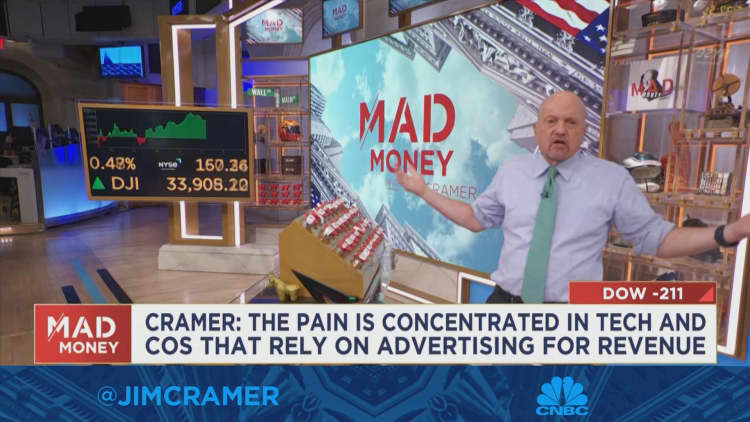

CNBC’s Jim Cramer on Monday said that there’s enough pain in the market for the Federal Reserve to consider easing its pace of interest rate hikes.

“There’s enough turmoil that the Fed needs to slow down its rate hikes, if only to prevent the headwinds from turning into some sort of weird [Category] 5 hurricane,” he said.

related investing news

Stocks fell on Monday, snapping last week’s streak of gains, as investors mulled over corporate and economic news that sent mixed signals about the state of the economy.

Amazon reportedly plans to lay off around 10,000 workers starting this week, which would be its largest headcount cut in history. The cuts would make the e-commerce giant the latest tech firm to curtail its workforce this year to slash costs in a worsening economic environment.

A bright spot during the trading session was Federal Reserve Vice Chair Lael Brainard’s indication that the central bank could soon reduce its pace of raising interest rates.

Cramer pointed to the reported layoffs at Amazon and turmoil in other sectors like crypto and software stocks as examples of the Fed’s damage. “The Fed’s already done a great deal of damage to the economy, it’s just that it’s all packed into the most bloated sectors,” he said.

He added that consumers are also starting to feel the weight of the Fed’s interest rate hikes, especially as the number of companies laying off their workers increases.

“Other than travel, people aren’t really doing much. They’re hunkered down now, trying to figure out if they should go back to work while going to their tenth wedding since we came out of pandemic mode,” he said.