Is your home city not a great place for investing in real estate? If so, you need to find new investment locations that offer lucrative returns.

Investing in real estate is one of the best ways to earn substantial profits. Whether you want to buy and sell a property or acquire one to rent out, there are several ways to earn generous returns in real estate. However, to be a successful investor, you need to invest in the right location.

Table of Contents

- How to Find New Investment Opportunities in Any Up-and-Coming US Location

- 10 New Investment Locations for Long Term Rentals

- 10 New Investment Locations for Short Term Rentals

The adage “location, location, location” still applies in real estate investing in 2023. Where you invest can significantly affect the quality of your investment—in fact, your investment location can either make or break your success as an investor. That’s why when it comes to finding the best markets to invest in, you need to be prudent and take extra caution.

Some new investors think that they should be limited to buying an investment property only within the place where they live. However, not all home cities are optimal for real estate investing. If you want to find the best investment property, you should be open to finding opportunities in new investment locations. Such locations can be outside of your home state or city.

But the challenge there is how to know which real estate markets are optimal for investing.

In this article, we will share some tips on finding new investment opportunities in up-and-coming locations across the country. We will also discuss how Mashvisor’s Market Finder tool can help you find the best real estate housing market in the United States.

How to Find New Investment Opportunities in Any Up-and-Coming US Location

Investing in other locations outside of your home city or state is a great way to diversify your portfolio. Investing in out-of-state real estate market is a great option if:

- You live in an area where it’s too expensive to invest in.

- Your local real estate market is too saturated.

- There are no sufficient housing demands in the location where you currently live.

- You might want to take advantage of undervalued markets with a strong potential for population and economic growth.

- You want to expand your portfolio and access other real estate markets.

- You want to access investor-friendly laws and favorable tax laws.

- You find a lucrative real estate market that’s outside your home market.

Whatever your reason is, finding a new investment opportunity in another location can be beneficial to your bottom line. However, whether you’re a new or a seasoned investor, buying an investment property outside the place that you’re already familiar with can be daunting.

One of the most common problems you will encounter is that you don’t know where and how to begin. Although the thought of investing outside your territory can be a bit scary, the process is pretty simple if you know what to do. Use the following tips as a guide to help you get started.

1. Determine Your Investment Strategy

There are several ways to invest in real estate. Some investors who do not want to buy an actual property opt for other real estate investment alternatives. They include real estate investment trusts (REITs) and real estate mutual funds. Assuming that you prefer to acquire a property, there’s a handful of options for your investment strategies, including:

Buy and Sell

You can purchase a property at a low price and immediately sell it for a profit. It typically applies to homes that are ready for occupancy. The buy and sell strategy may work in markets where buyer demand is higher compared to the demand from renters.

Buy, Fix, and Sell

You can also choose to buy a fixer-upper, perform the necessary renovations, and sell it for a profit after the renovation. The method is popularly known as “fix-and-flip” among investors. The fix-and-flip strategy is best in markets where there are plenty of fixer-upper inventories and high demand from homebuyers.

Related: 5 Red Flags Investors Should Look for in Fix-and-Flip Properties

Buy, Use, and Hold

The buy, use, and hold strategy involves buying a house, using it for yourself, and waiting for the value to appreciate before you sell it for a profit. Such a type of investment is considered a medium to long term strategy. You can use the property as your primary home or as a secondary or holiday home.

Buy, Fix, and Use as a Long Term Rental

One of the most popular real estate investment strategies is to buy a property to be used as a long term rental. With the said strategy, you will rent out your investment property to long term tenants with lease agreements that typically last six months to one year (or even more). The strategy is best in markets with high rental demands and a growing population of renters.

Buy, Fix, and Use as a Short Term Rental

Another popular investment strategy is buying a property for listing on home-sharing platforms like Airbnb as a short term rental. Investing in short term rental properties allows you to earn generous returns if you choose the best short term rental markets to invest in. The strategy works best in markets with a strong tourism industry, which attracts visitors all year round.

The investment strategy that you should choose must be based on your unique financial circumstances, risk appetite, and preferred location. Keep in mind that while some locations may be optimal for a particular investment strategy, it may not be as profitable if you choose to use another strategy.

2. Prepare a Few Select Locations Based on Your Criteria

When investing in real estate, your options are almost limitless when it comes to choosing your investment locations. However, it can also get overwhelming, especially if you don’t prepare a list of criteria when selecting the real estate market to invest in. Before you start searching for new investment locations, make sure to come up with a few ideas first.

Here are the sample investment location criteria that you may consider:

- Distance: You may select new locations based on how far they are from your home city or home state.

- Time Zone: You may also choose locations based on your preferred time zone. For instance, you may want to invest in states or cities with the same time zone as your current home location for easy coordination.

- Personal Preference: Another factor that you may consider is, of course, your personal preference. For example, you currently live in a cold area and you want to own a vacation property somewhere warm (or it can be the other way around). Also, some investors buy vacation homes for sale in the place where they want to visit.

Once you have a few select locations in mind, it would be easier for you to narrow down your options furthermore based on the real estate market’s profitability potential.

Related: 40 Best Places for Buying Investment Property in 2023

3. Find the Best Investment Location Based on Your Chosen Strategy

Once you’ve decided on an investment strategy and selected a few locations that you personally prefer, you should then find out which specific location suits your strategy. To do so, you need to conduct a thorough research and comprehensive real estate analysis. However, it may take a lot of time if you choose to do this manually on your own.

Fortunately, with the availability of advanced technology nowadays, you can now generate reliable real estate data and analytics through various real estate platforms. The challenge here is to find the perfect platform to use, as not all of them are created equal.

You need to ensure that the platform you choose offers reliable and accurate information. Not only that, but it should also provide up-to-date data and helpful investing tools to make your search so much easier. With all the available real estate platforms available online, nothing can beat Mashvisor when it comes to data accuracy, features, ease of use, and functionality.

Plus, when it comes to finding the best real estate markets to invest in, you can never go wrong with Mashvisor’s Market Finder.

What Is Market Finder and How Can It Help You Find New Investment Locations?

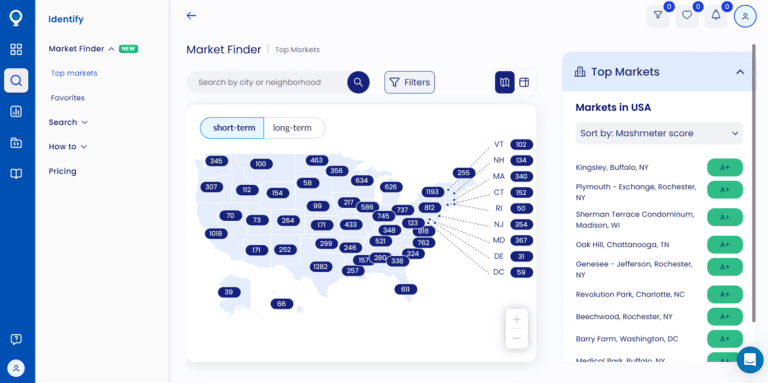

Mashvisor’s Market Finder tool is a feature that helps you find the best real estate deals on the most profitable investment locations based on various factors. The tool provides varied market insights so that you will understand how a market is performing before you make any investment decision.

Market Finder provides a general overview of the entire US housing market. It lets you zoom into specific locations so you can assess how a specific market is doing. It is a great tool to use, especially if you plan to invest in long term or short term rentals. With Market Finder, you can easily identify the hottest investment opportunities within and out of your home state.

Mashvisor’s Market Finder tool can help you identify the most lucrative investment opportunities in and out of your home state.

What Are the Features of Market Finder?

Here are a few things that you can access using Mashvisor’s Market Finder tool:

- Heatmap: The heatmap gives a visual presentation of how neighborhoods are performing for either long term or short term investment strategy. By using the tool, you’ll easily see which areas are performing well based on your chosen rental strategy and which areas you need to avoid.

- Mashmeter Score: The Mashmeter feature lets you evaluate a specific neighborhood to know if it is ane excellent investment location. The score is generated by AI technology and a reliable machine-learning algorithm. It helps you find whether a neighborhood is optimal for your chosen strategy within minutes.

- Neighborhood analysis: Once you find a city that you want to invest in, you can narrow down your new investment location option by analyzing specific neighborhoods. Market Finder provides accurate, relevant, and up-to-date market data. It also offers insights to help you determine the best neighborhood for investing.

- Table View: You’ll not only identify the best areas to invest in, but you’ll also find a convenient and efficient way to compare different markets effectively through its Table View feature. It is extremely useful if you can’t decide between two or more markets that you are eyeing.

- Market Insights: Market Finder also offers reliable and fresh market insights right on your dashboard. It allows you to study and analyze the performance of the market and its trends before you make a final decision.

Use Market Finder to help you find the best opportunities in new investment locations. Start your 7-day free trial today.

10 New Investment Locations for Long Term Rentals

When finding new investment locations for your long term rental investments, you need to consider several factors that may significantly affect your income potential. The factors include the median price, number of long term rental listings, rental income, price to rent ratio, and cash on cash return.

The good news is you can find all the above data from Mashvisor without performing any manual research and analysis. To help you get started with your search, we listed the hottest up-and-coming markets for you to consider.

We only selected areas with median home prices of not more than $1 million, with 50 to 100 long term rental listings, and a price to rent ratio of 20 or higher.

The price to rent ratio refers to the proportion of the home selling price versus the rental rates in the market. The higher the price to rent ratio is, the higher the percentage of residents who prefer to rent rather than buy a home.

In addition to the above criteria, we also made sure to only include areas with an average monthly rental income of at least $2,000 and cash on cash return of 2% or more.

Related: What Is a Good Cash on Cash Return?

Based on Mashvisor’s real estate data report as of March 2023, here are the top 10 long term rental markets to consider, ranked from the highest to the lowest cash on cash returns:

1. Lutherville Timonium, MD

- Median Property Price: $607,128

- Average Price per Square Foot: $250

- Days on Market: 43

- Number of Long Term Rental Listings: 56

- Monthly Long Term Rental Income: $2,488

- Long Term Rental Cash on Cash Return: 3.63%

- Long Term Rental Cap Rate: 3.68%

- Price to Rent Ratio: 20

- Walk Score: 54

2. Mundelein, IL

- Median Property Price: $575,980

- Average Price per Square Foot: $216

- Days on Market: 58

- Number of Long Term Rental Listings: 51

- Monthly Long Term Rental Income: $2,307

- Long Term Rental Cash on Cash Return: 3.10%

- Long Term Rental Cap Rate: 3.15%

- Price to Rent Ratio: 21

- Walk Score: 74

3. Waianae, HI

- Median Property Price: $652,604

- Average Price per Square Foot: $470

- Days on Market: 96

- Number of Long Term Rental Listings: 96

- Monthly Long Term Rental Income: $2,249

- Long Term Rental Cash on Cash Return: 3%

- Long Term Rental Cap Rate: 3.04%

- Price to Rent Ratio: 24

- Walk Score: 19

4. Lewes, DE

- Median Property Price: $640,891

- Average Price per Square Foot: $401

- Days on Market: 151

- Number of Long Term Rental Listings: 72

- Monthly Long Term Rental Income: $2,491

- Long Term Rental Cash on Cash Return: 2.96%

- Long Term Rental Cap Rate: 2.99%

- Price to Rent Ratio: 21

- Walk Score: 65

5. Rochester Hills, MI

- Median Property Price: $503,227

- Average Price per Square Foot: $244

- Days on Market: 91

- Number of Long Term Rental Listings: 62

- Monthly Long Term Rental Income: $2,024

- Long Term Rental Cash on Cash Return: 2.86%

- Long Term Rental Cap Rate: 2.92%

- Price to Rent Ratio: 21

- Walk Score: 22

6. Niceville, FL

- Median Property Price: $577,973

- Average Price per Square Foot: $348

- Days on Market: 123

- Number of Long Term Rental Listings: 56

- Monthly Long Term Rental Income: $2,235

- Long Term Rental Cash on Cash Return: 2.75%

- Long Term Rental Cap Rate: 2.78%

- Price to Rent Ratio: 22

- Walk Score: 56

7. Spring Branch, TX

- Median Property Price: $649,767

- Average Price per Square Foot: $258

- Days on Market: 91

- Number of Long Term Rental Listings: 60

- Monthly Long Term Rental Income: $2,144

- Long Term Rental Cash on Cash Return: 2.34%

- Long Term Rental Cap Rate: 2.37%

- Price to Rent Ratio: 25

- Walk Score: 10

8. Montebello, CA

- Median Property Price: $799,057

- Average Price per Square Foot: $459

- Days on Market: 51

- Number of Long Term Rental Listings: 50

- Monthly Long Term Rental Income: $3,072

- Long Term Rental Cash on Cash Return: 2.32%

- Long Term Rental Cap Rate: 2.33%

- Price to Rent Ratio: 22

- Walk Score: 80

9. Newtown, PA

- Median Property Price: $908,540

- Average Price per Square Foot: $290

- Days on Market: 164

- Number of Long Term Rental Listings: 89

- Monthly Long Term Rental Income: $3,073

- Long Term Rental Cash on Cash Return: 2.26%

- Long Term Rental Cap Rate: 2.29%

- Price to Rent Ratio: 25

- Walk Score: 85

10. Chester, NY

- Median Property Price: $722,539

- Average Price per Square Foot: $458

- Days on Market: 104

- Number of Long Term Rental Listings: 50

- Monthly Long Term Rental Income: $2,789

- Long Term Rental Cash on Cash Return: 2.03%

- Long Term Rental Cap Rate: 2.06%

- Price to Rent Ratio: 22

- Walk Score: 44

Start searching for high-income long term rental property investments using Mashvisor.

10 New Investment Locations for Short Term Rentals

Vacation rentals are a popular investment strategy among both new and seasoned investors. The short term rental market offers lots of opportunities and remains strong as ever. It comes despite the fear of a slight housing cooldown this year due to high mortgage rates. It is the reason why investing in short term rentals is still a good idea in 2023 and beyond.

With travelers from around the world remaining eager to go to new places for vacation, there’s a lot of expected demand from guests. Even business travelers are back too, and most of them prefer to stay in short term rentals than in hotels due to the former’s affordability and unique amenities.

Before buying vacation rentals for sale, you need to find a profitable short term rental market first. We listed the most ideal markets for vacation rentals to help you get started with your search. Additionally, we included areas that offer at least $2,000 in average monthly Airbnb rental income and a cash on cash return of 2% or higher.

We also listed up-and-coming locations with a median property price of $1 million or lower, Airbnb listings of between 50 and 100, and an occupancy rate of 50% or more. A high Walk Score is a plus.

Here are the top 10 short term rental markets based on Mashvisor’s real estate data as of March 2023, ranked from the highest to the lowest cash on cash returns:

1. Barberton, OH

- Median Property Price: $231,051

- Average Price per Square Foot: $127

- Days on Market: 48

- Number of Short Term Rental Listings: 57

- Monthly Short Term Rental Income: $2,926

- Short Term Rental Cash on Cash Return: 7.85%

- Short Term Rental Cap Rate: 8.03%

- Short Term Rental Daily Rate: $177

- Short Term Rental Occupancy Rate: 53%

- Walk Score: 44

2. Moline, IL

- Median Property Price: $162,400

- Average Price per Square Foot: $100

- Days on Market: 96

- Number of Short Term Rental Listings: 58

- Monthly Short Term Rental Income: $2,060

- Short Term Rental Cash on Cash Return: 7.55%

- Short Term Rental Cap Rate: 7.84%

- Short Term Rental Daily Rate: $127

- Short Term Rental Occupancy Rate: 60%

- Walk Score: 49

3. Dundee, NY

- Median Property Price: $351,550

- Average Price per Square Foot: $261

- Days on Market: 83

- Number of Short Term Rental Listings: 60

- Monthly Short Term Rental Income: $4,348

- Short Term Rental Cash on Cash Return: 7.19%

- Short Term Rental Cap Rate: 7.30%

- Short Term Rental Daily Rate: $267

- Short Term Rental Occupancy Rate: 56%

- Walk Score: 36

4. Grand Island, FL

- Median Property Price: $339,756

- Average Price per Square Foot: $198

- Days on Market: 99

- Number of Short Term Rental Listings: 59

- Monthly Short Term Rental Income: $3,439

- Short Term Rental Cash on Cash Return: 6.07%

- Short Term Rental Cap Rate: 6.16%

- Short Term Rental Daily Rate: $117

- Short Term Rental Occupancy Rate: 56%

- Walk Score: 15

5. Greenland, NH

- Median Property Price: $750,700

- Average Price per Square Foot: $292

- Days on Market: 81

- Number of Short Term Rental Listings: 99

- Monthly Short Term Rental Income: $5,875

- Short Term Rental Cash on Cash Return: 5.20%

- Short Term Rental Cap Rate: 5.24%

- Short Term Rental Daily Rate: $286

- Short Term Rental Occupancy Rate: 59%

- Walk Score: 45

6. Joplin, MO

- Median Property Price: $384,838

- Average Price per Square Foot: $141

- Days on Market: 52

- Number of Short Term Rental Listings: 98

- Monthly Short Term Rental Income: $2,321

- Short Term Rental Cash on Cash Return: 5.13%

- Short Term Rental Cap Rate: 5.25%

- Short Term Rental Daily Rate: $102

- Short Term Rental Occupancy Rate: 62%

- Walk Score: 76

7. Guntersville, AL

- Median Property Price: $325,317

- Average Price per Square Foot: $165

- Days on Market: 136

- Number of Short Term Rental Listings: 100

- Monthly Short Term Rental Income: $2,438

- Short Term Rental Cash on Cash Return: 5.06%

- Short Term Rental Cap Rate: 5.17%

- Short Term Rental Daily Rate: $186

- Short Term Rental Occupancy Rate: 50%

- Walk Score: 38

8. Stephenson, VA

- Median Property Price: $480,078

- Average Price per Square Foot: $177

- Days on Market: 84

- Number of Short Term Rental Listings: 61

- Monthly Short Term Rental Income: $3,012

- Short Term Rental Cash on Cash Return: 4.78%

- Short Term Rental Cap Rate: 4.86%

- Short Term Rental Daily Rate: $128

- Short Term Rental Occupancy Rate: 64%

- Walk Score: 9

9. Newbury Park, CA

- Median Property Price: $978,287

- Average Price per Square Foot: $512

- Days on Market: 82

- Number of Short Term Rental Listings: 99

- Monthly Short Term Rental Income: $6,715

- Short Term Rental Cash on Cash Return: 4.33%

- Short Term Rental Cap Rate: 4.36%

- Short Term Rental Daily Rate: $253

- Short Term Rental Occupancy Rate: 64%

- Walk Score: 37

10. Milford, CT

- Median Property Price: $584,504

- Average Price per Square Foot: $857

- Days on Market: 77

- Number of Short Term Rental Listings: 100

- Monthly Short Term Rental Income: $4,460

- Short Term Rental Cash on Cash Return: 4.23%

- Short Term Rental Cap Rate: 4.28%

- Short Term Rental Daily Rate: $273

- Short Term Rental Occupancy Rate: 56%

- Walk Score: 64

Are you ready to find a profitable short term rental investment? Start searching for the best investment property in your desired location now.

Be Open to Opportunities in New Investment Locations

Profitable investment opportunities may be available in new investment locations other than where you currently live. When it comes to investing in real estate, being open to opportunities, even if it means investing out-of-state, can bring you more prosperity and success.

While it can be daunting to invest in new locations that are unfamiliar to you, proper research and thorough market analysis will help lessen your risk. Fortunately, with Mashvisor’s Market Finder tool, you can easily find which markets are optimal for your chosen investment strategy and which areas you should avoid.

Mashvisor also offers other useful tools that can help you assess the profitability of the market, as well as the investment property that you consider buying. One such tool is the famous investment property calculator, which helps you compute a particular property’s income potential based on cash flow, cap rate, cash on cash return, occupancy rate, and more.

With Mashvisor’s reliable tools and accurate data, it’s possible to find the best investment opportunities in any US housing market in a matter of minutes.

Don’t miss out on opportunities to maximize your earning potential. Start your 7-day free trial now and let Mashvisor help you reach the peak of success!