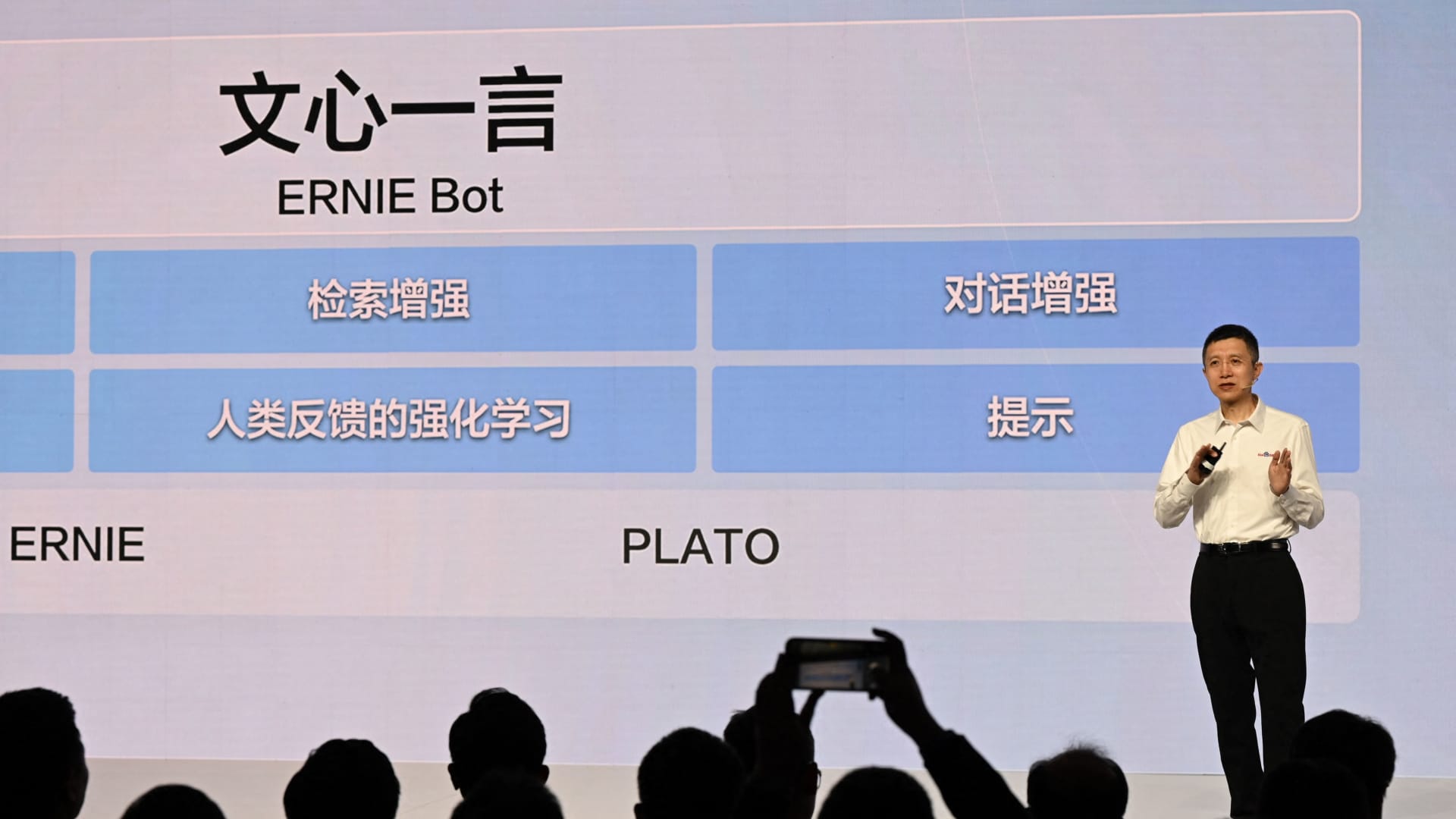

Baidu CTO Wang Haifeng speaks at the unveiling of Baidus AI chatbot Ernie Bot at an event in Beijing on March 16, 2023.

Michael Zhang | Afp | Getty Images

BEIJING — More than two months since the ChatGPT craze hit China, a similar artificial intelligence-based product has yet to reach the country’s population at large.

Instead, the most well-known alternatives released by Baidu, Alibaba and others have limited access with waitlists — or restricted trials to business partners.

In what has been compared to an “iPhone moment,” ChatGPT reached an estimated 100 million monthly active users two months after launching in November. The AI-chatbot learns using big data and can generate everything from poems to business strategies in a human-like conversation.

But ChatGPT, created by U.S.-based OpenAI, isn’t available in China, where access to Twitter, Facebook and Google is also banned via the government’s internet firewall. Beijing this month also released draft rules for regulating AI-generated content, with a public comment period until May 10.

Those restrictions haven’t stopped the Chinese press and social media in general from talking frequently about ChatGPT and AI tech. Some people tried to buy overseas ChatGPT accounts on Chinese e-commerce sites.

Domestic companies rushed to release and test alternative products. Accumulating big data and machine learning experience are integral to the tech behind ChatGPT.

So far, publicly available figures indicate similar AI products in China are not as widely available.

Alibaba Cloud said Wednesday it received more than 200,000 requests from businesses to test the company’s version of ChatGPT-style tech, called Tongyi Qianwen. The product was announced on April 11.

One of those business partners, Kunlun Tech, launched the “Tiangong” on April 17 which can interact with users in a question-and-answer format. The product is currently invite-only. Kunlun claims Tiangong is the only chatbot in China with training metrics at the level of ChatGPT.

Similarly, it’s not clear how many people have gained access to Baidu’s Ernie bot.

Just under a week after its launch on March 16, the chatbot had more than 1.2 million people on a waiting list. The company stopped disclosing numbers within a few days. No update was available Friday.

When CNBC tried to sign up for Ernie bot in March, the Baidu system required a mainland Chinese phone number and local ID in order to use the chatbot. More apps in China now require ID verification, or strongly encourage it.

Baidu this week said that since Ernie bot’s launch, it had updated the product four times, and reduced costs for operating the AI model to one-tenth of what it was previously.

The public version of Ernie bot allows users to generate English and Chinese text, images and audio.

In the U.S., new AI-based products from Google and Microsoft also have waitlists. ChatGPT isn’t consistently usable due to server capacity. Some in the industry also expect such AI tools will be easier to commercialize for business products than for public tools such as search.

Development challenges

Regulatory uncertainty lingers while Beijing remains in a comment period for its generative AI draft rules. Authorities have not announced when a final version of the rules would take effect.

Outside China, the U.S. and Europe have generally been lax on ChatGPT, except for Italy, which this month banned the chatbot until OpenAI addresses privacy issues.

A bug had given ChatGPT users temporary access to other people’s conversations. OpenAI this week said it released incognito-like features that allow users to turn off chat history and opt out of having their data used for training its models.

Another challenge for companies in China will be obtaining the most advanced chips for training AI models. The U.S. in October announced stringent export bans aimed at restricting China’s access to high-end semiconductors.

A model at the level of OpenAI’s GPT-3 requires at least 1,000 Nvidia A100 graphics processing units, a kind of chip known as GPUs, to complete one 23-day round of training, HSBC analysts said in an April 20 report.

More than 30 companies and institutes in China are training such AI models, indicating “robust demand for AI server and increased spending on networking infrastructure,” the report said.

The analysts said they expect AI GPU demand in China to grow by more than 40% this year.

Another estimate, based on checks with cloud providers, predicts that demand to at least double — contributing to a “significant shortage” of chips, according to a representative of a firm investing in AI models, who requested anonymity due to the sensitivity of the topic.

On regulation, the source said authorities are supportive of ChatGPT-style tech while planning to regulate it — companies anticipate they will need licenses to operate ChatGPT-like tech and are preparing for applications.

— CNBC’s Michael Bloom and Ashley Capoot contributed to this report.