Chinese authorities have carried out an investigation into consulting firm Capvision Partners, state media CCTV reported on May 8. CCTV said that investigations by Chinese national security authorities had found that overseas institutions have used domestic consulting firms to steal state secrets and intelligence on areas key to China.

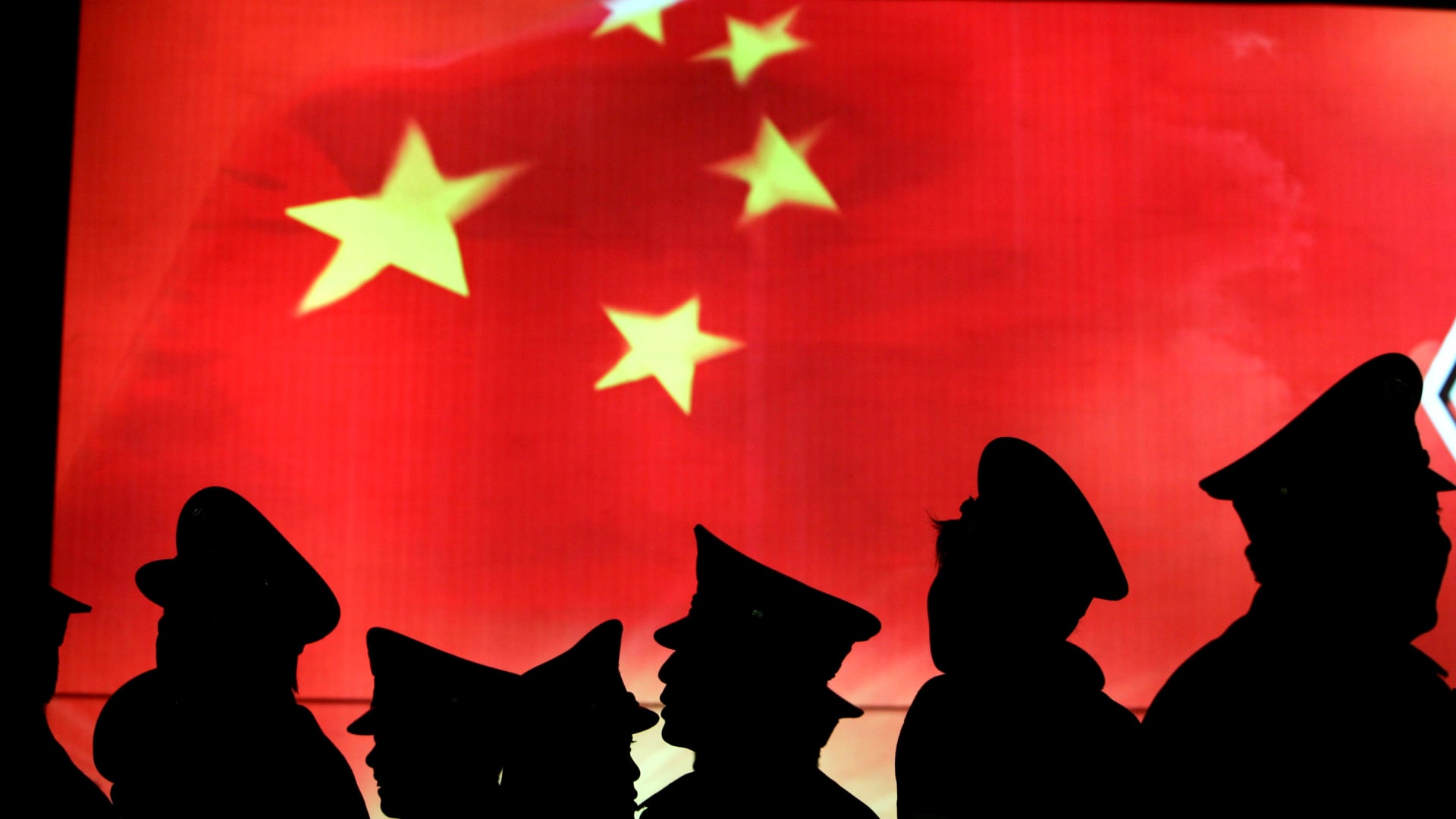

China Photos | Getty Images News | Getty Images

China wants foreign investment, but it wants them on its own terms.

However, Beijing’s terms aren’t clear for now — and it’s raised concerns and triggered second guessing in the global business community.

Last Monday, state broadcaster CCTV singled out a consulting company for not complying with China’s national security laws.

Shanghai-based Capvision Partners was just the latest company recently subjected to such investigations in the mainland. In March, U.S. due diligence firm Mintz told Reuters police raided its Beijing office, and detained some of its Chinese staff. In April, U.S. management consultancy Bain & Co reportedly confirmed police visited its Shanghai office.

These firms provide due diligence services, which companies and investors routinely employ to determine whether suppliers are complying with rules and regulations – not just in China, but in other jurisdictions as well. They also audit supply chains, among many other services.

At a time when China is actively encouraging foreign investment into the world’s second-largest economy that has been deeply hurt by the country’s long-held zero-Covid policy, such an escalation in China’s concerns about data is hurting sentiment and seems at odds with its overt claims of openness.

“It may seem a paradox,” said Chong Ja Ian, an associate professor at the National University of Singapore who studies Chinese foreign policy. “But this is consistent with what we have seen of the current China leadership: they want more control over all facets of society.”

“This is a government that built its legitimacy on performance, so they would be anxious to maintain a perception of control when the country is facing more pressures from different directions now,” he told CNBC.

… So much of what is now regarded as national security or state secrets is not sufficiently defined or classified.

“This is a government that built its legitimacy on performance, so they would be anxious to maintain a perception of control when the country is facing more pressures from different directions now, including demands for more access to information,” Chong added.

At a regular press conference helmed by China’s Foreign Ministry a week ago, Beijing appeared keen to downplay the Capvision probe as an isolated incident.

“These are normal law enforcement actions consistent with Chinese laws that aim to promote sound and well-regulated growth of relevant sector and safeguard national security and development interests,” said ministry spokesperson Wang Wenbin.

‘Arbitrary’ enforcement

“The enforcement actions seem very arbitrary now,” Lester Ross, a foreign lawyer in China, told CNBC. “To have multiple companies involved now in this crackdown and the restriction of financial data to foreigners, it appears that Chinese security departments are on to something larger.”

“A major question about Chinese law generally is the need for greater precision in delineating what’s permissible and what’s not: so much of what is now regarded as national security or state secrets is not sufficiently defined or classified,” Ross added.

Leaked state secrets?

The accusations against Capvision included claims the consultancy was among those used by foreign institutions with “complex backgrounds” as a pretext to steal state secrets and intelligence in key sectors while evading the law. Chinese authorities alleged that Capvision accepted more than 2,000 remittances from hundreds of overseas companies totaling $70 million between 2017 and 2020, according to a CNBC translation.

State-owned CCTV claimed that Capvision tapped on a vast “network of experts” of about 300,000 people in areas ranging from domestic policy research, national defense and military technology to banking, finance and medicine.

The CCTV program also claimed to feature one of Capvision’s experts who was convicted of disclosing information relating to the number of unnamed military aircraft on the inventory of a particular institution or company, according to a CNBC translation.

A building official stands outside the Capvision office in Beijing on May 10, 2023. China said on May 9 a raid by authorities on US consultancy Capvision’s offices in the country was aimed at safeguarding its “national security and development interests”.

Greg Baker | Afp | Getty Images

In a sign that last week’s state media report has triggered plenty of reassessment in the business community, the state-owned Securities Times reported last Thursday that Chinese regulators have instructed mainland Chinese brokerages securities firms to strengthen compliance over sensitive information, expert invitation and interviews.

The American and European chambers of commerce in China also expressed concern.

The recent investigations “risk heightening uncertainty at a time when European companies are looking for clear signs that China’s business environment is becoming more reliable and predictable,” the European Chamber of Commerce in China said in a statement. “The European Chamber respects the rule of law and expects it to be followed in these cases.”

Last Wednesday, Capvision pledged to “actively address” demands by Chinese authorities about the company’s negligence of its national security responsibilities, having formed a three-person internal “compliance committee” chaired by its chief executive Xu Rujie.

“We are deeply aware we have failed to fully comply with national security responsibilities in our past business activities and there are major hidden dangers and loopholes that have led to serious danger to the country’s national security,” the Shanghai-based company said in a statement, according to a CNBC translation.

Without more details on what is permissible could make it more difficult for prospective investors to do their due diligence before committing to deals, particularly given the nature of doing business in China.

“In a state-driven economy like China’s, a lot of local Chinese companies would have dealings with the government at various levels,” said Chong from NUS. “So some commercial data would inevitably have political and national security implications.”

“I am not sure if the Chinese government is interested in being more precise about what it means,” the professor added. “After all, ambiguity and lack of clarity is a tool commonly used by authoritarian governments to retain and enhance its control.”