Opinions expressed by Entrepreneur contributors are their own.

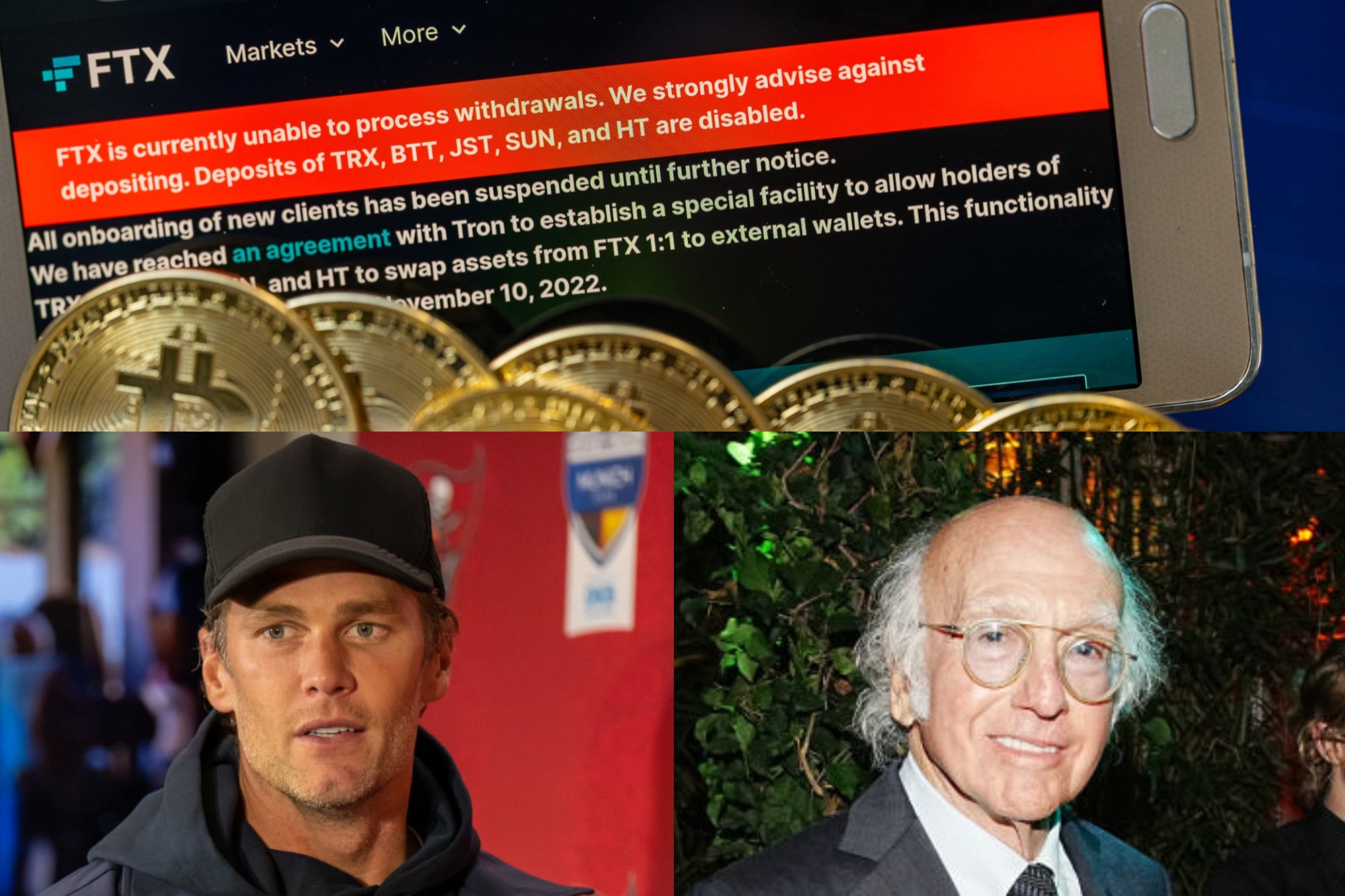

Cryptocurrency investors burned by the spectacular failure of FTX are prepared to sue exchange founder Sam Bankman-Fried and the celebs who took part in promoting it. In a class-action suit filed in Miami late Tuesday, the plaintiffs targeted celebrities, including Tom Brady, Larry David, and Steph Curry, alleging that by shilling FTX, they were taking part in deceptive practices.

The lawsuit also claims that FTX was selling unregistered securities in the form of yield-bearing accounts. According to the suit, the defendants made “misrepresentations and omissions” designed to “induce confidence and to drive consumers to invest in what was ultimately a Ponzi scheme.”

The lawsuit, filed Tuesday in U.S. District Court in Miami, alleges that FTX was designed “to take advantage of unsophisticated investors” by persuading them to use the company’s services to invest in crypto. None of the defendants who appeared in advertisements for the investment platform “performed any due diligence before marketing these FTX products to the public,” the filing added.

Noted attorney David Boies — who recently represented Theranos entrepreneur Elizabeth Holmes in her trial for fraud — filed the suit on behalf of Oklahoman Edwin Garrison, owner of an interest-earning FTX account.

The filing states that while the celebrities named as defendants did disclose they were in partnership with FTX, they didn’t detail “the nature, scope, and amount of compensation they personally received in exchange for the promotion of the Deceptive FTX Platform.”

Court papers point out that the Securities Exchange Commission (SEC) has said that a “failure to disclose this information would be a violation of the anti-touting provisions of the federal securities laws.”

The suit didn’t ask for a specific dollar amount but claimed that the defendants may be liable for “many billions of dollars in damages.”