[ad_1]

CNBC’s Jim Cramer told investors not to discard their traditional, steady stocks after Tuesday’s trading session.

“It is so easy to panic out of stocks on the first sign of weakness,” he said, adding, “I’m urging the opposite.”

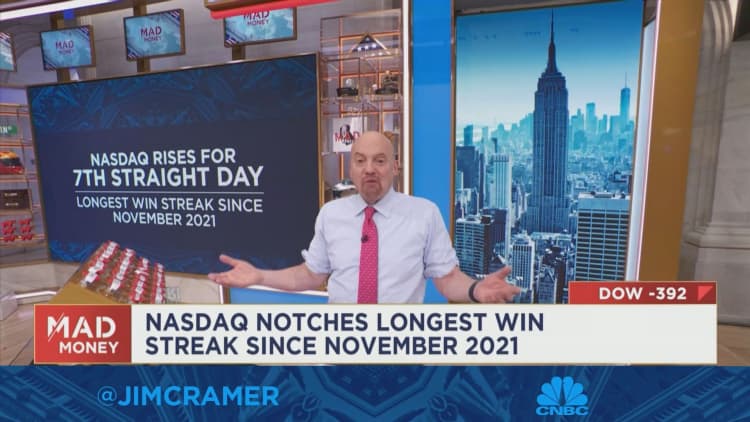

The Dow Jones Industrial Average and S&P 500 fell on Tuesday on the back of weaker-than-expected bank earnings, which ended a four-day winning streak. The Nasdaq Composite was the only major index to end up on the day.

So far, the tech-heavy Nasdaq is leading the way year to date at 6.01%, with gains driven by Wall Street’s hopes that signs of softening inflation means a better year is in store for growth stocks.

Cramer reiterated his stance that investors shouldn’t rush into tech stocks, warning that most companies haven’t taken the cost-reduction steps necessary for their stocks’ recent runs to be sustainable.

He added that Tuesday’s losses represent a buying opportunity for another group of stocks.

“I remain more partial to those traditional cyclical stocks. You’re getting a chance to buy them ahead of what I believe will be better earnings comparisons than you’re going to see from tech,” he said.

[ad_2]