If you want to invest in the Dallas real estate market in 2023, here are the trends and information you should keep in mind before doing so.

As far as the situation in the Texas real estate market is concerned, it is still a seller’s market. The demand and home prices remain relatively high—despite the decline seen over the past few months.

Table of Contents

- The Texas Real Estate Market: Will It Be Profitable in 2023?

- Reasons to Invest in the Dallas Real Estate Market in 2023

- 3 Reasons to Not Invest in the Dallas Real Estate Market in 2023

- 3 Best Neighborhoods in the Dallas Real Estate Market for Long Term Rental Investment

- 3 Best Neighborhoods in the Dallas Real Estate Market for Short Term Rental Investment

- Last Say on Investing in Dallas Real Estate in 2023

In the Dallas real estate market, home prices went up by 9.9% in 2022, compared to 2021. Currently, it’s a seller’s market—but it doesn’t mean you should back off from investing in real estate property here.

If you really dive into the available information, you’ll come to find that the Dallas real estate market offer some tempting deals in 2023.

Mashvisor’s gone the extra mile to help you see the big picture and figure out whether you should step into this particular real estate market and invest in short or long term rentals. So, stick around; we have a lot to discuss.

The Texas Real Estate Market: Will It Be Profitable in 2023?

Before getting into the details regarding the Dallas real estate market analysis, we would like to take a moment to look at the bigger picture—the general situation in Texas.

First and foremost, it is important to mention that Texas is the second most populous state in the US. It is a popular destination, especially for young people who want to progress career-wise and enjoy an affordable cost of living.

Because of the breadth and size of Texas, housing trends and home prices in the said real estate market are subject to change—and they greatly depend on the particular city and region.

The suburbs of Dallas, which is our main focus today, and Austin are the most popular areas for investing in real estate in Texas.

Texas Housing Market Trends

Now to paint a clearer picture of the current situation and forecast, here are the most popular trends for the Texas real estate market in 2023.

For one, mortgage rates are on the rise in the Texas real estate market—which should come as a surprise, bearing in mind the situation in the US housing market.

Additionally, Texas is a popular renter’s market right now. The fact that approximately 38% of the Texas housing market is renter-occupied should give investors hope—and motivate them to invest in the local market in 2023.

Texas Housing Market Forecast

Here’s a prediction that might be of the utmost importance to investors:

Buying a house in the Texas real estate market may end in a better deal compared to other states, with the national median sale price being $25,000 cheaper, according to Bankrate.

However, given the soaring mortgage rates, it is clear why some people seem worried about the possibility of not attaining profit here.

The forecast for the Texas housing market looks good, though. According to professionals, the gray cloud will pass, and most importantly, the Texas housing market won’t suffer a crash any time soon.

Related: Will the Housing Market Crash in 2023?

5 Reasons to Invest in the Dallas Real Estate Market in 2023

Now that you know what to expect in the Dallas real estate market, here are the five crucial factors that will likely encourage investors to proceed with their plans.

1. Low Crime Rates

There’s no such thing as a 100% crime-free area. Dallas comes close, though. You can take our word for it:

Dallas is, in fact, one of the safest places in Texas to live in at the moment.

The majority of crimes that occur here are related to petty thefts and cases of vandalism. It is certainly not something that should be ignored, but, at the same time, it is not something that would deter a family from wanting to move there, either.

Of course, there are safer and less safe neighborhoods. Naturally, areas deemed “safe” tend to attract growing families with kids—and the Farmers Market District is one of them.

2. Low Living Costs

Dallas boasts a good living standard at the moment, thanks to the strong local economy.

You might’ve heard that it is expensive to live in Dallas. But generally speaking, it is only 1% more expensive than the national average—which is remarkable for such a developed city in Texas.

We assume that future residents will be most interested in how much they’d need annually to live comfortably. For a comfortable life in Texas, the household’s income needs to be around $58,000 per year.

Add the fact that this state doesn’t impose an individual income tax; it makes life in Dallas, Texas, quite affordable.

Related: Where Can You Find Airbnb Properties for Sale?

3. Home to Technology and Innovation

Another very important thing that sets the Dallas real estate market apart is that it is home to technology and innovation. We can cite the contribution of young professionals finding their way to this amazing city to thank for that.

The population of Dallas consists mostly of immigrants and Latinos. They’re mainly students and young adults who want to make a name for themselves in highly competitive markets.

The youth, coming in increasing numbers to Dallas, also contributes to growing businesses, developments in technology, emerging industries, and the opening of new job positions. Even more so, this influx of the younger population contributes to the demand for short term rentals, too.

4. Population Growth and Job Opportunities

Dallas continues to see an increase in population. In 2022, the Dallas metro population was 6,488,000, up 1.42% from 2021.

The forecast is that the population will continue to grow in 2023. And by 2029, the population is actually expected to increase by 17.9%.

Regarding job opportunities, Dallas, TX, offers a bright forecast for 2023.

Over the past years, the job market’s expanded by nearly 100,000 new jobs. It directly affected the influx of people coming to kick-start their careers in this metropolitan area.

According to Zippia, the jobs currently in demand in Dallas, Texas, include registered nurses, sales associates, senior software engineers, and chefs, to name a few.

5. Interest in Short Term Rentals

A growing interest in short term rentals seems logical now that we’ve already mentioned an influx of students and young professionals, the booming economy, and low living costs. It brings us to Dallas as a tourism hotspot.

The demand for short term rentals among tourists is increasing—and the record was set in 2019 when Dallas was named one of the best places for Airbnb investors.

Being the most popular state for Airbnb listings in the United States makes Dallas a hotspot for prospective investors who want to expand their portfolios with short term rentals in 2023.

The accommodation is comfortable, the rates are generally affordable—and there is a lot to see in Dallas.

Related: The Most Profitable Types of Real Estate Investment for 2023

3 Reasons to Not Invest in the Dallas Real Estate Market in 2023

If you’re considering a career in real estate investing in 2023—and the Dallas market is one of your top three choices—that’s great. However, you should step into the real estate business with your eyes wide open. Here’s what we mean:

You should consider the advantages of investing in the Dallas area—and be aware of the potential risks that come with it.

With that said, we’d like to go over a few reasons why investing in Dallas real estate may not be the right move for everyone.

1. Extremely Hot Weather

The climate in Dallas is characterized by hot and humid summers. This city, on average, sees 234 sunny days a year, with high temperatures that only residents seem to tolerate.

The hottest days here can easily reach 95 degrees Fahrenheit—while the winter tends to be relatively mild, with temperatures in January averaging 47 degrees Fahrenheit.

While some enjoy the sun, others cannot stand the heat. It is one of the reasons why tourists seem to favor spring and early fall—when the weather is not as extreme—to visit Dallas.

It’s a common concern for many investors, too. They are afraid that too few renters would actually enjoy the type of climate in Dallas.

2. Occasional Tornadoes

California experiences earthquakes, Florida sees hurricanes, and Texas—well, the state is known for the occasional tornadoes. Dallas, as well as most of North Texas, is one of the targets of such weather hazards.

If you’re considering investing in a single family home, for example, you’ll notice that there is rarely a house in Dallas built without a basement—precisely for the above reason.

The Dallas area deals with approximately 134 tornadoes on a yearly basis. Even though not all of them are life-threatening, they can still damage properties and cause huge repair bills.

As such, it can be a problem for renters and investors alike.

People who come to stay in Dallas from areas where these extreme weather conditions aren’t as frequent might second-guess their decisions. On the other hand, investors are left to cope with financial responsibilities and the aftermath of a tornado.

3. Traffic Jams

With population growth, economic development, and new jobs, Dallas is becoming a hotspot for professionals—and the frequent traffic jams are there to confirm it.

In some neighborhoods, you can find everything in one place—and the distance is generally walkable. However, a few events and activities—namely, trips related to business, celebrations, and tourist excursions—will require you to travel.

Owning a car certainly makes life easier, but you can expect huge traffic jams on the highway during rush hour. The traffic in Dallas—and the surrounding area—can get crazy sometimes, and it’s certainly a downside to keep in mind.

3 Best Neighborhoods in the Dallas Real Estate Market for Long Term Rental Investment

If you’re interested in investing in long term rentals in Dallas, Texas, in 2023, here are the top three neighborhoods from Mashvisor’s January 2023 location report. The neighborhoods are arranged from those with the highest to the lowest cash on cash return.

1. Farmers Market District

- Median Property Price: $523,889

- Average Price per Square Foot: $242

- Days on Market: 12

- Monthly Long Term Rental Income: $2,672

- Long Term Rental Cash on Cash Return: 3.06%

- Long Term Rental Cap Rate: 3.10%

- Price to Rent Ratio: 16

- Walk Score: 94

At the top of our list is the Farmers Market District. Considering that it took first place, there is no doubt that it is an excellent choice for investing in long term rentals.

Farmers Market District is a place made for growing families with kids. The Dallas neighborhood is packed with delectable local food, public events, and parks where people can enjoy family leisure time. The district is also known for being home to highly-rated elementary schools—making it a great place for raising children.

2. Oak Lawn

- Median Property Price: $677,736

- Average Price per Square Foot: $348

- Days on Market: 15

- Monthly Long Term Rental Income: $3,299

- Long Term Rental Cash on Cash Return: 2.82%

- Long Term Rental Cap Rate: 2.87%

- Price to Rent Ratio: 17

- Walk Score: 89

Second on the list of highly-rated Dallas neighborhoods would be Oak Lawn. Like the first location above, the area is one of the better destinations in Texas.

In the said Dallas neighborhood, most residents rent their homes. It comes with a suburban feel, and it’s also considered one of the friendliest communities in Dallas, TX. boasting a handful of coffee shops and hangouts.

Many young professionals decide to live here and work on their careers.

3. Arts District

- Median Property Price: $797,869

- Average Price per Square Foot: $393

- Days on Market: 14

- Monthly Long Term Rental Income: $3,855

- Long Term Rental Cash on Cash Return: 2.31%

- Long Term Rental Cap Rate: 2.33%

- Price to Rent Ratio: 17

- Walk Score: 84

The Arts District is the third Dallas neighborhood that offers a variety of long term rentals. And, as the name suggests, the area is known for its exquisite, world-class attractions and exhibits. In short, it is a hotspot for culture lovers.

It is one of Dallas’ most unique neighborhoods, with more than 60 beautiful boutiques, coffee shops, bars, and galleries.

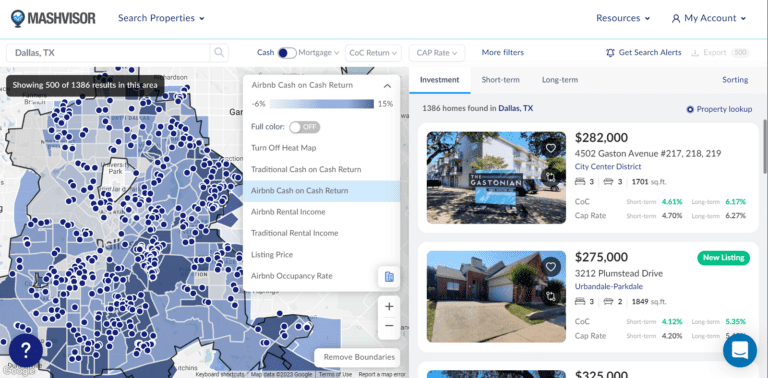

Searching for long term rentals you can invest in is a lot easier with a little help from Mashvisor’s tools. Start your search here for the next successful investment to add to your portfolio.

You can use Mashvisor to search for profitable long term and short term rental properties to add to your portfolio.

3 Best Neighborhoods in the Dallas Real Estate Market for Short Term Rental Investment

If you’re leaning more towards investing in short term rentals in Dallas in 2023, here are the hotspots the Dallas real estate market offers, based on our January 2023 location report. The locations are arranged from the highest to the lowest cash on cash return.

1. City Center District

- Median Property Price: $414,789

- Average Price per Square Foot: $249

- Days on Market: 17

- Number of Short Term Rental Listings: 1,349

- Monthly Short Term Rental Income: $2,517

- Short Term Rental Cash on Cash Return: 3.60%

- Short Term Rental Cap Rate: 3.74%

- Short Term Rental Daily Rate: $180

- Short Term Rental Occupancy Rate: 37%

- Walk Score: 86

Next on the list of top spots to invest in Dallas real estate is the City Center District. It is the perfect place for tourists who want access to amenities within walking distance. Restaurants, bars, coffee shops—everything is within reach.

It’s not a place exclusively intended for families with kids, though. There are few kind-friendly spaces—and everything’s busy. It’s more suited for vacation, with many bars and restaurants organizing fun game nights and events to attract tourists.

2. Reunion District

- Median Property Price: $616,432

- Average Price per Square Foot: $296

- Days on Market: 11

- Number of Short Term Rental Listings: 893

- Monthly Short Term Rental Income: $3,403

- Short Term Rental Cash on Cash Return: 2.56%

- Short Term Rental Cap Rate: 2.61%

- Short Term Rental Daily Rate: $169

- Short Term Rental Occupancy Rate: 37%

- Walk Score: 50

The Reunion District is a great place to invest in Dallas’s short term real estate. The number one attraction is, of course, the Reunion Tower—a place where you can take a deep breath and enjoy the view of the entire Dallas skyline.

And to add to it, there’s also the Hyatt Regency Hotel and many highly-rated restaurants and boutiques to visit.

3. Northwest Dallas

- Median Property Price: $182,445

- Average Price per Square Foot: $254

- Days on Market: 15

- Number of Short Term Rental Listings: 145

- Monthly Short Term Rental Income: $1,371

- Short Term Rental Cash on Cash Return: 2.06%

- Short Term Rental Cap Rate: 2.12%

- Short Term Rental Daily Rate: $168

- Short Term Rental Occupancy Rate: 28%

- Walk Score: 33

Closing the list of places to invest in the Dallas real estate market, there’s the one and only Northwest Dallas.

The place is attractive—especially for tourists looking to go shopping and spend some money. Shopping sprees seem to be one of the most common activities of people who come here on vacation.

In addition, the neighborhood is dog-friendly, the streets are well-lit, and it’s relatively close to uptown. It will help you if you own a car, though.

Start your search for profitable short term real estate property investments with a little help from Mashvisor’s tools.

Last Say on Investing in Dallas Real Estate in 2023

It’s time to conclude today’s topic. So, hopefully, by now, you have the necessary information and insights to decide whether you should invest in the Dallas real estate market in 2023.

We wanted to paint a vivid picture of the conditions and trends in the real estate market. So, we incorporated the situation in the Texas market, referred to important trends, and provided you with an analysis of the Dallas housing market.

The favorable situation for renters and investors—namely, low living costs, low crime rates, a thriving economy, and a growing population—makes the Dallas real estate market stand out based on recent trends and forecasts.

What you should pay attention to, however, are weather conditions.

The Dallas housing market is favorable for both long term and short term rentals—and it is up to you to decide which strategy suits you better.

Of course, with adequate analysis provided by Mashvisor, you’ll save considerable time, and you can rest assured that you will always deal with accurate, up-to-date information.

There’s one more thing we’d like to add:

Schedule a free demo with one of our specialists now. We’ll provide an in-depth introduction to our products and happily answer all your questions.