Miami is quite known as a happening place for residents and visitors alike. But is the Miami short term rental market worth investing in in 2023?

As a short term rental property market, Miami is considered one of the hottest places in the US. The sparkling coastal city remains a top destination among tourists, both domestic and foreign. However, due to the global economic events that happened in the past year, is Miami still a city worth investing in for vacation rental properties?

Table of Contents

- Real Estate Market Trends and Forecasts in Miami

- How to Find a Profitable Short Term Rental Property in Miami

- Top 3 Miami Beach Neighborhoods for Short Term Rentals

Florida has been one of the hottest real estate markets in the US for quite some time now. The Sunshine State boasts the highest number of homes for sale, with 82,000 active listings.

That being said, Miami – the city that keeps the roof blazing, according to Will Smith – is home to one of the most successful vacation rental markets in the country. According to real estate website Mashvisor, there are a little over 4,000 vacation rentals in the city and it keeps growing by the day.

What makes Miami a hot spot for short term rental property investors? Why are Miami vacation rentals in demand? These and a few other equally important questions will be answered in this article. If you’re into real estate investing and you have your eye on The Magic City, keep reading.

Related: The Ultimate Guide to Real Estate Investing for Beginners

Real Estate Market Trends and Forecasts in Miami

Around this time of the year, real estate forecasts and predictions abound. They’re usually out as early as August or September as experts and analysts give their fearless forecasts on the real estate market for the following year.

As we near the end of 2022, we took a look at what industry experts have to say about the Miami real estate market and certain travel and tourism trends that can significantly impact the Miami short term rental market.

Miami by the Numbers

Before we proceed to our forecasts, let’s take a look at what the present market conditions are in The Magic City. According to real estate website Mashvisor, these are Miami’s overall stats as a rental market as of end-November 2022:

- Median Property Price: $854,001

- Average Price per Square Foot: $598

- Days on Market: 95

- Number of Long Term Rental Listings: 8,238

- Monthly Long Term Rental Income: $3,339

- Long Term Cash on Cash Return: 2.76%

- Long Term Cap Rate: 2.80%

- Price to Rent Ratio: 21

- Number of Short Term Rental Listings: 4,004

- Monthly Short Term Rental Income: $3,043

- Short Term Rental Cash on Cash Return: 1.30%

- Short Term Rental Cap Rate: 1.31%

- Short Term Rental Daily Rate: $229

- Short Term Rental Occupancy Rate: 35%

- Walk Score: 56

Given the numbers above, one would think that investing in vacation rentals in Miami may not be worth it. Here are a few good reasons why you should consider buying an investment property in Miami:

It Has a Balanced Housing Market

Miami has more than five times the national average when it comes to housing inventory. The city offers a lot in terms of housing stock, while the rest of the country experiences shortages left and right.

On top of being a top tourist destination, it also attractive to those who are interested in becoming landlords and owning long term rental properties. Its high price to rent ratio of 21 makes it an attractive location for aspiring landlords.

It Has Good Rental Rates

Speaking of rental properties, Miami offers some of the best rental rates in the region (and in the country). Its rental rates are nine times higher than the national average and may seem pricey, but people continue to flock to it despite the higher cost of living.

Miami-Dade, the county in which Miami is located, is in the top 20 most expensive short term rental markets in the US. It is not surprising since the present average monthly short term rental income for Miami is a little higher than $3,000.

It Offers Tax Benefits You Can Enjoy as an Investor

One of the main reasons why investors continue to flock to Miami is the tax benefits. Florida, in general, is a very tax-friendly state. There are no state tax, personal income tax, estate tax, and capital gains tax in Florida. Property taxes are lower than the national average. It is basically a paradise for those looking for tax benefits (which is pretty much all of us!).

It Has a Thriving Economy

Since Miami is also known as the Gateway to the Americas, it is not surprising that investments continue to pour into the city over the years. Even amid the COVID-19 pandemic, the volume of investments that kept coming into Miami was still significant enough to sustain the city’s economy and keep it at optimal levels.

Now that we’re nearing pre-pandemic normals, Miami’s economy is recovering very fast, as countless jobs and opportunities are brought into the city by big companies, especially tech companies.

Tourism and Travel Trends and Forecasts in Miami

Miami has always enjoyed a very strong and healthy tourism industry. Even during the pandemic, it continued to rake in tourists and visitors, especially after the relaxation of international travel restrictions.

Since the pandemic’s onset, Miami tourism has grown significantly with every quarter. The trend is expected to continue as foreign travels resume. The only hindrance to this growth is today’s high inflation rate, which makes travel a lot more expensive now than it was a year ago.

Another hurdle that Miami tourism must overcome is the current airport staffing crisis. Although it seems a minor concern compared to inflation, it is still a challenge nonetheless that needs to be addressed. It is particularly important if Miami wants to optimize its tourism industry.

MIA is identified to enjoy greater foot traffic compared to other busy airports like Atlanta, Denver, Dallas/Fort Worth, and Seattle. According to Placer.ai, foot traffic in MIA increased by over 30% in July 2022 compared to the same period in 2019.

Related: Here’s the Real Estate Forecast for the Next 5 Years

Short Term Rental Laws in Miami

As far as short term rental laws and rules are concerned, Miami is not exempt. There are certain ordinances in place in the city of Miami to protect its residents and communities but also ensure that tourism also prospers.

If you’re looking for an investment property in Miami with the intent of starting an Airbnb business, you should read up on Miami’s short term rental laws. (Looking at the state’s map won’t be enough).

For instance, is the subject property located in the proper zoning for vacation rentals? What does the ordinance say about owner-occupied and non-owner-occupied rental properties? These are some of the things you need to consider before you make any final decisions.

According to Miami-Dade’s website, a couple of noteworthy restrictions on Miami short term rentals are:

- A responsible party must be living on-site for six months in a calendar year; and

- The maximum occupancy for vacation rental homes is two persons per bedroom plus two additional people per property. The maximum occupancy is 12 people, excluding children below 3 years of age.

For more information on rental laws in Miami, as well as other locations, check out Mashvisor’s short term rental regulations page.

How to Find a Profitable Short Term Rental Property in Miami

We’ve already given you the basic information about the Miami short term rental market that you need to know. If you’re still keen on buying income properties for sale in Miami to convert into vacation rentals, here are a few tips to keep in mind:

Tip #1: Identify the Top Neighborhoods to Invest In

Even if Miami is a hot short term rental market, each neighborhood has something different to offer real estate investors. Each neighborhood’s performance as a rental property market differs from the others.

As a real estate investor, you should know how to identify which ones offer the best return on investment based on cash on cash return and cap rate. If you cannot afford an all-cash transaction, we recommend using cash on cash return as your primary ROI metric. The cash on cash return formula factors in the financing method used, so you get a good idea of how much each dollar earns.

Related: The Best Cash on Cash Return Calculator in 2022

Tip #2: Connect with Local Real Estate Professionals and Investors

One of the things you need to keep in mind as a real estate investor is that everyone you meet is a potential lead. It means that each person you meet and encounter can potentially point you in the right direction of an excellent investment opportunity.

That being said, as an investor, you should know how to connect with people and expand your network. It will give you a wider reach when it comes to real estate investing.

However, if you’re just starting out as an investor or you don’t know that many people in the Miami area yet, it is best to look for real estate agents and investors online and get in touch with them. These people can answer your questions about the local market since they are quite familiar with it.

You may also ask your existing contacts if they know people in the area that you can talk to about rental property investing. Sometimes all you need to do is to be extra resourceful to find the most profitable investment deals in any market of your choice, including Miami.

Tip #3: Use Technology to Your Advantage

Lastly, take advantage of the wonders of modern technology. Real estate investing has never been easier. We now live in the digital age, where you can go online to connect with other investors and professionals beyond your hometown.

Several real estate websites can be accessed online, including Mashvisor. Mashvisor is a real estate platform that’s been helping investors find the most profitable rental properties that match their investment needs.

The platform offers users access to a massive database that covers nearly every location in the US housing market. It gathers data from reliable sources like Zillow, Realtor.com, the MLS, and even Airbnb. It regularly updates its data so that investors can create a highly accurate and realistic investment property analysis on potential rental properties.

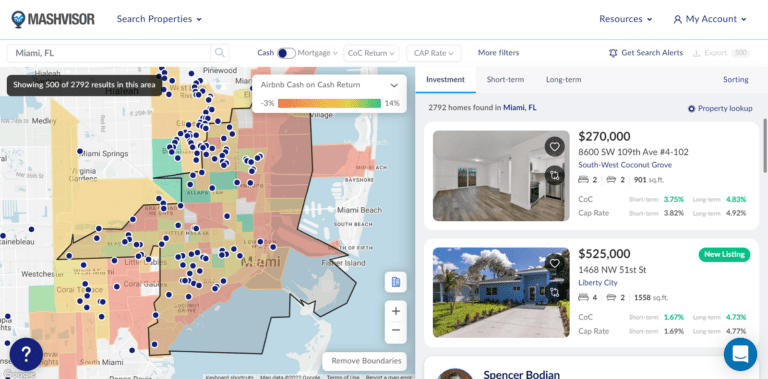

Additionally, Mashvisor’s property search tool utilizes a real estate heatmap that makes it easier to filter and sift through actively listed properties in any location. You can personalize your search, so you only get the results that are a high match to your requirements.

Mashvisor’s investment property calculator is also considered one of the best out there today. Since it utilizes actual market data, computing for potential ROI on a subject property is much more realistic and accurate compared to other online calculators.

Learn more about what Mashvisor has to offer investors like yourself by signing up for a 7-day free trial, followed by a lifetime discount of 15%.

You can use Mashvisor’s real estate heatmap to sift through actively listed properties in Miami and identify those that match your requirements.

Top 3 Miami Beach Neighborhoods for Short Term Rentals

Now that we’ve discussed the things you need to know as an investor, let’s take a look at the most profitable neighborhoods in the Miami short term rental market.

We’ve listed the top three Miami neighborhoods worth checking out if you’re serious about investing in Miami investment properties. We were able to come up with the list below using the following criteria as our filters:

- Each neighborhood must have a minimum monthly rental income of $2,000;

- Each neighborhood must have a cash on cash return of 2.00% or higher; and

- Each neighborhood must have at least a 50% short term rental occupancy rate.

Looking at Mashvisor’s end-November 2022 data, we found the following three neighborhoods that fit our criteria. The following list is ranked from highest to lowest cash on cash return, so investors have a better idea of what the dollar-for-dollar return on investment is:

1. South-West Coconut Grove

- Median Property Price: $807,033

- Average Price per Square Foot: $465

- Days on Market: 85

- Number of Short Term Rental Listings: 532

- Monthly Short Term Rental Income: $4,086

- Short Term Rental Cash on Cash Return: 3.69%

- Short Term Rental Cap Rate: 3.73%

- Short Term Rental Daily Rate: $192

- Short Term Rental Occupancy Rate: 43%

- Walk Score: 59

2. Overtown

- Median Property Price: $670,308

- Average Price per Square Foot: $604

- Days on Market: 35

- Number of Short Term Rental Listings: 501

- Monthly Short Term Rental Income: $3,253

- Short Term Rental Cash on Cash Return: 3.04%

- Short Term Rental Cap Rate: 3.08%

- Short Term Rental Daily Rate: $209

- Short Term Rental Occupancy Rate: 53%

- Walk Score: 73

3. Auburndale

- Median Property Price: $654,941

- Average Price per Square Foot: $948

- Days on Market: 102

- Number of Short Term Rental Listings: 640

- Monthly Short Term Rental Income: $3,137

- Short Term Rental Cash on Cash Return: 2.85%

- Short Term Rental Cap Rate: 2.88%

- Short Term Rental Daily Rate: $162

- Short Term Rental Occupancy Rate: 47%

- Walk Score: 70

If you’re serious about investing in Miami, start searching for and analyzing Miami properties in any neighborhood of your choice today.

Wrapping It Up

To sum it up, the Miami short term rental market remains one of the most in-demand markets in the country. Its thriving tourism industry and robust economy make Miami a favorite among real estate investors all over the country.

As an investor, you still need to do your homework if you’re planning to invest in Miami. The positive feedback helps, but you need to know for yourself what the market has to offer in terms of numbers and ROI.

Wise and successful investors know that nothing beats seeing the actual market condition and crunching the numbers. It ensures a higher investment success rate.

To increase your chances of investment success, whether it’s in Miami or not, we recommend signing up for Mashvisor’s services. The website already has a proven track record of helping countless investors land the best deals. Plus, it also has a high Trustpilot rating of 4.7 out of 5 stars.

As a Mashvisor user, you will have access to a wide range of high-quality data and tools that you can use for rental property analysis. It will help you make a wiser and more informed investment decision that you will surely not regret.

To learn more about how Mashvisor can help you find profitable investment properties, schedule a demo with us today.