Are you looking to learn how to invest in real estate in 2023? Here’s our comprehensive guide to getting started in three simple steps.

Table of Contents

- Step 1: Decide on a Real Estate Investment Strategy

- Step 2: Choose a Financing Option

- Step 3: Build a Team

Investing in real estate has always been a surefire way to generate handsome returns. Lately, the high-interest rates have been making it a bit hard for new investors to obtain financing for investment.

However, real estate remains to be one of the favorite long-term investment methods for Americans, even beating stocks. As such, we’re likely to experience investors flocking into the industry if and when the interest rates go back to normal.

While the interest rates may be high now, it could be the best time to save up cash for a down payment as you await for the rates to fall. Real estate investing is a long-term game that requires a long-term mindset.

In today’s article, we’re going to learn how to invest in real estate.

Step 1: Decide on a Real Estate Investment Strategy

Interestingly, many real estate investors don’t know that there are various ways of investing in real estate. While the most common way is becoming a landlord, there are other methods for investors who may not want to manage a property or deal with tenants.

You don’t have to follow the most popular investment strategy if your goals and needs are different.

Carefully scrutinize each investment strategy since each one has its own pros and cons. First, you need to determine how much money and time you’re willing to dedicate to the investment.

That said, here are some real estate investment options for you to learn:

Become a Landlord

This is the most common way of investing in real estate. It involves buying a residential property, such as a duplex or single-family home, finding tenants for the units, and collecting rent from your tenants.

The biggest benefit of this strategy is that you get to enjoy a consistent flow of income. Gauging the residential property marketplace is also easier and more straightforward compared to commercial real estate.

Another advantage is that you require a significantly lower amount of capital to get started than when investing in commercial properties. You can find it even cheaper if you can find distressed sales, off-market homes, or foreclosed properties.

Before investing in rental properties, you need to determine your rental strategies. There are two common rental strategies:

Long Term Rental Strategy

This is the traditional way of renting out properties where you find long-term tenants who lease for a long period, say one or two years. These tenants pay their rent monthly or annually, depending on the terms of the lease.

Many beginners choose this strategy since it assures a consistent flow of income, though this depends on the type of tenants they get.

Related: 8 Factors That Affect Rental Rate Calculation

Short Term Rental Strategy

Also referred to as Airbnb rental strategy, this involves hosting short-term tenants (called guests) who stay in your property for a minimum of one night. This strategy has become increasingly popular in the last few years since it offers real estate investors higher potential returns.

Keep in mind that rental properties require more effort from you. If you aren’t ready to deal with tenants, handle payments, and schedule maintenance and repairs, you might want to consider other methods of real estate investment.

However, you can also reduce the headache by hiring a professional property manager or property management agency. While this may require you to pay them a percentage of your rental income, think of it as an investment to streamline your business tasks.

Related: 5 Best Short Term Rental Sites for Real Estate Investors

Flipping Houses

Flipping properties is a high-risk affair. However, if done well, it also promises higher returns and can be extremely rewarding.

As the name suggests, this strategy involves buying homes that are in dire need of repairs, fixing them up, and selling them for a higher price. The selling price has to more than make up for all the expenses involved, namely the buying price and rehab costs.

Since home values are making a recovery, this could be the best time to consider flipping houses. The biggest advantage of this strategy is that you can make high profits faster than by becoming a landlord.

However, this may not be the best strategy for absolute real estate beginners. You need to learn how to have a sharp eye for properties that make good flipping projects. Not all properties that need repairs are good for flipping.

You also need to learn how to estimate the potential property price after accounting for all expenses. A small miscalculation could lead to lower profits or, in the worst-case scenario, an outright loss.

Also, prepare your mind for the possibility that you could not sell the home as fast as you wanted. In this case, you’ll be stuck with a home where you’ll pay interest, taxes, and other maintenance fees until you find a willing buyer.

This isn’t to frighten you, though. If done the right way, house flipping could be one of the most fulfilling real estate investment strategies.

Real Estate Investment Trusts (REITs)

REITs are a great option for investors looking to invest in real estate passively.

These are companies that own and operate commercial real estate properties, such as office buildings, hotel buildings, warehouses, medical complexes, and shopping malls. REITs sell shares of stocks or issue bonds to raise funds to buy and operate their assets.

They then issue dividends to their inventors.

As an investor, another advantage of REITs apart from the dividends is that you can start with a small amount and then grow your investment regularly as your budget grows. They are also highly liquid, as you can sell your shares any day when the market is open.

Just like other investment strategies, REITs also have their own disadvantages. The price of a REIT can fluctuate as the market changes, similar to stock prices.

While this may be less of a problem for investors who can hold during a dip, it may be loss-making for investors who want to sell their shares.

Real Estate Wholesaling

Real estate wholesaling is typically acting as a middleman between a property seller and a buyer. You get a property listing under contract, find a willing buyer, and then transfer the contract to them.

While this may sound synonymous with being a real estate agent, note that wholesalers aren’t required to have a real estate license since they technically own the property they’re selling.

There are two main types of real estate wholesaling to learn:

Residential Wholesaling

This is the type of wholesaling that involves residential properties, such as single-family homes, multi-family properties, condos, or townhouses. The properties could be undervalued or distressed sales.

As a wholesaler, you’ll purchase the contract from the seller, find a buyer, and sell them the contract for a fee. The buyer inserts themselves into the contract, meaning that the wholesaler doesn’t take possession of the property. This allows them to back out of the deal without losing their deposit if they’re unable to find a buyer in due time.

Commercial Wholesaling

This involves wholesaling commercial properties and generally flows in the same way as residential wholesaling. However, instead of finding undervalued residential properties, commercial wholesalers look for building with low occupancies or below-market rent.

Real Estate Crowdfunding

Real estate crowdfunding is another perfect option for investors who prefer a more hands-off approach. Crowdfunding platforms allow you to invest in specific real estate projects instead of large portfolios.

How does real estate crowdfunding work?

This strategy allows investors to pool their resources together to access investment opportunities they might otherwise not have the muscle to invest individually. In most cases, investors are required to commit for long periods, say five years or even more.

You can access your cash before your investment period matures, but you could face early withdrawal charges. Also, be sure to look out for any fees or additional costs that may eat into your returns.

Another potential downside is that you may not be able to access all real estate crowdfunding platforms. Some require a minimum investment amount, ranging from $500, and others go above $25,000.

Others may need you to be an accredited investor. This means you must have more than $1,000,000 in assets besides your primary residence or an annual income above $200,000.

How to Choose the Best Investment Strategy

While you may choose your investment strategy depending on your passion or interest, you need data and analytics to help you make your decision to ensure that the strategy is indeed lucrative. This is where online real estate tools come in.

Mashvisor is the best online real estate platform for both newbies and experienced investors. We have the most accurate and reliable tools to help you with your search for and analysis of real estate investment opportunities.

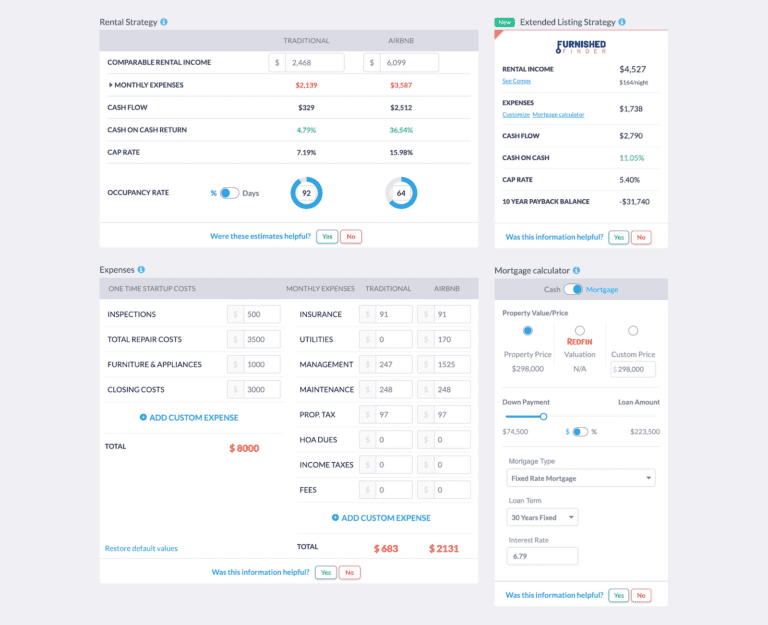

Should you decide to invest in rental properties, you need to conduct a comprehensive analysis that involves crucial numbers such as rental income, expenses, cash flow, and the rate of return on investment. The ROI metrics are cash on cash return and cap rate.

If you decide to learn how to carry out these calculations manually, it can be tedious and time-consuming. Besides, you’d expose these numbers to a lot of errors.

Mashvisor’s investment property calculator takes the whole burden off your shoulders. This tool uses machine-learning algorithms and predictive analytics to give its users important property metrics.

The best thing about this tool is that it provides you with metrics for both long term and short term rental strategies. This allows you to run an in-depth side-by-side comparison to settle on the rental strategy that matches your goals.

Sign up to Mashvisor today and begin your 7-day free trial.

Mashvisor’s Investment Property Calculator

Step 2: Choose a Financing Option

One of the initial steps for real estate investors is to learn how to align their financing options. You must build a large pool of accessible money to invest in real estate.

While many beginners want to invest in cash, the truth is that most investors have to look for financing to buy properties. This presents a huge advantage since you leverage financing to own property while only paying a 20% down payment.

In short, you claim 100% of the cash flow, tax benefits, and property value appreciation while just putting down a fraction of the property selling price.

Besides, financing allows you to minimize your risk through diversification by spreading your capital across multiple properties instead of paying 100% for one.

There are many different financing options available to you, depending on your real estate investment strategy. For example, an investor who wants to flip houses may look for different options from an investor who wants to invest in a REIT.

Related: 3 Best Investment Property Lenders for 2023

Let’s break down some of the available financing options for real estate investors:

Conventional Loans

When starting out, new real estate investors may choose to purchase a property and reside in it while fixing it or waiting for its value to increase. In such a scenario, conventional loans would be the best type of financing for you.

Conventional or traditional loans are loans offered by banks, savings and loan associations, and credit unions. Credit unions may be the best for beginners since they’re nonprofit organizations with lower interest rates and fees.

In addition, credit unions serve particular communities and are membership-based. As such, they have relaxed underwriting guidelines that will boost your chances of getting approved.

FHA Loans

FHA loans are loans backed by the Federal Housing Administration (FHA). These loans are more suitable for people who want to purchase their primary residence, not a rental property.

Due to this, you can use this type of financing for the house hacking strategy. House hacking is a type of strategy where you buy a multi-family property, live in one of the units, and rent out the rest for rental income.

FHA loans are less strict when it comes to the down payment and loan qualification requirements. This makes them a good alternative to conventional financing.

Private Money Lenders

Private money lenders are individuals who choose to invest in real estate debt instead of equity. These lenders make a profit by collecting interest and fees loaned to other investors.

Investors who don’t qualify for traditional loans may choose to acquire private loans.

Hard Money Loans

Hard money loans suit investors who are looking for short-term loans. While they typically have higher interest rates and fees compared to other types of financing, they are suitable if you have a bad credit history or if you’re seeking more flexible loan terms.

Owner Financing

Owner financing is an interesting financing option. Some property sellers are willing to receive a down payment for the property and then installments depending on the agreement.

While it’s not easy to find such sellers, it’s definitely worth it if you can’t find financing from the bank. The interest rate may also be higher, and you may have to pay a higher down payment, but you don’t have to pay the many loan fees banks have.

Step 3: Build a Team

As the adage goes, “If you want to walk fast, walk alone, but if you want to walk far, walk with other like-minded individuals.” Real estate investing isn’t any different.

As an investor who desires to succeed, you must build a team of like-minded and trustworthy professionals to work with. This is regardless of whichever real estate investment strategy you choose to pursue.

Whether you want to flip houses in the short term or buy and hold rental properties in the long term, you need people who can help you identify lucrative opportunities and avoid common pitfalls. This will make the difference between you succeeding or remaining a novice.

So, what kind of professionals do you need to have in your circle?

Seasoned Investors

You need to have an experienced investor who is willing to hold your hand as your mentor. You could use their journey to success in investing as a blueprint for your own journey. This will help you learn how to spot good real estate deals and also avoid pitfalls.

Real Estate Agents

Agents are important when it comes to identifying sweet deals in their local markets. They have great networks that could help you discover profitable properties for sale before they’re publicly listed.

Besides, they’ll also help you when you finally decide to sell.

Mortgage Brokers

You need to know mortgage brokers who will help you learn how to choose financing options depending on your financial situation and investment goals.

Since they mostly don’t work for one financial services provider, they can show you various financing options, rates, and mortgage payments from different lenders so that you can secure the best deal.

Real Estate Attorneys

Find an attorney who specializes in real estate to help you structure deals and scrutinize contracts. In addition, they’ll be in your corner when you need legal advice in a legal dispute in relation to a property.

Contractors

Having a contractor on your team is going to be helpful if you’re interested in home flipping or when your property requires repairs and renovations. While you might choose to carry out the repairs yourself, working with a contractor could be a worthy investment since they’ll handle everything, especially for beginners.

They will deliver the project within your budget and timeframe. They’ll also advise you on the best quality material and where to get them within your budget.

Other than a professional contractor, consider knowing a handyman who can take care of the small projects when the contractor isn’t available.

Accountant

An accountant will help you keep your financial books up-to-date and also prepare your taxes. They will also advise you on how your business processes could affect your taxes. Ensure you work with an accountant who’s experienced in real estate.

Insurance Agent/Broker

These professionals will walk you through the process of getting a suitable insurance policy to cover you, your rental property, and your tenants while still staying within your budget. Most agents work with a single insurance provider, while brokers may help you shop around multiple insurance providers to find the most suitable cover.

Property Manager

A property manager is a bridge between you and your tenants. They will help you find responsible tenants, collect rental payments, handle maintenance requests, schedule repairs, and regularly inspect your rental units.

Most property managers and property management agencies charge 10% of the rental income. While you don’t necessarily have to hire one, property managers will help you save time and money.

For every position, make sure you evaluate a few potential candidates to settle on the best one. Communicate your goals and expectations, and be sure to understand their charges and how you can both work together.

The cheapest option isn’t always the best. Remember, you get what you pay for.

Also, don’t stop networking. It’s always a good idea to have a few options, just in case.

Final Thoughts

Real estate investing has always been a great way to create a solid stream of income and generate handsome returns. As such, many investors want to learn how to invest in real estate.

Fortunately, this simple guide breaks down the process for you to make it easier. Firstly, you need to settle on an investment strategy. You can choose to buy rental properties, flip houses, wholesale properties, or invest in REITs.

Secondly, decide what financing option you’ll obtain. Many investors obtain financing due to the leverage it provides them. You can choose to obtain a conventional loan, hard money loan, FHA loan, or private money loan.

Thirdly, build a team of essential professionals to help you in your career. Get a seasoned real estate investor to mentor you so you can learn the ropes. Also, work with a real estate attorney, accountant, contractor, insurance agent, and property manager.

Most importantly, you need a real estate software solution that sorts all your investment needs. Mashvisor provides you with accurate and reliable data and analytics to help you make wise business decisions.

Book a demo today and see how our tools can help you.