The Denver real estate market is one of the hottest housing markets in Colorado. What is the forecast for real estate investors in 2023?

Year after year, many real estate investors always look at the Denver real estate market as a potential investment market. With the staggering real estate property prices, rising interest rates, and low housing supply, many investors are wondering what’s in store in the 2023 market.

Table of Contents

- Denver Real Estate Market 2022 Trends

- Denver Real Estate Market 2023 Forecast

- 5 Reasons to Invest in the Denver Real Estate Market in 2023

- 3 Best Neighborhoods in the Denver Real Estate Market for Long Term Rental Investment

- 3 Best Neighborhoods in the Denver Real Estate Market for Short Term Rental Investment

What story does the forecast tell? Are we going to experience low buyer demand? Or, will the home prices increase despite the high interest rates?

We dug through tons of market data and analytics and compiled the following Denver real estate market analysis and 2023 forecast. Read on to find out more.

Denver Real Estate Market 2022 Trends

According to the Denver Metro Association of Realtors Market Trends Committee October 2022 statistics, the average and median property closing prices for September 2022 were the highest for the said month.

The average closing price for a residential property was $671,024, $745,947 for a detached property, and $486,773 for attached units. The median closing price for the same real estate properties was $580,000 for residential properties, $632,000 for detached properties, and $410,000 for attached units.

In September 2021, the average closing price for residential real estate homes in Denver was $618,977. It means that over 12 months, the figure went up by $52,047, representing a year-over-year increase of 8.4%.

The data was gathered from 11 counties in the Denver metro area. The counties include Arapahoe, Adams, Broomfield, Boulder, Denver, Clear Creek, Elbert, Douglas, Jefferson, Gilpin, and Park counties.

From the above trends, what can we forecast for the Denver housing market in 2023?

Related: 3 Interesting Real Estate Market Trends to Expect in 2023

Denver Real Estate Market 2023 Forecast

While property prices in Denver were at all-time highs in 2022, the prices are now starting to become more affordable for buyers. After spending a considerable amount of time as a seller’s market, buyers can expect the market’s characteristics to change.

So, is the Denver real estate market cooling? Is there a bubble waiting to burst?

We forecast that the Denver real estate market is cooling to become a neutral market.

According to Denverite, after about 16 years of being a seller’s real estate market, the market is cooling and beginning to balance out. Also, the typical real estate cycle in the Denver real estate market lasts about seven years. However, it is due to a change in 2023.

Real estate prices may decline as the number of listings increases past 2021 levels to boost the housing supply.

Real estate properties that will be most affected are those in the luxury and premier categories selling for more than $500,000. The said properties are likely to spend more time in the real estate market or see significant price reductions.

On the other hand, properties that are competitively priced and listed below $500,000 will see stable home valuations with minimal or no price reductions.

From the above forecast, should you go ahead and invest in the Denver housing market?

Is 2023 a Good Time to Invest in the Denver Real Estate Market?

According to the forecast, Denver is cooling to become a favorable housing market for real estate investors. It is the first time prices are starting to dip in more than a decade.

However, Denver real estate prices are still high compared to the national average. They’re also expensive from a historical outlook. Fortunately, there are many homebuyer programs in Colorado for first-time real estate buyers. The programs are willing to give you loans and grants to purchase your property.

It isn’t to discourage you from buying real estate properties in Denver. 2023 is a perfect time to invest in the Denver real estate market. There are many reasons to justify that.

5 Reasons to Invest in the Denver Real Estate Market in 2023

We just looked at the Denver housing market trends, forecasts, and predictions. Now that the market is cooling, why should you go ahead and invest in the said city or metro area?

Here are some reasons why you should take investing in the Denver real estate market in 2023 seriously:

1. Rent Prices Are Rising

Urban areas with a high population are experiencing weaker rental prices and declining average rents. On the other hand, suburban areas are seeing small increases in real estate rental rates. It is mainly because working people prefer to live in less dense areas that are less expensive.

The rent prices in Denver are up by 0.8% over the past month. It is a sharp increase of 8.8% compared to the same period in the previous year.

In December, the average rents for a one-bedroom and a two-bedroom real estate apartment were $1,443 and $1,785, respectively. It was the sixth straight month that the prices rose after a slight decline in January 2022.

Interestingly, the year-over-year rate of increase in rental prices in Denver lags behind the state’s average of 10% and the national average of 12.3%.

The encouraging thing about 2023 predictions is the continuing increase in real estate rental prices not only in Denver city but in the entire metro area.

2. Denver Is Landlord-Friendly

Compared to the West, the state of Colorado is relatively landlord-friendly. Denver is a dream market for landlords. And it is due to a number of reasons.

For starters, you don’t need to formally notify your tenants when you want to access the real estate property. Existing laws allow you to promptly begin the eviction process if your tenants fail to rent on time. It protects your investment in the city.

There are no laws that prevent you from rekeying your real estate property’s locks once you’ve evicted tenants. If they’ve violated the lease agreement, give them a formal notice. It gives them a 72-hour period to correct the issue or move out.

If the tenant doesn’t take care of the issue or moves out, you can move to court. Once the case is ruled in your favor, the sheriff gives the tenant a 48-hour period to move out or force them out.

Related: Can a Landlord be Held Liable for Nuisance Tenants?

3. Limited Housing Supply

Denver is home to huge national forests and large mountainous areas. New real estate developments are limited since the housing market can’t expand to uninhabitable areas. It keeps rent prices high compared to other cities like Dallas due to demand.

The median real estate prices for residential properties in Denver hovers around $530,000. While it is a substantial bargain for the large number of investors coming in from places like California, it prices out locals from the real estate market.

The median monthly rent for all properties is $1,100. At such a price, many renters could get a more spacious single family home or condo elsewhere. If you own a three-bedroom detached single family home, you could charge over $2,000 in monthly rent.

The predictions show you that you’ll receive good ROI numbers in the Denver real estate market in 2023.

4. Quality of Life

Cities in Colorado recently appeared in the list of “150 Best Places to Live in the US.” Denver was ranked the second-best city in Colorado.

Denver’s real estate market was a little lower when ranked on value. However, it ranked high on quality of life, employment, and desirability.

The high quality of life in Denver can be attributed to the following factors:

- It is one mile high above sea level

- Located near the mountains

- Home to the largest city park system in the country, with over 14,000 acres of mountain parks and 2,500 acres of natural areas

While the above factors may not be enough to bring large numbers of people into the Denver real estate market in 2023, it does play a part. Denver is now the 19th most populous city in the US.

The high quality of life means that rental occupancy rates are high. It is a perfect forecast that you should invest in real estate in Denver in 2023.

5. Strong Economy and Job Growth

Job growth is a direct factor that determines the state of the real estate market. Many professionals move into certain areas to look for opportunities if there’s job growth. It drives up the demand for all types of real estate since the workforce needs a place to stay.

The availability of jobs is one of the top factors why people are moving to Denver in 2023. The unemployment rate in Denver has stayed below the national average for many years.

In 2015, Forbes ranked Denver as the best place for business and careers. In addition, the city ranked 16th for employment growth and 20th for education.

With the massive oil and government sectors and expanding aerospace and technology industries, you can expect the Denver real estate market to continue experiencing such a huge boom in 2023.

Due to all of the above factors, Denver has been one of the fastest-growing cities in the US. A strong economy greatly impacts the condition of the real estate market. Real estate investments give you a great opportunity to participate in the strong growth of Denver’s economy.

Related: 40 Best Places for Buying Investment Property in 2023

3 Best Neighborhoods in the Denver Real Estate Market for Long Term Rental Investment

After the market forecast and predictions, you’re probably thinking of investing in long term rentals in the Denver real estate market. What are the best neighborhoods for long term rentals in this city in 2023?

Here’s our list of the best neighborhoods for long term rental investment in the Denver real estate metro area. The statistics are based on Mashvisor’s December 2022 location report.

1. College View-South Platte

- Median Property Price: $506,514

- Average Price per Square Foot: $319

- Days on Market: 131

- Monthly Long Term Rental Income: $2,409

- Long Term Rental Cash on Cash Return: 4.34%

- Long Term Rental Cap Rate: 4.40%

- Price to Rent Ratio: 18

- Walk Score: 45

2. Globeville

- Median Property Price: $560,000

- Average Price per Square Foot: $337

- Days on Market: 22

- Monthly Long Term Rental Income: $2,601

- Long Term Rental Cash on Cash Return: 3.45%

- Long Term Rental Cap Rate: 3.48%

- Price to Rent Ratio: 18

- Walk Score: 61

3. Union Station

- Median Property Price: $663,733

- Average Price per Square Foot: $351

- Days on Market: 34

- Monthly Long Term Rental Income: $2,840

- Long Term Rental Cash on Cash Return: 2.54%

- Long Term Rental Cap Rate: 2.56%

- Price to Rent Ratio: 19

- Walk Score: 93

As you can see, long term rentals in the Denver real estate market give you a good return on investment.

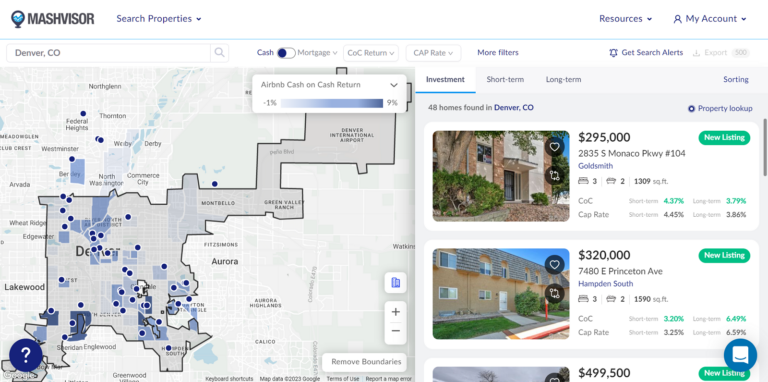

Start searching for lucrative long term rentals in Denver in 2023 by using a reliable platform such as Mashvisor.

You can use Mashvisor to search for profitable long term and short term properties in Denver, CO.

3 Best Neighborhoods in the Denver Real Estate Market for Short Term Rental Investment

If you want to invest in short term rentals in the Denver real estate market in 2023, here’s a list of neighborhoods we forecast are suitable for short term rentals. The following statistics are based on Mashvisor’s real estate market report from December 25, 2022.

1. College View-South Platte

- Median Property Price: $506,514

- Average Price per Square Foot: $319

- Days on Market: 131

- Number of Short Term Rental Listings: 137

- Monthly Short Term Rental Income: $2,985

- Short Term Rental Cash on Cash Return: 3.65%

- Short Term Rental Cap Rate: 3.69%

- Short Term Rental Daily Rate: $147

- Short Term Rental Occupancy Rate: 60%

- Walk Score: 45

2. Westwood

- Median Property Price: $397,944

- Average Price per Square Foot: $452

- Days on Market: 66

- Number of Short Term Rental Listings: 162

- Monthly Short Term Rental Income: $2,550

- Short Term Rental Cash on Cash Return: 3.49%

- Short Term Rental Cap Rate: 3.54%

- Short Term Rental Daily Rate: $157

- Short Term Rental Occupancy Rate: 55

- Walk Score: 45

3. Globeville

- Median Property Price: $560,000

- Average Price per Square Foot: $337

- Days on Market: 22

- Number of Short Term Rental Listings: 429

- Monthly Short Term Rental Income: $2,698

- Short Term Rental Cash on Cash Return: 2.42%

- Short Term Rental Cap Rate: 2.44%

- Short Term Rental Daily Rate: $183

- Short Term Rental Occupancy Rate: 59%

- Walk Score: 61

Begin your search for profitable short term rentals in Denver in 2023 today.

Is Denver a Good Place to Invest?

Real estate forecasts and statistics show that investing in the Denver real estate market in 2023 is going to be a wise decision. For a long time, it has been considered a seller’s market, where all factors favored the property sellers.

Forecasts and predictions show that we’re now beginning to see a shift. Housing prices will go down as more properties are listed on the real estate market to meet the demand.

The Denver real estate market should be on your radar since rent prices are going to rise. You can find limited housing supply, meaning that the demand for housing will drive rental rates up. Denver’s laws are also relatively landlord-friendly.

Should you make up your mind to invest in the Denver real estate market in 2023, make sure you carry out your own in-depth research. The best way to conduct a comprehensive real estate market analysis is by using Mashvisor.

Schedule a demo today to see how Mashvisor’s tools can help you in 2023.