If you invested in cryptocurrency last year, the U.S. government wants its cut.

The Internal Revenue Service (IRS) is getting more serious about tracking virtual currency transactions, and for the 2022 tax year now directly asks filers whether they received or sold any digital assets over the past year on Form 1040, Form 1040-SR and Form 1040-NR.

If you’ve bought or sold crypto, here are three things to keep in mind at tax time.

1. Cryptocurrency can be taxed

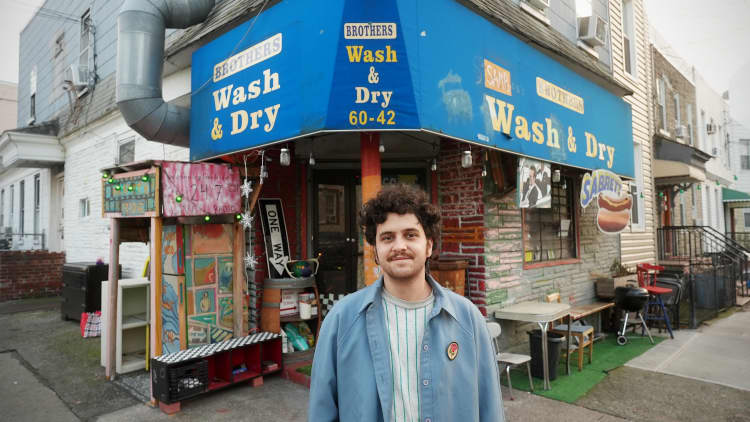

One of the biggest misconceptions cryptocurrency investors have is that their crypto can’t, or won’t, be taxed, Shehan Chandrasekera, a certified public accountant and head of tax strategy at crypto tax software company CoinTracker, tells CNBC Make It.

But it can be. Since 2014, the IRS has treated virtual currency as property for federal income tax purposes, according to the agency’s website.

Similar to stocks, crypto is subject to IRS rules surrounding capital gains and losses. That means that if you earned a profit by selling your crypto for more than what you purchased it for, you’ll owe capital gains tax on the difference.

Say you bought $500 worth of crypto and sold it for $600. The $100 difference would be considered a capital gain and subject to capital gains tax, which is typically taxed at a lower rate than ordinary income.

If you sold your crypto for less than what you paid for it, that would be considered a capital loss. The IRS allows investors to use capital losses to offset taxable capital gains. Additionally, capital losses can be used to reduce your regular taxable income by up to $3,000 per year if your capital losses exceed your annual capital gains.

Other taxable events include if you’ve used crypto to buy a product like coffee or if you’ve been paid in crypto to do a job, Chandrasekera says. However, you typically wouldn’t be taxed if you only purchased crypto using fiat currency like the U.S. dollar, moved your crypto from one virtual wallet to another or received crypto as a gift.

2. Your crypto activity isn’t completely invisible to the IRS

Another misconception among crypto investors is that the IRS isn’t able to see your crypto trading activity, and therefore you don’t have to report it at tax time, says Chandrasekera.

Although crypto is thought to be anonymous, regulators have a number of ways to connect your virtual activities to the real world.

If you trade on centralized exchanges like Coinbase or Gemini, those exchanges have to report to the IRS. Typically, they’ll send you a 1099 miscellaneous form detailing any income you’ve earned while trading crypto on their platform, Chandrasekera says.

Coinbase, for example, sends this form to customers who earned more than $600 in crypto, according to its website. However, you still need to report your earnings to the IRS even if you earned less than $600, the company says.

The IRS can also see your cryptocurrency activity when it subpoenas virtual trading platforms, Chandrasekera says. There may be thousands of names inside the files companies turn over to the government, which the IRS could use to verify if you have reported your trading activity to the government, he says.

And remember, even if you don’t use a major platform and don’t think the government will be able to track your crypto trades, you still need to report income, gains or losses from all taxable transactions involving cryptocurrency, according to the IRS website.

3. Proper record keeping is key

“The biggest mistake people make with crypto is keeping accurate records of their transactions,” says Douglas Boneparth, a certified financial planner, president and founder of Bone Fide Wealth and a member of CNBC’s Financial Advisor Council.

It mostly falls to investors to report cryptocurrency investments or earnings at tax time. That means you’ll need to keep track of every purchase or sale and the specific details of those transactions, Boneparth says.

Tools such as Cointracker can help you keep track of crypto transactions and automatically generate the necessary tax forms, Chandrasekera says.

Additionally, if you need more time to reconcile your crypto activity, you have the option to extend your filing deadline from April 18 to Oct.16 this year. But keep in mind that if you owe money to the government, you’ll still need to pay by the April 18 deadline, according to the IRS website.

More information on how the IRS taxes crypto can be found on the agency’s website.

DON’T MISS: Want to be smarter and more successful with your money, work & life? Sign up for our new newsletter

Get CNBC’s free Warren Buffett Guide to Investing, which distills the billionaire’s No. 1 best piece of advice for regular investors, do’s and don’ts, and three key investing principles into a clear and simple guidebook.

Check out: This loophole could help crypto investors lower their tax bill—but don’t abuse it, says CPA