Before you invest in real estate, it’s vital to conduct a thorough US property market analysis first. This is crucial to be a successful investor.

Investing in US real estate can be lucrative, but you need to find the right market that’s optimal for your chosen investment strategy first. That’s why you must perform your research and conduct a thorough analysis of the market before making any investment decision.

Table of Contents

- Our Analysis of the US Property Market So Far in 2023

- What Will the US Property Market Look Like for the Rest of the Year?

- What Do These Projections Mean For Investors?

- How to Do Your Own US Property Market Analysis

The best real estate market offers the potential to earn high returns. There are several ways to find the income potential of a certain market, and it’s possible to conduct a US property market analysis on your own. However, finding the right market can be time-consuming and prone to error, especially if you do it manually.

With modern technology, Market Finder tools are now available online, making the process of finding the right market a lot easier. One of the best ways to know whether a particular US market will make a good investment or not is to use a reliable online real estate analytics platform.

Since there are several real estate platforms available nowadays, choosing which one to work with can be challenging. When it comes to helping investors find the most profitable investment property, nothing can beat Mashvisor. Mashvisor provides the necessary tools to help investors find the best investment property that’s right for them.

In the following sections, we will learn more about the US market, how to conduct property analysis, and how Mashvisor can help set you up for success.

Our Analysis of the US Property Market So Far in 2023

The beginning of 2023 has been uncertain for the real estate industry. Before the end of 2022, it was projected that the real estate market would somehow see a downward slide due to the rising interest rates and economic uncertainties. In fact, there were fears of a possible housing market crash—albeit mild—that might happen this year or anytime soon.

Almost a quarter into 2023, we have noticed that the declining trend of mortgage rates in January 2023 appears to have stopped. While most home prices did not essentially drop as a response to high mortgage rates, their appreciation rates have slowed down, to say the least. The increase in home prices remains close to single digits and may not accelerate soon.

Here are the most current top three trends and insights on the US real estate market:

1. Home Inventory Is Slowly Increasing But Remains Low

Low inventory is one of the biggest problems of the US real estate market for quite a while now. Based on our current US property market analysis, home inventories remain insufficient, and there may not be enough listings to meet demands from buyers. This problem started to get worse since the 2020 real estate boom, and we are still dealing with the same problem now.

Since supplies remain limited, the competition between homebuyers remains tough. Homeowners and investors who purchased properties at record-low interest rates seemingly do not intend to list their properties on the market just yet. What’s more, new home construction fell at the beginning of 2023, which adds to the problem of low inventory.

The good news, however, is that even though inventory remains low, it’s been slowly moving upward since mid-last year. In fact, the upward trajectory in housing supply began in mid-May 2022. Although the increase in inventory is slow, it can somehow help with the longstanding issue of limited supplies.

Low inventories can affect real estate investors because it means the competition remains tight. If you go looking for a real estate investment, you need to keep an eye out on the listings and act quickly, lest all the best properties will be sold before you know it. In fact, in the best rental markets, homes spent fewer days on the market than usual.

2. Asking Prices and Annual Home Values Are Still Rising

Despite the high mortgage rates, home prices are still on an upward trend nationwide. In fact, according to a report from Realtor.com, the median price of homes for sale saw a 7.8% annual increase in February 2023. However, the figure is lower compared to January 2023’s growth rate of 8.1%.

The above figures show that while home prices are still moving upward, the growth rate is slowing down. As a matter of fact, we are now only seeing a single-digit rise in home prices for the past consecutive weeks since 2023 started. The current increase in home prices is just half of the home appreciation rate back in the last quarter of 2022.

With the said trend, it’s safe to say that the speed of housing price growth is declining, which means that this year will be pretty slow when it comes to housing appreciation rates. On the bright side for real estate investors and sellers, we won’t see home prices plunge drastically since there is still strong buyer demand and limited inventory.

If you’re an investor looking to buy a property, the slow-rising home prices can be good for you. While home values are increasing, at least the prices are not growing as fast as before—but you can still expect your investment to grow in value over time. And with proper research and comprehensive real estate analysis, there’s a possibility that you can get yourself a good buy.

3. Days on Market Remain Lower Than During Pre-Pandemic

The same report from Realtor.com shows that the average days on market in February 2023 increased by 23 days compared to around the same time last year. However, the time that for-sale listings spend on the market still remains significantly shorter compared to the pre-pandemic average.

The increase in days on market may be due to high mortgage rates, which caused many buyers to pull back. However, since the average days on market are shorter than in 2019, it goes to show that there is still more buyer demand this year than before the pandemic, despite some buyers pulling back.

What does it mean for real estate investors like you? The said trend only proves that the US housing market is currently calming down a bit. Due to economic uncertainties, high mortgage rates, and the fear of a possible recession, many buyers who want to remain on the safe side are slowing down a bit.

However, it also proves that the market demand has not slowed down back to pre-pandemic levels. Keep in mind that while the inventory is gradually increasing, it still remains low compared to buyer demand. And while the appreciation rates have slowed down, too, home prices are still on an upward trend. It means the competition still remains fierce.

What Will the US Property Market Look Like for the Rest of the Year?

Based on the current trends that we’ve learned from our US property market analysis, we can expect a slight cooling down of the US housing market in 2023. However, the US real estate market will remain on the positive side as home prices will continue to rise, albeit at a slower pace. We can also expect inventory to continue to rise.

As a real estate investor, it’s crucial to know what’s in store for the US housing market for the rest of 2023 and beyond. Will it be a good time to buy an investment property? What investment strategy will make the best option? How to find a profitable investment?

Let’s take a look at the top three US housing market forecasts to see what we can expect when it comes to real estate investing for the remaining months of 2023 and beyond:

1. There’s a Possible Housing Market Correction

Many people fear the predicted housing market crash might happen in 2023 or anytime soon. However, with the current real estate trends, a housing market crash may not materialize this year—instead, the US real estate market is more likely to experience some kind of correction. And it may be a good thing for most investors.

The market will likely correct itself from the double-digit home price increase in the past few years, especially during the pandemic. The slow home price growth rate trend that we’ve noticed is a sign of a possible ongoing correction. Home prices will remain steady in most parts of the country, while the national median price will slightly change.

Related: Will the Housing Market Crash in 2023?

2. Rental Rate Growth Will Also Slow Down

According to expert economists, there’s a possibility that rent will be cheaper compared to the past few years. After the national rent prices peaked at the beginning of 2022, we saw the rental rates go on a downward trend ever since. But although the cooling off of the rental market may be favorable to renters, it has not yet resulted in any significant relief for most tenants.

We might see rent prices drop in the next few months, but they might not go as low as it was before the pandemic. As a matter of fact, in some markets, rent prices are not expected to really go down—rather, rent increases will just slow down. The slowing down of rent started in late 2022, when the rent growth rate dropped to 8.4% in November from 17.2% in February 2022.

3. Short Term Rentals Will Remain a Hot Investment

The good news for real estate investors is that the short term rental market will remain strong in 2023. In most parts of the world, employment remains strong and consumers are increasingly eager to travel after almost two years of lockdown. And because short term rentals are the more affordable accommodation option, they will continue to thrive this year and beyond.

Investors need to be careful, however, as not all markets are optimal for short term rental investing. That is why before buying any investment property, conducting a proper rental property analysis is crucial to ensure that you’re buying into the right market. While short term rentals may be thriving in most areas, some locations may not be as profitable.

What Do These Projections Mean For Investors?

Given the US market projections for the rest of 2023, there will be a lot of opportunities for real estate investors who are planning to invest in either long term and short term rentals. In fact, with proper US property market analysis, the top three projections that we mentioned above are generally favorable to investors in many ways.

The possible market correction indicates that the increase in housing prices will slow down this year, which means that homes for sale will be a lot more affordable. If you’re a new investor planning to buy rental properties for sale, it would be easier for you to find a house that you can afford since prices won’t increase at a fast rate.

For long term rentals, there’s a possibility that the increase in rental rates will slow down. While this forecast may seem unfavorable for rental property owners, it can actually be turned into something beneficial for you. It means that tenants are more likely to sign a lease because they can now afford the rent, which results in a positive occupancy rate and cash flow.

If you’re looking to buy vacation rentals for sale, then you’re up for a good treat, as short term rentals are predicted to remain strong this year and beyond. With no more travel restrictions and most businesses back to normal, you’ll see an increase in bookings from both leisure and business travelers. You’ll likely generate high returns if you invest in the right market.

Related: What Is a Cash Flow Calculator for Real Estate Investors?

How to Do Your Own US Property Market Analysis

In general, the competition among investors may remain tough, since the outlook of the US real estate market remains optimistic for investors. If you want to stay ahead of the competition, it’s vital to know how to conduct a market analysis of the US property that you’re planning to invest in.

A real estate market analysis is important because it helps you determine if a particular location will make a good investment or not. You’ll also be able to identify the obstacles in a particular market and what factors hinder a profitable investment. Studying real estate data thoroughly will also let you determine the market demand, and which rental strategy is optimal for the area.

The following tips can help you conduct a proper US property market analysis:

1. Identify a Few Markets That You Want to Invest In

Before you can study the market, you must first identify which markets you want to invest in. In most cases, investors often start with their home city and other close neighboring cities that are easily accessible to them. After you identify a few real estate markets, you can now start your research and conduct a market analysis to know if these markets will make a good investment.

Related: 40 Best Places for Buying Investment Property in 2023

2. Analyze the Historical Data of Each Market

Before you can understand how the market will perform in the future, you must know how it’s already performing at present and how it has performed in the past. You can check the historical market performance of each location in which you are interested. There are reports from the National Association of Realtors that you may be able to access to help you with this.

3. Study the Market Demand

One of the most important factors that make a rental market optimal for investing is the demand from renters. A market with high rental demand is more likely to get a high occupancy rate than one with little demand from renters. Depending on your chosen investment strategy, you need

to determine if there are sufficient market demands in the location that you choose.

4. Find More In-Depth Information About the Market and Neighborhood

Before you settle on a particular market, you should go deeper with everything that there is to know about the location. You need to determine the population in a certain area, as well as the population growth rate. Find out how strong the economy is and whether or not there are plenty of job opportunities for new residents.

It’s also important to learn about the market’s tourism industry, especially if you consider buying vacation homes for sale. In addition, you must study the amenities in the area and whether or not they offer essential services like public transportation, education, medical services, and recreational facilities. They can be helpful if you choose to invest in long term rentals.

5. Research the Property Value Estimates in the Area

You have to calculate the average sale price per square foot in the area that you’re interested in to determine the value estimate. It allows you to identify how much budget you need to set for a particular investment property. It can also help you determine whether the property that you’re looking at is selling at a fair price or not.

6. Determine the Rental Estimates in the Area

Whether you’re planning to invest in a long term or short term rental, identifying the rental estimate in the market that you’re planning to invest in is essential to your profitability. If you have an idea of how much rent you can charge for a particular rental property in a specific market, you will know if the investment will be profitable or not.

7. Identify the Possible Expenses Associated With a Rental Property

To know how much profit you can possibly earn from a rental property, you should be able to identify the expenses that you need to spend on. In most cases, researching the expense information is one of the most difficult parts of conducting a US property market analysis. Doing it manually can be tedious and prone to error.

8. Use Mashvisor’s New Market Finder Tool

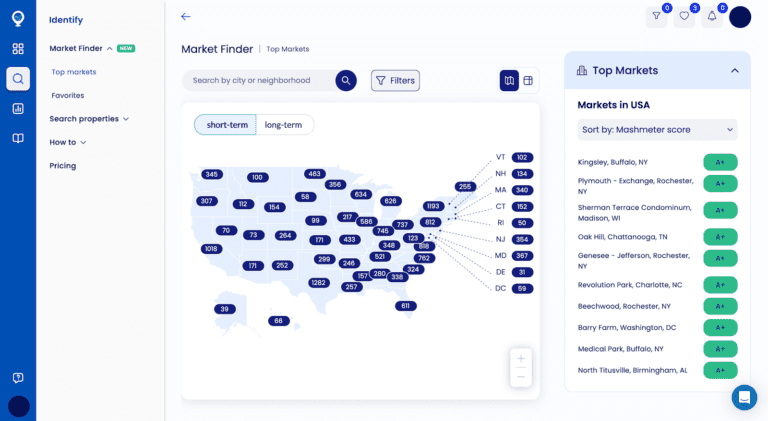

The easiest and most reliable way to find the best US market for your rental property investment is by using Mashvisor’s Market Finder tool. The tool allows you to see the overview of the US housing market so you can easily determine which areas offer the most profitable opportunities. What’s more, you can zoom in on an area so you can see what a neighborhood has to offer.

Using a heatmap, Market Finder visually presents the current performance of a specific city or neighborhood for both long term and short term rental investments. With the heatmap tool, you can easily see which areas are best to consider and which areas you should avoid. On top of that, you can customize your search using filters to get results that match your preferences.

Perform your own US property market analysis using Mashvisor’s Market Minder tool. Start your 7-day free trial now.

Mashvisor’s Market Finder tool makes it easier for beginner and experienced investors to analyze the US property market.

Analyze the Market to Stay Ahead of the Game

The US real estate market may be cooling down slightly this year, but it only means that the market opens more opportunities, especially for real estate investors. As with any type of investment, there are risks and rewards that you need to consider before deciding which one is best for you. That’s why it’s crucial to first understand the market that you’re investing in.

Conducting an in-depth US property market analysis is important because it allows you to determine if such a market will make a profitable investment. You will also be able to identify which investment strategy is optimal for a specific market based on rental demands, amenities, economy, and other factors that affect the market condition.

As an investor, you should not take this important process for granted, as the results from your analysis can help save you from making a risky investment. To make the process smoother, make sure to work with a reliable real estate analytics platform like Mashvisor. With Mashvisor’s new Market Finder tool, finding the best US market to invest in is a lot easier.

What’s more, Mashvisor also offers other real estate tools that can help short term rental hosts and investors manage their investment properties successfully. With our accurate and up-to-date real estate data, making an informed decision has never been this straightforward.

Are you ready to find the most profitable investment property in the US? Sign up for a 7-day free trial today.