[ad_1]

Pascal Broze | Onoky | Getty Images

To be sure, other changes may be on the table.

Sens. Angus King, I-Maine, and Bill Cassidy, R-La., are reportedly leading a bipartisan coalition to propose changes including raising the retirement age to 70. Their plan also reportedly calls for the creation of a sovereign wealth fund that could invest Social Security’s funds in stocks. If the returns on those funds fell short, that could trigger more wages to be subject to payroll taxes, as well as higher rates on those levies.

Spokesmen for the Cassidy and King declined to provide further details, noting the plan is not finalized.

Meanwhile, Senate Democrats led by Elizabeth Warren, D-Mass., and Bernie Sanders, I-Vt., last month reintroduced legislation that calls for reapplying the Social Security payroll tax on wages over $250,000. It would also require wealthy individuals to pay a 12.4% tax on business and investment income. The plan would also add $2,400 per year to benefits.

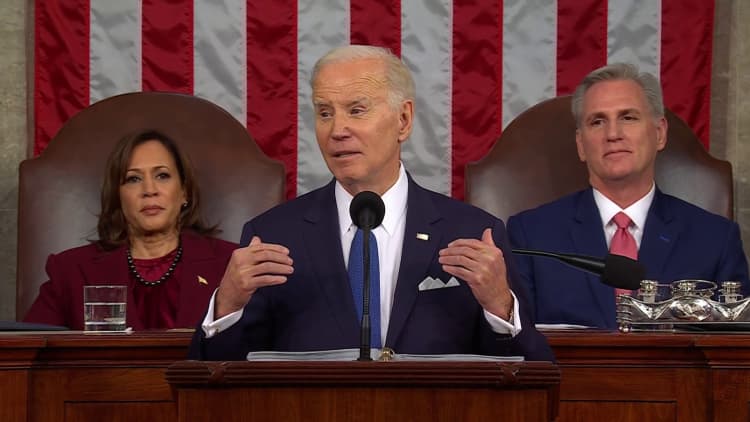

Discussion about how to shore up Social Security has increased since President Joe Biden’s State of the Union address, during which he prompted both sides of the aisle to promise not to cut the program.

“I will not cut a single Social Security or Medicare benefit,” the president vowed later that same week at an event in Florida.

Yet the clock is ticking to shore up the program.

A recent Congressional Budget Office report projected Social Security’s combined funds may run out in 2033, two years sooner than the Social Security actuaries estimated last year. Once those depletion dates are reached, that would mean benefit cuts of 23% or 20%, respectively.

Changes to prevent those cuts may have profound effects on Americans’ retirements and the U.S. wealth distribution.

Raising retirement age may be a 20% benefit cut

The Social Security full retirement age is gradually changing to 67, based on changes enacted in 1983.

Lawmakers are considering raising the full retirement age again to age 70.

“This absolutely is a benefit cut,” said Kathleen Romig, director of Social Security and disability policy at the Center on Budget and Policy Priorities.

The change would result in a 20% benefit cut across the board to lifetime benefits, she noted.

People who retire at 62, the earliest eligibility age, would see a 43% reduction from their full benefit, according to Romig. A $1,000 benefit, for example, would be reduced to $570.

“It would be hard for people to absorb that cut,” she said.

While delaying benefits could help increase a beneficiary’s monthly checks, many people are not able to do that.

In 2021, 3 in 10 Social Security beneficiaries claimed at age 62. Of those who claimed at that age, about a quarter had already stopped working, Romig noted.

The most common reasons for retiring early were job losses, health issues or caregiving responsibilities.

Current beneficiaries and near retirees would likely be spared from any retirement age changes. But younger generations may feel the pinch. The Republican Study Committee budget, put forward by House leaders, has called for raising the full retirement age to 70 for people born in 1978 or later.

Payroll tax changes could target wealth inequality

In 1983, 90% of earnings were subject to Social Security taxes, which was a record high following the reforms Congress put in place, according to the Economic Policy Institute. In 2021, 81.4% of all wages were subject to Social Security taxes, as income inequality has led more earnings of high wage workers to fall over the cap.

That drop has caused big revenue declines for Social Security.

Cumulative losses since 1983 mean the Social Security trust fund had 50% fewer reserves, or $1.4 trillion less, as of 2022, according to the Economic Policy Institute. Between 2019 and 2021, about $26 billion in revenue was lost.

“It’s pretty clear that we need to tax higher earners’ wages that are spilling over that Social Security cap,” said Elise Gould, senior economist at the Economic Policy Institute.

In 2023, $160,200 of earnings are subject to Social Security payroll taxes. The tax rate is 6.2% for both employees and employers, or 12.4% for workers who are self-employed.

Warren and Sanders are calling for reapplying the Social Security payroll tax to income over $250,000, while also taxing certain business and investment income at 12.4%.

At a minimum, lawmakers should consider lifting the earnings cap to a level that results in 90% of earnings being subject to Social Security taxes, the Economic Policy Institute recommends.

“If we were back to that 90%, that would significantly increase revenues,” Gould said.

Leaders face tough trade-offs as debt ceiling looms

As Democrats resist benefit cuts, and Republicans oppose higher taxes, finding a compromise to fix the program will not be easy.

It will be crucial to look at the effects of any reform package in its entirely, said Shai Akabas, director of economic policy at the Bipartisan Policy Center.

A higher retirement age may be accompanied by other changes like a robust minimum benefit, for example, that can protect people at the bottom of the income distribution, Akabas said.

Just raising payroll taxes — without any benefit cuts — could provide enough money to shore up the program.

But some experts question whether that would be responsible when other tax increases are needed to pay for the country’s needs.

“If we rely only on more revenue from high income people to fix this problem, we’re not going to be able to tap that endlessly for other priorities that we have as a country, like a massive federal debt,” Akabas said.

It’s “dangerous” to think about Social Security without looking at the entire budget, said Maya MacGuineas, president of the Committee for a Responsible Federal Budget.

“It’s very easy for people to pretend there’s [an] infinity [of] resources in our budget, and there are not,” she said.

[ad_2]