Finding the best rental investment property for sale is a crucial step in real estate investing. But many investors don’t know how to go about it.

Investing in rental properties remains a popular way to invest in real estate. Investors love them since they offer a consistent monthly income and price appreciation. They also serve as a hedge against inflation.

Table of Contents

However, investing in any rental property isn’t an assurance that you’ll generate handsome returns. Building a rental real estate portfolio requires energy, patience, time, and skill. Also, you must be willing to keep changing your strategy to adapt to evolving market conditions.

The first step is always refining how you find your rental property investments. Many investors, especially beginners, don’t know how to find a lucrative rental property with a good return on investment.

In today’s blog post, we will show you some tried and tested ways to find the best rental investment property for sale.

But before then, how do you actually spot a good rental investment property?

Characteristics of a Good Rental Property

Before you start your search for a lucrative rental investment property for sale, you need to know how to spot one. Here are some important characteristics you should watch out for:

1. Good Location

Location is one of the most vital pillars of a good rental property investment. It can make or break your investment.

It won’t matter whether you’re investing in a luxury high-end multifamily property or a single family unit for sale. If you don’t get the location right from the beginning, you won’t get the expected returns from your investment.

There are a few indicators that help identify a good location for rental property investment. They include a rising population, a low unemployment rate, and a growing economy.

Keep in mind that, in most cases, locations with all of the above indicators tend to be more expensive than other markets. However, it doesn’t mean that you should withhold your investment. It can signify that your property may appreciate at a higher rate and generate more returns.

Related: How to Choose the Best Location for Investment Property

2. Housing Demand

Housing demand is another factor intertwined with the location. A good investment location often sees a high demand for rental properties. You don’t want to invest in a property that will sit around vacant for a long time.

Here are some questions to ask yourself to determine an area’s demand for housing:

- At what rate is the population growing?

- Would the residents rather buy a home for sale or rent one?

- What type of properties do residents in that area prefer?

One way to do this is to find out the location’s price to rent ratio. An area with a high price to rent ratio indicates that renting is relatively more cost-efficient compared to buying a home.

3. Property Prices

Many real estate investors consider property prices as a factor before they invest in a rental property for sale. Property prices are a huge factor in determining your rate of return on investment. You want to invest in a property that’s reasonably priced.

The best way to ensure that the rental property is priced competitively is to check real estate comps. Real estate comps are other recently sold comparable properties that are as similar as possible to the property you’re interested in.

Gathering comps can be a challenge for many real estate investors. That’s why it’s important to use an online real estate platform that’s reliable and accurate. We’ll be looking at one in a while.

4. Current Property State

It’s natural for used properties to come with some flaws. In most cases, you’re going to need to make some repairs. However, it’s important to ensure that the repairs are minimal and do not cost a lot.

Spending a lot of money on repairs will eat into your profits. If you don’t know how to check the extent of damages, get a property inspection and involve a professional.

Ensure that you set aside a good budget for repairs, just in case.

5. Positive Cash Flow

Cash flow is one of the vital reasons why people invest in rental properties. It is the money left once you’ve settled all rental expenses.

Positive cash flow means that you’re left with a good profit. Negative cash flow means that you’ll need to settle for some expenses from your pocket. The goal is to invest in a property where the rental income is considerably higher than the expenses.

But how do you spot a rental property with positive cash flow? Stick around for that.

Related: How Do You Achieve a Positive Cash Flow in Real Estate?

How to Find the Best Rental Investment Property for Sale

Now that you know what to look out for, let’s look at how to find a profitable Maryland rental investment property for sale. It’s important to note that the best method will vary from person to person, depending on your situation and budget.

That said, let’s dive right in:

1. Online Real Estate Platforms

The automation of most of our daily tasks has made our lives easier. It’s now easier to find potential investment properties for sale online.

Most real estate investors use the MLS database to access rental property listings online. However, the MLS database is limited to licensed realtors. It means that you must work with a real estate agent to find such listings.

Fortunately, there are many other property listing platforms online, some that pull their listings from the MLS. These platforms give you access to thousands of listings for sale. Choose the website carefully since they have different subscription costs.

These listing sites allow you to access potential rental property investments without leaving the comfort of your house. They also provide you with a wide array of listings to choose from. It’s easy to find different property types with different features going for different prices.

Be careful which site you choose to use since not all are reliable. Some include outdated listings, while others display inaccurate details.

What’s the Best Online Real Estate Platform?

The best online real estate platform is one that gives you access to listings on the MLS, as well as those from other sources. You also want a platform that will also equip you with the necessary tools and analytics to help you decide whether an investment makes financial sense.

This is where Mashvisor comes in. Mashvisor is a one-stop shop for any real estate investor who desires to make smart business and financial decisions.

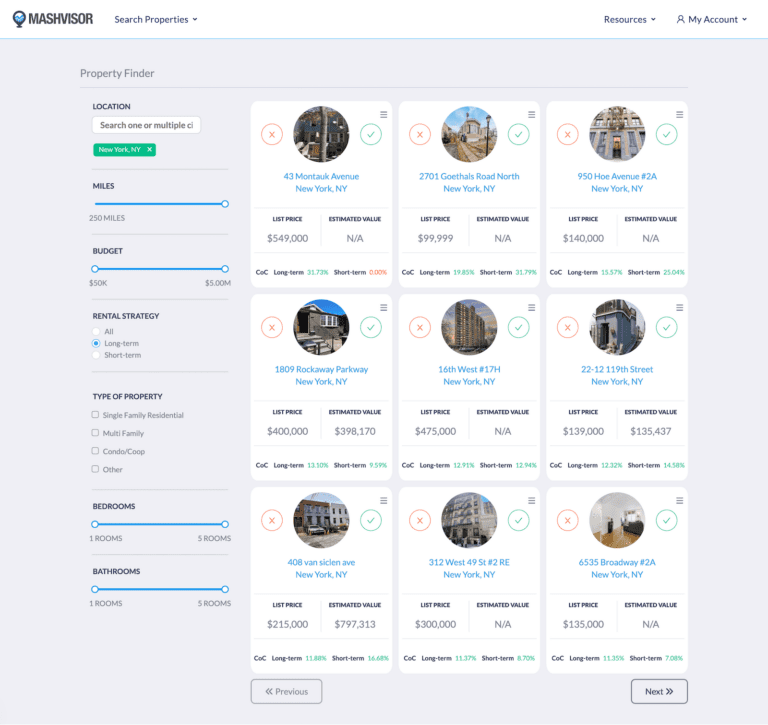

Our Property Finder will help you search for top-performing rental properties in your city and neighborhood of choice. You can set up your search criteria on the tool using the following metrics:

- Budget

- Location

- Rental strategy

- Property type

- Number of bedrooms and bathrooms

Mashvisor’s Property Finder

After finding a potential rental investment property for sale, you can use the investment property calculator to conduct an in-depth rental property analysis. The tool helps you to see whether a property makes financial sense by providing you with estimated property metrics, such as:

- Startup costs

- Recurring costs

- Rental income

- Cash flow

- Cash on cash return

- Cap rate

The best thing about Mashvisor is that it provides you with metrics for both long term and short term rental strategies. It helps you choose the most profitable rental strategy for your investment goals.

Sign up on Mashvisor today and start your 7-day free trial.

2. Leverage Your Network

Word of mouth is one of the best methods any real estate investor and professional can use. Many people planning to sell their homes first notify their family and friends before listing the properties publicly. You can leverage your circle of family and friends to be the first to know.

Simply talk to everyone in your circle. Let your family, friends, neighbors, and colleagues know that you’re looking to invest in a rental property. Be sure about what features you’re looking for so that they can help you find exactly that.

If the word spreads wide enough, chances are that somebody might know somebody who knows somebody who’s selling the exact rental property you’re looking for. Sometimes, you might even find that someone in your circle is selling but has not listed on the market yet.

Once you’ve spread the word, make sure to follow up with your circle from time to time. You want them to know that you’re serious about investing. You can even offer a small incentive for the person who helps you find a good deal.

Using word of mouth is relatively easy. You may also come across good deals since the properties are not yet listed publicly.

On the other hand, this method may not work if you’re looking to buy urgently or if you have a small network.

3. Look Up Ads

The traditional ways of finding investment properties are still useful. Pursue through newspapers and magazines looking for “Properties for Sale” ads.

The newspaper listings are usually categorized as houses, apartments, or condos. These properties are also listed as for sale by owner or by an agent. They also include details to help you reach out to the contact person.

The best thing about such ads is that they face less competition. With the digitization of everything, only about 25% of potential property buyers will look at newspaper listings. There’s also a possibility of buying directly from the property owners.

The potential downsides of this method are that only a few sellers still list in newspapers, and it might also take time.

4. Driving for Dollars

Driving for dollars is a term used to refer to driving around neighborhoods looking for potential off-market deals. It may not be the most efficient method since you’re trying your luck with unlisted properties, but it can certainly help you strike gold.

Besides, you might find some homes with a “For Sale” sign in the front yard. It would be more efficient since you’re sure the property owner is looking to sell.

Remember that the driving for dollars strategy doesn’t assure you of finding a rental property for sale. You may also need to do it several times, which might cost you a lot of fuel.

5. Work With a Real Estate Agent

Hiring a real estate agent is another great way to find find the best rental investment property for sale. Real estate agents help investors, especially beginners, save time, money, and disappointment.

If you don’t know where to start, real estate agents help you get started on the right footing. They often possess an in-depth knowledge of the local real estate market. They know hot neighborhoods and property types that have high rental demand.

Remember, since they’re licensed, they also enjoy access to the MLS database. If you work with one, they’ll give you access to local listings on the MLS. It can work for you in a big way since MLS contains listings that you might not find in newspaper ads.

Agents will also use their skills to help you find the best Illinois rental investment property for sale within your budget and negotiate better prices. Since they’re well connected in the local market, they’ll also help you access off-market real estate deals.

The only flipside to such a strategy is that you’ll need to spend more money since they charge a certain fee based on the deal’s value.

Don’t just work with a random agent. Know what you want from them and interview them to see whether they’re a good match. Build a rapport to ensure they prioritize your needs.

Again, you want to ensure they’re experienced in your local market.

Related: Should Investors Work With Real Estate Agents Near Me?

Final Thoughts

Putting your money in the best rental investment property for sale has always been one of the best ways to invest in real estate. While many beginners may be hesitant to take the first step, finding a profitable rental property isn’t that complicated.

First, you need to know what to look for in a lucrative rental property for sale. The property must be in a good location. A good location is one with a good economy, significant housing demand, and a good population growth rate.

Once you’ve spotted a good location, you can now begin your search for a lucrative rental property. Some strategies to identify one include talking to your network, driving around neighborhoods, looking up newspaper ads, and hiring a real estate agent.

You’re also going to need a good online real estate platform. One that will not only help you access property listings in your desired location but also help you analyze the property to determine its profit potential. The best tool for this is Mashvisor.

Book your demo today and see how our tools will hold your hand.