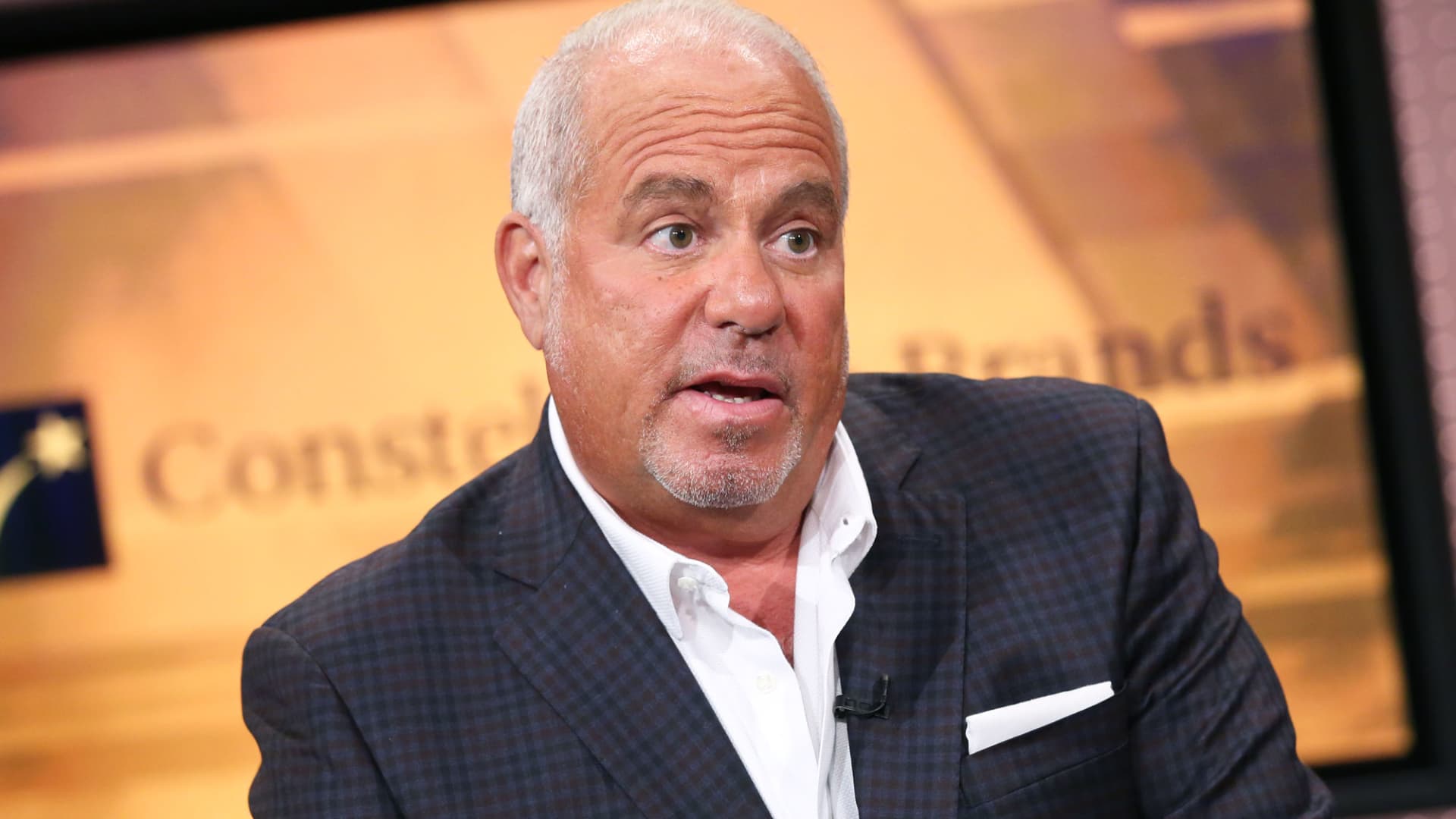

Morgan Stanley named a slew of stocks recently that analysts believe are significantly undervalued in the new year. The firm said investors should buy these companies now as the risk-reward has never been better. CNBC Pro combed through Morgan Stanley’s research to find the most well-positioned stocks to buy in 2023. They include Dick’s Sporting Goods, Verizon , Alibaba, Constellation Brands and Sealed Air. Dick’s Sporting Goods It’s been an “Olympic transformation” for the sporting goods retailer, according to analyst Simeon Gutman. The firm said earlier this week that Dick’s Sporting Goods is one of the “rare” retailers that have had success changing its sales/margin profiles. “Retail transformation stories tend to lead to outsized stock returns,” he said. But Gutman is worried that investors are not yet convinced, acknowledging that the company has a history of “uneven sales growth.” Still, the firm said investors should buy the stock. Dick’s Sporting Goods made pre-pandemic structural changes that leaves the company with a “faster-growing & more profitable business,” Gutman added. Meanwhile, he said the retailer’s customers have gotten wealthier and the sporting goods category has room for growth. “If DKS retains the majority of its COVID-driven sales and margin gains, the stock screens with among the best risk/rewards in Retail,” he wrote. Shares of the company are up 6.9% this month. Constellation Brands Analyst Dara Mohsenian is standing by shares of the beer and beverage giant — and investors should, too, the firm said recently. Shares are down almost 9% over the past 12 months, but Mohsenian said the fear is largely overdone. “To be very clear up front, we do think macros are having a negative and durable impact on STZ’s beer depletion growth, and expect depletion growth more in the ~6% range forward, vs our ~6-7% prior modeled forecast,” he said. But that makes for a very “compelling risk/reward,” according to the firm. Mohsenian said there are many beneficial catalysts ahead, including positive distributor feedback and long-term share gains. Further, in the company’s fiscal third quarter, beer revenue growth came in ahead of consensus. Morgan Stanley added that the market was unfairly calling Constellation a “a broken growth story.” It’s all the more reason to take advantage of the buying opportunity, Mohsenian said “Limited Downside, Substantial Upside,” he said. Sealed Air The maker of bubble wrap and other packaging products is firing on all cylinders, according to analyst Angel Castillo and his team. In particular, this stock is just too cheap at current levels, Castillo wrote in a recent outlook note. He named Sealed Air as a top pick for 2023. The firm said it sees “idiosyncratic growth drivers, balance sheet strength, and solid shareholder returns.” Taken together, these factors should should drive “volume outperformance, both in 2023 and longer term,” Castillo said. The analyst noted that Sealed Air is not immune to a tough macro, but he said that it is well equipped to overcome the obstacle. “We think pricing power/stability will be even more important in 2023 than it was last year and prefer Sealed Air for its differentiated operating model, which drove material price/cost and margin expansion outperformance in 2022,” he wrote. Shares are down about 20% over the past year. Constellation Brands “To be very clear up front, we do think macros are having a negative and durable impact on STZ’s beer depletion growth, and expect depletion growth more in the ~6% range forward, vs our ~6-7% prior modeled forecast. … Stock Looks Compelling Here With Limited Downside, Substantial Upside. … why we believe each of these concerns are overblown, despite some validity, and we see a compelling risk/reward here. … Net, we believe the market is unfairly pricing STZ as a broken growth story.” Alibaba “BABA looks mispriced at ex-growth F24e P/E of 11x. … Easing regulation, particularly on fintech, is a key catalyst. Elevate to a non-consensus Top Pick – first time in three years. … top pick in China’s Internet industry in 2023: We see multiple catalysts (reopening, cost optimization, easing regulatory environment, cloud reacceleration, and valuation) driving the most attractive risk-reward in the industry.” Sealed Air “We reiterate our OWs on CCK & SEE, where we see idiosyncratic growth drivers, balance sheet strength, & solid shareholder returns. … Therefore, we think pricing power/stability will be even more important in 2023 than it was last year & prefer Sealed Air for its differentiated operating model, which drove material price/cost & margin expansion outperformance in 2022. … Remain Overweight on Crown Holdings & Sealed Air, which we think have idiosyncratic factors that could drive volume outperformance, both in 2023 and longer term.” Verizon “Attractive Risk-Reward With Free Cash Flow Set to Ramp. … Following significant underperformance in ’22, VZ trades at a historically attractive valuation on an absolute and relative basis. We see room for improved operational performance in ’23 and FCF ramping 45% by ’24. … However, we believe that at current levels, the stock is now discounting an overly negative relative outlook and see signs that trends are gradually improving.” Dick’s Sporting Goods “An Olympic Transformation. … LT we believe DKS will be a faster-growing & more profitable business. … Retail transformation stories tend to lead to outsized stock returns. Few examples of retailers that have successfully changed their sales/margin profiles. DKS could be one of the rare few. … DKS has a history of uneven sales growth & margins, & operates in a category which was a significant COVID beneficiary. … If DKS retains the majority of its COVID-driven sales and margin gains, the stock screens with among best risk/rewards in retail.”