1Q results on May 8. While management blamed the transaction margin weakness on mix shift towards higher-growth but less-profitable Braintree, investors remain worried that pricing compression is also at play.” Atlantic Equities upgrades Coinbase to overweight from neutral Atlantic Equities said the crypto exchange is “leveraging its trust credentials to exercise pricing power.” ” Coinbase’s 1Q23 results confirmed management’s focus on returning the business to sustainable profitability. The company is regaining custody asset share and is also leveraging its trust credentials to exercise pricing power – both important steps towards building resilience in the model. Bernstein reiterates Quanta Services as outperform Bernstein said the construction services company is an under-the-radar energy transition stock. ” PWR owns the picks and shovels that will be used to make the energy transition a reality. In this note, we lay out a scenario for how to value PWR in a full embrace of the energy transition.” JPMorgan initiates Kenvue as overweight JPMorgan said the consumer health company is “uniquely positioned.” “As the largest pure-play consumer health company in the world following its separation from parent Johnson & Johnson, we view KVUE as uniquely positioned to benefit from consumer mega trends.” Read more about this call here. Morgan Stanley upgrades Medtronic to overweight from equal weight Morgan Stanley said in its upgrade of Medtronic that it’s turning an operational corner. ” MDT’s restructuring of internal operations should drive more consistent performance, while our bottom-up work shows 4 areas that could drive midteens EPS upside, adding some $5-6bn to group sales longer term.” Morgan Stanley downgrades Abbott Labs to equal weight from overweight Morgan Stanley downgraded the medical device company mainly on valuation. “Our new work suggests ABT is in solid shape, with the shift to leadless pacing and solid Libre demand offsetting technology risk in ablation. Street numbers and valuation look fine though, so assuming coverage and moving to EW for now.” Truist reiterates Disney as buy Truist raised its price target on Disney to $121 per share from $105 and says it sees a “favorable” risk/reward. “Maintain Buy with sentiment pinned negative, viewing valuation/risk-reward as favorable.” Bank of America reiterates Procter & Gamble as a top pick Bank of America said P & G is poised to deliver shareholder returns. “Our Buy ratings on PG and KVUE are based on our view that they are each positioned to deliver top tier shareholder returns with the flexibility to balance brand support, earnings growth, and returning cash to shareholders.”