[ad_1]

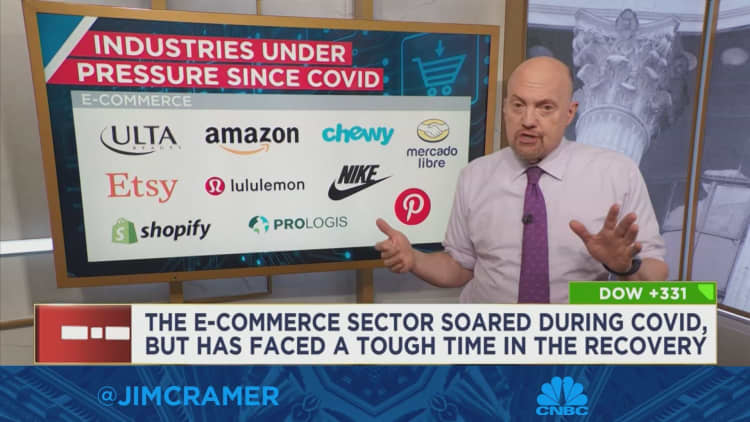

CNBC’s Jim Cramer on Friday offered investors a list of e-commerce plays he believes are worth buying, despite the group’s rough performance in 2022.

“There are still some e-commerce plays that I’m willing to get behind here, the ones that have truly prioritized profitability,” he said.

Here is his list:

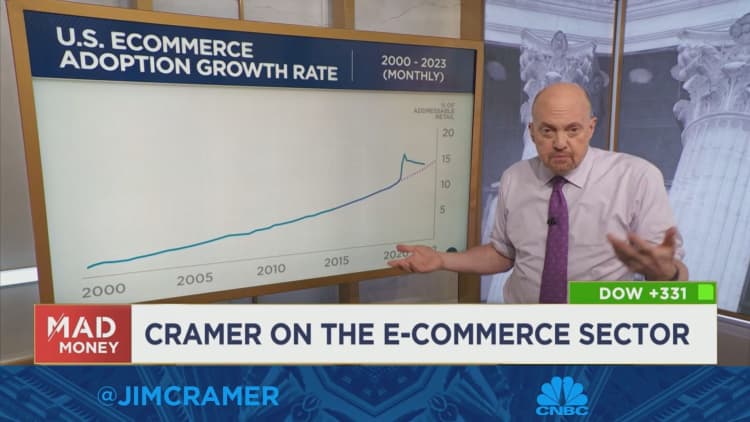

E-commerce stocks skyrocketed during the height of the Covid pandemic, as at-home consumers made purchases online rather than in-store. But when the economy reopened, consumers prioritized spending on travel and experiences over goods.

That shift, along with the Federal Reserve’s interest rate hikes, sent e-commerce stocks tumbling from their highs last year.

Cramer cautioned that while he believes the group’s struggles are temporary, it’s still too early to buy many of the names in the e-commerce space — including Amazon.

He said that one of his biggest concerns with the company is that it needs to cut more costs. Amazon said earlier this month that it plans to lay off over 18,000 employees.

While that might seem like a sizable cut, “this is a company with well over a million employees — to them, this is a drop in the bucket,” Cramer said.

But Amazon’s stock will eventually bottom, he said. “I think the business can eventually make a big comeback and there will come a point where the stock’s a screaming buy.”

Disclaimer: Cramer’s Charitable Trust owns shares of Amazon.

[ad_2]