If you want to invest in residential real estate but aren’t 100% sure what your first step should be, we’re here to help you develop a plan.

Considering the main topic of our platform—which is real estate investing—it’s pretty easy to guess which question we get the most. The investment industry saw a boom over the past few years. Nowadays, we always receive the same question countless times: How to get started?

Table of Contents

- Commercial vs. Residential Real Estate Property

- Why Invest in Residential Real Estate?

- 5 Ways to Invest in Residential Real Estate

- The Benefits and Risks of Investing in Residential Real Estate

What many need help understanding, especially as beginners, is how broad the above question is.

You see, the question of how to invest in residential real estate can be approached from a few different angles. It depends on whether you’re investing in long or short-term rentals, apartments or houses, and so on.

To make matters even trickier, prospective investors are bombarded with information about how to navigate the US housing market. It can be hard to know which sources you can and cannot trust.

Now, for some good news:

Here at Mashvisor, we strive to serve only accurate, up-to-date information that will truly help aspiring investors in their careers.

And if you’re eager to get into the real estate game and kick-start your investing career, stick around. By the end of this guide, you’ll be fully informed about how to invest in real estate.

Commercial vs. Residential Real Estate Property

Investing in real estate can be somewhat challenging for someone with no previous contact with the industry—especially when you take into account the different branches and ways to start up your investment career.

So, right off the bat, we’d like to clear the air on what is possibly the most important division: commercial vs. residential real estate property.

Surely, you’ve seen numerous articles dealing with this topic before. So, we are here to offer a rundown of the most important facts:

Commercial real estate makes up one of the most significant portions of the US real estate market and encompasses retail, office, and industrial properties.

Granted, such properties can include apartments, condominiums, daycares, movie theaters, industrial floors, warehouses—and more. However, one thing they all have in common is that they are business-oriented.

The said properties are intended to be used exclusively for business purposes, hence the term commercial real estate, or CRE for short.

On the other hand, we have our primary focus of the day—residential real estate property.

Residential real estate property refers to housing. Such types of properties are supposed to be rented as living spaces. And—unlike the previous category—in most cases, they are not owner-occupied or used for business-related purposes.

Now that we’ve cleared that out, it’s easy to draw a conclusion:

Any property that is intended for living purposes is considered residential real estate, or RRE, for short.

The key difference between these two, as you could’ve guessed, is in the way they’re rented or leased—and there is, of course, a legal line between them.

Related: 6 Ways to Find Real Estate Investment Properties

Why Invest in Residential Real Estate?

As real estate investors, you’re constantly searching for validation for your next investment and solid evidence that it guarantees a profit. With that in mind, here are three main reasons to invest in residential real estate:

1. Portfolio Diversification

If you’ve been in the investment industry for a few years now or you’ve read about the key reasons for investing, portfolio diversification has surely popped up more than once. There is a reason for that:

It is one of the best ways to mitigate investment-related risks and maximize potential returns.

Whether you are strictly committed to residential property or have been primarily focused on commercial real estate until now, the fact remains:

Seeking out new opportunities to invest is the best thing you can do for your portfolio.

Besides making a name for yourself in the industry, you are also working on expanding your professional background—and generating income streams from several different sources.

2. Leverage

As we hinted at the beginning, investing can be viewed from many different angles. Primarily, it’s a business venture with the ultimate goal of bringing you passive income and helping you grow professionally.

However, it doesn’t need to stop there; quite the contrary:

Investing in real estate can provide an investor with the benefit of maximized returns through leverage.

Besides—you, as an investor and property owner—have the right to use your residential real estate property for private purposes, as well. Remember, you’re also investing in housing for yourself.

3. Home Appreciation

A magnificent characteristic of residential real estate is that it is a tangible asset with a rising value.

Let’s say you recently decided to invest in a real estate property in Arizona, for example, and choose to do a fix-and-flip project. In the meantime, you found out that residential real estate property values in the Arizona housing market have spiked.

That’s great news for you as the investor. You can sell the fix-and-flip project for a larger sum and achieve an even higher profit.

Remember that the above is just an example of smart investing—and home appreciation applies to many more cases.

5 Ways to Invest in Residential Real Estate

We’re moving closer to answering the question of how to invest in residential real estate. On that note, here are a few recommended ways for you to make a breakthrough and start your residential real estate investment journey:

1. Purchase a Property and Become a Landlord

If you are familiar with the market climate and you’ve come across a profitable market, it is an excellent chance to invest in a residential property and become a landlord.

There’s more than one way to get started:

You can apply for a mortgage, find a distressed property via foreclosures, or simply direct your savings toward this business venture.

Becoming a landlord means you can invest in a single-family house or a duplex and rent it out long-term. It will ensure a passive income that will remain steady for a long time—and you can always be certain that your property will be renter-occupied.

There’s another option, though:

You can explore different real estate markets—and invest in apartments in locations where tourism is popular. Entering into the real estate market with a short-term rental strategy can bring you generous income, too.

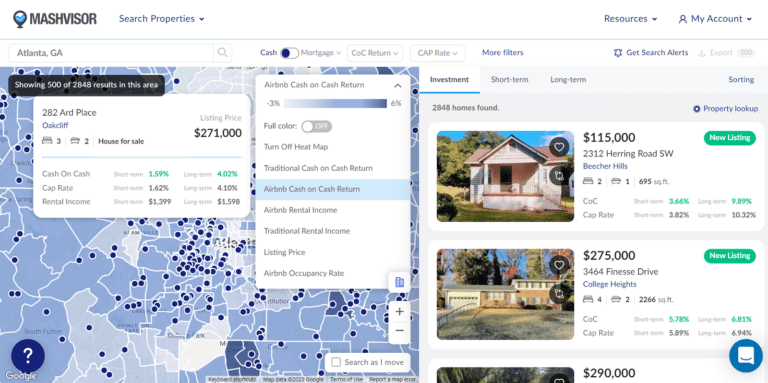

Ready to become a landlord? Search for short-term or long-term residential properties with Mashvisor’s help.

You can use Mashvisor to look for and identify profitable short-term and long-term residential properties.

2. REITs

Another common way to invest in residential properties is through the so-called real estate investment trusts or REITs.

REITs are, in essence, a more “formalized” version of a real estate investment group (REIG); the capital is pooled from a group of investors, much like in a mutual fund.

The trusts are created when a corporation uses investors’ money to purchase and operate investment properties. They are bought and sold, much like stocks. Do note that REITs don’t pay corporate income taxes—but the dividends are taxed as regular income.

What makes this type of investment special is that it was specifically developed for investors who desire a regular income—without buying or managing the property themselves.

More importantly, REITs are considered “liquid” because they are traded like stocks. In other words, you can buy and sell shares in such income-producing properties as you wish, eliminating certain drawbacks of traditional real estate purchases.

3. House Flipping

House flipping is arguably one of the well-known ways to invest in residential real estate.

The house flipping method of investing in residential real estate implies purchasing a property, investing in repairs and upgrades, and selling the property afterward for a profit.

Do note that house flipping is more profitable when there is more demand than supply in the housing market.

The initial costs shouldn’t scare you off, though. As long as the real estate housing market you invest in is in a “good place,” you can expect to get a generous return out of this venture.

With that said, this strategy is typically reserved for investors who have already established a career and built an extensive portfolio to back them up.

Related: 5 Steps to Conducting an Accurate Rental Market Analysis

4. Online Investment Platforms

The main advantage of using investment websites when investing in residential real estate is that these online platforms may assist you with investing in both short- and long-term rentals.

One of the leading contenders when it comes to assisting investors is Mashvisor:

The platform’s specifically designed to help real estate investors—including beginners—build the most profitable investment portfolio.

One of the main advantages of this way of investing is that it can save you quite a bit of time. It goes without saying that the investment journey is long—but with a well-equipped platform, you can get the desired information in a matter of minutes.

Moreover, Mashvisor collects real estate data that is 100% verified and up-to-date—meaning investors don’t need to worry about dealing with misinformation. The platform obtains its data from a long list of credible sources—including the MLS, Redfin, and Zillow, among others.

And to make your research easier, the platform also provides a dedicated search function. With a few clicks, prospective investors can see listed properties on the MLS, foreclosed properties, bank-owned homes, auctioned homes, and so on.

Related: Rental Property Calculator: What Is It For?

5. Crowdfunding

Another popular way to invest in residential real estate is through crowdfunding. In this case, you’ll rely on the Internet and social media platforms to reach out to an audience of potential investors.

The idea is that, with the help of others, numerous smaller investments turn into a large sum that can actually help achieve your goal of getting into real estate investing.

It’s an excellent way of assisting companies to raise the capital they didn’t think was possible until now—and something investors should consider, too.

Start a promising and profitable investment journey with Mashvisor. Sign up for a 7-day free trial now.

The Benefits and Risks of Investing in Residential Real Estate

As with other investment ventures, investing in residential real estate carries certain benefits and risks. Now that you know how to invest in residential real estate, here’s what you should keep in mind:

The Benefits

First, let’s look at the bright side of investing in residential real estate:

1. Less Financial Power

In general, investing requires a certain degree of financial strength on the investor’s part.

You are expected to possess a certain amount of money before purchasing a residential real estate property—be it through loans, mortgages, or personal savings.

That said, the advantage of such a type of investment is the amount of initial capital you need to prepare. Investing in residential real estate will generally cost less compared to how much you’d need as a commercial real estate investor.

A residential real estate investor will, on average, need approximately $100,000.

2. A Constant Need for Housing

The next advantage of investing in residential real estate is that this type of investment offers more opportunities for the investor—and guarantees a larger pool of buyers and renters.

People will always be looking for a place to live, settle in, or rent—and as long as the price is reasonable, you will get a good deal.

Remember:

Regardless of the specific real estate market in the US, there is always a need for housing.

3. Passive Income

Sure, raising capital may turn out to be a bit harder than you imagined. But when it comes to investing, it is crucial to look at the bigger picture—and look forward to long-term profits.

The most compelling reason to opt for residential real estate is to ensure a passive stream of income. Investing money in your residential property is inevitable; there will always be some costs that you’ll need to cover.

But you will also always enjoy a guaranteed influx of money from your tenants. It goes for both long-term and short-term rental properties.

With long-term rentals, you can even expect stable passive income for years—especially if your tenants decide that your property is the right place for them to settle down or even start a family.

And on the other hand, short-term rentals can really pay off and bring you a generous return, provided you do your homework and pin down the right location.

The Risks

Our wishes are for everything to run smoothly. But, unfortunately, that’s not the reality of the investment industry.

It can be turbulent at times. So, it’s important to be aware of some issues you may encounter along the way:

1. Problematic Tenants & Expenses

It doesn’t matter how many times your listings emphasize who would be the preferred tenant for your rental property or mention that you are looking for someone who’ll take good care of the residential space and respect the rules; the reality is:

Tenants never fail to surprise.

So, be prepared for them to cause some sort of damage to the residential property. Financial problems related to the tenants failing to pay rent on time and property-related damage—like broken furniture and windows, for example—are something that can be expected.

Unfortunately, such issues usually lead to the same outcome:

The investor must pay out-of-pocket for these expenses—and potentially lose a part of their profit.

2. Time-Consuming

What many beginner investors might not realize as they progress in their investment strategy is how much time this business venture actually takes.

You’ll be required to visit your property from time to time, participate in the maintenance, and might take on other obligations as the property owner. If you can’t set aside a certain amount of time for that, it can be a problem.

Whether you’re dealing with short and long-term residential property investments, you will be expected to spend time “in the field” and be present—not just physically but mentally, too.

Do note that short-term rentals may require even more of your time because the tenants will change on a more frequent basis in this scenario.

3. Rising Interest Rates

Another hurdle that someone hoping to invest in residential real estate may encounter would be the constantly rising interest rates.

The 2022 US housing market saw a rise in interest rates, and it seems like it will spill over into the beginning of 2023. The reasons for that are numerous—but one thing is certain:

It could make applying for a mortgage more difficult and should be something to consider as you develop an investment strategy.

Final Thoughts

We successfully finished the topic of how to invest in residential real estate property. Since it is a pretty extensive subject, we’d like to go through the key takeaways:

Those who want to get into the investment industry should first learn to differentiate between commercial and residential rental properties. Our focus today, as you realize by now, was on the latter—properties meant to provide housing for individuals, be it long-term or short-term.

And given the rise of the real estate investment industry, there are numerous reasons to turn your attention to residential real estate as an aspiring investor. Some of the most noteworthy ones include home appreciation, portfolio diversification, and leverage, to name a few.

We would also like to remind you that investors have the freedom of choice when it comes to starting their residential real estate investment journey. You can do so through REITS, house flipping, real estate investment platforms, crowdfunding, or becoming a landlord.

Of course, before you actually say “Yes” and invest in residential real estate, you should also be familiar with the pros and cons. While it will help you generate passive income, residential real estate can sometimes lead to tenant-related problems and out-of-pocket expenses.

Mashvisor offers extra help to prospective investors:

Book a free demo now with Mashvisor—and ask anything that comes to mind. Investors can schedule their appointment and get in touch with one of our product specialists to get an informed introduction.