Traders work on the floor of the New York Stock Exchange (NYSE) during morning trading on February 01, 2023 in New York City.

Michael M. Santiago | Getty Images

Here are the most important news items that investors need to start their trading day:

1. Stumbling toward the weekend

Stocks are on track for a losing week as we head into Friday’s session. Thursday was an especially weak showing for the bulls as all three major indices fell, led by a 1% decline in the tech-heavy Nasdaq. For the week, the Nasdaq heading toward a 1.8% loss, while the S&P 500 is also down more than 1%. Lackluster earnings continue to pop up. Lyft, for instance, tanked more than 30% in off-hours trading. Investors will hear more about the Federal Reserve’s strategy later Friday, when Fed Governor Christopher Waller and Philadelphia Fed President Patrick Harker speak during the afternoon. Read live markets updates.

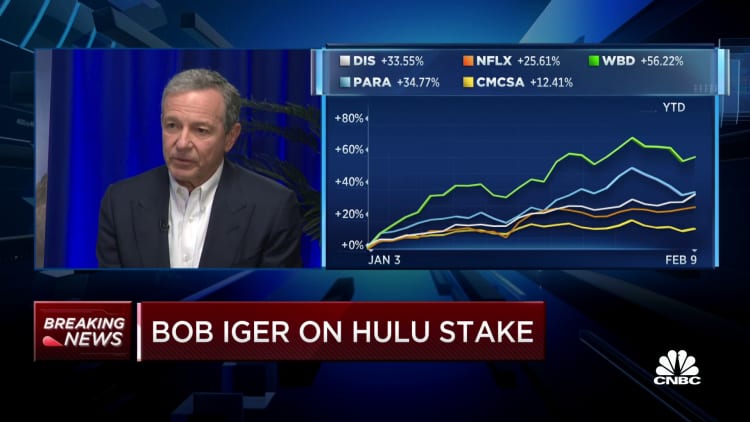

2. Disney’s Hulu dilemma

Bob Iger just kept making news this week. After unveiled a broad restructuring of Disney, including billions of dollars in cost cuts and 7,000 layoffs, the CEO spelled out his vision in an exclusive interview with CNBC’s David Faber. While Disney’s shares slid more than 1% Thursday during a broader market selloff, Iger’s message resonated on Wall Street. Activist investor Nelson Peltz even called in to CNBC after the Faber-Iger interview to say he was dropping his proxy fight against Disney. But the most eyebrow-raising part of the interview had to be when Iger, who wants to focus less on general entertainment, signalled he was open to potentially selling the rest of Disney’s stake in popular streaming service Hulu. Disney owns two thirds of it, and Comcast owns the other third. It’s been long expected that Disney would buy the rest of it in 2024, but Iger’s comments marked a huge shift in strategy, as CNBC’s Alex Sherman and Lillian Rizzo report.

3. Russia to cut oil output

Russia announced that it would cut oil production by 500,000 barrels per day in March after the West slapped price caps on Russian oil and oil products.

Picture Alliance | Picture Alliance | Getty Images

Russia will reduce its oil output by 500,000 barrels per day in March, according to a top government official. The move follows Western nations’ bans on Russia’s oil and oil products as Vladimir Putin’s forces continue their invasion of Ukraine. The production cut amounts to about 5% of Russia’s most recent crude oil output. Oil prices jumped on the news. Meanwhile, Russia has continued its aerial onslaught on Ukraine, while Moldova said a Russian missile violated its airspace. Read live war updates.

4. Adidas’ Yeezy hangover

“The numbers speak for themselves. We are currently not performing the way we should”, Adidas CEO Bjørn Gulden said in a press release.

Jeremy Moeller / Contributor / Getty Images

The ghost of Ye continues to haunt Adidas. The company said it could lose about $1.3 billion in revenue this year if it can’t sell the rest of its stock of Yeezy products. The German company terminated its partnership with the rapper and fashion designer formerly known as Kanye West in October, after he made several racist and antisemitic comments. Adidas said that it’s still trying to figure out what to do with all Yeezy product, saying it has already experienced a “significant adverse impact” for not selling it off. The company could write it off, as well. Shares of Adidas fell more than 10%.

5. PayPal CEO checks out

Dan Schulman, president and chief executive officer of PayPal Holdings Inc., arrives for the morning session of the Allen & Co. Media and Technology Conference in Sun Valley, Idaho, U.S., on Wednesday, July 10, 2019. The 36th annual event gathers many of America’s wealthiest and most powerful people in media, technology, and sports.

Patrick T. Fallon | Bloomberg | Getty Images

PayPal CEO Dan Schulman will retire from the company at the end of this year. He became the company’s head honcho after it split from eBay in 2015. He’ll stick around on the board of directors after he leaves the CEO role. The board, meanwhile, is hiring a search firm to find his successor. The announcement comes weeks after the company announced it would lay off about 7% of its workforce, or about 2,000 employees. activist investor Elliott Management accumulated an undisclosed stake in PayPal. Activist investor Elliott Manaagement had acquired a stake in PayPal last summer, but Schulman told CNBC’s Kate Rooney that he hadn’t been pressured by the firm to step down.

– CNBC’s Hakyung Kim, Alex Sherman, Lillian Rizzo, Ruxandra Iordache, Karen Gilchrist, Hannah Ward-Glenton and Jonathan Vanian contributed to this report.

— Follow broader market action like a pro on CNBC Pro.