Ask 100 CMOs their greatest concerns entering 2023 and most will mention inflation. They also may note supply chain issues and the general weakening of the U.S. and global economies. In fact, PwC found “appropriate pricing in the wake of soaring inflation and softness in the economy” is the top challenge for CMOs, according to a recent survey.

CPG brand leaders are grappling with the latest rise of Private Label and value brands amidst economic concerns. 65% of retail shoppers say they will trade brands if prices are too high, according to a recent Deloitte survey. The survey also found that 41% of shoppers expect the economy to weaken in 2023 (vs. 33% in 2021, 27% in 2020) — which is backed by an even larger segment of experts (over two thirds of U.S. economists believe a recession is likely to hit in 2023).

A majority of categories across 2022 experienced significant movement between Private Label and branded products. Of these categories, 71.5% have gained in Private Label share.

Optional Caption

The Ibotta Performance Network

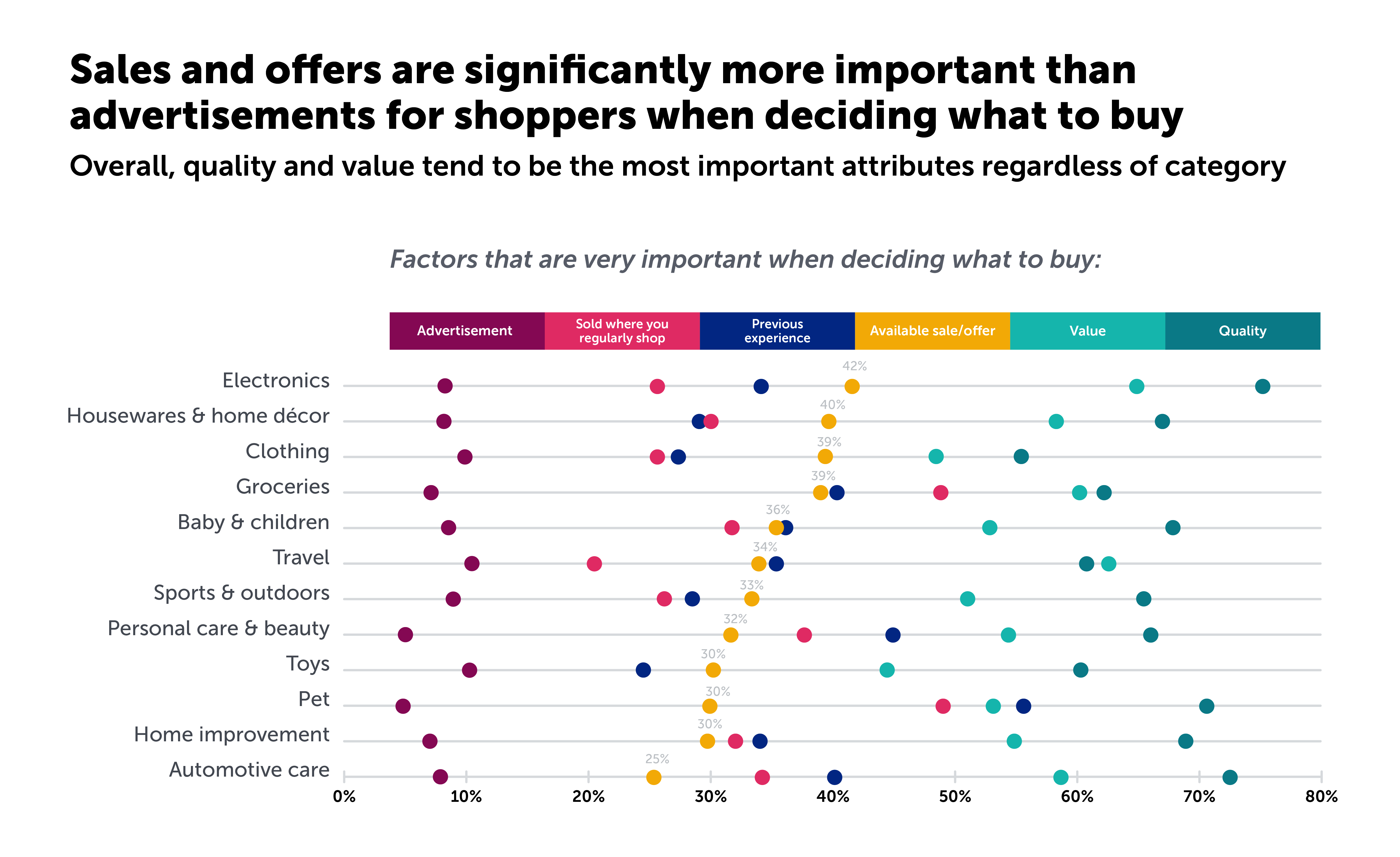

Looking back decades, Private Label gaining market share is not new. However, the issue for CPG brands is exacerbated by economic conditions causing shoppers to get even savvier and readily trade down. Retailers are combatting this trend, appealing to shoppers to increase retention, by leaning on promotional and rewards strategies.

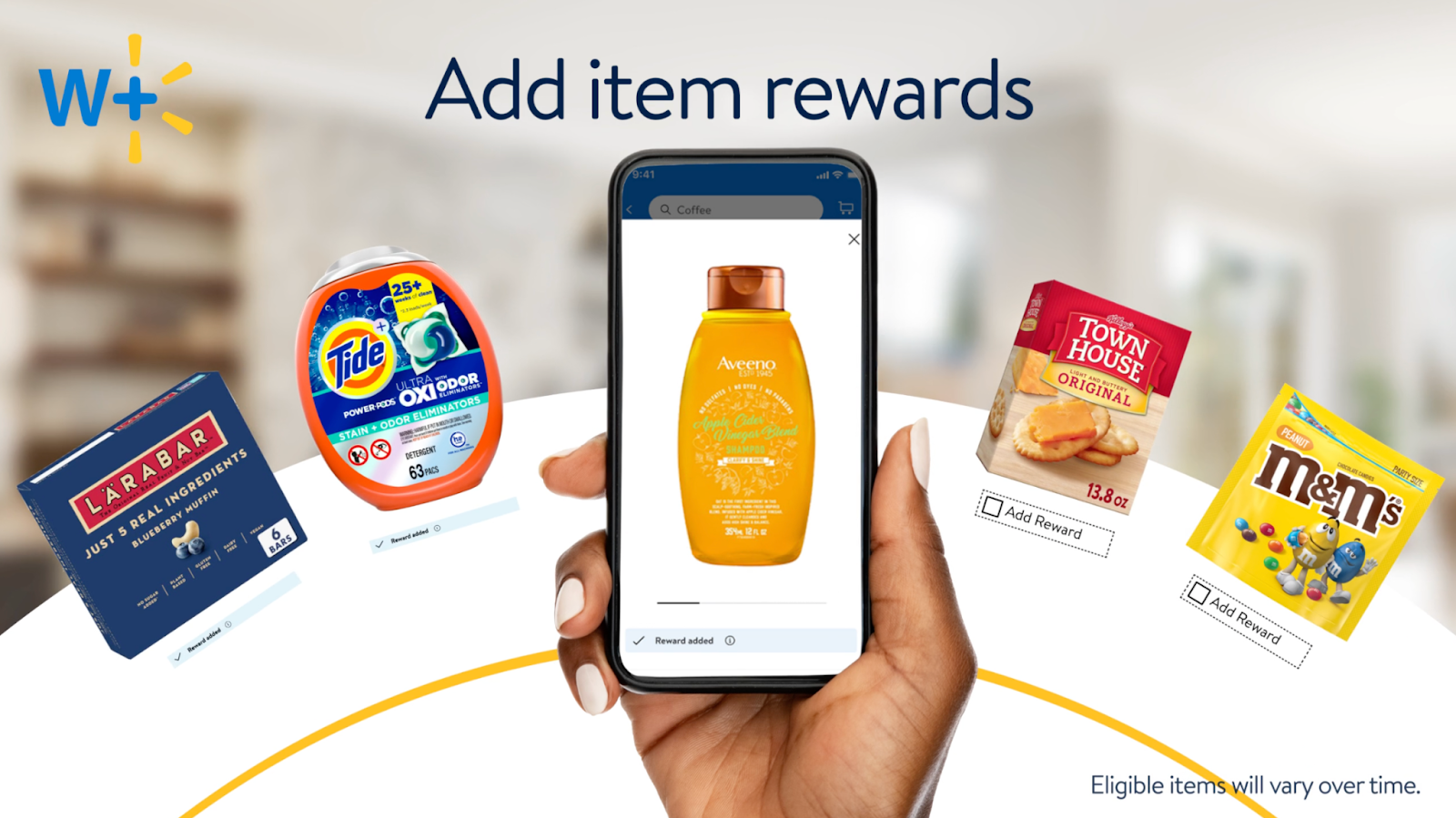

Walmart for example launched Walmart Rewards in mid 2022, powered by the Ibotta Performance Network (IPN). Chris Cracchiolo, Senior Vice President and General Manager of Walmart+ said, “Walmart Rewards is a new and easy way for Walmart+ members to earn additional savings toward future Walmart purchases. As members search for products on Walmart.com or the Walmart app, they’ll see an option to add rewards starting with hundreds of bestselling items, from groceries to household goods to pet care and beyond. This is on top of Walmart’s everyday low prices.”

Optional Caption

The Ibotta Performance Network

As General Mills sees it, “There’s a whole variety of benefits,” to joining the IPN, according to KC Glaser, General Mills Senior Manager, Loyalty Rewards. In key categories, over the first months post-launch of IPN campaigns, the Company saw 3 – 8X ROAS, an average of 44.5% incremental unit lift, and 35 – 41% of redeemers trading up from Private Label and value brands.

As more brands and retailers join the rapidly expanding IPN, consumer expectations will continue shifting toward the availability of incentives offered by the brands they love. Rewards and cash back offers will keep shoppers coming back, and ultimately, loyalty can be forged with incremental growth for brands and retailers.

Optional Caption

The Ibotta Performance Network

Shopper Loyalty Research

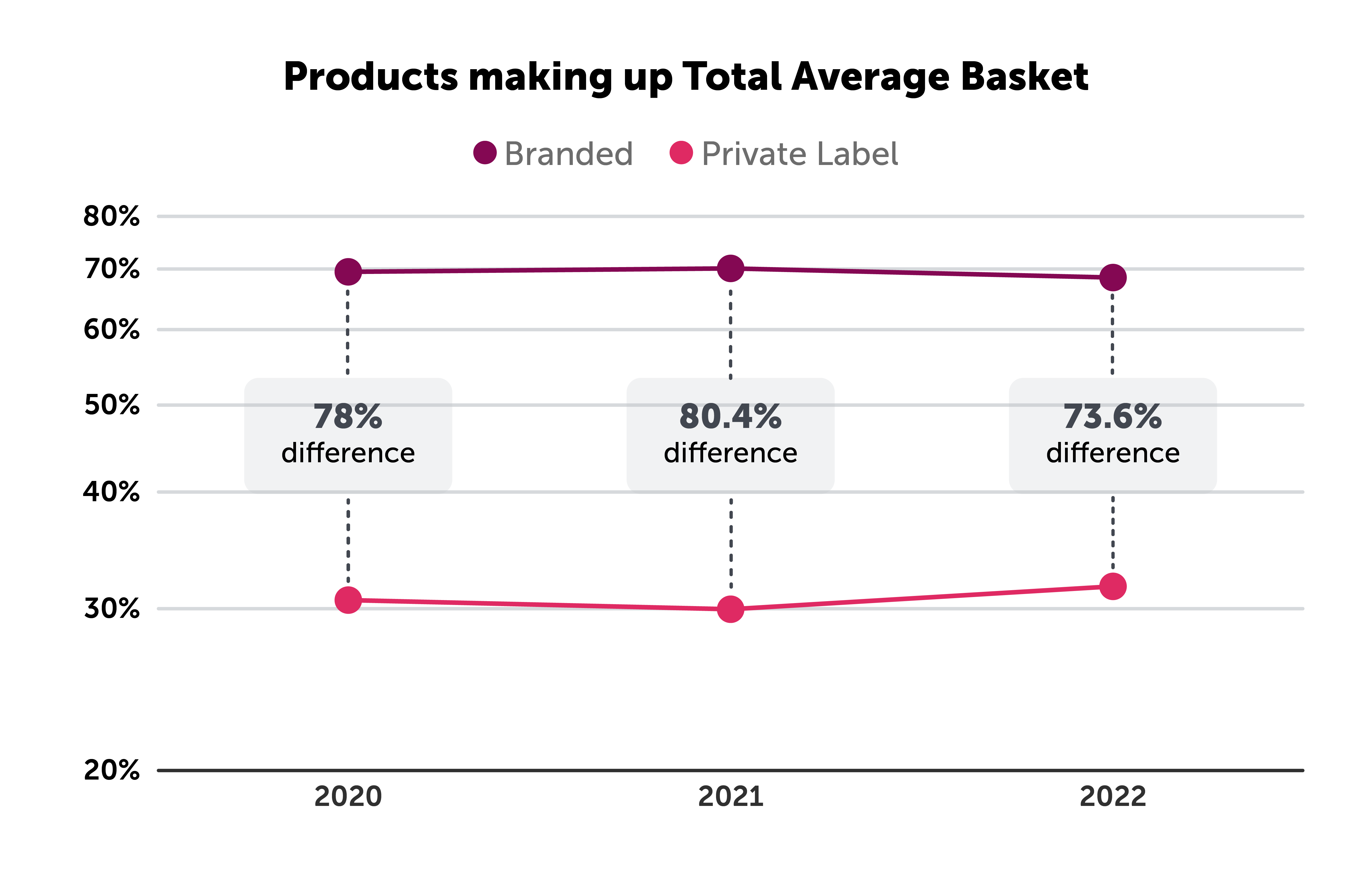

Back in 2020, McKinsey reported “Some 80 percent of customers who started using a private brand during the pandemic indicate they intend to continue using it once the COVID-19 crisis is over.”

IPN data indicate there was truth in such a prediction. Looking at shoppers’ average basket size and the products making up total basket, 2021 showed a small shift in favor of branded products. A 2022 shift swings back toward Private Label, as the logarithmic chart below illustrates.

Optional Caption

The Ibotta Performance Network

As with the crises of 2020, it can be reasonably estimated that the economic downturn of 2022 and beyond will similarly impact consumer behavior (and therefore brands and retailers), driving shoppers to trade down, seek lower priced items, or even spurn categories of higher elasticity entirely.

Long term effects will take form as brands strategize to win market share and keep customers coming back. As Retail TouchPoints (RTP) aptly noted in early 2022, “an elemental truism of the human condition: repeated actions can become habitual, which in turn can evolve into default behavior.” The ways in which brands execute their rewards and promotional strategies now and in the near term can be critical determinants of their growth and shopper loyalty going forward.

The Private Label Perspective

Combating the latest rise of Private Label requires a foundational understanding of what’s driving it — an opportunity for retailers to acquire and retain price-conscious consumers. Many retailers are leveraging the economic climate to drive loyalty. Take for example Target, an Ibotta partner, which in Q2 2021 launched its Favorite Day line, featuring 700+ items, precisely to tap into that price-conscious consumer.

In the spirit of comedic relief, Cannes Lions International Festival of Creativity recently resurfaced this Shortlisted ALDI video project, created in partnership with BMF Advertising Australia, showcasing ALDI’ Private Label Frusion: “Like Brands. Only Cheaper.”

Efforts to drive Private Label growth are proving effective, as seen in the breadth of key categories impacted. The table below shows two dozen of the 103 key categories with critical share increase to Private Label throughout 2022 — each with great statistical significance.

Optional Caption

The Ibotta Performance Network

Private Label and value brands aren’t to be underestimated — leaders and teams driving them are equipped with pricing structure advantages in addition to creative consumer engagement and brand awareness initiatives, just as brands are.

National brands must also take advantage of the current market opportunity, to ensure continued growth throughout an inflationary period and beyond. There has never been a more critical time for brands to capitalize on the ability to show up at the shelf (digital or in-store or both) offering cash back incentives to influence purchase behavior, make real-time adjustments to maximize impact, and all at 100% pay-per-sale.

The Role of Performance Marketing in 2023

Recently, there has been industry chatter around performance marketing. The marketing firm Analytics Partners, for example, points out how binary clicks and search metrics are overstated. Others, like Gartner, explore how performance marketing will fit into the mix in 2023. In its Recession Playbook for Marketing Leaders, responding to what it names “The Triple Squeeze,” or three compounding pressures: inflation, talent scarcity, and supply chain volatility — the research firm says companies must “Narrow the metrics” used to measure and manage digital initiatives.

Any way you slice it, the proven performance marketing model of the IPN empowers brands to leverage critical metrics (new sales, daily unit lift, purchase cycle reduction, category incrementally & growth for retail partners) and ultimately achieve results at scale.

Optional Caption

The Ibotta Performance Network

Economic weakening, fluctuating consumer behavior, and the latest rise of Private Label are challenges for brands to reckon with en masse — because shoppers seek value, perhaps now more than ever, and brands can deliver it via closed-loop cash back offers at the right time, right place, and at 100% pay-per-sale.

To take a deep dive on key categories to watch in 2023, along with seasonal trends, view the full article here. IPN insights and proprietary data enable brand and retail leaders to identify new opportunities for effective promotional strategies. Get in touch with your Ibotta rep or inquire here to learn more.

.png?width=1073&height=466&name=2023%20Outlook%20Blog%20Article%20Graphics_Artboard%202%20(2).png)