Conducting a search for profitable rental areas in 2023 is a straightforward process when you can access up-to-date and accurate information.

It’s high time you evaluate the state of the US housing market and the most popular areas at the moment.

Table of Contents

- Real Estate News for 2023

- 5 Best Long Term Rental Areas in the US

- 5 Best Short Term Rental Areas in the US

- How to Find the Best Rental Area for Your Chosen Investment Strategy

The property investment industry is going strong. Despite the consequences of COVID-19, which can still be felt in some parts of the real estate market, the potential of rental properties is not diminishing.

One thing is certain, though—nothing compares to thorough research.

By looking closely at profitable rental areas across the US real estate market, along with the specific neighborhoods, investors will get a stronger sense of what to expect from their strategy and how to form it.

If you’d like to read more about trending real estate news, discover rental areas that are at the top of investors’ lists in 2023, and learn how to develop your strategy, read on.

Real Estate News for 2023

Deciding on the most profitable strategy involves staying up-date with predictions and trends, as well as news regarding the US housing market. With that said, let’s go over the top three real estate news that marked 2023 so far.

As expected, the first news is related to interest rates.

According to Melissa Dorman, a broker at Living Room Realty, interest rates are bound to hit 9% in some areas of the US market. And, as we continue to fight against inflation and its consequences, she believes that such high interest rates are possible in the future.

Secondly, buyers in their early 30s are predicted to enter the housing market throughout 2023 and show considerable interest in properties. And even though the high interest rates are making it harder to obtain loans, the influx of the said group of buyers should remain steady.

They’ll be cautious, but ready to settle.

Finally, Dorman predicts a fairly strong spring for the real estate market. She’s already seen some favorable deals earlier in the year and believes that buyers will go home-hunting once the interest rates start decreasing.

Related: 3 Interesting Real Estate Market Trends to Expect in 2023

5 Best Long Term Rental Areas in the US

After going over some trending news, let’s jump straight to the five best long term rental areas in the US, according to Mashvisor’s April 2023 report. The following locations are ranked from the highest to the lowest in terms of cash on cash return.

1. Ormond Beach, FL

- Median Property Price: $554,452

- Average Price per Square Foot: $307

- Days on Market: 102

- Number of Long Term Rental Listings: 206

- Monthly Long Term Rental Income: $2,290

- Long Term Rental Cash on Cash Return: 3.22%

- Long Term Rental Cap Rate: 3.26%

- Price to Rent Ratio: 20

- Walk Score: 52

The first among the top locations for investing in long term rentals is Ormond Beach, FL. It’s among the best places to live in the Sunshine State, offering its residents a suburban feel. Many of them own their homes, too.

Do note that Ormond Beach is a more conservative area that is popular among retirees and families with children.

2. Cape Coral, FL

- Median Property Price: $585,570

- Average Price per Square Foot: $309

- Days on Market: 93

- Number of Long Term Rental Listings: 1,407

- Monthly Long Term Rental Income: $2,224

- Long Term Rental Cash on Cash Return: 3.19%

- Long Term Rental Cap Rate: 3.23%

- Price to Rent Ratio: 22

- Walk Score: 79

Another profitable location for investing in long term rentals is Cape Coral.

Compared to Miami and Naples, the average cost of living in Cape Coral is significantly lower. Even more so, it’s a relatively quiet neighborhood with nice, warm weather.

Investors should not encounter any issues finding many great opportunities for investing in single family homes, duplexes—and even triplexes—here.

Related: 20 Best Places to Invest in Real Estate in Florida in 2023

3. Wilmington, NC

- Median Property Price: $509,012

- Average Price per Square Foot: $393

- Days on Market: 63

- Number of Long Term Rental Listings: 133

- Monthly Long Term Rental Income: $2,057

- Long Term Rental Cash on Cash Return: 3.17%

- Long Term Rental Cap Rate: 3.21%

- Price to Rent Ratio: 21

- Walk Score: 30

Next on the list is Wilmington, a wealthy community in North Carolina. It’s known as the “Port City” because of its connection to the Cape Fear River.

Wilmington is known for its restaurants, parks, and shops. Even more so, it also offers many entertainment opportunities for people seeking a fun nightlife.

4. Peoria, AZ

- Median Property Price: $548,741

- Average Price per Square Foot: $275

- Days on Market: 21

- Number of Long Term Rental Listings: 319

- Monthly Long Term Rental Income: $2,242

- Long Term Rental Cash on Cash Return: 3.12%

- Long Term Rental Cap Rate: 3.16%

- Price to Rent Ratio: 20

- Walk Score: 62

Peoria, located in Arizona, is our fourth location for investing in long term rentals. There are many reasons why investors put it on top of their investment lists. They include access to various entertainment and employment opportunities to the sunny climate and quality schools.

In addition, housing costs in Peoria are generally lower, making it more affordable and flexible for many newcomers.

5. Atlanta, GA

- Median Property Price: $559,022

- Average Price per Square Foot: $1,709

- Days on Market: 73

- Number of Long Term Rental Listings: 2,778

- Monthly Long Term Rental Income: $2,290

- Long Term Rental Cash on Cash Return: 3.11%

- Long Term Rental Cap Rate: 3.17%

- Price to Rent Ratio: 20

- Walk Score: 43

Atlanta in Georgia is fifth on the list of popular long term investment locations in 2023. Despite the not-so-great reputation, it is actually a very safe neighborhood. It’s also an attractive area for families and young entrepreneurs, primarily because of its growing economy.

Aspiring students also find the city tempting. The area is known for its highly-rated private, public, and international schools, with the most popular ones including Georgia State University, Agnes Scott College, and SCAD Atlanta.

Summing up, nvesting in long term rentals will be a profitable business venture in 2023. However, it is essential to consider many different factors before making the final decision.

We can help you reach the best decision and land a successful investment property. Start searching for profitable long term rental areas now.

5 Best Short Term Rental Areas in the US

What if short term rental areas are your cup of tea?

Well, in that case, here are the leading locations you should consider in 2023 based on our April 2023 data. We ranked the locations below from those with the highest to the lowest cash on cash return.

1. Homer, AK

- Median Property Price: $409,296

- Average Price per Square Foot: $330

- Days on Market: 4

- Number of Short Term Rental Listings: 290

- Monthly Short Term Rental Income: $3,550

- Short Term Rental Cash on Cash Return: 5.93%

- Short Term Rental Cap Rate: 6.01%

- Short Term Rental Daily Rate: $222

- Short Term Rental Occupancy Rate: 57%

- Walk Score: 52

First on our list when it comes to investing in short term rental areas is Homer, an Alaskan city that’s definitely worth visiting. Also known as “Cosmic Hamlet by the Sea,” Homer offers its visitors stunning landscapes, adventure, entertainment, and friendly people.

2. Madison, WI

- Median Property Price: $550,623

- Average Price per Square Foot: $273

- Days on Market: 1

- Number of Short Term Rental Listings: 285

- Monthly Short Term Rental Income: $4,943

- Short Term Rental Cash on Cash Return: 5.39%

- Short Term Rental Cap Rate: 5.45%

- Short Term Rental Daily Rate: $237

- Short Term Rental Occupancy Rate: 71%

- Walk Score: 45

Madison, WI, takes second place for the best short term rental areas to invest in this year. It is known for offering visitors the best of both worlds: a vibrant community and natural beauty.

It also boasts several historical landmarks and a rich local food scene.

3. Woodway, TX

- Median Property Price: $541,362

- Average Price per Square Foot: $210

- Days on Market: 61

- Number of Short Term Rental Listings: 243

- Monthly Short Term Rental Income: $4,476

- Short Term Rental Cash on Cash Return: 4.98%

- Short Term Rental Cap Rate: 5.04%

- Short Term Rental Daily Rate: $192

- Short Term Rental Occupancy Rate: 52%

- Walk Score: 43

Woodway, which is in Texas, is a popular suburb with just over 9,130 residents. It’s a perfect location for a weekend getaway, offering simple pleasures to its visitors. Tourists can enjoy the farmers market on Sundays, play golf, and spend outdoor time in the parks of such a conservative and quiet suburb.

Related: The Ultimate Beginner’s Guide to Airbnb Analytics for Hosts

4. Beaufort, SC

- Median Property Price: $612,461

- Average Price per Square Foot: $306

- Days on Market: 140

- Number of Short Term Rental Listings: 290

- Monthly Short Term Rental Income: $3,590

- Short Term Rental Cash on Cash Return: 4.39%

- Short Term Rental Cap Rate: 4.44%

- Short Term Rental Daily Rate: $184

- Short Term Rental Occupancy Rate: 54%

- Walk Score: 30

Here is a fun fact for you: Beaufort is the second oldest city in South Carolina. What makes it an attractive short term rental investment location is much more profound, though. Real estate investors and visitors are drawn to Beaufort because of its luxurious Southern lifestyle, delicious seafood, and breathtaking coastal views.

5. Lancaster, PA

- Median Property Price: $407,954

- Average Price per Square Foot: $259

- Days on Market: 98

- Number of Short Term Rental Listings: 371

- Monthly Short Term Rental Income: $2,928

- Short Term Rental Cash on Cash Return: 4.00%

- Short Term Rental Cap Rate: 4.07%

- Short Term Rental Daily Rate: $171

- Short Term Rental Occupancy Rate: 55%

- Walk Score: 98

Whether you’re visiting Lancaster with friends or family, you’re bound to enjoy the city filled with entertainment. It’s a great place for foodies and those who want good music and quality drinks.

Lancaster is also a theater hotspot. Moreover, galleries are open until extra late every first Friday of the month.

Investing in short term rental areas can be a simple process when you can access specifically developed investment tools like Mashvisor. Begin your search now and pin down a promising short term rental property.

How to Find the Best Rental Area for Your Chosen Investment Strategy

Dealing with the constantly changing climate of the US housing market when you are looking for the next profitable investment property can be a time-consuming and often overwhelming process.

But even though it may initially seem complicated, there’s a simple way to go about it:

You should narrow things down from the “big picture” to the tiniest details of your investment strategy.

To assist you in your research for the best rental areas in the US, regardless of whether you want to focus on long term or short term rentals, here are the key steps you’ll need to take to get there:

1. Pick the Right Market

As we said, looking at things from a bigger picture is vital in the initial stages of your strategy. And in this case, it means choosing the right real estate market.

Read, research, and interact with fellow investors. The main goal is to collect and analyze as much information as possible about real estate markets that align with your expectations and plans.

Consider relying on the following factors as you’re doing your assessment, as they’re usually accurate indicators of success:

- Market growth

- Employment opportunities

- Home values

- Rental rates

- Local climate

2. Pick the Right Neighborhood

After selecting a potential real estate market that meets your expectations, now is the time to narrow your search to a specific neighborhood.

Before conducting the research, it is important to mention that the neighborhood you choose will also depend on your target tenants.

With that in mind, consider the following factors:

- Amenities

- Schools

- Crime rate

- Public transportation

- Income levels

3. Use Online Tools to Help With Your Decision

Searching for profitable rental areas is, by no means, a simple process. In addition to 100% concentration and dedication, such a business venture also involves a huge amount of information that needs to be handled.

And to make matters worse, relying on out-of-date or inaccurate data could easily take a toll on your entire rental strategy.

Therefore, it’s important not to take any chances here. If you want to take the safe route, you can do so by choosing Mashvisor.

Mashvisor’s tools are specifically designed to help investors from the start to the end of their real estate journey—maximizing their profits and expanding their portfolios.

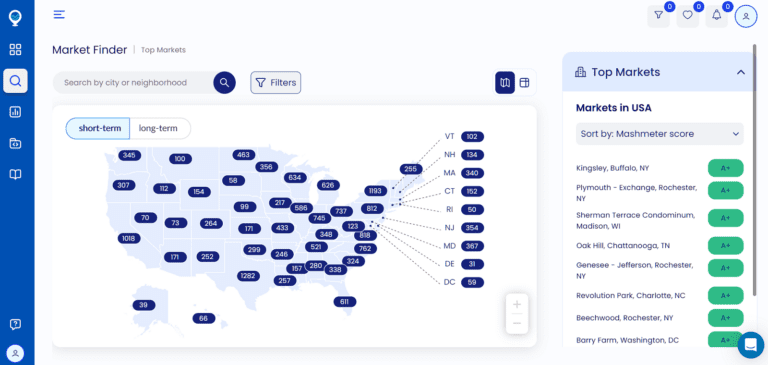

One such tool is the Market Finder—a tool that allows investors to view the US housing market from a wider perspective. It uses a heatmap to show how specific neighborhoods perform as investment locations.

The Market Finder tool uses the Mashmeter score, a neighborhood evaluation system of neighborhoods across the US based on grades from A+ to D. Mashmeter works by using cutting-edge machine learning and algorithms. It is especially useful in narrowing down neighborhoods and saving you precious time and money along the way.

Within just minutes, investors can identify long term or short term investment opportunities.

With Mahsvisor’s tools, investors will have no issues staying up-to-date with highly accurate and relevant market data.

To get the full experience, sign up for Mashvisor’s 7-day free trial and kick off your investment journey.

Mashvisor’s Market Finder tool gives investors a broader perspective of the US housing market, helping them identify profitable long term or short term investment opportunities.

10 Best Rental Areas in 2023: Summing Up

We just successfully reviewed the ten best rental areas in 2023 that guarantee good cash on cash return. That said, we covered quite a bit of information above, so let’s go over the main points one more time.

Any professional real estate investor knows how crucial it is to keep up with the latest news about the real estate market. And, as far as 2023 is concerned, high interest rates, inflation, and a steady influx of homebuyers in their 30s seem to hug the main headlines.

Regarding rental areas that should be on your list this year, they are located all over the US housing market—from North Carolina, Arizona, and Florida, all the way to Alaska.

The ultimate decision depends on your rental strategy.

Are you looking to invest in long term or short term properties?

To get a head start, you should first look at the bigger picture and analyze popular real estate markets. Then, narrow things down to the neighborhoods of your preference. Make sure to use online investment tools to review the numbers and maximize profits.

On that note, we’d like to add the following:

With Mashvisor at your side, pinning down the next best rental property will be a breeze. Our investment tools are tailored to the real estate investors’ needs—and can guide them on that journey from beginning to end.

Schedule an inquiry with one of Mashvisor’s dedicated Product Specialists and get a detailed introduction to our products and services. Schedule a demo now.