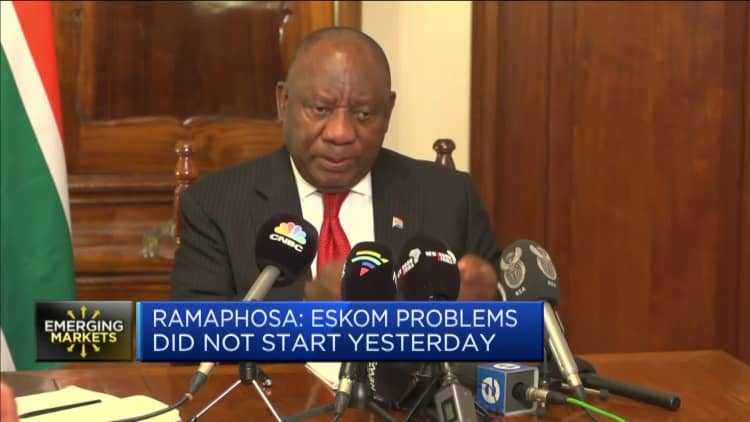

LONDON – South Africa’s President Cyril Ramaphosa speaks during a press conference in central London on November 24, 2022

JUSTIN TALLIS/AFP via Getty Images

South Africa’s long-awaited economic reforms have begun to improve the country’s outlook, but the age-old problems of political uncertainty and a failing power system still pose significant risks.

The Economic Reconstruction and Recovery Plan has been a key tenet of President Cyril Ramaphosa’s agenda since he succeeded Jacob Zuma as the country’s leader in 2018. But deep divisions within the ruling African National Congress (ANC) and his own cabinet have made for sluggish progress.

The suite of reforms — focused on energy security, infrastructure development, food security, job creation and the green transition — is designed to create a “sustainable, resilient and inclusive economy,” the government says.

And — some at least — appear to be working. S&P Global Ratings earlier this month affirmed its positive outlook on the country, saying that government measures to stimulate private sector activity could boost growth, and the measures had the potential to ease economic pressures.

“There is some hope in the public finances in South Africa, mainly due to the increase in government revenues as a result of higher commodity exports, and also due to the progress made in reducing debt and debt distress, and to ushering a public deficit,” Aleix Montana, Africa analyst at risk consultancy Verisk Maplecroft, told CNBC last week.

However, political frailties and persistent issues at a state-owned utility continue to pose present economic risks.

Ramaphosa faces a “perfect storm of inflation, electricity cuts and corruption accusations that will continue to deteriorate South Africa’s profile and to pose risk for investments in the country,” Montana said.

A report into an alleged corruption scandal surrounding Ramaphosa is set to be examined by the National Assembly on Dec. 6, just 10 days before the party conference of his ruling ANC (African National Congress).

Energy woes

Though Ramaphosa is expected to secure a second five-year term, Montana said he will have to improve his credibility on economic and anti-corruption reforms in order to continue pushing through his agenda. The economy also remains at risk from persistent disruptions at state-owned companies, such as power utility Eskom.

South Africans have faced rolling blackouts as Eskom — which has long been a thorn in the side of the country’s economy — contends with shortfalls in generation capacity due to equipment failures and diesel shortages.

The company has warned that power outages, known as “load-shedding,” will continue for the next six to 12 months, and recently said it had run out of funds to acquire the diesel needed to run auxiliary power plants that are deployed during periods of peak consumption or emergencies.

Montana said that in order to secure sustained economic growth, the South African government will need to prioritize energy sustainability.

“Energy will require financial assistance from international players, but they will also need to ensure that it doesn’t have a negative impact on South African society,” he said.

“Apart from financial challenges, a lot of citizens of South Africa are employed in Eskom or in the fossil fuels sector, so the government will need to ensure that in their plan, they mitigate this potential impact of transitioning from a fossil fuels-based economy to the implementation of renewables in order to sustain electricity stability.”

Asked about this issue on a recent state visit to the U.K., Ramaphosa told CNBC’s Arabile Gumede that the problems at Eskom started long before 2014, when former President Jacob Zuma appointed him to address the country’s energy problems.

“As we are generating electricity, power stations keep breaking — many of them are old — but we are trying with a new boat, the management that’s in place to address this problem,” Ramaphosa said.

“So the problems of Eskom were seeds that were planted many years ago, rather than in 2014, and because we’re dealing with huge, complicated and complex machinery, it’s not a one-day fix, it can never be as these are very complex processes.”

He added that the government was working to reduce load-shedding requirements and to “ensure that the money’s there,” noting that Eskom “used to be the best utility in the world.”

“Do I have confidence that we will solve these problems? Yes, I do. I do have enormous confidence that we will solve them,” he said.

“But I think it’s important to have an appreciation of where we’ve come from, and obviously, it is very easy to put all the blame on the president, to put all the blame on the government, and yet these problems have come way back from the past.”

‘Taming the monster’ of inflation

Along with the domestic issues unique to South Africa, the country also faces the same inflationary pressures that have plagued economies around the world over the past year.

Annual headline inflation rose to 7.6% in October, defying the South African Reserve Bank’s expectations for price pressures to ease. This prompted the bank’s Monetary Policy Committee to hike interest rates by an aggressive 75 basis points last week, taking the benchmark repo rate to 7%.

This marked the seventh consecutive meeting at which monetary policy had been tightened, and central bank Governor Lesetja Kganyago said in a press conference that it must “tame the monster of inflation.”

With prices rising much faster than the central bank’s 3-6% target, Kganyago noted that the SARB needs to see clear evidence that inflation has not just peaked, but begun to sustainably decline toward the midpoint of the range.

But further monetary tightening will place additional pressure on the economy.

“We think that inflation is unlikely to return within the target range (let alone the midpoint) in the coming months, keeping policymakers in tightening mode well into 2023,” said Virág Fórizs, emerging markets economist at Capital Economics.

She flagged that food inflation continues to increase, offsetting some of the effects of softening fuel price pressures, while core inflation is likely to remain high. Capital Economics expects inflation to hover around 7.5% annually until early 2023, before dropping markedly around the middle of the year.

Fórizs said the weakness of the economy is unlikely to prevent further rate hikes, with growth concerns playing second fiddle to inflation worries. South African GDP contracted by 0.7% in the second quarter.

“While the end of the tightening cycle is not yet in sight, we expect the pace of tightening to slow over the next MPC meetings,” she noted.

Three MPC members voted to hike rates by 75 basis points last week, while two voted for 50 basis points. It marked an apparent softening of approach by some who voted for a 100-basis-point rise at the previous meeting.

“All in all, we’ve penciled in 100bp of further increases in the repo rate, to 8.00%, by Q2 2023,” Fórizs said.