Industry experts believe that the US could be headed for a real estate housing market correction after two years of continuous price increases.

It is something that a lot of homeowners, homebuyers, and real estate investors are currently stressing over, especially those who have not been through something similar in the past. It really depends on which side you’re coming from. On the one hand, it means housing affordability is within reach. On the other hand, your property could end up losing some value.

Table of Contents

- What Is Real Estate Housing Market Correction?

- Will There Be a Housing Market Correction in 2023?

- How to Stay Ahead in Real Estate Investing

- 10 Most Affordable yet Profitable Markets to Invest in 2023

As a real estate investor, you must keep yourself informed and updated with whatever is going on in the US housing market, especially in markets where you own investment properties. One of the most common discussions going around is that we’re headed for a real estate housing market correction. But what does it mean?

We will talk about what you need to know about this so-called market correction and how it will impact investors and real estate investing in general. We’ll also show you how you can stay ahead of the game by investing in profitable real estate properties using data from real estate website Mashvisor.

Related: How to Find Profitable Rental Investment Properties for Sale

What Is Real Estate Housing Market Correction?

During the past few years, the real estate market was booming in the US. The median property price rose steadily, and people were buying more properties to rent them out or invest in them. But now, it seems that the housing market is about to undergo a correction.

Real estate housing market correction is a term used to describe a drop in the price of houses and other properties. One housing market correction that happened in recent history was during the 2007-2008 housing market crash.

A number of factors can cause a housing market correction, such as the availability of mortgage credit, job losses, and rising interest rates. The latter is one of the most probable reasons why industry experts are predicting that a real estate housing market correction will happen again soon.

The housing market correction will be a good thing for those who are looking for long term rentals and short term rentals. It will also be advantageous for those who want to purchase investment properties because they can get better deals on such properties.

The Impact of a Real Estate Housing Market Correction

A housing market correction has been a long time coming. We saw property prices fall at the pandemic’s onset. However, for the past couple of years, they’ve been rising recently. The price increases have made it more difficult for first-time buyers to enter the real estate market.

A correction of the housing market is inevitable. As the demand for homes decreases due to the continuing increase in mortgage rates, so do the home prices. The real estate industry is expected to see a significant decline in sales in 2023 as a result of a possible correction.

The real estate industry is not only going through a correction but also an evolution. Many people are turning to long term rentals or short term rentals as opposed to buying property. As a result, it’s becoming clear that there should be more investment properties available for buyers who don’t want to buy property yet but are looking for an investment opportunity.

Related: Home Builders Expecting Downturn in the Real Estate Market in 2023

Will There Be a Housing Market Correction in 2023?

Before the pandemic, the residential housing market was on a steady incline. The median property price in San Francisco was up by more than $500,000 from 2012 levels. According to a 2019 CNBC article, a San Francisco property bought in 2009 would be worth approximately 90% more in 2019.

That was before COVID-19 swept throughout the world and upended almost everything, including the real estate industry.

During the pandemic, we saw how property prices fell, along with historically low interest rates on mortgages. It caused a buying frenzy among homebuyers and real estate investors. But over the last several months, we also saw how both property prices and mortgage rates went up.

However, according to a recent report by Zillow, there is a possibility that a housing market correction will happen in 2023. If it happens, it will be due to three major factors, including:

- The rise of short term rentals over long term rentals will reduce demand for residential properties and make it harder for homeowners to sell their properties.

- The increase in interest rates will make it more expensive for people to buy homes.

- Real estate prices are at an all-time high, which means that there is an oversupply of high-priced homes.

A housing market correction is coming. Experts are making predictions that the market will begin to correct in 2023. The median property price is predicted to drop by 8%.

Many people are now wondering if it is a good time to purchase a house or rent. With the median property prices predicted to decline by a significant number, it might be a good time to invest in rental properties at present. Experts predict that the market will begin correcting in 2023, with prices falling by 8%.

What Industry Experts and Veterans Have to Say

The market for real estate is a volatile one. A real estate housing market correction in 2023 is not an exception to the said rule.

Real estate experts and veterans have been warning about the housing correction in the real estate market for quite some time now. Median property prices have been increasing at an alarming rate, which is why we are seeing a lot of people renting out their properties because they can’t afford to sell them.

Industry experts predict that a correction will be a good thing for both buyers and sellers. For example, people who want to buy homes but don’t have enough money saved up will finally be able to afford them because house prices will go down.

On the other hand, people who are thinking about selling their property might find that they can sell it at a higher price if they wait until after the correction.

According to a few industry experts and veterans, we should not think of housing as an investment, per se, because it is too unpredictable and risky at present. It pertains to investment strategies other than rental property investments. They say that we should only buy a home if we plan on living in it or converting it as a rental property investment.

How to Stay Ahead in Real Estate Investing

If you were to believe the predictions from real estate experts about the real estate housing market correction, you might be wondering how to stay ahead in real estate investing.

There are many ways to invest in property that will still make you money even if the housing market slows down. One way is to invest in rental properties.

Rental properties are classified into two main categories: long term and short term rental properties. Both investment strategies have their own advantages and disadvantages, but generally, they make for better investment opportunities today compared to house flipping.

With median property prices in many markets going up in the past year, investing in affordable homes to rent out is a sound investment strategy. Housing affordability has become out of reach for a lot of people, with many of them choosing to rent homes for the time being.

As a rental property owner, you can help meet the demand for rental properties and make a decent return on your investment.

And with travel restrictions eased, the demand for short term rentals has also gone up significantly. It makes investing in vacation rental properties a lucrative option for investors like yourself.

Finding the Most Profitable and Affordable Investment Properties

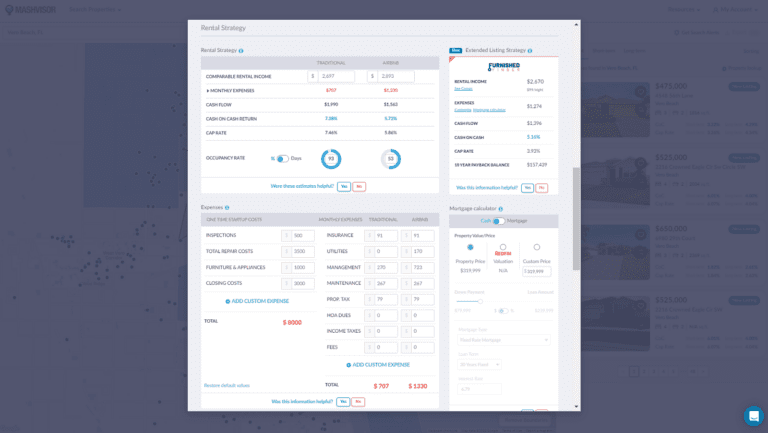

The best way to find the best rental properties in the most lucrative markets is by using an investment property website like Mashvisor. The platform offers a wide array of real estate investing tools that helps investors find investment properties that line up with their goals and needs.

Mashvisor will help you locate and analyze any investment property in any location to see how profitable it can be for you. As a subscriber, you’ll be able to access a massive database of almost every real estate market in the country.

You will also find useful tools like the Property Search, a real estate heatmap, and perhaps the best investment property calculator out there today.

To get access to our real estate investment tools, click here to sign up for a 7-day free trial of Mashvisor today, followed by 15% off for life.

Mashvisor provides investors with a variety of valuable tools, such as an investment property calculator, to find profitable properties.

10 Most Affordable yet Profitable Markets to Invest in 2023

As mentioned earlier, Mashvisor provides real estate investors with the most accurate data and up-to-date information on different real estate housing markets all across the US. In light of the anticipated real estate housing market correction, we took a look at the 2022 US housing market numbers to determine which ones are promising investment locations.

According to Mashvisor’s November 27, 2022 location report, we came up with a list of ten affordable and profitable markets for both long term and vacation rental property investments.

Related: 20 Best Places to Invest in Real Estate in 2023

5 Markets Suitable for Long Term Rental Property Investments

The following list of locations was selected based on the following criteria:

- Each market should not have a median property price that exceeds $1,000,000

- Each market should have at least 100 active listings

- Each market should have a minimum monthly rental income of $2,000

- Each market should have a cash on cash return of 2% and above

- Each market should have at least a price to rent ratio of 20

The locations are ranked according to their affordability, from the lowest to the highest median property price.

1. Waxahachie, TX

- Median Property Price: $478,607

- Average Price per Square Foot: $200

- Days on Market: 77

- Number of Long Term Rental Listings: 174

- Monthly Long Term Rental Income: $2,016

- Long Term Rental Cash on Cash Return: 2.23%

- Long Term Rental Cap Rate: 2.28%

- Price to Rent Ratio: 20

- Walk Score: 65

2. Melbourne, FL

- Median Property Price: $496,841

- Average Price per Square Foot: $257

- Days on Market: 64

- Number of Long Term Rental Listings: 581

- Monthly Long Term Rental Income: $2,054

- Long Term Rental Cash on Cash Return: 3.18%

- Long Term Rental Cap Rate: 3.26%

- Price to Rent Ratio: 20

- Walk Score: 73

3. Morrisville, NC

- Median Property Price: $498,183

- Average Price per Square Foot: $244

- Days on Market: 48

- Number of Long Term Rental Listings: 227

- Monthly Long Term Rental Income: $2,006

- Long Term Rental Cash on Cash Return: 2.57%

- Long Term Rental Cap Rate: 2.59%

- Price to Rent Ratio: 21

- Walk Score: 41

4. Buckeye, AZ

- Median Property Price: $500,110

- Average Price per Square Foot: $249

- Days on Market: 61

- Number of Long Term Rental Listings: 204

- Monthly Long Term Rental Income: $2,067

- Long Term Rental Cash on Cash Return: 2.93%

- Long Term Rental Cap Rate: 2.97%

- Price to Rent Ratio: 20

- Walk Score: 72

5. Palm Harbor, FL

- Median Property Price: $502,088

- Average Price per Square Foot: $301

- Days on Market: 55

- Number of Long Term Rental Listings: 193

- Monthly Long Term Rental Income: $2,116

- Long Term Rental Cash on Cash Return: 2.46%

- Long Term Rental Cap Rate: 2.50%

- Price to Rent Ratio: 20

- Walk Score: 64

Find out more about Mashvisor’s products and how we can help you make smarter investment decisions today.

5 Markets Suitable for Short Term Rental Investments

The following list of locations, like the previous one, was compiled using the following criteria:

- Each market should not have a median property price that exceeds $1,000,000

- Each market should have at least 100 active listings

- Each market should have a minimum monthly rental income of $2,000

- Each market should have a cash on cash return of 2% and above

- Each market should have at least a 50% short term rental occupancy rate

And just like the location for long term rentals, the list below is ranked based on affordability, from the lowest to the highest median property price.

1. North College Hill, OH

- Median Property Price: $190,121

- Average Price per Square Foot: $135

- Days on Market: 47

- Number of Short Term Rental Listings: 124

- Monthly Short Term Rental Income: $2,296

- Short Term Rental Cash on Cash Return: 6.81%

- Short Term Rental Cap Rate: 7.18%

- Short Term Rental Daily Rate: $126

- Short Term Rental Occupancy Rate: 52%

- Walk Score: 74

2. Midway Park, NC

- Median Property Price: $201,800

- Average Price per Square Foot: $139

- Days on Market: 54

- Number of Short Term Rental Listings: 113

- Monthly Short Term Rental Income: $2,037

- Short Term Rental Cash on Cash Return: 5.64%

- Short Term Rental Cap Rate: 5.78%

- Short Term Rental Daily Rate: $106

- Short Term Rental Occupancy Rate: 51%

- Walk Score: 12

3. Rockford, IL

- Median Property Price: $204,660

- Average Price per Square Foot: $133

- Days on Market: 63

- Number of Short Term Rental Listings: 115

- Monthly Short Term Rental Income: $2,350

- Short Term Rental Cash on Cash Return: 5.42%

- Short Term Rental Cap Rate: 5.67%

- Short Term Rental Daily Rate: $104

- Short Term Rental Occupancy Rate: 57%

- Walk Score: 87

4. Syracuse, NY

- Median Property Price: $204,819

- Average Price per Square Foot: $113

- Days on Market: 75

- Number of Short Term Rental Listings: 203

- Monthly Short Term Rental Income: $2,564

- Short Term Rental Cash on Cash Return: 6.06%

- Short Term Rental Cap Rate: 6.24%

- Short Term Rental Daily Rate: $153

- Short Term Rental Occupancy Rate: 57%

- Walk Score: 53

5. Rochester, NY

- Median Property Price: $209,408

- Average Price per Square Foot: $140

- Days on Market: 54

- Number of Short Term Rental Listings: 423

- Monthly Short Term Rental Income: $2,532

- Short Term Rental Cash on Cash Return: 5.46%

- Short Term Rental Cap Rate: 5.61%

- Short Term Rental Daily Rate: $139

- Short Term Rental Occupancy Rate: 56%

- Walk Score: 57

Go to Mashvisor now to start looking for and analyzing the most profitable short term rental properties in any location of your choice.

Wrapping It Up

As predictions about a real estate housing market correction continue to make their rounds online, you need to plan for your next move as a real estate investor. Wise investors know how to filter information and plan accordingly.

Keep yourself updated with the latest news about the US housing market. It will also help if you have access to Mashvisor’s database to keep you up-to-date with actual market conditions and data. The right data and information can go a long way in your journey as a real estate investor. It can spell the difference between investment success and failure.

Given the predictions of experts and veterans about a correction taking place in the housing market in 2023, you will need every bit of information and data you can get your hands on to make better investment decisions.

Learn more about how Mashvisor can help you find the best deals in the most profitable markets by scheduling a demo now.