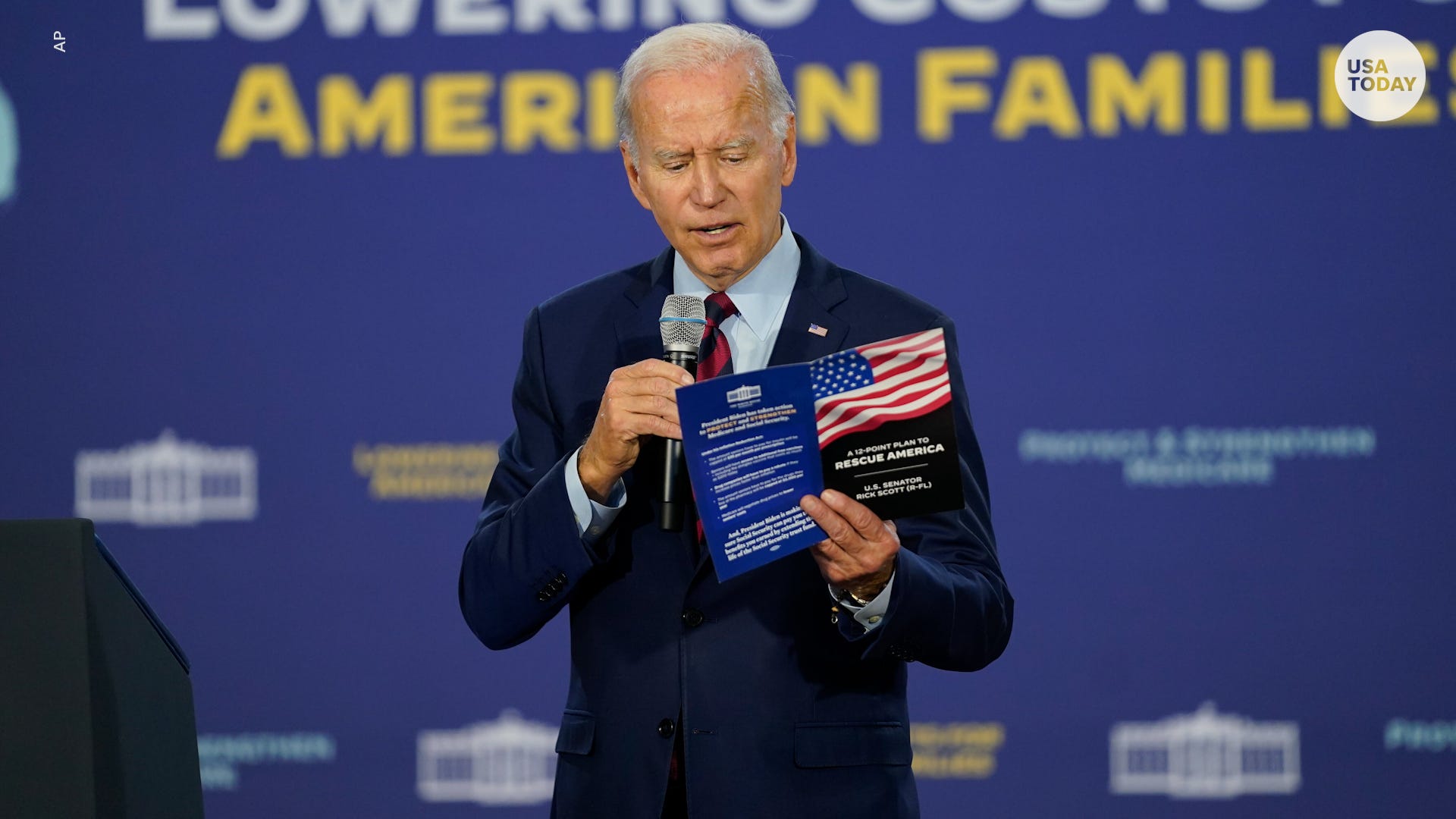

Biden discusses Social Security, Medicare protection in Florida

President Joe Biden spoke in Florida, emphasizing how the midterms could impact the future of prescription prices, Social Security and Medicare.

Ariana Triggs, USA TODAY

With pharmaceutical companies hiking prices on nearly 1,000 drugs in January, some consumers might experience sticker shock next time they pick up prescriptions.

The price increases come as a new federal law requires companies to pay Medicare a rebate if they increase prices above the rate of inflation. Other Inflation Reduction Act provisions — such as capping Medicare recipients’ out-of-pocket expenses at $2,000 and allowing Medicare to negotiate the costliest drugs — haven’t kicked in yet.

Major drug companies such as AbbVie, Pfizer and Bristol-Myers Squibb have raised prices so far this month, according to data provided by 46brooklyn Research, a nonprofit that researches drug pricing. The amount consumers pay depends on their insurance coverage and complex rebates often hidden from public view.

Drug affordability remains a top worry for consumers. About 3 in 10 people don’t take a drug as prescribed over concerns about cost – some don’t fill prescriptions, others skipped doses or sought cheaper over-the-counter medication, according to a Kaiser Family Foundation poll last year.

Analysts say it’s too early to tell whether this month’s batch of price hikes were influenced by the federal law. But experts say drugmakers likely will launch new drugs with more expensive prices and seek to maximize sales before Medicare can bargain for more affordable prices.

“Raising prices each year will become more difficult,” said Dr. Benjamin Rome, a Harvard Medical School professor of medicine. “You’re going to see changes in pricing behavior over the lifecycle of medicines based on the Inflation Reduction Act.”

How much are companies hiking prices?

Drug companies often roll out price increases in January for existing drugs, but the amount of the price hikes vary from year to year.

The data from 46brooklyn tracks list prices for drugs but does not include rebates and discounts to insurance companies or pharmacy benefit managers. Such rebates are becoming more expensive each year and don’t always result in cheaper prices for consumers. .

Through the first three weeks of January, drugmakers raised prices on 985 products.

It’s the most January hikes sought by manufacturers since at least 2011, according to 46brooklyn, which found:

- The median price increase so far this year is 5%.

- This increase is slightly higher than last year’s 4.9% but lower than when rates spiked 9% in 2015 and 2016.

- Prices on more than two dozen drugs swelled 10% or more, but the vast majority had smaller increases, and prices on more than two dozen drugs increased 1% or less.

- GE Healthcare imposed the largest price increase, 26% for Omnipaque, a drug people take before undergoing imaging tests such as CT scans.

How does the Inflation Reduction Act influence prices?

Drugmakers that increase prices above inflation levels must pay rebates to Medicare. This law applies this year to prices on retail and physician-administered drugs.

While inflation is retreating from the four decade highs reached last summer, it’s still far above the miniscule rates before the COVID-19 pandemic. So some drug companies might see an opportunity to raise the price of retail drugs to the rate of inflation.

“Inflation has been running higher than recent historical trends,” said Ryan Urgo, managing director of health policy at Avalere, a health care consulting company. “This may certainly create opportunities for manufacturers to raise list prices higher in percentage terms than in the past, given that this could be done without triggering a rebate penalty.”

Health care costs are about to skyrocket. Analysts explain inflation’s drastic impact.

Expect higher launch prices for new drugs

Medicare will seek to rein the costs of the most expensive drugs by directly negotiating with manufacturers. By Sept. 1, the federal health program will select the first 10 drugs to negotiate maximum prices that will take effect in 2026.

The federal health program will negotiate more retail “Part D” drugs and physician-administered “Part B” drugs, but drugmakers will get several years of pricing autonomy before drugs are subject to negotiation. Part D drugs are eligible only after they have been on the market for nine years. Physician-administered drugs will have 13 years before being subject to negotiation.

The federal law does not limit the amount manufacturers charge once they begin selling new drugs after gaining Food and Drug Administration approval.

One study found the typical launch prices for new drugs increased 20% each year over the past decade and a half, contributing to total U.S. spending on prescription drugs of over $500 billion in 2020.

Nearly half of new drugs cost $150 000 per year in 2020 and 2021. Fewer than 10% of new drugs launched at that price in 2008, according to a study last year co-authored by Harvard’s Rome.

Because Medicare will limit annual price increases to the rate of inflation, Rome said some manufacturers might “start at a higher price to give themselves a breathing room.”

Controversial Alzheimer’s drug, explained: What to know about Aduhelm

Prices increase on blockbuster drugs Humira, Eliquis and Stelara

Drugmakers with widely-prescribed medicines that have been on the market for years are raising prices despite looming competition.

Manufacturer AbbVie will raise the price of its blockbuster anti-inflammatory drug Humira by 8%. The world’s top-selling drug generated more than $20 billion in sales last year, but generic biosimilar competitors are set to launch later this year.

Other top-selling drugs that will see price increases:

- Eliquis, a blood thinner from Bristol Myers Squibb and Pfizer, will rise 6%.

- Imbruvica, a cancer drug, is up 6.2%.

- Stelara, used to treat plaque psoriasis, psoriatic arthritis and Crohn’s disease, is up 4%.

Some of the steepest prices hikes are reserved for hospital drugs, not medicines consumers pick up at pharmacies.

Pfizer will raise prices by 10% on more than a dozen sterile injectable drugs used in hospitals. Many of the drugs are inexpensive with the price increases amounting to $1 or less. The drug giant said it is spending $2 billion to upgrade manufacturing to ensure high-quality, reliable supply.

“Sterile injectables are vital to patient care and often lifesaving, Although low priced, they are among the most difficult and costly medicines to produce. It is critical to have a sustainable pricing structure to fund the ongoing advancements in technology required to manufacture these important products,” Pfizer said in a statement.

‘Profiting at the expense of patients’: Insurers, middlemen take concessions

Analysts say drug companies also must factor in the growing power of middlemen called pharmacy benefit managers. These organizations influence whether a drug gets on an insurance plan’s formulary. In exchange, these middlemen demand concessions from drug companies in the form of rebates or drug discounts.

“We love to think that drugmakers sit there and say, ‘Hey I can just charge a million bucks get away with it,’ – and sometimes they can,” said Antonio Ciaccia, CEO of 46brooklyn.

But Ciaccia said some drug companies hike prices so they can pay rebates to pharmacy benefit managers. They also charge higher prices to offset discounted drug programs such as Medicaid, the government program for low-income families.

“A lot of things go in the sauce when they’re trying to create the price,” Ciaccia said.

Officials with the drug industry organization, the Pharmaceutical Research and Manufacturers of America, said too often insurance companies and pharmacy benefit managers don’t pass rebates and discounts to consumers

“More than half of what’s spent on medicines goes to entities that don’t make the medicines, said Priscilla VanderVeer, a PhRMA spokeswoman. “These entities, including insurance companies and middlemen like PBMs, are profiting at the expense of patients. Unless we fix what’s broken, patients will be the ones losing out.”

Dig deeper

Ken Alltucker is on Twitter at @kalltucker, or can be emailed at alltuck@usatoday.com.