[ad_1]

Prices of fruit and vegetables are on display in a store in Brooklyn, New York City, March 29, 2022.

Andrew Kelly | Reuters

Global markets have taken heart in recent weeks from data indicating that inflation may have peaked, but economists warn against the return of the “transitory” inflation narrative.

Stocks bounced when October’s U.S. consumer price index came in below expectations earlier this month, as investors began to bet on an easing of the Federal Reserve’s aggressive interest rate hikes.

related investing news

While most economists expect a significant general decline in headline inflation rates in 2023, many are doubtful that this will herald a fundamental disinflationary trend.

Paul Hollingsworth, chief European economist at BNP Paribas, warned investors on Monday to beware the return of “Team Transitory,” a reference to the school of thought that projected rising inflation rates at the start of the year would be fleeting.

The Fed itself was a proponent of this view, and Chairman Jerome Powell eventually issued a mea culpa accepting that the central bank had misread the situation.

“Reviving the ‘transitory’ inflation narrative might seem tempting, but underlying inflation is likely to remain elevated by past standards,” Hollingsworth said in a research note, adding that upside risks to the headline rate next year are still present, including a potential recovery in China.

“Big swings in inflation highlight one of the key features of the global regime shift that we believe is underway: greater volatility of inflation,” he added.

The French bank expects a “historically large” fall in headline inflation rates next year, with almost all regions seeing lower inflation than in 2022, reflecting a combination of base effects — the negative contribution to annual inflation rate occurring as month-on-month changes shrink — and dynamics between supply and demand shift.

Hollingsworth noted that this could revive the “transitory” narrative” next year, or at least a risk that investors “extrapolate the inflationary trends that emerge next year as a sign that inflation is rapidly returning to the ‘old’ normal.”

These narratives could translate into official predictions from governments and central banks, he suggested, with the U.K.’s Office for Budget Responsibility (OBR) projecting outright deflation in 2025-26 in “striking contrast to the current market RPI fixings,” and the Bank of England forecasting significantly below-target medium-term inflation.

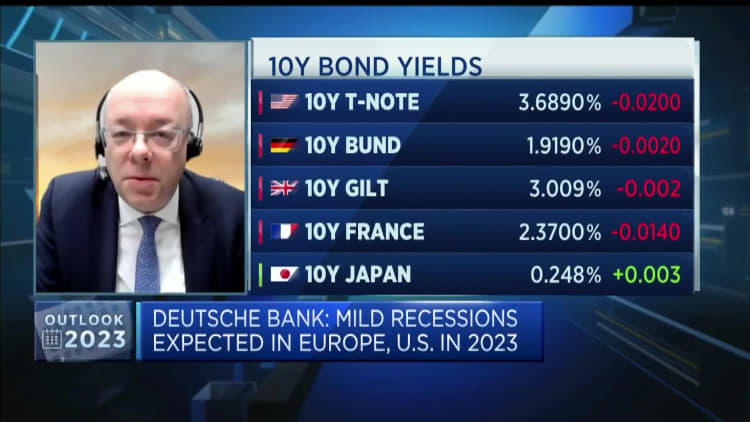

The skepticism about a return to normal inflation levels was echoed by Deutsche Bank. Chief Investment Officer Christian Nolting told CNBC last week that the market’s pricing for central bank cuts in the second half of 2023 were premature.

“Looking through our models, we think yes, there is a mild recession, but from an inflation point of view,” we think there are second-round effects,” Nolting said.

He pointed to the seventies as a comparable period when the Western world was rocked by an energy crisis, suggesting that second-round effects of inflation arose and central banks “cut too early.”

“So from our perspective, we think inflation is going to be lower next year, but also higher than compared to previous years, so we will stay at higher levels, and from that perspective, I think central banks will stay put and not cut very fast,” Nolting added.

Reasons to be cautious

Some significant price increases during the Covid-19 pandemic were widely considered not to actually be “inflation,” but a result of relative shifts reflecting specific supply and demand imbalances, and BNP Paribas believes the same is true in reverse.

As such, disinflation or outright deflation in some areas of the economy should not be taken as indicators of a return to the old inflation regime, Hollingsworth urged.

What’s more, he suggested that companies may be slower to adjust prices downward than they were to increase them, given the effect of surging costs on margins over the past 18 months.

Although goods inflation will likely slow, BNP Paribas sees services inflation as stickier in part due to underlying wage pressures.

“Labour markets are historically tight and – to the extent that there has likely been a structural element to this, particularly in the U.K. and U.S. (e.g. the increase in inactivity due to long-term sickness in the UK) – we expect wage growth to stay relatively elevated by past standards,” Hollingsworth said.

China’s Covid policy has recaptured headlines in recent days, and stocks in Hong Kong and the mainland bounced on Tuesday after Chinese health authorities reported a recent uptick in senior vaccination rates, which is regarded by experts as crucial to reopening the economy.

BNP Paribas projects that a gradual relaxation of China’s zero-Covid policy could be inflationary for the rest of the world, as China has been contributing little to global supply constraints in recent months and an easing of restrictions is “unlikely to materially boost supply.”

“By contrast, a stronger recovery in Chinese demand is likely to put upward pressure on global demand (for commodities in particular) and thus, all else equal, fuel inflationary pressures,” Hollingsworth said.

A further contributor is the acceleration and accentuation of the trends of decarbonization and deglobalization brought about by the war in Ukraine, he added, since both are likely to heighten medium-term inflationary pressures.

BNP maintains that the shift in the inflation regime is not just about where price increases settle, but the volatility of inflation that will be emphasized by big swings over the next one to two years.

“Admittedly, we think inflation volatility is still likely to fall from its current extremely high levels. However, we do not expect it to return to the sorts of levels that characterised the ‘great moderation’,” Hollingsworth said.

[ad_2]