The Golden State is optimal for investing in Airbnb. If you’re wondering how to start an Airbnb in California, you will find this guide useful.

Short term rentals are a great investment strategy if you want to earn additional income. Many investors benefit from investing in short term rentals due to their high market demand and lucrative returns. However, not all locations are ideal for investing in Airbnb. You need to find the best short term rental markets if you want to be a successful Airbnb owner.

Table of Contents

- Is Airbnb Profitable in California?

- Short Term Rental Regulations in California

- How to Start an Airbnb in California in 6 Steps

- Top 8 Cities in California for Airbnb

The ideal short term rental markets are those that are frequently visited by tourists almost all year round. California is one of the best states for investing in Airbnb. There are several reasons why the Golden State is excellent for short term rentals. One is because California is a highly popular tourist destination, attracting millions of visitors every year.

In California, the demand for short term rentals is consistently high, especially in popular tourist areas. By investing in a short term rental property in California, you can take advantage of the increased demand. You can generate substantial rental income, particularly during peak seasons.

However, due to California’s favorable weather conditions, it’s a good year-long destination. The state enjoys a Mediterranean climate, with warm, dry summers and mild, wet winters that attract tourists year-round. It means short term rentals in California can be profitable throughout the year, not just during the peak summer months.

However, not all areas in California are optimal for Airbnb investing—and it’s crucial to find the right location to become a successful Airbnb owner.

Is Airbnb Profitable in California?

Before we discuss how to start an Airbnb in California, let us first determine if it is a profitable location for short term rentals. In general, as one of the most popular tourist destinations in the world, California is an excellent location for Airbnb investors looking to generate profitable short term rental income.

Here are some reasons why you should consider the Golden State as your next Airbnb investment location:

High Rental Demand

California is a popular destination for both domestic and international tourists, and millions of visitors go to the Golden State every year. As many travelers prefer the flexibility and affordability of short term rentals over traditional hotels, Airbnb properties in California are consistently in high demand.

It means you can charge premium rates for your properties to earn significant rental income. Plus, you will also benefit from high occupancy rates, which is crucial if you want a steady stream of cash flow.

Strong Tourism Industry

California’s tourism industry is a significant contributor to the state’s economy, with many attractions and activities that draw visitors year-round. The state is home to several world-renowned tourist destinations, including Disneyland, Hollywood, and the Golden Gate Bridge, among others.

Additionally, California’s favorable weather conditions make it an attractive destination for outdoor enthusiasts. Visitors get to enjoy activities such as surfing, skiing, and hiking, which are available in various locations.

Diverse Range of Properties

California offers a diverse range of properties, from beachfront apartments to city lofts and mountain cabins. It means that you can cater to a broad range of travelers with varying preferences and budgets, depending on your investment location. As a result, you can maximize your occupancy rates and short term rental income.

Growing Short Term Rental Market

The short term rental industry experienced significant growth in California in recent years, with the number of Airbnb listings in the state steadily increasing. In fact, the growth prompted the State of California to establish a strong legal framework to regulate Airbnb rentals in the state.

The strong tourism growth only indicates a healthy and vibrant California Airbnb market, providing opportunities for investors to start an Airbnb business. With the right short term rental location and well-thought-out investing methods, even new investors can succeed in the short term rental industry in California.

Favorable Rental Income and Cap Rate

While tourist attractions, weather conditions, and other physical factors can greatly affect the Airbnb market, you also need to consider the actual numbers that may indicate profitability. In California, investors can earn lucrative rental income with favorable cap rates, which are both important metrics for measuring a property’s return on investment.

Here is California’s real estate data based on Mashvisor’s location report as of April 2023:

- Median Property Price: $998,564

- Average Price per Square Foot: $675

- Days on Market: 81

- Number of Airbnb Listings: 87,459

- Monthly Airbnb Rental Income: $3,879

- Airbnb Cash on Cash Return: 2.38%

- Airbnb Cap Rate: 2.41%

- Airbnb Daily Rate: $229

- Airbnb Occupancy Rate: 50%

- Number of Long Term Rental Listings: 50,172

- Monthly Long Term Rental Income: $3,420

- Long Term Rental Cash on Cash Return: 2.64%

- Long Term Rental Cap Rate: 2.67%

- Price to Rent Ratio: 24

- Walk Score: 50

Related: 40 Best Places for Buying Investment Property in 2023

Short Term Rental Regulations in California

In order to operate a short term rental business in California, you need to comply with the short term rental law and regulations at both the state and local levels. Here are some of the key California Airbnb regulations that you need to be aware of:

- State Regulations: The state of California passed a law that requires short term rental platforms such as Airbnb and VRBO to provide local governments with data on their hosts and rental listings. The law aims to help local governments enforce their own short-term rental regulations. It also requires platforms to collect and remit relevant taxes.

- Local Regulations: Many cities and counties in California impose their own regulations for short term rentals. In most cities, hosts are required to obtain a business registration for their short term rental. Some cities limit their rentals to a certain maximum number of days per year, and most require hosts to pay a transient occupancy tax.

- Zoning Regulations: In addition to business and registration requirements, many local governments in California adhere to zoning regulations that affect short term rentals. For example, some cities only allow short term rentals in certain zones, such as commercial or mixed-use zones, and prohibit them in residential zones.

- Health and Safety Regulations: Short term rental hosts in California should also comply with health and safety regulations. For instance, there are building and fire codes that the property must adhere to. Also, hosts must provide smoke detectors and carbon monoxide detectors. They must maintain the cleanliness and safety of the properties.

In general, the short term rental law and regulations in California vary by location, so it’s crucial to check with your local city to ensure that you understand the law. In some cases, the regulations may restrict your ability to maximize your earning potential.

Top 5 California Cities With Strict Short Term Rental Regulations

California is one of the states with the strictest Airbnb law. Because of the rise of Airbnb rentals in the Golden State, the state passed several laws and regulations aimed at regulating the short term rental industry. It ensures that Airbnb rental properties are properly licensed, and taxes are properly collected.

However, in some cities, regulations are too rigid that operating an Airbnb business may not be a practical option. Here are the five cities in California with the strictest short term rental laws:

1. Los Angeles

In Los Angeles, short term rental owners need to file an application and pay the filing fee to participate in home-sharing through the city’s online registration portal. To be eligible, you need to comply with the following rules:

- The property must be your primary residence, and you must live in the property for at least six months in a year.

- The area must be approved for residential use.

- The property must only be rented for a maximum of 120 days per year.

- You do not need to be home when guests are staying at the property.

- While you can list more than one room in the same property, you are only allowed to rent out one listing at a time. It means that if you rent out two rooms, you cannot have both rooms booked at the same time.

- You need to pay the relevant taxes and fees as imposed by the city.

2. Daly City

In Daly City, a short term rental permit and business license are required. To register, you need to submit a short term rental permit application form and pay the application fee. The property needs to be your primary residence to be eligible. You also need to show two documents as proof that the property is your primary residence.

Here are the other rules:

- You must reside in the property for 265 days or more per year.

- Unhosted stays are allowed for a maximum of 100 days per year.

- If you stay on the premises at the same time the guests are there, there is no limit on the number of days allowed.

- There’s a guest limit of two guests per bedroom and two additional guests per stay.

- Only one booking per property per day is allowed.

- You need to pay transient occupancy tax.

- You need to designate a contact person who is available 24 hours to address your guests’ concerns during their stay.

3. San Diego

In San Diego, the short term rental regulations are restricted and a bit complicated. There are four tiers available, and the number of licenses issued is limited. The tiers are as follows:

- Tier 1: Part-time short term rental that’s rented out for 20 days or less per year

- Tier 2: Owner-occupied rental, where you rent a room or rooms in your house for more than 20 days in a year as long as you are staying onsite during the guests’ stays

- Tier 3: Renting an entire home unhosted (excluding mission beach) for more than 20 days per year

- Tier 4: Renting an entire mission beach home unhosted for more than 20 days per year

4. Berkeley

In Berkeley, short term rentals refer to any dwelling unit that is rented for 14 days or less. You need to register your short term rental with the city to become a certified host. To be eligible, you must meet the following requirements:

- The rental unit must be your primary residence.

- It must be covered by liability insurance of $1 million.

- It must be located in one of the approved zones.

- You need to pay a $220.00 non-refundable application fee and a $5.50 processing fee upon application for registration.

- You also need to pay a 12% transient occupancy tax, as well as a 2% enforcement fee that’s remitted monthly.

5. Inglewood

Inglewood investors who want to venture into short term rentals are also required to complete an application and meet all requirements to obtain a permit. Here are the eligibility requirements:

- You need to be a resident of Inglewood for at least 10 years and must have resided in the dwelling unit for 365 consecutive days prior to registration.

- You must own the primary residence for at least five consecutive years and own the vacation rental for one year or more.

- You need to pay transient occupancy tax.

- If your property has two or more units, you need to reside in one of the units as your primary residence.

Top 5 California Cities With Lenient Short Term Rental Regulations

While there are cities in California that impose strict Airbnb rules, there are also cities with lenient regulations. They are the places that are ideal for short term rental investing. If you’re wondering how to start an Airbnb in California, you need to find a city with favorable Airbnb laws first.

Here are the five cities in California with investor-friendly short term rental laws:

1. Fresno

In Fresno, you need to obtain a permit to operate a short term rental business. Once the application is submitted, you will be given a provisional permit to operate a short term rental while waiting for the decision of the city. You don’t need to be at the property during the guests’ stay, and there is no maximum limit on the number of days you can rent your short term rental.

2. Corona

In Corona, you are also required to secure a business license and short-term residential rental permit from the city before you can advertise the property. While unhosted rentals are permitted, you need to designate a contact person who is available 24 hours to address your guests’ concerns. There is no limit to the number of days the unit can be rented in a year.

3. San Bernardino

To operate a short term rental in San Bernardino, you need to obtain a short term rental permit. There may be limitations on the number of occupants and vehicles, depending on the property size. Also, you need to provide a 24-hour phone number to address any concerns from guests. The property should also comply with fire, building, zoning, and health and safety codes.

4. Anaheim

Anaheim is known for Disneyland, making it one of the top destinations for tourists. To operate a short term rental in Anaheim, you need to secure a short term rental permit. You also need to ensure that the property complies with all applicable codes and all other relevant laws. Bookings should be at least three consecutive nights, but there is no maximum limit per year.

5. Richmond

In Richmond, you need to obtain a business license and collect and remit transient occupancy tax to operate a short term rental. In addition, you also need to secure a Home Occupation Authorization, as well as a building inspection, prior to the issuance of the business license. You may rent your property unhosted, and there is no maximum booking limit for a year.

Related: 40 Best Cities for Airbnb Rental Income in 2023

How to Start an Airbnb in California in 6 Steps

Due to its favorable weather conditions, world-class attractions, and large influx of tourists every year, California is no doubt a great place for investing in Airbnb. If you’re planning to buy vacation rental property in the Golden State, you will most likely earn profitable returns as long as you choose the right Airbnb market.

Follow the step-by-step guide below on how to start an Airbnb in California:

Step 1: Find an Optimal Location

Not all cities and neighborhoods in California are ideal for real estate investing. That’s why it’s crucial to do your research thoroughly when searching for the right investment location. The best Airbnb market in California is one that attracts renters all year round. When conducting your research, you also need to check other metrics that can affect your ROI.

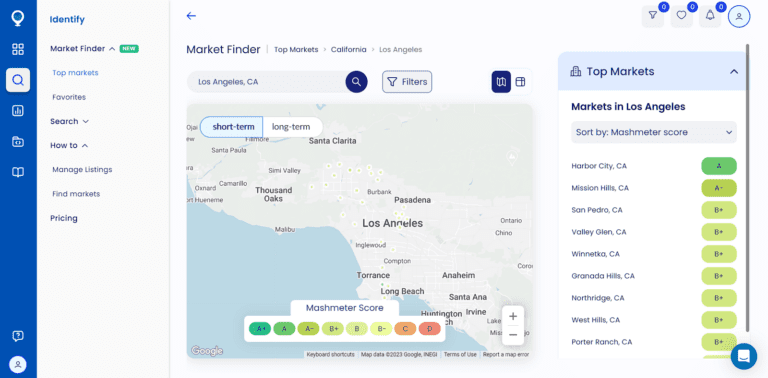

One of the best ways to find the best location is by using a real estate online tool, such as Mashvisor’s Market Finder. The tool features a heatmap, which allows you to see a general overview of the US housing market. You may click California on the map, and you’ll see the top cities on the right side of the page based on several factors, including:

- Mashmeter Score: A score given by Mashvisor to evaluate a location

- Rental Revenue: The anticipated monthly income

- Cap Rate: A rate of return that takes into account the value of the property against the net income

- Crime Rate: Measures the safety of the location

You can also explore other cities by zooming in on the map. Plus, you can optimize your search by setting your custom filters, including the ones mentioned above, as well as occupancy rate, property type, home value, and regulatory law. In general, using Market Finder makes it a lot easier to find the best rental markets to invest in Airbnb.

Start your 7-day free trial with Mashvisor today to learn more about the Market Finder tool and how it works.

You can use Mashvisor’s Market Finder to get insights into the top Airbnb cities in California based on the Mashmeter Score and other factors.

Step 2: Determine the Airbnb Regulations

After finding a location where you want to invest in, the next step is to determine the rules and regulations that govern short term rentals in the local market. You may visit the city’s housing department to check the process for operating a short term rental, as well as the rules and restrictions that you should be aware of.

Also, you can opt to check the applicable Airbnb law online, which is more practical, especially if you’re eyeing more than one location. You can use Mashvisor’s short term rental regulations page to know if a particular location imposes favorable Airbnb laws or not.

Step 3: Find an Investment Property

Once you’ve finalized your location, the next step is to find the best investment property to buy. Remember that even in markets that are optimal for short term rental investing, not all properties will be profitable. It’s critical to perform a rental property analysis to ensure that the one you’re buying will bring gainful returns.

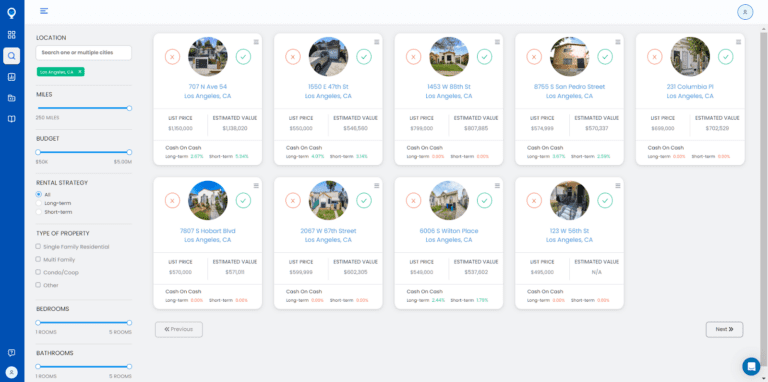

To make your search easier, you can use Mashvisor’s Property Finder feature. The tool allows you to search for available listings for sale in your chosen city or neighborhood. You can filter your search results by customizing your budget, property type, number of bedrooms and bathrooms, and distance.

Once you find properties that interest you, Mashvisor provides comprehensive real estate analytics for each property so you can determine which one is the most profitable. You can also use Mashvisor’s investment property calculator. The calculator allows you to determine how much you can earn based on the property’s estimated income, expenses, and your preferred financing method.

It’s important to note that in some cities in California, it is required that the property is your primary residence in order for you to be allowed to rent it out on Airbnb. It means that you need to reside on the property for a certain number of days in a year for it to be eligible to operate as a short term rental.

Related: How Is Mashvisor’s Property Finder Helping Real Estate Investors?

You can use Mashvisor’s Property Finder to look for available listings for sale in your chosen city or neighborhood in California according to your preferred real estate metrics.

Step 4: Renovate and Furnish the Property

After buying an investment property, you need to perform the necessary renovations and furnish the rental unit to make it attractive. Keep in mind that since there’s tough competition among Airbnb properties in California, you need to ensure that your property is appealing and can stand out among the rest.

Conduct some market research to learn what are the preferred amenities of guests. You can perform a rental comps analysis to know how your competitors are doing. It can help you better strategize your investment plan and position your Airbnb rental thoroughly so that it will stay ahead of the competition.

Step 5: Register Your Short Term Rental

Most cities in California require that you register your short term rental business before you can operate one. You need to obtain a business license and short term rental permit before you will be allowed to list the property on Airbnb or other home-sharing platforms. Check the registration process in your city to ensure that you remain in compliance.

Step 6: List Your Vacation Rental on Airbnb

After securing your registration and all other required permits, you may now list your property on home-sharing platforms like Airbnb. Since short term rental is seasonal, you need to use a dynamic pricing strategy to ensure that your rental rates are accurate and can help maximize your earnings.

To help, Mashvisor’s Dynamic Pricing tool helps automate your nightly rates based on several factors, such as market demand, local events, seasonality, holidays, and booking trends. You can control your earnings by setting your preferred base price, minimum price, and maximum price, as well as your booking settings and availability.

With Mashvisor’s dynamic pricing, you’ll take the guessing game out of the equation when planning the rental estimate for your Airbnb nightly rate. You can trust that the suggested rates are based on accurate and updated data, including AI-powered technology and machine-learning algorithms that are tested and proven.

Top 8 Cities in California for Airbnb

Are you ready to start an Airbnb business in California? If so, we listed below the top eight cities that are ideal for short term rental investing.

We only included cities with a median property price of below $1 million, with at least 100 active Airbnb listings, and generate an estimated monthly rental income of above $2,000. Plus, we only considered areas with cash on cash return of over 2% and an occupancy rate of 50% or more.

Based on Mashvisor’s data as of April 2023, here are the top eight cities in California for Airbnb investing, ranked from those with the highest to the lowest cash on cash returns:

1. Los Osos

- Median Property Price: $905,444

- Average Price per Square Foot: $571

- Days on Market: 92

- Number of Airbnb Listings: 134

- Monthly Airbnb Rental Income: $4,929

- Airbnb Cash on Cash Return: 3.95%

- Airbnb Cap Rate: 3.98%

- Airbnb Daily Rate: $241

- Airbnb Occupancy Rate: 57%

- Walk Score: 38

2. San Pedro

- Median Property Price: $980,244

- Average Price per Square Foot: $549

- Days on Market: 96

- Number of Airbnb Listings: 101

- Monthly Airbnb Rental Income: $5,009

- Airbnb Cash on Cash Return: 3.66%

- Airbnb Cap Rate: 3.68%

- Airbnb Daily Rate: $167

- Airbnb Occupancy Rate: 68%

- Walk Score: 91

3. Canoga Park

- Median Property Price: $630,976

- Average Price per Square Foot: $458

- Days on Market: 17

- Number of Airbnb Listings: 433

- Monthly Airbnb Rental Income: $4,009

- Airbnb Cash on Cash Return: 3.53%

- Airbnb Cap Rate: 3.56%

- Airbnb Daily Rate: $271

- Airbnb Occupancy Rate: 51%

- Walk Score: 81

4. Chatsworth

- Median Property Price: $856,780

- Average Price per Square Foot: $469

- Days on Market: 62

- Number of Airbnb Listings: 187

- Monthly Airbnb Rental Income: $4,194

- Airbnb Cash on Cash Return: 3.38%

- Airbnb Cap Rate: 3.42%

- Airbnb Daily Rate: $260

- Airbnb Occupancy Rate: 54%

- Walk Score: 40

5. Anaheim

- Median Property Price: $855,508

- Average Price per Square Foot: $525

- Days on Market: 80

- Number of Airbnb Listings: 933

- Monthly Airbnb Rental Income: $5,060

- Airbnb Cash on Cash Return: 3.34%

- Airbnb Cap Rate: 3.36%

- Airbnb Daily Rate: $267

- Airbnb Occupancy Rate: 55%

- Walk Score: 56

6. Wilmington

- Median Property Price: $671,144

- Average Price per Square Foot: $500

- Days on Market: 51

- Number of Airbnb Listings: 332

- Monthly Airbnb Rental Income: $3,220

- Airbnb Cash on Cash Return: 3%

- Airbnb Cap Rate: 3.02%

- Airbnb Daily Rate: $175

- Airbnb Occupancy Rate: 58%

- Walk Score: 90

7. Garden Grove

- Median Property Price: $803,706

- Average Price per Square Foot: $550

- Days on Market: 76

- Number of Airbnb Listings: 114

- Monthly Airbnb Rental Income: $3,993

- Airbnb Cash on Cash Return: 2.53%

- Airbnb Cap Rate: 2.55%

- Airbnb Daily Rate: $220

- Airbnb Occupancy Rate: 58%

- Walk Score: 90

8. Alta Loma

- Median Property Price: $788,749

- Average Price per Square Foot: $439

- Days on Market: 60

- Number of Airbnb Listings: 127

- Monthly Airbnb Rental Income: $3,801

- Airbnb Cash on Cash Return: 2.45%

- Airbnb Cap Rate: 2.47%

- Airbnb Daily Rate: $189

- Airbnb Occupancy Rate: 55%

- Walk Score: 79

Start searching for profitable Airbnb properties in California using Mashvisor’s property search feature.

It’s Time to Start an Airbnb in California

There are plenty of opportunities for short term rental investors in California. Now that you know how to start an Airbnb in California, it’s time to begin your search for the best California short term rental market. Look for the best Airbnb for sale for the most profitable return. Don’t forget to know the rules and regulations pertaining to short term rentals first before deciding on a location to invest in.

Since some cities impose stricter Airbnb rules, it’s important to understand the restrictions so you can easily determine which city will work best for your situation. If you already own a house and want to buy another to operate as a vacation rental, it’s important to find a location that allows non-primary residence for your Airbnb.

Keep in mind that choosing the right location is vital to your success, so don’t take it lightly. Make sure to spend time doing your research and analysis to ensure that you choose the right market for your investment. With the help of Mashvisor’s tools, it will be easier for you to find the right investment location for your California short term rental.

See for yourself how the tools work. Schedule a demo today and learn how Mashvisor can help set you up for success.