[ad_1]

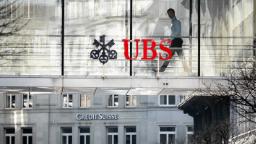

e tunning and rapid takeover of Credit Suisse, orchestrated by Swiss authorities Sunday, took one giant, wobbling domino off the table. Hours later, a group of central banks from around the world boosted the movement of US dollars through the global financial system to keep loans flowing to households and businesses and support the world’s major economies.

The question investors and nervous customers want answered this week: What’s next? Are other banks about to fall — or be saved? Will regulators be forced to step in with more rescue plans?

Some regional banks have teetered on the brink over the past week, with anxious customers pulling tens of billions of dollars in cash from the smaller banks and placing them with bigger institutions that are better capitalized.

To pay customers their withdrawals, regional banks have scrambled to access enough cash. First Republic received a $70 billion loan from JPMorgan Chase a week ago and another $30 billion lifeline on Thursday. That still appears to be insufficient, with First Republic’s shares tumbling another 33% Friday.

Many other banks, the identities of which will likely remain unknown for quite some time, sought emergency loans from the Federal Reserve over the past week. Banks borrowed a record $153 billion from the Fed’s discount window last week — a last-resort option for banks to gain quick access to cash.

The good news: Those loans do not indicate anything inherently wrong with the global banking system. None of the banks that borrowed from the Fed’s discount window borrowed on secondary credit terms — emergency, overnight loans that help deeply troubled banks keep the lights on. Those loans come with severe restrictions and more oversight from the Fed.

The fact that the loans the Fed delivered were primary credit “indicates that US bank supervisors consider the banks that needed emergency support ‘healthy’ and not at elevated risk of imminent failure,” noted Jill Cetina, Moody’s analyst, in a note to investors Friday.

The bad news: Banks may be healthy on the whole, but all that borrowing shows just how much strain is on the financial system at the moment.

Strain means banks may be resistant to lend money, adding more scrutiny to the creditworthiness of borrowers. That means fewer mortgages and less money flowing to businesses, which could slow the global economy.

That’s why central banks stepped in on Sunday. Their coordinated action, the likes of which the world hasn’t seen since the European debt crisis a decade ago, represents the first indication that the banking crisis could have long-lasting and damaging effects to the global economy.

— CNN’s Matt Egan and Phil Mattingly contributed to this report

[ad_2]