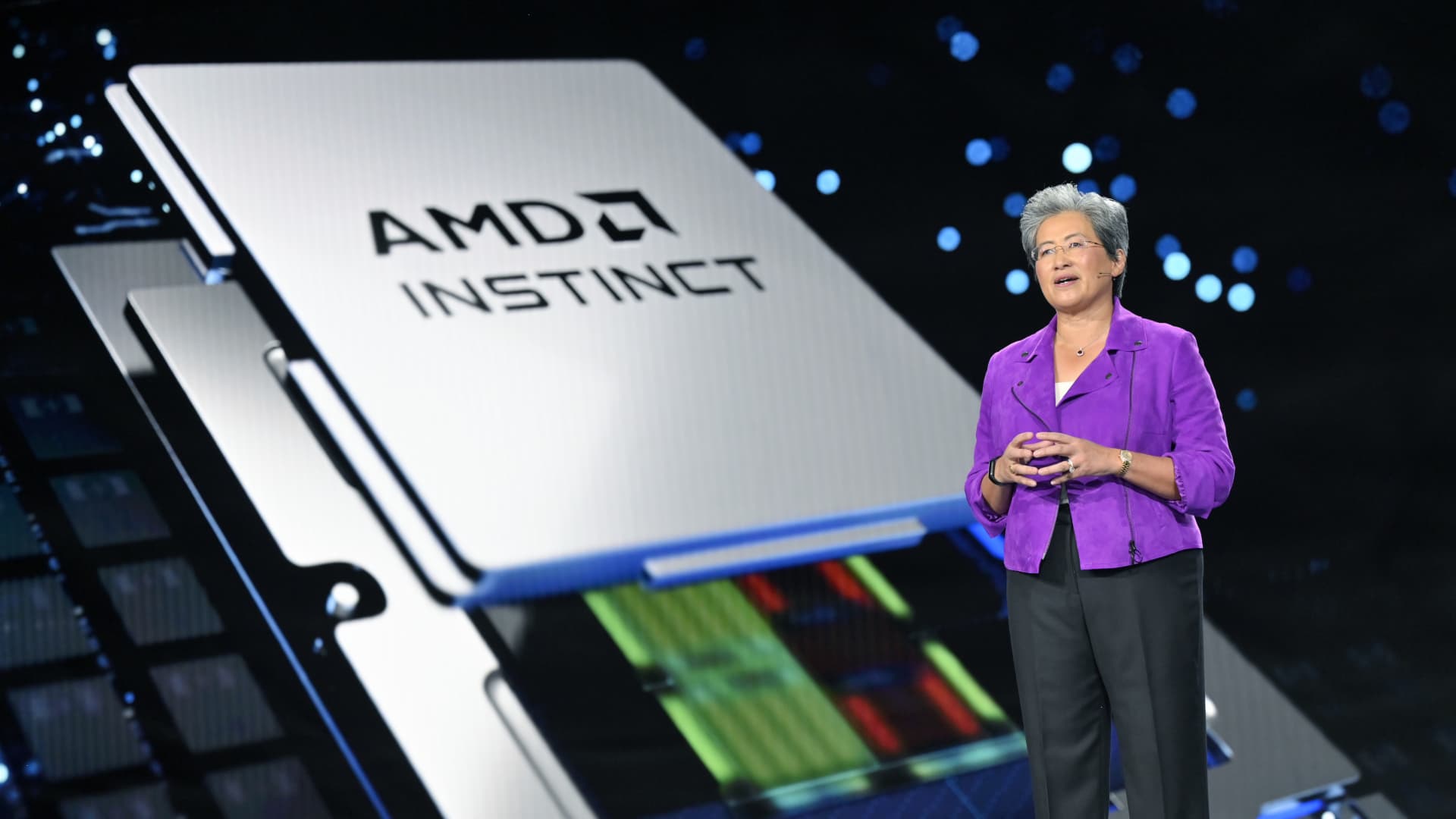

Some of the most overbought stocks this week on Wall Street are chipmakers, as investors piled into the artificial intelligence play after Nvidia’s blockbuster quarter. Nvidia and Advanced Micro Devices are just two of the names that investors snapped up. While Nvidia only reported earnings Wednesday night, the semiconductor firm’s market value has since surged to just under $1 billion — adding roughly $200 billion in not even two days of trading. Other chip stocks also surged as traders sought out possible beneficiaries of what they perceive as an A.I. “gold rush.” However, that could mean these stocks are overbought, at least according to one metric. Called the “relative strength index,” the metric measures the speed and magnitude of recent price moves to indicate which stocks are possibly overbought or oversold. A stock with a 14-day RSI greater than 70 is considered overbought, signaling investors may have gotten too bullish on a stock. Meanwhile, a stock with a 14-day RSI lower than 30 is considered oversold and could spell a buying opportunity. Based on this measure, CNBC Pro screened for the most overbought and oversold names this week. Here are the most overbought stocks that came up. Chipmakers dominated the list of overbought names, with shares of Advanced Micro Devices and Broadcom surging 20% and 19% this week, respectively. AMD topped the list, with a a 14-day RSI of 89.72, according to FactSet data. Bank of America hiked its price target on the company , saying it’s poised to take a larger slice of the AI market. However, it reiterated a neutral rating on the stock. Broadcom has a 14-day RSI of 84.36, FactSet data showed. This week, Bank of America hiked its price target on the firm, calling it the “most underappreciated AI beneficiary” after its multibillion deal with Apple was announced. Nvidia also made the list, with an RSI of 83.62. Other stocks on this list include Meta Platforms and Alphabet . Other stocks have seen extreme selling recently, based on their 14-day RSIs. Defensive stocks such as health care and utilities dominated the list of most oversold stocks this week, including Humana . The stock has a 14-day RSI of 8.02. In an April note, Cantor Fitzgerald initiated coverage of the stock with an overweight rating, saying the health care stock is “undervalued” with a boost from Medicare Advantage (MA) share gains. Amgen came up as an oversold stock this week as well. It has a 14-day RSI of 9.58. In a May note, Oppenheimer said the biotech firm has a “unique risk/reward” profile.