Investors ask, “What does STR mean in real estate?” STR, or short term rentals, is a great investment strategy that offers lucrative returns.

Short term rentals are one of the most preferred strategies when it comes to investing in real estate. Following the rise of home-sharing platforms back in the late 2000s, when Airbnb first became popular among travelers, many new and seasoned investors ventured into short term rentals. Most of them became successful, which only proves that Airbnb is a gainful investment.

Table of Contents

- What Does STR Mean in Real Estate?

- STR vs. LTR: What’s the Difference?

- STR vs. LTR: Which Is the Better Real Estate Investment Strategy?

- How to Start Investing in STR

There are several reasons why short term rentals became famous. For one, they are the preferred accommodation option for most travelers because of their affordability compared to staying in hotels. Short term rentals also provide a kind of atmosphere that makes guests feel more at home.

Also, most vacation rentals offer amenities and features that are not available in hotels, like a full-kitchen amenity that allows guests to cook on the property. Additionally, guests can opt to rent an entire home, which is great for families and large groups of travelers. As a result, many consider staying in short term rentals the more practical option.

As an investor, owning a short term rental property is an excellent way to earn generous returns, especially when you invest in the best short term rental markets. In fact, despite the recent speculations about a potential housing market crash, experts believe that the short term rental industry will remain strong. It makes STRs the better investment strategy this year.

If you’re looking to invest in Airbnb, this article will guide you through the entire process.

What Does STR Mean in Real Estate?

In real estate, STR is the abbreviation for short term rentals. Short term rentals, also known as vacation rentals or Airbnb rentals, are properties that are rented out for short periods, typically for 30 days or less. The rental homes are usually listed on home-sharing platforms, like Airbnb and VRBO, where guests use to book a stay.

Short term rentals are now the most common—and in many cases, more preferred— alternative to traditional forms of accommodation, such as hotels, hostels, and motels. What makes short term rentals unique is that guests can choose from different types of accommodations, including a single room or an entire home. Even tents or cabins can be an option.

The rise of home-sharing platforms opened opportunities for real estate investors to own short term rentals and rent their spaces to temporary guests. Owning a vacation rental is a more affordable investment option if you want to be in the hospitality business, compared to owning and operating a hotel.

In addition, investors can take advantage of the home-sharing platforms that essentially offer free marketing, which provides their properties free exposure to prospective guests from all over the world. Airbnb, for instance, counts over 150 million users worldwide. It means that if you list your property on Airbnb, you can reach a broad customer base without spending on advertising.

Related: How to Invest in Real Estate Online in 2023

STR vs. LTR: What’s the Difference?

The major difference between short term and long term rentals is (based on their names themselves) the length of stay. However, there are other things that make STR and LTR differ from one another. Now that you understand what STR means in real estate, it’s crucial to find how it differs from long term rentals to know which strategy is right for you.

In general, short term and long term rentals differ from one another in terms of the following:

Length of Stay

We have learned that short term rentals are typically rented out for only 30 days or less. Long term rentals, on the other hand, are usually leased for months, with common lease terms of up to one year or more.

With long term rentals, tenants need to sign a rental agreement and should agree to stay at the property until the lease term ends. Typically, depending on the provisions of the agreement, pre-termination of the lease is either not allowed or will be charged with penalty fees.

With short term rentals, guests normally book the length of stay using an online platform and they are expected to check out of the property on the last day.

It’s important to note that short term rentals are typically seasonal. It means that on some days, the demand for vacation rentals may be high, while on other days, there isn’t enough demand for you to get a booking. In contrast, the demand for long term rentals depends on market conditions and the population growth in your area.

Target Guests

The target guests of short term rental owners are leisure or business travelers, as well as temporary visitors in the area who are there for reasons other than business and leisure. With long term rentals, on the other hand, your target renters are long-term residents who do not own a house.

Long-term tenants are migrants or new residents in the area. Usually, they are non-permanent residents who are there for a few years due to school, temporary business assignments, or personal reasons. Long term rental investors can also target newly married couples, small families who couldn’t afford to buy their own properties yet, and retirees who want to settle in your location.

Governing Rules

If you invest in short term rentals, you need to comply with the Airbnb rules and regulations in your city. Some cities impose strict rules on operating vacation rental property. It’s crucial to know the restrictions to avoid violating the law.

Similarly, long term rental investors also need to abide by the landlord-tenant law in their state. Moreover, there are city ordinances regarding building, health, and safety codes that long term rental owners should remain in compliance with.

Amenities

To stand out among the competition, both short term and long term rental owners need to provide amenities that will increase the value of your rental property. For short term rentals, providing unique amenities is crucial if you want to attract guests. You also need to invest in furniture, appliances, and aesthetics to make your property appealing to prospective guests.

If you own a long term rental property, you need to decide whether you will rent it furnished or unfurnished. If you want to target renters who do not plan to stay too long, renting your property furnished is a wise idea. However, if you plan to rent out your property to those who want to settle for a longer term, renting an unfurnished rental home is a better option.

STR vs. LTR: Which Is the Better Real Estate Investment Strategy?

Now that we know the differences between LTR and STR in real estate, you may be curious to know what is the better real estate investment strategy to use. In general, the best rental strategy depends on various factors, including the following:

- Location

- Market conditions

- Rental demand

- Rental trends

- Target customers

- Budget

- Level of commitment that you are willing to give

- Personal preferences

Before you decide which strategy to use for your next investment, you have to take these factors into consideration to understand the best option for your unique situation. Both long term and short term rentals offer the potential to earn generous returns as long as you choose the right market to invest in. After all, when it comes to real estate investing, location is everything.

However, when done correctly, vacation rentals are capable of generating higher profits than long term rentals—despite the fact that short term rentals are generally seasonal. There are several reasons why many investors believe that short term rentals are the better investment strategy. Three of the reasons are:

1. High Rental Demand

Since short term rentals are relatively more affordable compared to hotels’ rates, many travelers prefer to stay in an Airbnb property than book a hotel room. Also, as mentioned, vacation rentals offer more amenities that provide a homey atmosphere, which is why many guests prefer to stay in Airbnb properties when they travel.

Because of this, there is a high demand for short term rentals not only in the US but also all over the world. This is one of the reasons why the short term rental market remains strong despite the recent cooling down of the housing market due to rising interest rates. With a thorough rental analysis, you will know if a local market is optimal for Airbnb investing or not.

Related: How to Research an Airbnb Market and Quickly Find a Good Place to Buy Rental Property

2. Flexible Pricing

We’ve mentioned that short term rentals are a seasonal business. The demand is expected to be higher during peak season, meaning that you can freely increase your nightly rate to maximize your income. During the off-peak season, when the demand is low, you can also adjust your pricing to attract occupants.

It means that you can control how much you can earn based on the market demand. With long term rentals, however, your rental rates will depend on your property’s value, and in some cases, are controlled by the government. As a result, short term rentals offer a greater potential for earning higher profits than long term rentals.

3. Less Wear and Tear

Because of the high turnover rate of short term rentals, your property will be maintained more frequently. Also, it will experience less wear and tear because guests who stay in short term rentals don’t usually stay at the property all day. Since most of your guests are there for business or leisure trips, they seldom use your furniture and other stuff, resulting in less wear.

In contrast, long term tenants essentially live in the property. They will use the rental unit like it’s their house, and your property is more prone to damage due to wear and tear. Moreover, since tenant turnover is relatively less, maintenance is also less frequent.

How to Start Investing in STR

Now that we’ve established the advantages of investing in short term rentals over long term rentals, we understand why many investors prefer to buy vacation homes for sale. If you’re a new investor and don’t know how to start investing in STR, the following steps will guide you through the process.

Step 1: Find the Ideal Location for STR

When it comes to investing in real estate, your location can either make or break your success. If you want to become profitable, make sure to choose the right market to buy vacation rental property. Finding the right location for your short term rental investment is crucial. You need to take several factors into consideration when choosing a location, such as:

-

- Safety: A location that is safe for visitors is essential if you want to attract guests and prevent safety issues. Check the crime rate in the area and make sure that the neighborhood is not too isolated or abandoned.

- Attractions: A good location for STR is one that is home or close to many attractions since most of your guests will be there for sightseeing. The more attractions near your location, the higher the rental demand would be.

- Seasonality: Consider the seasonality when choosing a location. For instance, a beach house may be great for warmer days, but it may not get as much occupancy during the cold months. Consider how long the low-peak season would be, as it will significantly affect your profitability. Choose a location with longer peak months.

- Demand: Some locations see higher market demand not only because of their attractions and seasonality but also because of other factors like busy business districts. Study the market trends and demand before choosing an area to invest in.

How to Find the Best Market for STR Investing?

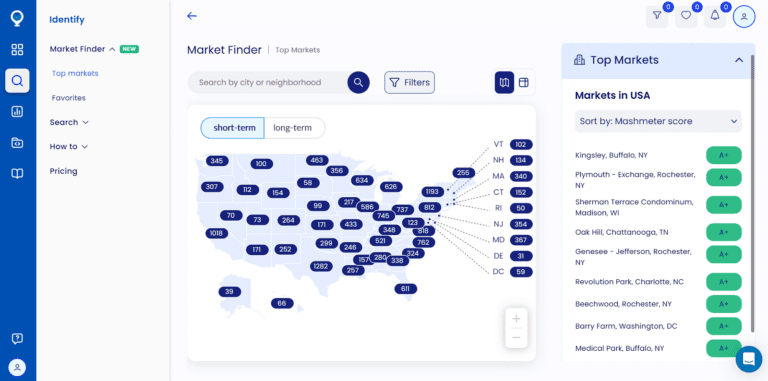

The most efficient way to find the best short term rental market is by using an online real estate tool, such as Mashvisor’s Market Finder. With Market Finder, you will get a bird’s eye view of the entire US market, allowing you to zoom in on the state, city, and/or neighborhood that you want to analyze. It features the heatmap, which makes your search a lot easier.

You can customize your search by setting filters like Airbnb occupancy rate, Airbnb cash on cash return, or Airbnb rental income. The heatmap will then show you which areas meet your criteria. What’s more, you will see a Mashmeter score for each neighborhood that you analyze, which easily evaluates the market if it is optimal for short term rental investment or not.

Start a 7-day free trial with Mashvisor today to see how Market Finder and its other tools work.

Mashvisor’s Market Finder provides investors with a bird’s eye view of the US market, allowing them to zoom in on and analyze their preferred state, city, and/or neighborhood.

Step 2: Know the STR Law in Your Chosen Location

After choosing a real estate market that’s optimal for STR investing, the next step is to find out whether or not it’s legal to operate a short term rental in the area. What you need to do is to find the short term rental rules and regulations in your city of choice. Keep in mind that each city may impose different rules, even if they are in the same state.

When researching the Airbnb law of a certain STR market, you need to determine the following:

- Does the city allow short term rentals?

- What are the requirements for operating a short term rental business?

- Does the city require you to register your STR? If so, what is the process of STR business registration?

- Does the city charge fees and taxes? If so, what are they, and how much?

- Does the city impose certain restrictions for STRs? If so, what are these restrictions?

- What are the other rules and regulations that you need to be aware of?

How to Find the Short Term Rental Law and Rules?

You need to conduct your research to know the STR rules and regulations that apply to your chosen location. You may opt to visit your local city’s government office, or you may also perform online research to determine the rules. Fortunately, you can also go to Mashvisor’s Short Term Regulations page and search for a location’s STR rules.

Step 3: Find an Investment Property to Buy

After you decide where to invest and you’ve established that you can legally operate a vacation rental in the area, the next step is to find the best investment property to buy. It is another critical step (or series of steps) that needs a thorough evaluation of several properties in the area so you can choose the most profitable one.

To make the process easier, you need to decide on the following before you search for available listings:

- Budget: How much are you willing to spend on an investment property? Your budget must include the listing price of the property, as well as other costs that you need to pay for, such as closing and renovation costs.

- Property Type: What kind of property do you want to invest in? STRs in real estate range from single-family homes to apartment complexes, condo units, multi-family homes, and even cabins. Deciding what type of property you want to buy will make your search more efficient.

- Property Size: Depending on your budget, you also need to decide how big the property is. Also, decide how many bedrooms and bathrooms should the property have.

How to Find the Best STR Investment Property?

With modern technology, searching for properties for sale is a lot easier nowadays. One of the easiest and most efficient ways to find a property for sale is through Mashvisor’s Property Finder tool. Mashvisor’s database contains hundreds of thousands of properties for sale across the US. So, finding one that meets your criteria is highly possible.

What’s best about Mashvisor’s Property Finder tool is that you can easily customize your search results based on your budget, distance, chosen strategy, property type, and size. All you need is to type the city or neighborhood of your choice and set your filters. Then, our platform’s AI-powered algorithm will generate results that match your requirements.

Step 4: Analyze the Property’s Profitability Potential

After finding a few properties that interest you, the next thing to do is to perform a thorough rental property analysis to ensure that you’re choosing a profitable investment. When evaluating a property’s profitability potential, make sure to check the following:

- Rental income

- Monthly expenses

- Cash flow

- Occupancy rate

- Cap rate and cash on cash return

How to Assess the Profitability of an Investment Property?

A rental analysis starts with comprehensive research. Some investors do it manually, which means they need to check on similar properties in the same area and interview owners to get the real estate data that they need. However, doing so manually is prone to error and time-consuming.

The good news is that with Mashvisor, you’ll get access to short term rental analytics that can help you make the right investment decision. You can use Mashvisor’s Airbnb calculator to determine how much you can possibly make from a particular investment property. The best thing about the said tool is that all the data that you need is readily provided for you.

You can trust that the Airbnb data offered by Mashvisor is highly accurate and up-to-date. With Mashvisor’s investment property calculator, you will know the property’s cash flow, cap rate, cash on cash return, and occupancy rate. What’s more, you will see a side-by-side comparison of both LTR and STR investment strategies, making it easier to decide which one is better.

Another great thing about Mashvisor’s rental property calculator is that it is interactive, meaning you can customize certain figures to get more personalized results. Additionally, you can also input your financing method so that you can take into account your mortgage payments. It provides a more accurate cash on cash return.

Related: What Is a Good Cash on Cash Return?

What Is a Good Cap Rate for STR?

Many investors and real estate experts agree that a cap rate of anywhere between 8% to 12% is considered good. With the said range, does it mean that a cap rate below 8% is not good? Actually, the figure is not set in stone. In fact, there is no hard-and-fast rule when it comes to deciding what is a good cap rate for STR.

Cap rates may increase or decrease depending on the short term rental market. It does decrease in markets with high appreciation rates—so essentially, a cap rate that’s lower than 8% may still be good if the property is located in a fast-growing market. Cap rates of at least 2% or higher are generally considered acceptable.

Step 5: Buy a Vacation Rental and List It on Airbnb

Once you find a profitable STR investment property, the next thing to do is to buy an Airbnb for sale, perform the necessary renovations, and get it listed on home-sharing platforms like Airbnb. If you think that this is the end of it, well, think again.

As mentioned, short term rentals are seasonal, so you need to stay updated with the market demands and trends to be able to set the right rental estimate for your STR. It means that you need to continue doing your research to be able to maximize your returns and occupancy. If you think of it, it takes a lot of effort and hard work, not to mention that it’s time-consuming, too.

How to Set the Right Nightly Rates for STR Properties?

While manual research is not really a bad idea, it can take a lot of your time and your assessment may also be inaccurate. To prevent any issues, it’s best to use a dynamic pricing tool that can help you streamline your STR rates. Thankfully, Mashvisor offers such a tool, and you can take advantage of its benefits to maximize your income-earning potential.

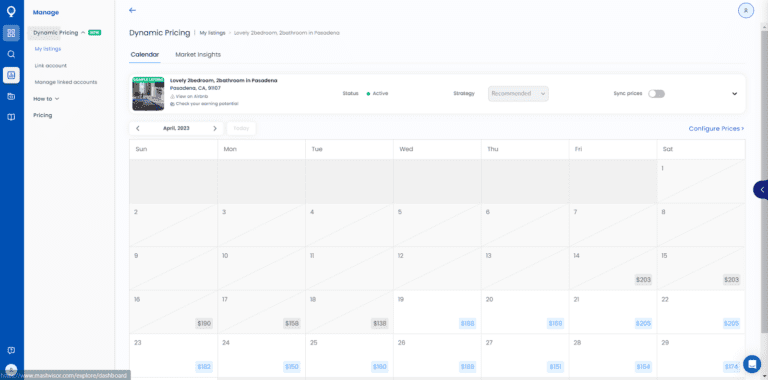

Mashvisor’s Dynamic Pricing lets you manage your Airbnb properties with ease and set the right nightly rates based on factors like market demand, events, seasonality, and booking trends. Not only that, but you still exert full control of your income. It is because you are allowed to set your base, minimum, and maximum prices, as well as configure the booking settings and availability.

Moreover, you will also obtain access to the Market Insights feature, which lets you better understand the market and how your competition performs. It allows you to better position your property so that you can stay ahead of your competitors. Mashvisor’s high-quality data and AI-powered pricing feature are valuable tools to set accurate and realistic nightly STR rates.

Mashvisor’s Dynamic Pricing enables investors to manage their STR properties easily and set the right nightly rates.

Consider STR As Your Investment Strategy

Now we’ve answered the question: “What does STR mean in real estate?”—and we’ve also established that STR is a lucrative investment strategy that provides high returns. The demand for vacation rentals across the US will continue to grow, and you can take advantage of this by choosing the best STR market to invest in.

Before you invest in short term rentals, make sure to find the right location and the best investment property that is optimal for the STR strategy. Follow the steps mentioned above to help guide you through the process. Additionally, ensure to perform a thorough analysis so you can determine its profitability.

Fortunately, you can do it efficiently by using Mashvsior’s real estate investment tools, such as the Market Finder, Property Finder, investment property calculator, and Dynamic Pricing.

Learn how Mashvisor can help you become a successful real estate investor. Schedule a demo today to experience first-hand how our tools work.